Over 20 billion!You can also see the large -scale photovoltaic contract, which is equivalent to the company's total market value!

Author:China Fund News Time:2022.09.14

China Fund reporter Nan Shen

The management has just finished the "Bao Neng" South Bolume A, and a great gift was harvested.

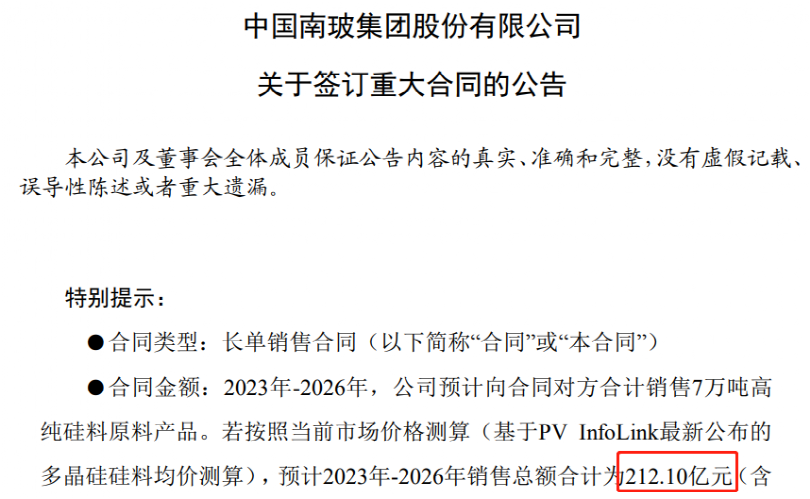

On the evening of September 13th, the South Glass A announced that with Tianheguang Energy, a high-purity silicon material cooperation agreement was recently signed. According to the contract, Tiansheng Energy is expected to purchase a total of 70,000 tons of high-purity silicon from 2023-2026 Materials products.

The total sales of the contract are expected to be 2.121 billion yuan, and the company's latest market value is only 2.122 billion yuan. In the first half of 2022, the company's contribution of silicon material products contributed less than 1.1 billion yuan. In addition, the company's current high -pure crystal production capacity is 10,000 tons, which is equivalent to 7 times that of its existing production capacity.

Recently, the photovoltaic industry has frequently seen a large contract. In July, Tongwei announced the two polysilicon sales contracts, with a total amount of 120 billion yuan. On August 26th and September 9th, Jingke Energy announced the two hundred billion -level silicon procurement contracts, with a total amount of more than 200 billion yuan.

The largest procurement contract in the history of South Glass A

According to the announcement of the two companies, Nanyang A and Tianheguangneng, the sales agreement is a long-order sales contract. Based on the contract, from 2023 to 2026, the South Glass A is expected to sell a total of 70,000 tons of high-pure and pure. Silicon material products. If calculated based on the current market price (based on the latest polysilicon silicon material price announced by Pvinfolink), it is expected that the total sales in 2023-2026 will be 21210 billion yuan (including tax).

However, Nanyang A emphasized that the calculation does not constitute a price or performance commitment. The specific order price is discussed. The total contract transaction is subject to the final transaction amount. The company said that the signing of this contract is conducive to the stable sales of the company's high -purity silicon products, which meets the company's future business plan and will have a positive impact on the company's future business performance. The business cooperation will not have a significant impact on the company's current business business.

The company also prompts that the contract performance period is relatively long. During the performance of the contract, if the impact of industry policy adjustments, market environment changes, and the adjustment of the operating strategies of transaction, the impact of non -estimated factors may cause the contract to be unable to perform as scheduled or all. In addition, the total amount of calculated sales has not considered influencing factors such as contract performance risk and future high -purity silicon market prices, and there are certain uncertainty.

The China Fund News reporter traced back to the past announcement. This is the largest single procurement contract signed by the South Glass A. The company's last large contract occurred in August 2020. At that time, many subsidiaries under Longji Green Energy intend to purchase 65 within five years 100 million yuan photovoltaic glass.

New annual capacity of 10,000 tons of convertible bonds to issue convertible bonds

Nanyang Group is actually one of the earliest companies in the field of photovoltaic products in China.

According to the 2022 interim report, its Yichang production base currently has a high -pure crystal silicon production capacity of 10,000 tons/year, a silicon wafer 2.2GW/year, and 7,200 tons/year of the purification single crystal of the ingot; Component 0.6GW/year production capacity; Shenzhen photovoltaic holding 139MW.

In the first half of 2022, the company's solar and other business operating income totaling 1.434 billion yuan, an increase of 225.49%year -on -year, and a net profit of 282 million yuan, a significant increase of a year -on -year. Among them, it is a silicon product that contributes to the large -scale revenue, with revenue of 1.07 billion yuan.

In June this year, the company announced that it would build an annual output of 50,000 tons of high pure crystal silicon production lines in Qinghai, with a total investment of about 4.5 billion yuan and a construction period of 20 months. After the project is completed, it is expected to achieve an average annual sales revenue of 3.389 billion yuan, with an average annual net profit of 863 million yuan. The project investment recycling period is expected to be 5.19, and the financial internal yield is 28.64%.

At that time, the board of directors of the South Boli A believe that the photovoltaic industry is expected to develop rapidly in the future, and the demand for high pure crystal silicon continues to increase, and upstream companies need to expand production capacity. And this project can expand its existing advantages of the photovoltaic industry chain and further enhance the overall competitiveness of the new energy field.

However, Nanyang A is actually not abundant at hand. The company claims that the project funds come from foreign fundraising and other financing methods. The insufficient raised funds or unsuccessful raising will be solved by the company's self -raising method. In June, Nanyang A announced that it was proposed to disclose the issuance of A -shares convertible corporate bonds, and the total amount of funds raised was not more than 2.8 billion yuan. After deducting the issuance costs, 2 billion yuan was used for an annual output of 50,000 tons of high pure crystal silicon projects, and 800 million yuan was used to supplement mobile funds and repay debts.

At present, the convertible bond matters have been approved by the board of directors and shareholders, and the regulatory authorities have not been announced for approval.

Seeing a large photovoltaic contract this year

Although the large contract of more than 20 billion has created the most in the history of South Glass A, and even tied the company's total market value, but in the fiery photovoltaic track this year, in fact, it can only be regarded as a "little witch" and "big witch". For example, Tongwei shares have harvested 100 billion yuan.

On the evening of July 1, Tongwei announced that the company's four subsidiaries have recently signed a polysilicon long-order sales contract with Meike Silicon Energy. Meike Silicon Energy is expected to purchase a total of 256,100 tons of polysilicon silicon from 2022-2027 to 2027 Products are expected to sell about 64.41 billion yuan.

On the same day, Shuangliang Energy Conservation Announcement, the company's wholly -owned subsidiary Shuangliang Silicon Materials and four subsidiaries (sellers), a subsidiary of Tongwei, signed the "Polycrystalline Silicon Purchase Framework Agreement". It is expected to be about 222,500 tons, and the purchase amount is expected to be about 56 billion yuan. In this way, the two orders totaled 120.41 billion yuan, while Tongwei's revenue last year was only more than 60 billion yuan. On August 26, Jingke Energy also announced that from 2023 to 2030, Jingke Energy and its subsidiaries will purchase 336,000 tons of native polysilicon from Xindu Energy, with an estimated purchase amount of 102077 billion yuan. Less than two weeks later, September 9th, Jingke Energy issued another announcement and purchased about 382,800 tons of polysilicon products from the subsidiaries of Tongwei. The estimated total contract amount was about 103.356 billion yuan. From month to December 2026, the actual procurement price adopts a monthly bargaining method.

Since last year, the price of solar -level silicon materials has continued to have a high fever. The average price of polycrystalline silicon dense materials has risen from 87,600 yuan/ton in early 2021 to the current 300,000 yuan/ton, an increase of more than 240%. In this context, the downstream giants of the photovoltaic industry chain in an attempt to ensure the long -term stable supply of polysilicon raw materials through the long -term single -section of the lock -up price, the monthly bargaining, and the batch purchases.

East Asia Qianhai Securities Analyst Duan Xiaohu analyzed that the historical price and supply and demand situation of the re-inventory polysilicon 2000-2022, the sharp rise in the three historical prices was caused by the imbalance between the supply and demand of silicon materials and its downstream links. The current head silicon material enterprises are expanding the production cycle, new production capacity is limited, and the continuous high increase in downstream demand has led the price of silicon material to enter a new round of rising cycles, and the price of silicon material has continued to rise to a new high of nearly ten years.

It states that according to calculations, the global photovoltaic silicon market space will reach 648,800 tons in 2022, a year -on -year+45.1%. In the context of the current tight supply and demand pattern of polycrystalline silicon, it is optimistic that it has the advantages of production capacity and profitability that is expected to continue high silicon material companies.

Edit: Captain

- END -

Stabilizing the economic market, these 50 policy measures issued by Hunan Province, Hunan Province, are full of dry goods

On June 13, the People's Government of the Miao Autonomous Prefecture of the Xiang...

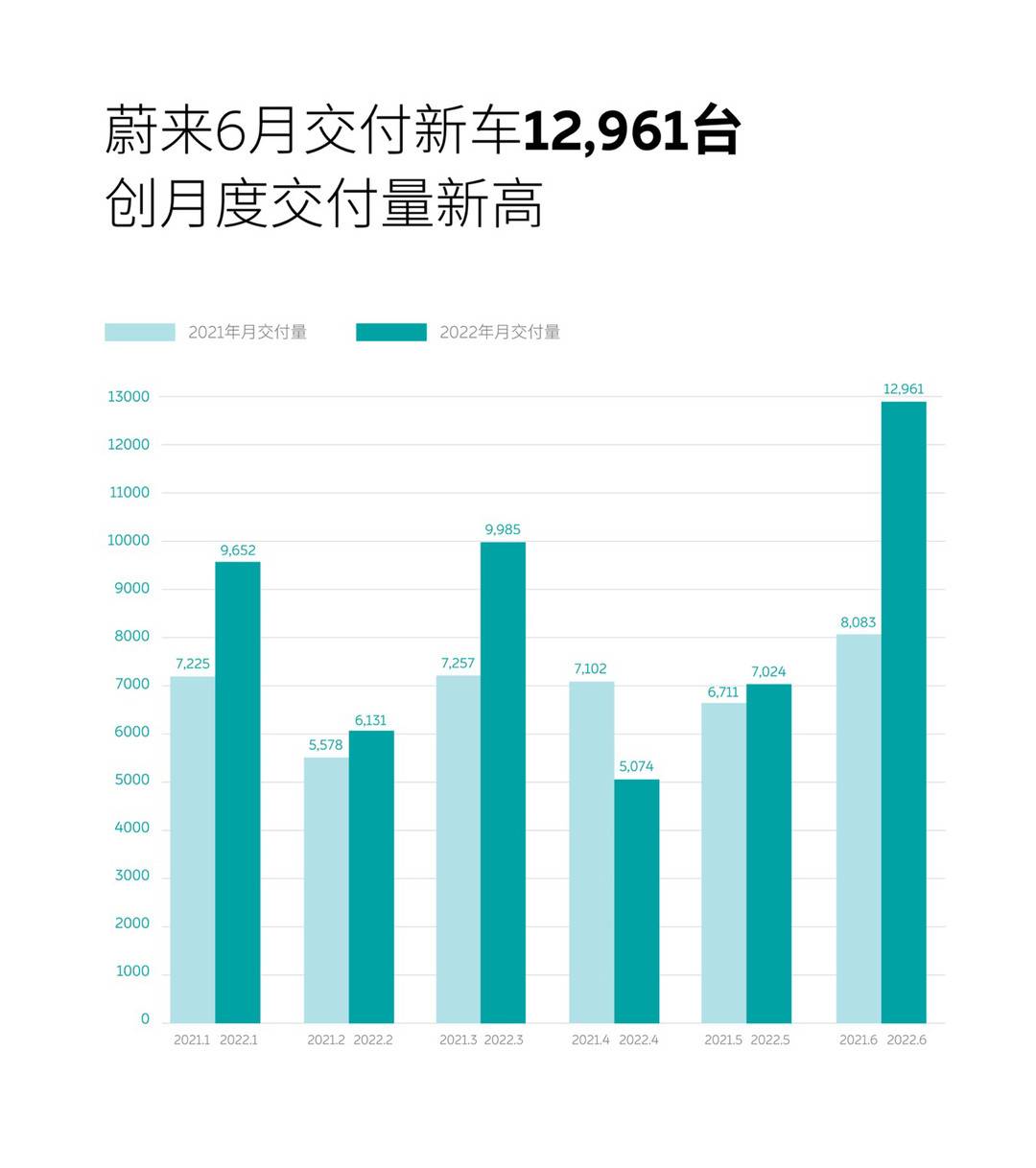

The semi-annual report of the auto market | January-June year-on-year increased by 21.1%!Weilai, who was "shorted" by the Grizzlies, responded with the transcript of the middle school entrance examination

Cover news reporter Zhang FuchaoOn July 1, Weilai announced its June sales data, w...