Overnight, collectively plummeted!This data scares the market, will A shares fall?

Author:Qianjiang Evening News Time:2022.09.14

In the context of Russia and Ukraine's conflict and inflation, the nerves of the global capital market have become particularly fragile.

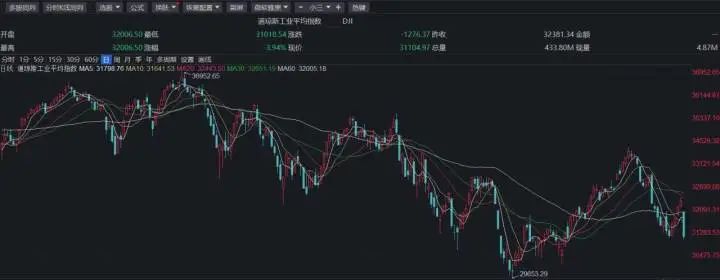

U.S. stock markets, which have risen for four days! Overnight Dao plummeted by more than 1200 points, a decline of 3.94%, the Nasda Index fell 5.16%, and the S & P fell 4.32%. The U.S. stocks have reached the largest single -day decline in 27 months.

The A -share syndrome index opened down early this morning, a decrease of 1.2%, and then the weak shock. As of the closing of the morning, the Shanghai Stock Exchange Index fell 1.02%, and the GEM index fell 2.01%.

The blood case of US stocks was triggered by an economic data. Last night Beijing time, data distributed by the US Department of Labor showed that the US August CPI increased by 8.3%year -on -year, estimated to 8.1%, and the previous value was 8.5%. After eliminating the price of large fluctuations, the core CPI in the United States rose 0.6%month -on -month and 6.3%year -on -year. These two data rebounded from the previous month.

Although the Fed ’s interest rate hike at the September interest rate interest rate rate has become a market consensus, after the announcement of CPI data in August, US stocks have plummeted, which has also caused a sharp turbulence in the global stock market and foreign exchange market.

U.S. stocks have fallen in a single day of more than two years

Causes the global stock market turbulence

After the CPI data was announced in August, the three major indexes of US stocks plummeted. Dow Jones plunged 1276 points, a decrease of 3.94%; the S & P 500 index fell 4.32%, all the largest single -day declines since mid -June 2020; Fall.

Diving in the European stock market, the British FTSE 100 Index, the German DAX30 Index, and the French CAC40 index fell 1.17%, 1.59%, and 1.39%, respectively.

Large -scale technology stocks fell, Nvidia fell 9.47%, Naifei fell 7.78%, Intel fell 7.19%, high in highlights 6.07%, Microsoft, Google, and Apple fell more than 5.5%, Tesla fell more than 4%. Among them, both Apple and Microsoft set the largest single -day decline since September 2020. U.S. stock banks fell across the board, Wells Fargo fell more than 5%, Goldman Sachs fell more than 4%, and JP Morgan Chase, Citi, Morgan Stanley, and Bank of America fell more than 3%. Energy, aviation and other economic recovery concept stocks were not spared. Among them, US aviation fell 5.46%, Royal Caribbean cruise ships fell 3.33%, Norwegian cruise ships fell 2.70%, and Boeing fell 7.19%.

Apple stock price trend chart

Well -known technology companies fall list

Overnight China stocks also followed the U.S. stock market. The Nasdaq's China Golden Dragon Index closed down 3.27%, and Ali, Pinduoduo, Baidu, and JD.com all fell more than 5%. The ideal car and Weilai rose against the trend, up 2.84%and 1.01%, respectively.

Ali stock price trend chart

Baidu stock price trend chart

Jingdong stock price trend chart

Pinduoduo stock price trend chart

On September 20-21, the Fed will hold a interest conference. After the CPI data was announced, the Federal Reserve raised interest rate hikes in September and almost nailed it. At the same time, the market is expected to adopt a more radical policy in the next year, and the policy interest rate is expected to reach a range of 4%-4.25%next year.

The market is expected to maintain radical interest rate hikes in the future for a longer period of time. Nomura even becomes the first Wall Street Bank, which is expected to raise interest rates by the Fed next week. Chief Economist KPMG also said that 100 basis interest rate hikes at one time at a time The range has definitely been included in the Fed's consideration.

Previously, some market participants believed that, in view of the high debt of the US government, the total national debt reached 31 trillion US dollars, and the US GDP a year was US $ 23 trillion, and the central government's fiscal revenue was US $ 4.05 trillion. It will exceed 4%, and if it is about half a year, it will enter the expectations of interest rate cuts. The reason is that the higher the interest rate, the more interest to the US government to repay debts. Even if the annual interest rate is 4%, it will be US $ 1.24 trillion in debt.

However, some experts said that the U.S. government has already rely on new debt to pay off the old debt to pay for the old debt. It is the so -called "debt is not worried", and as long as the debt defaults are not incurred, the international credit of US debt is still strong. As for how much interest rate hikes will be reached, it is mainly depending on the goals to be achieved by the Federal Reserve.

The dollar soared more than 600 points overnight

The euro fell below 1: 1 again to the US dollar again

Due to the further heating up in the US dollar rate hike, the US dollar index rose rapidly, and the daily increase reached 1.52%. This morning, the maximum of the 110 mark has been exceeded.

The US dollar soared 633 points over the offshore RMB, an increase of 0.91%. By 6:30 in the morning of Beijing time, the US dollar touched the highest offshore RMB to 6.9843, approaching the "7" mark again. Since the beginning of this year, the cumulative increase in offshore RMB has reached 9.71%.

Not only RMB, the US dollar has also soared to the euro, pound, yen and other currencies. Among them, the euro, which just raised the 75 base point, plunged 1.53%overnight to the US dollar, and fell below the 1: 1 mark within a few days of rebound. This morning, it closed at a minimum of 0.9967. The pound plunged 1.63%overnight.

Analysts believe that the recent increase in RMB exchange rate fluctuations is mainly affected by fluctuations in the international foreign exchange market. The two -way fluctuation of the RMB exchange rate is normal. Short -term rise and falling is normal. There will be no "unilateral cities", and there is no need to pay too much attention to "Breaking 7". At present, the domestic economic stability and recovery and the trade surplus have remained at a high level. In addition, the relevant departments have strengthened macro -prudential management and expected guidance in a timely manner. The RMB exchange rate does not have the basis of long -term depreciation. Today's A -share opening pressure is high

What can you suck in the adjustment

Affected by the plunge of U.S. stocks, the A50 index futures fell 1.33%in front of the market, which basically represents a kind of emotions of foreign capital. Some analysts believe that the pressure on the opening of A shares today will not be small.

Soochow Securities believes that from the perspective of the US August CPI data and other situations, the September interest rate interest rate hike 75bp basic board is nailed, and the core CPI is difficult to fall within 5%and the still strong U.S. economy, November and 12 The monthly interest rate meeting may still use an ultra -normal rate of interest rate hikes, making the final value of policy interest rates to 4%in 2022. In terms of A -share opportunities, Soochow Securities believes that the pharmaceutical sector is currently exhausted, and it is expected to usher in a counterattack in the fourth quarter. The performance of photovoltaic equipment and lithium battery equipment has increased high performance. It can be noted, especially lithium -battery equipment vendors have benefited from the large -scale expansion of power battery factories at home and abroad, and at the same time, the opportunity brought by the improvement of profitability under scale effects.

Mr. Cheng believes that today's A -share opening is a high probability, but considering that domestic policies are still loose, after the domestic financial data in August, the market generally expects that wide credit policies are expected to make further efforts, and even have expected expectations. Furthermore, we did not rose much when U.S. stocks rose. Therefore, investors with lighter positions in A shares can find the opportunity to take the opportunity to lowered the stocks that are worthy of future stocks, especially companies with high performance.

Founder Securities believes that the weakening of stocks on Tuesday, dragging the A -share market and falling. The current market risk preferences are low, and the effect of making money is not high. The "three lows" are still favored by funds. The "three highs" still become the object of profit -making. If the gain is difficult to release, the short -term A -share market will run between the 5 -day and 50 -day line, and the structural differentiation is still the main feature of the market.

At present, the uncertainty of global geopolitical politics has brought greater uncertainty to the global financial market. During a period of time, the Fed's monetary policy will still be "eagle". The continuous rise is sharply up, but the decline of traditional energy prices is the general trend. It is difficult to reverse the trend in the short term. It will affect the trend of A -share structure. It is difficult to rise sharply against the US dollar in the short term. In terms of operation, light indexes and heavy stocks, follow the dots to follow brokers, electricity, transmission and transformation equipment, information technology, new energy, new materials and "three lows" second -line blue chip stocks to avoid the subject stocks and garbage stocks that are too high in the early stage.

Source: Qianjiang Evening News • Camel reporter Liu Yexin Wang Yanping, CCTV Finance

Editor on duty: Dong Xiaole

- END -

Party building leads to promote the development of "three -dimensional economy"

In the first half of 2022, the party committee of Tangyi Town, the 3rd Division of...

Houzhuang Village of Xiaoyi City is 400 acres of walnut trees "operation"

Huanghe News Network Luliang News (Li Zhuhua) is now an important period for the i...