[East look at the west] High inflation heavy pressure US stocks, A -share toughness is still there

Author:Zhongxin Jingwei Time:2022.09.14

Zhongxin Jingwei, September 14th (Song Yafen) Due to the failure of US inflation data, the market expects the Fed's monetary policy to continue to tighten sharply. The three major US stocks have experienced the largest decline since March 2020.

Market sentiment is criticized

According to data released by the US Department of Labor on the 13th, the US Consumer Price Index (CPI) rose 0.1%month -on -month, an increase of 8.3%year -on -year, higher than the market expectations of 8.1%.

Regarding the data, Dong Chengxi, a researcher at Zhixin Investment Research Institute, told Zhongxin Jingwei: "Considering that energy prices fell 5%compared with the previous month, the cooling speed of the US CPI was still slow."

After US inflation data was announced, the US stocks plummeted across the board. The Dao Index was 1200 points, closing a decrease of 3.94%to 31104.97 points, and the S & P 500 index fell 4.32%. Both major indexes hit the largest single -day decline since mid -June 2020. The Nasda Index leaked 600 points and closed down 5.16%, the largest daily decline since mid -March 2020.

Why is the market reaction so fierce? Xiong Yuan, the chief economist of Guosheng Securities, believes that there are two main reasons: First, the scores of this CPI resident The subsequent CPI data has a profound impact, which means that inflation will fall slower than expected; second, the Fed will usher in a meeting of interest rates on September 22. Previously The time data undoubtedly clarifies at least 75 base points, and it is amended to the long -term interest rate hike expectations in the future.

British Securities Li Daxiao also held a similar point of view. "US stocks' plunge originated from the market expectations of the United States in August, causing the market to panic in the Fed's violence in response to inflation. ","

Data show that as of the closing of the 13th, European stocks fell across the board, the German DAX index fell 1.59%, the French CAC40 index fell 1.39%, and the British FTSE 100 index fell 1.17%.

On September 14, the Asia -Pacific stock market opened the entire board. The Nikkei 225 index opened low, as of the closing of 2.78%; the South Korean KOSPI index closed down 1.56%on September 14. The Hong Kong Honsant Index opened 2.04%lower and lost 19000 points again.

The three major indexes of A shares fell more than 1%. As of the close, the Shanghai Index fell 0.79%, the Shenzhen Index fell 1.25%, and the GEM index fell 1.84%.

The toughness of the Chinese market still exists

If the Federal Reserve raised interest rates again in September, what impact would it on the global capital market, especially the Chinese market? In this regard, Yang Delong, chief economist of Qianhai Open Source Fund, said that if the U.S. federal benchmark interest rate rises to more than 3%, it will undoubtedly have a significant impact on the US economic growth, causing economic growth Essence The inflation without bull market also means that the performance of US stocks will not be too good in 2022.

However, Li Daxiao believes that the market situation may not be so bad. "The yield of 10 -year Treasury bonds in the United States has not reached the high point on June 14. The US dollar index has not exceeded the high point on September 6 during the day, and the price of gold has not reached a new low. Although the level of inflation in the United States is still high, it is still high. However, the determination of the determination of the commodities pointed out the direction for the development of the stock market. "

As far as A shares are concerned, Li Daxiao said that there is no need to panic. "China's inflation is well controlled, and China's economic cycle is not synchronized with the United States. The monetary policy is relatively loose, the fiscal policy is relatively positive, the policy space is huge, and the policy tool box is rich. The tough characteristics of the stock market still exist. The decline in the A stock is expected to be relatively small, and it is recommended to deal with it calmly. "Li Daxiao said.

Yang Delong also emphasized that the current level of inflation in China is not high, and the level of benign inflation that has been controlled within 3%has provided a certain foundation for China's monetary policy to maintain independence. The performance of A shares on the 14th also shows that compared with US stocks, A shares are relatively resistant.

Deng Haiqing, chief investment officer of AVIC Fund, pointed out that it is still domestic fundamentals that determine the trend of China's stock market. At the moment when the focus of the policy focuses on steady growth, the economy will be likely to move towards the real spring in September, so it is firmly optimistic about the Chinese A shares, and it is now more optimistic about the opportunity to repair large -cap stocks. (Zhongxin Jingwei APP)

This article is original by the Sino -Singapore Jingwei Research Institute, and the copyright of the Sino -Singapore Jingwei. Without written authorization, no unit or individual may be reprinted, extract or use in other ways.

Editor in charge: Sun Qingyang

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

The high -quality development of state -owned enterprises has taken the substantial pace

On June 17, the Propaganda Department of the Central Committee of the Communist Pa...

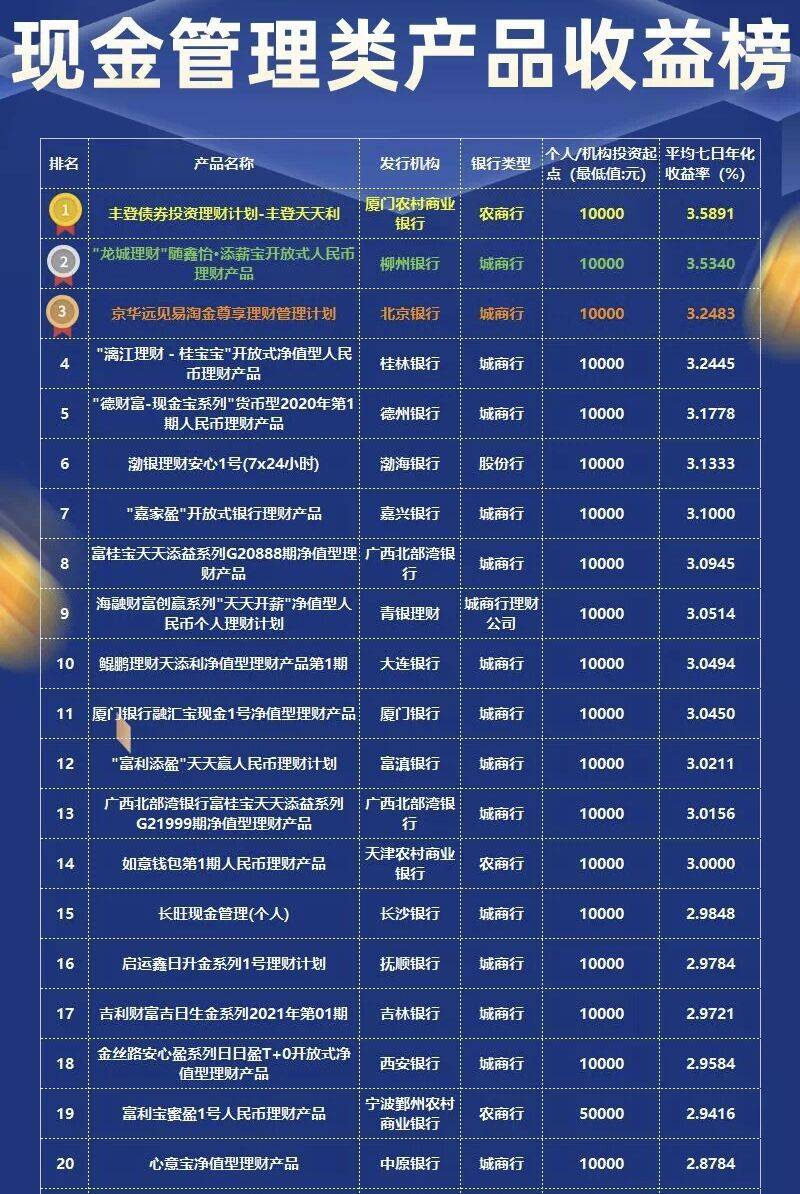

There are counts | August cash management product return on inventory

After more than three years of transition period, the new asset management regulat...