"Baoneng Department" in favor of, state -owned shareholders and small and medium shareholders 'opposition to Zhongju High -tech employees holding a shareholding plan to be rejected by the shareholders' meeting

Author:Daily Economic News Time:2022.09.14

Under the dispute, Zhongju Hi -tech (SH600872, stock price of 32.93 yuan, market value of 25.9 billion yuan) has just launched a setback on employee holding plans.

Zhongzhu High -tech disclosed on the evening of September 14 that the company's shareholding plan was rejected at the shareholders' meeting. From the perspective of voting, the "Baoneng Department" voted for votes, and the second largest shareholder of the listed company Zhongshan Torch Group voted against the vote, and most of the small and medium shareholders also opposed the employee's shareholding plan.

Is the employee holding plan?

According to Zhongju Hi -tech announcement, the company held a second interim shareholders meeting in 2022 on September 14. The meeting mainly reviewed the "Proposal on Change the Company's first repurchase of shares in 2021" ("The following referred to as the" Change of the Revolutionary Sharement Proposal ")," Company 2022 Draft and Abstract of Employees Stock Plan "(hereinafter" " Five proposals such as the Draft of Employee Stock Plan) and "Proposal on Amendment". Except for revising the "Company Articles of Association", the remaining four bills are related to the company's 2022 employee holding plan, but none of these four bills have passed the shareholders' meeting.

Among them, the "Change of the Receive Shares" obtained 176 million shares of consent votes, accounting for 44.81%of the total number of shares held by shareholders attending the meeting; 60.764 million shares, accounting for 1.54%.

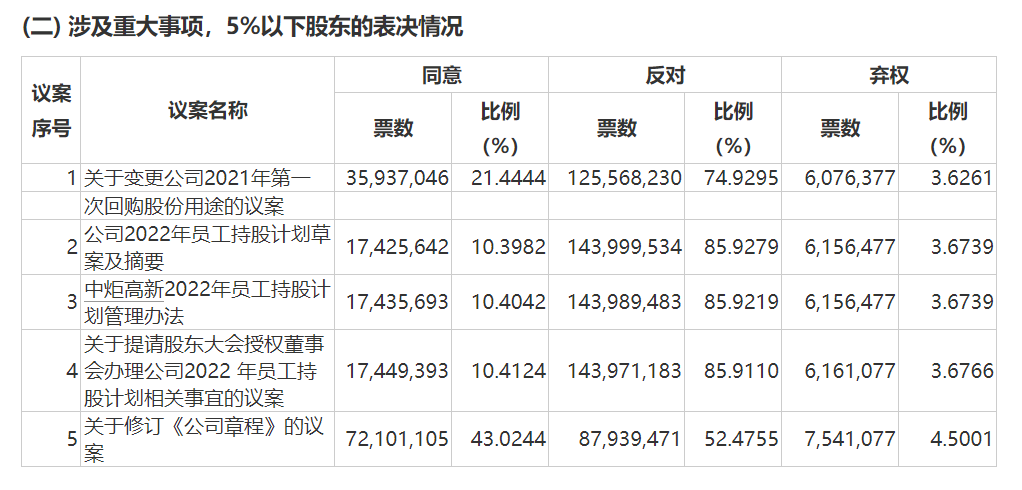

In the above voting, the consent votes invested by small and medium shareholders were 35.937 million shares, 126 million opposition votes, and 6.0764 million shares. Based on this, the number of consent votes from more than 5%of shareholders is about 140 million shares, and the opposition votes are about 85.42545 million shares.

The remaining three voting results from the company's employee shareholding plan are somewhat different. Among them, the "Draft of Employees Holding Plan" received consent tickets of 158 million shares, accounting for 40.11%; the number of opposition votes was 229 million, accounting for 58.33%; the number of abandoned votes was 61.565 million shares, accounting for about 1.57%. Combining the voting situation of small and medium shareholders, the number of votes from more than 5%of shareholders also approximately 140 million shares, and the opposition votes are about 85.42545 million shares.

As of June 30, Zhongshan Runtian Investment, a subsidiary of "Baoneng Department", holds 159.3 million shares of Zhongzhu High -tech shares, and Zhongshan Torch Group, a Zhongshan Torch High -tech Industrial Development Zone Management Committee, holds Zhongzhu High -tech shares 85.42545 million Essence The shareholding ratio of these two shareholders is higher than 5%. In addition, according to the announcement issued by Zhongzhu High -tech on the evening of September 14, Zhongshan Runtian Investment has reduced its holdings of 24.6 million shares from May 18th to September 13th. The proportion is 17.72%.

Taken together, Zhongshan Runtian Investment has approved the votes at the High -tech Shareholders Conference of the Zhongju High -tech shareholders, and the Zhongshan Torch Group voted against it.

There is a lot of controversy when the board of directors review

Small and medium shareholders have hundreds of millions of objections to the employee shareholding plan, and also show their disagreement about the plan. "I hope that the plan can be re -developed without opposing equity incentives, as long as a reasonable solution can be taken out!" Some investors spoke in the stock bar.

Picture source: Screenshot of the company announcement

Earlier, Zhongju Gao New released the 2022 employee shareholding plan (draft) on August 30. The employee holding plan intends to use non -trading transfer and other methods to transfer the company to repurchase special securities accounts held by the company not more than 1438.8 Thousands of shares, including 11.788 million shares for the first time, reserved 2.6 million shares.

The price of the shares of the company's shareholding plan for the High -tech employee shares are set at 18.14 yuan/share. The listed company had previously cost nearly 600 million to repurchase the company's 14.388 million shares, with the highest repurchase price of 46.20 yuan/share, the minimum price of 38.24 yuan/share, and the average repurchase price of 41.694 yuan/share.

According to the original plan, "(repurchased shares) were used to implement the company's equity incentives to further improve the company's governance structure, build a long -term incentive and restraint mechanism for the management team to ensure the realization of the company's long -term business goals, promote all shareholders of all shareholders The consistency of interests and income sharing, enhance the overall value of the company. " In order to implement the employee shareholding plan, the listed company announced on August 30 that it would adjust the use of repurchase shares. The original plan was changed to "all used for equity incentives" to "all for equity incentives or employee holdings".

In fact, the board of directors held by the listed company on August 29 When reviewing the employee's shareholding plan, there was a lot of controversy. The voting results of the relevant proposal were "5 votes consent, 3 votes against, and 1 voting abstain." The company's directors Yu Jianhua and Wan Hequn, independent directors Gan Yauren all voted against the votes, and Qin Zhihua, an independent director, voted for abandoned votes. From the perspective of work resumes, Yu Jianhua and Wanhequn are both representative directors of state -owned shareholders of listed companies.

Yu Jianhua said at the time that the biggest difference between the employee's shareholding plan and equity incentive was that the voting right of repurchase shares belonged to the shareholding committee, but whether the shareholding committee could represent the opinions of the employees. Changing the use of repurchase shares may not be able to obtain actual incentives. He also worried that if the holding committee obtained 1.83%of the voting rights, it strengthened the controlling shareholder's control of listed companies and affected the rights and interests of small and medium shareholders. In addition, Yu Jianhua also questioned the unlocking conditions and exit mechanisms. Wan Hequn believes that there are obvious defects such as unlocking conditions and setting proportions, and the nature of welfare is greater than incentives; independent directors Gan Yauren also raised similar doubts; independent directors Qin Zhihua suggested to delay the implementation.

Regarding the doubts of the directors, Zhongju Gaoxin responded at the time that the purpose of implementing the employee shareholding plan was to establish and improve the interest sharing mechanism of employees and shareholders; The amortization of costs affects the company's annual net profit during the lock -up period, but it is at a reasonable level.

Daily Economic News

- END -

@Everyone opens here!

Jilin Provincial Museumopen! Museum! La!Notice of opening the museumAccording to t...

Ningxian Chunrong Town: Planting gold and silver flowers, pave the "gold and silver" road

In June, the gold and silver flower picked golden season.In the honeysuckle planti...