225 million, why Gao Yan Capital invested in the Emperor Palace of Shenzhen

Author:36 氪 Time:2022.09.14

A more Buddha company began to step on the throttle.

Wen | Peng Xiaqiu

Source | 36 氪 South China (ID: South_36kr)

Cover Source | Enterprise Official

At 11 pm last Friday, a paper announced that the high -end confinement center Ai Di Palace (00286.HK) stated that Gaozhang Capital contributed 225 million Hong Kong dollars to subscribe to the transfer of preferred shares. It is equivalent to a category A -shares of the share of 0.5 HK $ 0.5 and a category B -shares per share of 0.7 Hong Kong dollars.

It seems that it is actually the right of Gao Yan Capital after buying one after buying one of the stocks (ordinary shares). According to the agreement, the conversion period can be completed at any time within two and a half years after the investment is over one year.

On the first trading day after the announcement, Aidi Palace's stock price did not rise as the previous Gao Yan concept stocks. Instead, it fell 10.34%, but the transaction volume really doubled. At present, its stock price is HK $ 0.52, with a market value of HK $ 2.244 billion.

There are four points worth paying attention to for this investment:

Birth rate is getting lower and lower, and it is a bright card.

If the Emperor Palace itself is, the Chinese fertility market is undergoing tremendous changes, but neither industry companies and practitioners are aware of this profound change. In the future, there will be two very different fertility people, and the behavior differences will be very different.

Specifically, it is clearly divided into first -child and multiple people. Among them, the first child is younger and needs to meet the functional needs of confinement. Multi -fellow groups need to experience a more perfect experience and focus on the focus to the women themselves.

From this logic, high -end confinement clubs are an industry with growth attributes. Especially in the context of increasingly scarcity in the future growth industry, for industries with growth potential, the volume of Gaomong Capital will not miss it. Take a step back, the high -end confinement club may not be a high -growth industry in the end, but it is still a good business.

Why did you choose the Emperor Palace?

The Emperor Palace is currently the leader of the industry and the only list of confinement centers in China. Its income in 2021 completed 643 million, an increase of 6.88%year -on -year; net profit was 34.785 million yuan, a year -on -year increase of 109%.

However, in the first half of this year, the Emperor Palace began to turn to losses, with 329 million revenue and 61.96 million losses. The reason for the loss is the impact of the epidemic and the unprofitable of the newly opened stores.

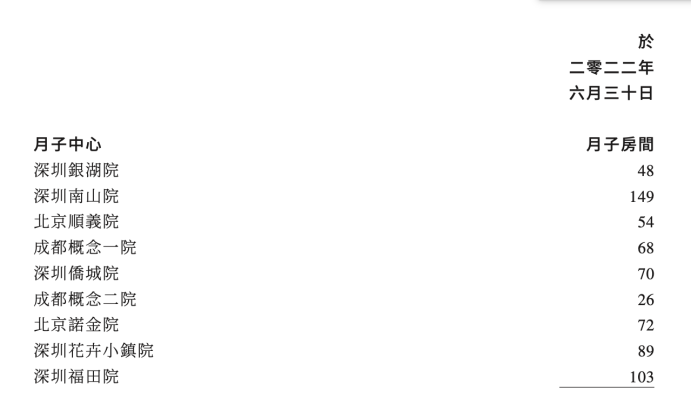

According to the semi -annual report, the confinement center of Aidi Palace is concentrated in Shenzhen (5), Beijing (2), and Chengdu (2), with a total of 9. The unit price of the Nanda Court is an example. The minimum package is priced at 68,800 yuan, the highest price is 368,000, and the entire cycle is 26 days.

Emperor Palace Price (Shenzhen Nanshan Academy)

The core is that the cash flow ability is strong

For any company, it is not enough to have profits, and it depends on cash flow. Last year, the net cash flow generated by Aidi Palace operating activities was positive, reaching 105 million yuan, more than 4 times.

Especially in pre -collection, it is obvious. As of June 30, Aidi Palace had a deferred income of 151 million confinement services and health revenue of 98.22 million yuan. Total more than 250 million.

What do you mean by deferred income? It is to receive the amount paid by the user in advance, and then confirm the corresponding income based on the content of the consumption. The most obvious is education and training. The one -time or one -year tuition fee is given to the training institution, and the institution will confirm how much income and income. However, all the money has been put into the pocket of the organization.

The end of the shop is a chain

If you are more familiar with Gao Yan Capital, it should be easy to think of China's largest private ophthalmology hospital, El Eye Department. The market value of up to 600 billion yuan, more than 187 domestic hospitals.

The same is true for the Emperor Palace. If you want to achieve high growth, you can only open more stores. Although the Emperor Palace in the past was established in 2007, the expansion speed has been slow. The reason is that all stores opened by Aidi Palace are self -decoration.

It was not until last year that the Emperor Palace began to adopt a light asset model, that is, the rental property was opened. For example, the currently running Shenzhen Overseas Chinese Town Store, the opening time is 41 days, shortening the store opening time from more than half a year to 2 months. The investment amount is only 15 million yuan, which is more than 70%lower than the same scale. What's more exaggerated is that the monthly profit has been completed in the sixth month of the opening, and it has continued to make a profit for 11 consecutive months.

After trying the sweetness, the Emperor Palace increased the pace of investment and won several five -star hotels to realize the joint venture. Among them, in the fourth quarter of last year, the Shenzhen Flower Town and Beijing Nuojin Institute were opened. In the first quarter of this year, Shenzhen Futian Institute was opened.

So, the question is here, why is the Aidi Palace so conservative before?

Compared with the strongest competitor of Aidi Palace, San Bella has chosen to cooperate with high -end hotels to achieve high -speed expansion. Since its establishment in 2017, there have been 9 domestic stores. At the same time, Tencent and Gao Rong Capital also invested 200 million to San Bella.

Therefore, the reason why the Emperor Palace changes conservative strategies and began to expand should be. With the adjustment of national policies and the emergence of new differentiation, the Emperor Palace has seen some new opportunities, and this opportunity is enough to seduce. At the same time, other players in the industry have gradually obtained capital recognition, and the background of the founder is younger, so the competitive pressure brought by is significantly greater. Whether it is to stabilize the existing market share or maintain growth, it will be forced to adjust.

More importantly, Aidi Palace's stock price has been suppressed before. However, after the policy of May and June last year, the Emperor Palace rose nearly 90%for two consecutive months, and the management should be seen. Therefore, there is a large expansion that started in the fourth quarter of last year, and three stores were opened in a row. In the end, a question to answer is, when the environment is down, it is unknown what space it can grow to. This may also be why Gaozhang Capital has not invested in ordinary shares directly, but chose a more insurance -shares.

36 氪 Public account

- END -

Sitting in Sanjia Sanchu to build Dongfang Kangyang City

The 2022 World Health Fair opened today (5th) at the Wuhan International Expo Cent...

Fragrant fluttering, not even sinking the market, it is not fragrant

Author | Jin YanEdit | Song HanI have been drinking incense when I was a kid.Who sti...