Clear!Continue to extend 4 months

Author:Hebei Radio and Television Sta Time:2022.09.15

Ministry of Finance of the State Administration of Taxation

Announcement on the continued delay in paying part of the taxes and fees related to the manufacturing industry

Announcement of the Ministry of Finance of the State Administration of Taxation 2022 No. 17

In order to thoroughly implement the decision -making and deployment of the Party Central Committee and the State Council, and further support the development of small and medium -sized enterprises in manufacturing, the manufacturing small and medium -sized enterprises (including individual wholly -owned enterprises, partnerships, individual industrial and commercial households, the same below) will continue to delay the payment of some taxes and fees policies The announcement of the relevant matters is as follows:

1. Since September 1, 2022, the announcement of the "Announcement of the Ministry of Finance of the State Administration of Taxation on continuing the implementation of the implementation of small and medium -sized enterprises in the manufacturing industry to delay the payment of some taxes and fees (2022 No. 2) has enjoyed the delay of the tax and fees of 50 %Of manufacturing medium -sized enterprises and small and micro enterprises that delay 100%of taxes and fees have continued to extend 4 months after the expiration of the slow payment period for the expiration of the slow payment and fees.

2. Delayed taxes and fees include the period of affiliated in November, December 2021, February, March, April, May, June (monthly monthly) or 2021 In the first quarter and the second quarter (quarterly paid), corporate income tax, personal income tax, domestic value -added tax, domestic consumption tax and attached urban maintenance construction tax, educational expenses, and local education additions, excluding buckles Payment, collection and payment, and taxes paid when applying for invoicing from tax authorities.

3. The delayed taxes paid paid in November 2021 and February 2022 will be paid in the warehouse before the announcement of this announcement after September 1, 2022, and you can voluntarily choose to apply for tax refund (fee) and enjoy the continuous and slow payment policy.

4. After the expiry of the post -end payment period stipulated in this announcement, the taxpayer shall pay the corresponding month or quarterly taxes and fees in accordance with the law. Apply for extension of tax payment.

V. Taxpayers who do not meet the requirements of this announcement and deceive the policies for the enjoying tax payment, the tax authorities will be dealt with seriously in accordance with the relevant provisions such as the "Taxation and Management Law of the People's Republic of China" and the implementation rules.

6. This announcement will be implemented from the date of issuance.

Special announcement.

Ministry of Finance of the State Administration of Taxation

September 14, 2022

• Recommended video •

•

- END -

In the first half of the year, Guangdong's implementation of tax refund and reduction and reduction of tax reduction total 297.6 billion yuan

In order to handle the tax refund of 190 billion yuan for more than 200,000 households, help small, medium and micro enterprises, etc.Yangcheng Evening News reporter Tang Yan reported: On the 20th, th

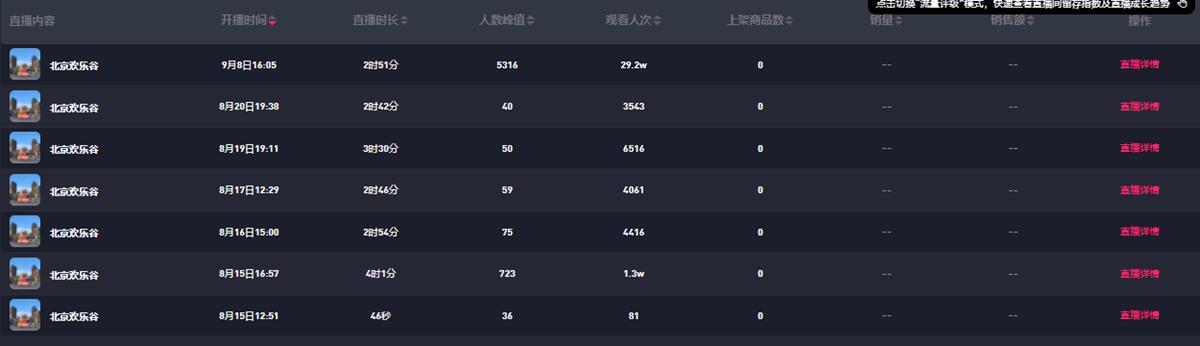

"The first angle crossing the roller coaster" live broadcast: the anchor admits that the challenge is huge, and the doctor reminds you to do your best

Jimu Journalist Zhang Hao Liu XunruiVideo editing Hu ZhiqiThe anchor with the good...