CCB Sichuan Branch: Precise policy delivery services, cross -border finance to guarantee

Author:China Economic Network Time:2022.09.15

Faced with multiple impacts of earthquake disasters and epidemic conditions, the Sichuan Branch of the Construction Bank resolutely carried political responsibility, conscientiously implemented the Chengdu branch of the People's Bank of China, the Sichuan Branch of the Sichuan Branch of the Foreign Exchange Administration, Requirement, quickly open emergency green channels, use various cross -border financial instruments to support foreign -related entities, give full play to digital business efficiency to promote the help of enterprises, ensure that basic services are continuously gear and fast market demand, and multi -level linkage and cross -domain collaboration are fully strived to make full efforts. Guarantee the smooth operation of the foreign exchange business.

Lita key areas and take the initiative to send services

In ancient times, camel bells sounded, and now the wheels are rolling. On the vast Asia -Europe continent, the Silk Road, which once "walked to the post, endlessly in the Moon", was rejuvenated by the Chinese European class. The Chengdu International Railway Port, which is located in the "Silk Road Economic Belt" and the "Yangtze River Economic Belt" national strategic remittance point, is one of the important departures of the China -Europe trains.

In the Chengdu International Railway Port, a new energy vehicle import and export company is the "frequent customers" of the China -Europe trains, and it is also the international settlement and credit customers of the Qingbaijiang Sub -branch of the Bank. After the start of this round of epidemic, Qingbaijiang Sub -branch issued a "cross -border fast loan" and 5 million yuan inclusive financial guarantee loan "good loans" through online ways. Use loans for related expenses such as payment, logistics.

During the home office, the business department of the branch also arranged for emergency duty personnel to handle an emergency account for a foreign exchange payment for customers, and instructed customers to settle foreign exchange settlement through online banking to ensure the timely turnover of funds.

The person in charge of the Qingbaijiang Sub -branch of the Bank said: "Faced with the sudden epidemic, we took the initiative to contact and understand the needs of customer needs. It has provided emergency financial services for more than 10 import and export companies, freight agency companies, and logistics companies to escort the normal operation of China -EU trains."

Make good use of the online platform, remotely solve the difficulty

Recently, after a import and export enterprise in Luzhou exported goods, considering that the exchange rate fluctuations were large, I hope that the bank can handle a long -term foreign exchange settlement and lock the exchange rate for it that night.

"In the past, the customer used to go to the bank's counter to complete the long -term foreign exchange settlement business, but due to the recent epidemic situation, Luzhou City advocated that personnel between districts and counties do not move across regions." After the customer's needs, they immediately arranged a special person to remotely guide customers to handle a long -term foreign exchange settlement transaction by self -service for a long -term foreign exchange settlement transaction to successfully avoid exchange rate risks and lock export revenue.

At the same time, CCB Sichuan Branch actively uses the "Certificate Cloud" platform to answer questions for corporate financial staff with the help of its online business guidelines. "Certificate Cloud" is a bank -enterprise management platform developed under the guidance of the Sichuan Branch of the Sichuan Provincial Bureau of the Sichuan Provincial Bureau of the Sichuan Branch of the Sichuan Branch of CCB Sichuan Branch. Data analysis, business guidance and other functions. During the home office, customers can directly retrieve the information and precautions required for the business through the "Certificate Cloud", and manage financial information while enjoying convenient services.

Flexible setting process, reasonable control risk

A semiconductor technology company in Sichuan has opened a RMB settlement account at the Yizhou Sub -branch of the First Bank of China Chengdu. Recently, the company urgently needs to account for a cross -border RMB income money to pay employees' salary. Helping the normal issuance of the salary of employees in the special period is an important part of ensuring the well -being of the people's livelihood. After the establishment of the business situation of the first branch of Chengdu Chengdu, the principle of "minimizing the offline traffic personnel" as the principle and temporarily adjusted positions temporarily. To set up and process links, the job reuse with Yizhou Sub -branch has not only compressed the emergency number, but also fulfilled the responsibilities of foreign exchange risk control management.

After the Luding earthquake, a certain unit in Sichuan received a donation funds from earthquake relief overseas, but it was not necessary to go to the bank to collect foreign exchange due to the prevention and control of the epidemic. In order to ensure the timely place of earthquake relief funds, the CCB Chengdu Xinhua Branch conscientiously implemented the Sichuan Branch of the Sichuan Provincial Bureau of the Foreign Exchange Bureau to do a good job in the relevant requirements of the earthquake relief financial services, simplified the document procedures for the unit, and processed the funds for the first time.

Open the green channel to preserve the time limit

The exported goods under the credit certificate of a private export enterprise in Leshan have been shipped out of the port. According to the shipping period and delivery period specified in the letter of credit, relevant documents need to be sent to overseas banks immediately to avoid being unable to receive the payment due to the delay of documents.

Construction Bank Council, Sichuan Branch, Leshan Branch Relay, urgently complete the review and order, and communicate with the domestic postal, international express companies and other units to overcome the inconvenience caused by the epidemic. The full process of high -efficiency services provides a guarantee for customers to collect letter of credit.

After receiving the letter of credit that Yibin's textile enterprise received a letter of credit, it applied to the CCB Yibin Branch to apply for a Fiftein financing of $ 300,000. As an important financing tool for export trade, Foffitin's business is mainly based on the letter of payment bank, tribute bank or other designated banks' payment commitments to the credit certificate. Powerful means of efficiency. Because the Foffitin business is an unspeakable buying business. For buying off the bank, it is necessary to comprehensively consider the elements such as the acceptance of the acceptance of the acceptance of the acceptance, the trade country, the price, and the term to control the overall business risk.

- END -

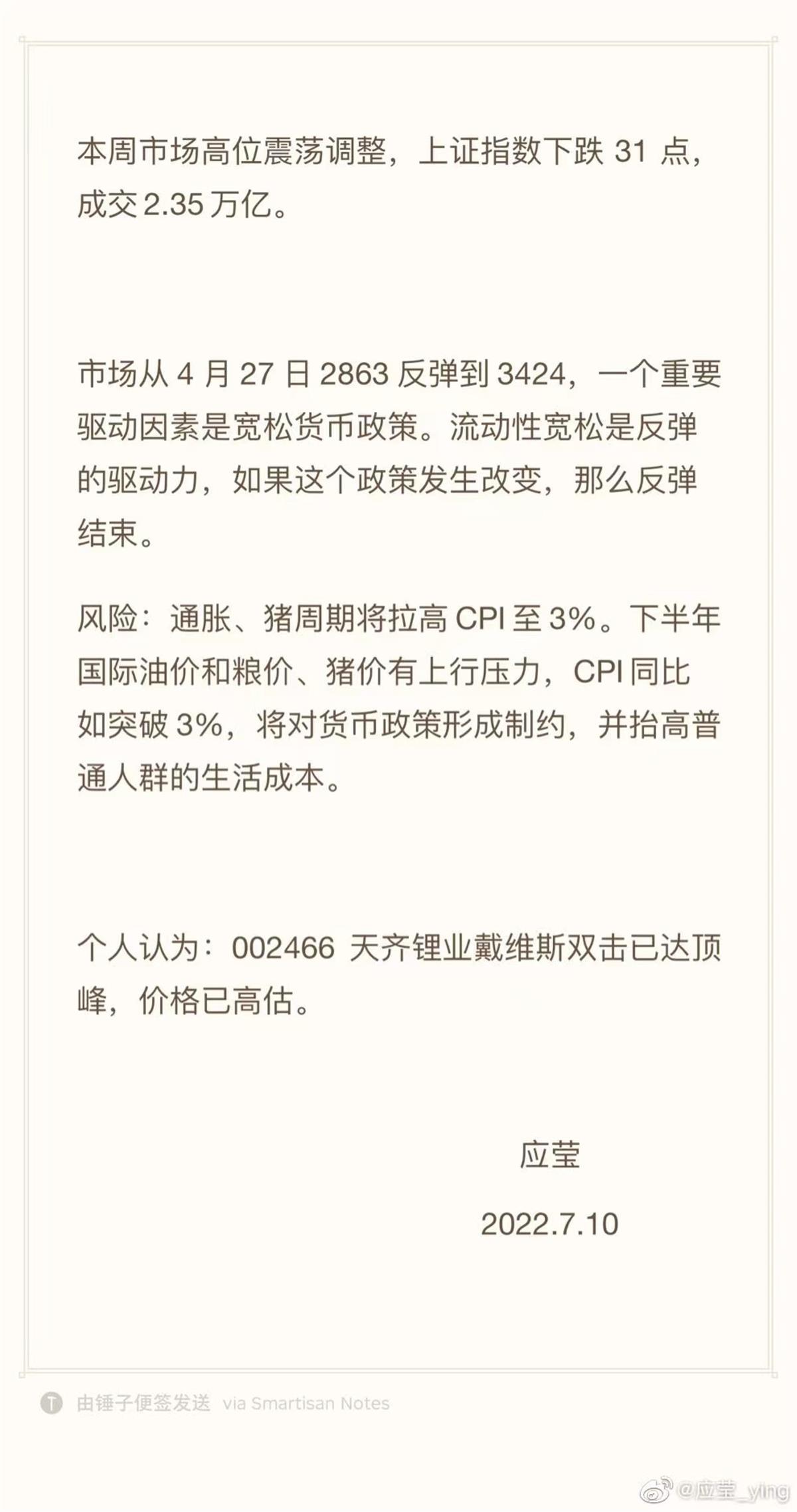

Tianqi Lithium Industry has the strongest limit of the limit track, and the adjustment has intensified. Is the new energy sector risk or opportunity?

Extreme news reporter Xu WeiTianqi Lithium Davis double -clicking has reached its ...

"2022 China Best Brand Ranking" released: The total value of the list of the list has increased by 9.8% year -on -year

Southern Finance, September 6th, on September 6, Interbrand British Boomi released...