Tingled!Sure enough, Crazy Thursday, the new energy track stocks hit the doubtful life, and the reason behind it was found again!Fosun Guo Guangchang announced: counterattack!

Author:China Fund News Time:2022.09.15

China Fund News Taylor

Brothers and sisters, today is another day of diving. The decline is harder than yesterday. The three major index diving is like a free fall, and the decline in the end has narrowed slightly.

Originally, I hope that today is the "cause of a big rise" found. As a result, I can't avoid the crazy Thursday. According to international practice, the reason for the plunge will be found.

Next, find the reason. Today, the biggest decline is a track stock section such as photovoltaic, new energy, and many new energy track stocks, including Sunshine Power and Ningde Times. Nearly 30%.

New energy track stocks collectively call back, and the power equipment sector has fallen by nearly 6%. More than 20 stocks such as Penghui Energy, Dire laser, and Jijia Weizhong fell more than 9%. Ningde continued to fall, and the stock price retreated to nearly 410 yuan, a new low since June.

Today, the major killing of the track stocks originated from the two major events in Europe and the United States.

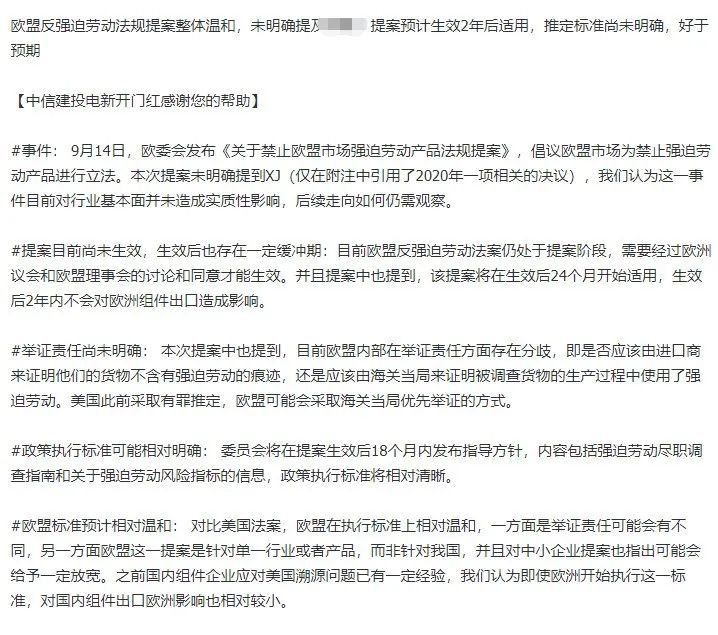

First, the Chairman of the European Commission issued a legislative proposal. The proposal stipulates that it is forbidden to sell and provide products that use forced labor in the EU market.

The European Commission stipulated in the proposal that products that are found to be forced to produce can neither sell them in the European Union nor exported from the European Union. For products that are already in the EU market, they must be withdrawn.

The proposal states that the ban "should be applied to products that use forced labor at any stage of production, manufacturing, harvesting, and extraction." The European Commission said in a statement that the regulations cover all product categories, including produced in the European Union, for domestic for domestic domestic, for domestic domestic, for domestic in China. Consumption and export products, as well as imported products, do not target specific companies or industries.

This proposal does not specifically mention any region or native country. Veralis Dombrovskis, Executive Vice President and Trade Council of the European Commission, said in a statement: "Our goal is to remove all products that are forced to work from the EU market, no matter where they are produced . Our ban will apply to domestic products, as well as import and export products. "

This proposal from the European Commission now needs to be passed by the discussion and consent of the European Parliament and the European Union Council. It will take effect within 24 months.

How does this affect photovoltaic? You can take a look at the interpretation of CITIC Construction Investment.

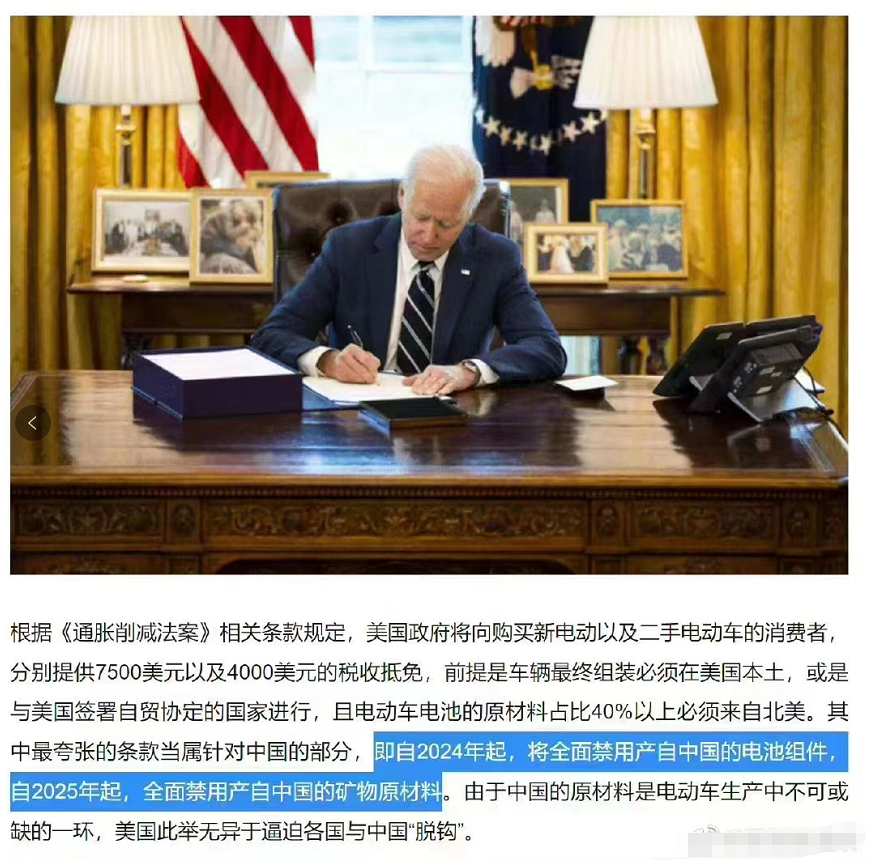

Second, the US inflation reduction bill

A panic caused by a screenshot.

However, according to the explanation of the new team of Tianfeng Power, the US electric vehicle subsidy plan is rumored: it is not disabled, but there is no subsidy

Today, a screenshot came out in the network, saying that in the US IRA Act, Chinese batteries will be disabled after 24 years for the tax credit credit policy of electric vehicles.

After verification, we updated as follows:

1. IRA policy Biden has signed and landed, and has not been updated recently. Subsidies will be officially taken into effect in January 23.

2. Subsidy quota and requirements: The proportion of key metal raw materials (40%in 23 years in a free trade country mining or processing) corresponds to $ 3750, and the battery assembly or production (50%in 23 years in North America) corresponds to $ 3750.

3. Restrictions on China: It is not the disability as mentioned in the screenshot, but does not enjoy subsidies. From 24 years, the battery composition contains any country (China in China) in the list of "Special Focus on Country", which will no longer apply this subsidy.

In addition, people familiar with the matter said Tesla suspended the plan to produce batteries in Germany because the company is considering obtaining the qualifications of US electric vehicles and battery manufacturing tax.

People familiar with the matter said that the company has been working hard to produce its own batteries and has discussed the problem of transporting the battery manufacturing equipment originally planned to be used to the United States.

The production of more batteries in China can help Tesla get additional tax reduction and exemption stipulated by the Inflation Act (also known as IRA).

Analysts say that according to the bill, as long as the rechargeable battery is manufactured and packaged in the United States, tax credit can offset the cost of more than one -third of the electric vehicle battery pack. The bill also extended taxes to some electric cars using batteries that meet various purchases requirements to provide $ 7,500 in tax credit.

Tesla's move reflects how new US law is reshaping the electric vehicle industry and accelerates the industry to ensure the supply of batteries and related components in China.

Third, the new energy sources have risen too much before, and the group has reached the extreme! The first two reasons are only the cause.

On September 13th, Chen Li, Vice Chairman of Soochow International and chief strategist in the world, said at the Golden Autumn Strategy Conference of Soochow Securities in 2022: At present, the proportion of partial stock public funds to new energy has reached an amazing 40%of the new energy sources. There is never a high point in the history of A shares.

Chen Li believes that the macro assumption corresponding to the configuration ratio is that the liquidity is relatively loose, the economic highlights are concentrated on a few tracks, global inflation can be suppressed, and the energy crisis will continue. "I can't say that this assumption is wrong, but I personally think that this assumption will have some fragile places in the next six months."

Chen Li suggested that investors should still do some industry balance. "Blindly and completely accumulated on the popular track since this year, I think it is still full of risks. It is recommended that you still balance it."

Banks and real estate took the banner and rose against the trend. The furniture industry chain is also rising.

The reason is simple, more and more cities have relaxed purchase restrictions. Chen Li believes that the real estate market may survive the most difficult time, and the recovery of consumer scenarios is also expected. Qingdao: Moderate adjustments to the current real estate related policies and no longer restricted purchase of second -hand housing

Suzhou purchase restriction policy adjustment: Foreign household registration can buy the first house directly in Suzhou Sixth District

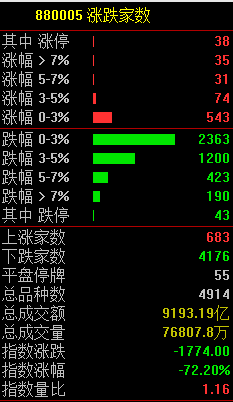

In the end, the two cities exceeded 4,100 shares, and they rose only more than 680 stocks. The transaction was obviously volume. As of the closing of the Shanghai Index, the Shanghai Index fell 1.16%, the Shenzhen Index fell 2.1%, and the GEM index fell 3.18%.

Northern wound funds sold more than 4.1 billion yuan.

Finally blessing on Friday, forget it, no blessing. Hahaha

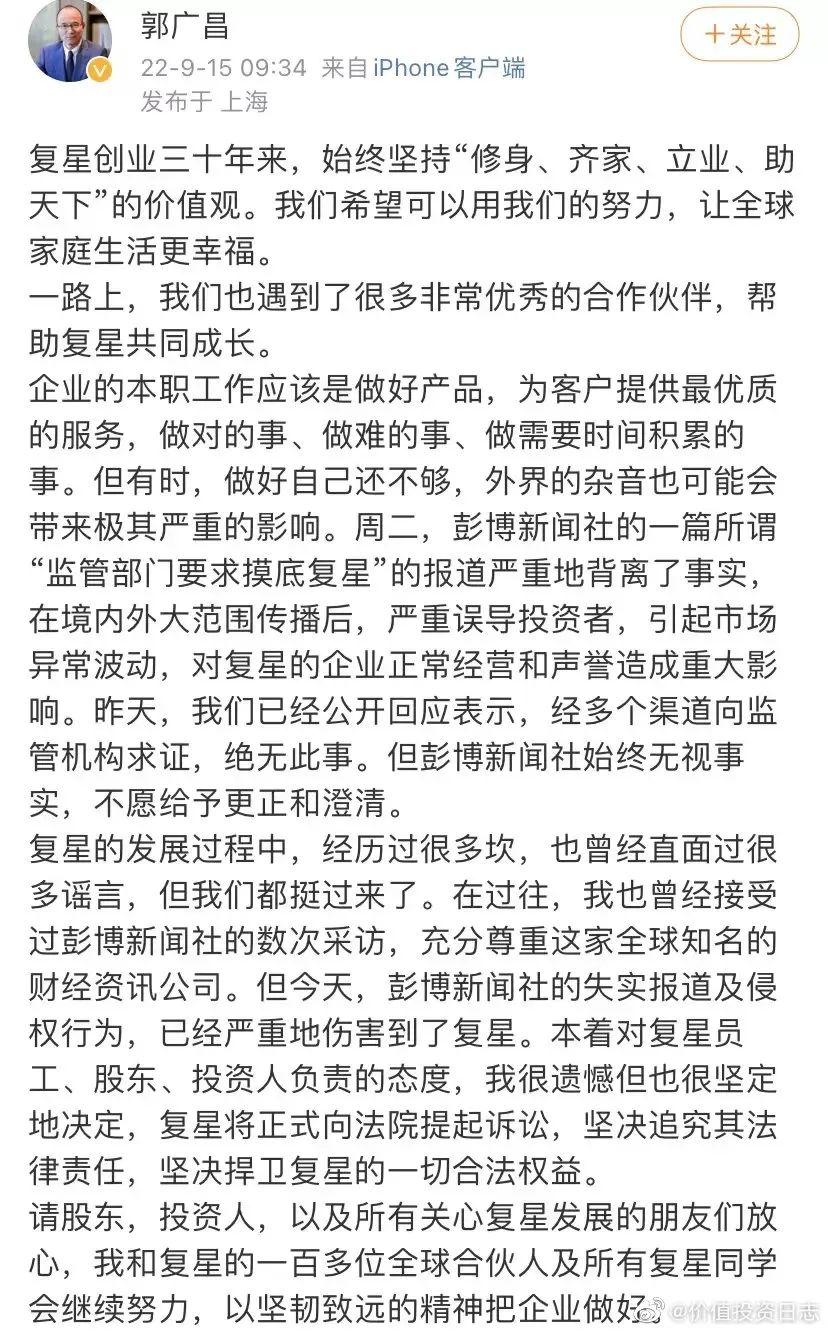

Guo Guangchang prosecuted Bloomberg to deny the regulatory authorities requested Fosun

Recently, a article published by Bloomberg's article entitled "China Regulatory Commission requires banks and some state -owned enterprises to find out with the Putu", which has aroused external attention.

Follow -up, Fosun responded that the report was false. On September 15th, Guo Guangchang, chairman of Fosun Group, said that Bloomberg News reported that the false reports and infringements had seriously harmed Fosun. Fosun would filed a lawsuit against the court and resolutely investigated its legal responsibility.

Guo Guangchang said that the repayment of a so -called "regulatory authority requests Fosun" in Bloomberg News seriously deviated from the facts. After spreading a large -scale spread in the territory, investors were seriously misled, causing abnormal market fluctuations.

Guo Guangchang said that although Fosun has publicly responded publicly, there is no such thing as a regulatory agency, but there is no such thing, but Bloomberg News has never given correction and clarification. Therefore, Guo Guangchang claimed that Fosun would formally file a lawsuit in the court.

Sudden diving! More than 4,000 stocks fell, and new energy of photovoltaic energy fell! A big news, bank real estate stretched! Sanya lifted temporary static management

- END -

When the price of teeth is closed, the National Medical Insurance Bureau is clear!

Three -level public hospital planting medical services price regulationThe target ...

Full closed loop!full load!Strive to complete the production delivery task of 700,000 pieces

Nearly 70 % of employees, two shifts, closed -loop management execution of product...