Announced down!Related to your money bag

Author:Voice of Zhejiang Time:2022.09.15

Source: CCTV News, CCTV Finance, China Securities News

The copyright belongs to the original author, if there is any infringement, please contact it in time

The reporter learned today from ICBC, Agricultural Bank of China, Bank of China, CCB, Bank of Communications, and Postal Savings Bank that the six major state -owned banks will adjust their personal deposit interest rates from today (September 15), including more deposits and regular deposits. The interest rate of individual varieties has a different range of fine -tuning.

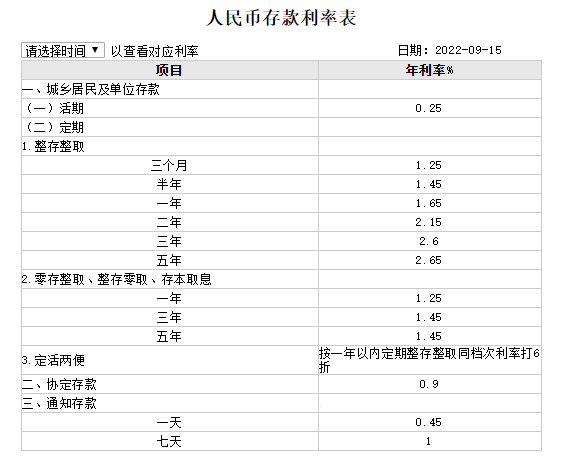

Picture source: ICBC website

Among them, the three -year regular deposit and large -scale deposit interest rates were reduced by 15 basis points, and the one -year and five -year regular deposit interest rate was reduced by 10 basis points, and the interest rate of the deposit rate was reduced by 0.5 basis points.

At present, the annual interest rate of the sixth largest banks is 0.25%; the one -year terminal deposit interest rate is 1.65%; the annual interest rate of the three -year regular deposit is 2.6%; the annual interest rate of the five -year regular deposit is 2.65%.

Earlier, the quotation of the loan market quotation (LPR) quotation released on August 22 showed that the 1 -year LPR reduced 5 basis points, and the 5 -year and above LPR downgraded 15 basis points. Many analysts believe that with the reduction of LPR, bank deposit interest rates may also be reduced.

Market participants believe that considering that the one -year LPR has recently lowered 5 basis points and 10 -year government bond yields has also declined to a certain extent. It is necessary to have space for the annual interest rate of limited time deposits and large deposit deposits.

In April this year, the People's Bank of China guided interest rate self -discipline mechanisms established a market -oriented adjustment mechanism for deposit interest rates. The People's Bank of China has clearly adjusted the interest rate of deposit interest rates with reference to members of the self -regulatory mechanism bank referring to the bond market interest rate represented by the 10 -year Treasury bond yield and the loan market interest rate represented by the 1 -year LPR. "The People's Bank of China has given appropriate incentives for the market -oriented market -oriented adjustment of deposit interest rates," said the People's Bank of China.

It is worth noting that this is another decline in bank deposit interest rates since April this year. In April of this year, the reporter learned that the annual interest rate of multiple banks' 2 -year and 3 -year regular deposit was reduced by 10 basis points.

Wang Yifeng, chief analyst of Everbright Securities Financial Industry, believes that the deposit interest rate should not be separated from the operation trend of broad -spectrum interest rates such as central ticket interest rates, benchmark interest rates, and inter -bank borrowing interest rates. "In the process of overall broader interest rates, the deposit interest rate should also show the characteristics of trending downward," he said.

It is substantially beneficial to the bank sector

The semi -annual report of listed banks shows that the industry's net interest margin is in a downward channel. Industry experts believe that with the continuous decline in the rate of return on the asset end of commercial banks, the rate of liabilities is also an inevitable trend. The reduction of deposit interest rates is conducive to relieving the narrowing pressure of interest differences.

Some experts also said that the deposit interest rate will be beneficial to the bank sector. Liao Zhiming, chief analyst of China Merchants Securities Banking Industry, said that the deposit interest rate is reduced to the substantial benefit of the banking sector, and the signal that the interest difference will not continue to be significantly reduced, which is conducive to stabilizing the profitability of banks.

In terms of stable interest margins, many bank executives point out that to start with the asset side and liabilities at the same time, the key to the liability side is to control and reduce costs.

Liu Jianjun, president of the postal savings banking, said that in terms of debt, the cost of liability should be continued, especially to increase the proportion of living periods, increase the traction of the assessment of wealth management, increase the proportion of the deposit of current deposits through wealth management, and continue to decline in the decline in the pressure Long -term deposit scale and interest rate.

Fu Wanjun, President of Everbright Bank, said that on the one hand, it is necessary to strictly control high cost liabilities, and on the other hand, it is necessary to absorb more current or low -cost liabilities by making large customer bases, strong transactions, and more settlement.

"In the next step, we must further give play to the role of the loan market quotation interest rate and the role of the market -oriented adjustment mechanism of deposit interest rates, guide financial institutions to transmit the decline in deposit interest rates to the loan end, and reduce the cost of corporate financing and personal credit." President Liu Guoqiang said.

- END -

The richest man in China is replaced, it is her!

(Yang BenboChinese female richest manFrom childhood accounting to Forbes best CEOI...

Beijing will launch a pilot of medical care services for the elderly

In order to effectively increase the supply of medical care services for the elderly and accurately connect with the needs of the diverse medical care services of the elderly, the Beijing Municipal He