Argentina's accumulated inflation rate or 95%this year, "Soybean dollar" has the effect of making up for debt gaps?

Author:21st Century Economic report Time:2022.09.15

21st Century Business Herald reporter Shu Xiaoting Beijing Beijing report

On September 14, local time, data released by the Argentine State Statistics and Population Census Research Institute showed that Argentina's cumulative inflation rate in the first eight months of this year was 56.4%. Data show that in the 12 months of August this year, Argentina's cumulative inflation rate reached 78.5%, the highest level since 1991.

While the inflation continues to be high, inflation expectations are also heating up. The marketing expected survey report released by the Central Bank of Argentina on September 9 pointed out that the cumulative inflation rate in Argentina in 2022 is expected to reach 95%, which is 4.8 percentage points from the expected expectations of last month, which is the annual inflation expectations for 6 consecutive months.

In order to suppress inflation, the Argentine Central Bank has raised interest rates eight consecutive times this year, raising the benchmark interest rate to 69.5%. At present, the market is generally expected to raise interest rates sharply at the next interest rate meeting. One of the basis for this judgment comes from: the debt restructuring agreement reached by the Argentine and the International Monetary Fund (IMF) in March this year promises to maintain the actual interest rate. In addition, according to the agreement, Argentina also needs to achieve the goals of 2022 fiscal deficit accounted for 2.5%of the total domestic production value and support the accumulation of foreign exchange reserves of US $ 5.8 billion a year.

In order to quickly return the US dollar and enrich the foreign exchange reserves, the Argentine government has formulated a preferential exchange rate around soybean surrounding soybean, so that soybean exporters can settle foreign exchange at a price of $ 200 (higher than the official exchange rate).

Sun Yanfeng, deputy director of the Latin America Institute of China Modern International Relations Research Institute, pointed out in an interview with the 21st Century Business Herald that the preferential exchange rate of soybeans can help alleviate the problem of farmers' sale and delayed soy exporters. Dollar.

Promoted by the new exchange rate policy, as of the week of September 7, the soybeans sold by farmers in Argentina were almost 8 times the previous week.

Wang Jialu, an analyst at China Integrity International Sovereign, told the 21st Century Business Herald reporter that the so -called "soybean US dollar" was created for the new exchange policy of soybean exports, which played a certain positive role in boosting Argentina exports and increasing foreign exchange reserves. Helps increase government liquidity funds. However, in the long run, Argentina faces insufficient foreign exchange reserves. As of the first quarter of 2022, Argentina's total foreign debt was US $ 274.4 billion, while its foreign exchange reserves were only $ 42.8 billion, which has a limited role in making up for debt gaps.

"Soybean US dollar" policy affects geometry

According to statistics from the Argentine Ministry of Agriculture, more than 40%of Argentina has been used to grow soybeans. The total value of soybean, soy oil, and soybean meal accounted for more than 20%of the country's total export value. Argentine soybean export accounts for about 98%of its total export. In 2021, Argentina's soybean exports reached US $ 21.5 billion. The Argentine government levied 33%of soybean export taxes, making soybeans an important source of tax and foreign exchange reserves in the country.

Recently, the overlay supply chain problem of Russia and Ukraine has led to the strong operation of commodity prices, driving the exporter of commodity exporters in Latin America to achieve surpassing recovery, and export revenue and fiscal conditions have improved. Since the beginning of this year, Argentina's agricultural products have exported a total of US $ 25.696 billion, a year -on -year increase of 10%, a record high. The foreign exchange obtained by exporting enterprises will directly enter the Argentine central bank system, and the central bank will settle in foreign exchange rates at an official exchange rate. The exchange policy will follow the principle of voluntariness and decide to join the voluntary system exporters will receive additional tax incentives.

Last week, Argentina Economic Minister Sergio Massa announced that the country's soybean exporters were implemented with a special exchange rate, and soybean exporters could settle foreign exchange at a price of $ 1 at a price of $ 200. Massa said that soybean exporters have reached an agreement with the government and will be sold at least $ 5 billion in soybeans in September.

Wang Jialu told reporters that Argentina's new exchange policy for soy exports has created the so -called "soybean dollar", which plays a certain positive role in boosting soybean exports and increasing foreign exchange reserves. In the short term, it will help increase government liquidity funds.

"Soy soybean exports are one of the main sources of Argentina for the US dollar." Sun Yanfeng said that at present, when Argentina's US dollar foreign exchange reserves are close to depletion, the US dollar is very important to the Argentine government. Therefore, after Massa as the new economic minister, he looked at soybeans to the high -price promotion of the official exchange rate or to stimulate the soybean US dollar to settle quickly. Earlier, Argentine soybean exporters needed to settle foreign exchange at a price of $ 1 against 90 pesos, while the black market exchange rate was as high as $ 1 and about 300 pesos. In addition, the exporters needed to pay 33%of the pre -deduction tax, which led to most of the time soybean exporters this year. Unwilling to carry out foreign exchange settlement.

It should be noted that the effective period of exchange policy is from September 5 to September 30. Sun Yanfeng believes that the reason why the policy is short in the short term is mainly considered: First, if the policy is implemented for a long time, the psychological expectations of the market formed an official exchange rate will be replaced by the black market exchange rate, which will cause the Argentine government to stabilize the exchange rate of the exchange rate to "pay the east flow" , A tech to the chaos in the financial market. Second, there is a game of interests between Argentina's left -wing government and agricultural and animal husbandry groups. In order to ensure long -term constraints and restraint, policies are often short -term.

Is the risk of debt default ease?

The proportion of foreign debt in a country is one of the indicators to measure its debt repayment pressure. As of the end of 2021, Argentina's foreign bonds were US $ 270 billion, accounting for about 58%of GDP, but foreign exchange reserves were only US $ 43.12 billion, and foreign debt accounted for 6.26 times that of foreign exchange reserves, far exceeding the international warning line. Wang Jialu told reporters that Argentina's capital projects are high and often in the deficit for a long time. Since 2010, Argentina's frequent accounts have continued to show deficit, and the net inflow of foreign direct investment has made up for some gaps. Argentina's foreign debt is rising rapidly and foreign exchange reserves are weak, while a large amount of debt is denominated in US dollars and euros, making its external balance very fragile.

Objectively, the debt repayment pressure facing Argentina is not a short -term issue. Sun Yanfeng believes that from the current situation, the risk of debt defaults has eased. Earlier, Argentina replaced three economic ministers in one month to form a blow to market confidence. In addition, whether the country can repay debts on schedule has increased, and the possibility of the financial turmoil caused by debt defaults to the financial turmoil has reached high. point. Along with the SERGIO Massa, he served as Argentine Economic Minister and was supported by international financial institutions. The market sentiment has rebounded from pessimism in July.

On September 12, Kristalina Georgieva, President of the International Monetary Fund, met with Sergio Massa, Argentine Economic Minister. Opinion.

On September 6, the American Development Bank President Mauricio CLVER -Carone and Argentine Economic Minister Sergio Massa held a meeting to discuss the bank's continuous efforts to support Argentina. The American Development Bank will provide a package of $ 700 million in special development loans (SDL) in September and a $ 500 million policy loan (PBL). During the meeting, President Caron and Minister Massa also discussed the final steps before the signing of the Board of Directors of the American Development Bank, with a total loan of 1.208 billion US dollars.

In Wang Jialu's view, the current borrowing of international institutions is positive for solving Argentina's current debt dilemma, but it should be noted that compared with the past tightening cycle, this round of developed economies is more radical. The rise in long -term borrowing costs and the tightening of the financing environment will bring more severe challenges to Argentina's debt management and foreign exchange acquisition capabilities. Because Argentina's finances and foreign payment risks are high, solving the problem of "sustainable debt" is an important problem that the Argentine government needs to face. "In the long run, adjusting the industrial structure, enhancing the inherent growth of the economy, and strengthening the system of systems are the only way for Argentina to achieve sustainable economic development."

- END -

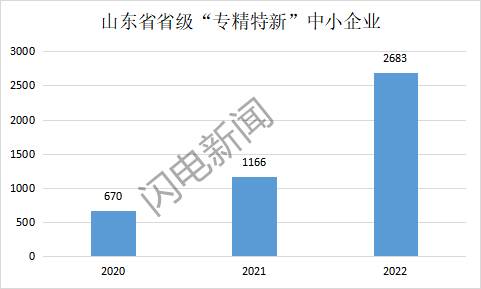

Add 2683 "specialized new"!Shandong Economic help adds "elite soldiers and strong generals"

Recently, the Shandong Provincial Department of Industry and Information Technolog...

The total market value of the top ten of the science and technology board is nearly trillion yuan in photovoltaic enterprises crystal energy ranked first

According to the Shanghai Stock Exchange, as of June 16, 2022, the total market va...