The offshore RMB "breaks 7", what do you think?

Author:Daily Economic News Time:2022.09.15

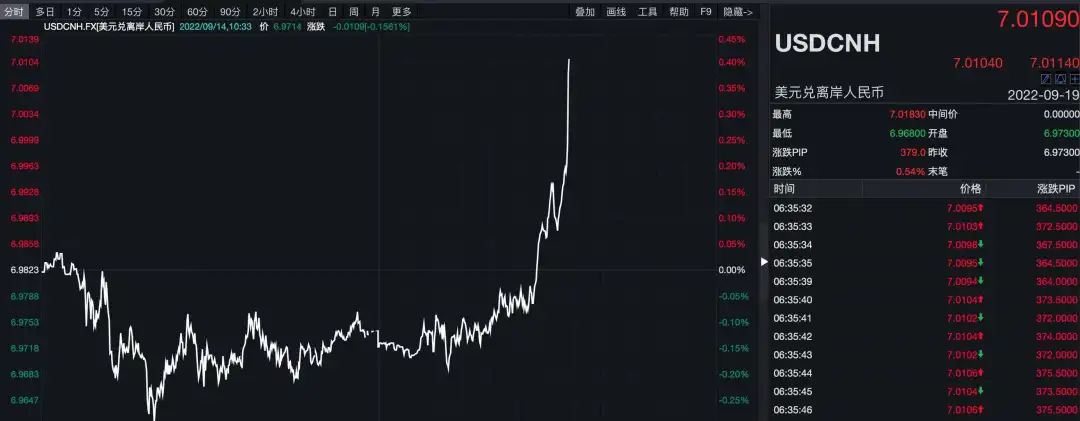

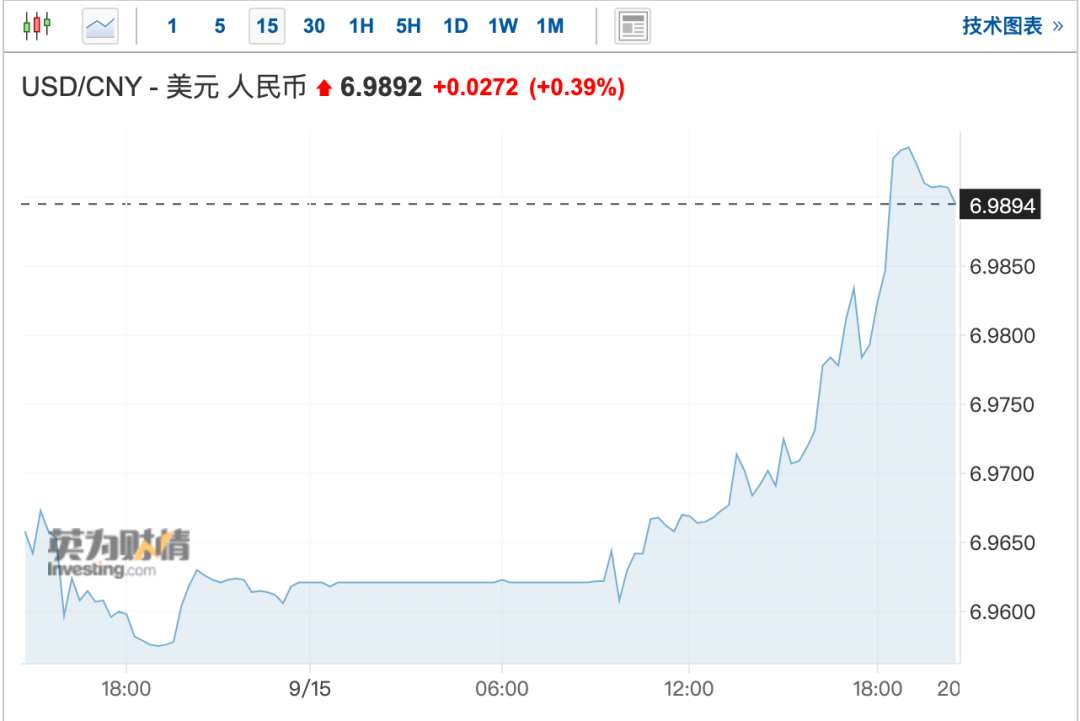

Today (15th), the exchange rate of the offshore RMB to the US dollar fell below the "7" mark. After a lapse of more than two years, the exchange rate of the RMB into the US dollar has once again entered the "7" era.

Image source: Wind data

As of press time, the offshore RMB exchange rate of the US dollar was 7.0183, which is currently reported at 6.9958; the exchange rate of the US dollar to the US dollar has fallen below the 6.99 mark.

Recently, due to the continued high of the US dollar index, the RMB exchange rate on the US dollar has experienced a rapid depreciation, which has aroused widespread market attention. Wang Chunying, deputy director and spokesman of the State Administration of Foreign Exchange, said on the 15th that a policy measure of my country's stability of the economy has been effective, the national economy continues to recover, and the long -term good fundamentals have not changed. At the same time, my country's international revenue and expenditure structure is more stable, the market -oriented regulation mechanism has become increasingly mature, and the main body of foreign exchange market participation is more rational. The comprehensive capabilities of the external environmental changes have been further improved, laying a solid foundation for the smooth operation of my country's foreign exchange market.

Treating the depreciation of the RMB against the US dollar in this round

What are the main reasons?

According to previous reports of the Economic Daily, at present, due to the Fed's accelerated tightening of monetary policy, the US dollar index once broke through the 110 mark, causing the devaluation of the Passiveness of the RMB against the US dollar.

Data show that the US dollar has appreciated by 14.6 % since this year. In the context of the appreciation of the US dollar, other reserve currencies in SDR baskets have depreciated significantly. From January to August, the euro depreciated by 12 %, the pound depreciated by 14 %, the yen depreciated by the yen, and the yen depreciated. 17 %, the renminbi depreciates 8 %. Compared with other non -US dollar currencies, the depreciation of the RMB is relatively small, and in the SDR basket, in addition to the depreciation of the US dollar, the RMB has appreciated the non -US dollar currency, and the renminbi has not comprehensively depreciated. On the other hand, RMB is actually appreciated than these non -US currencies.

In addition, according to the State Administration of Foreign Exchange on the 15th, in August, the exchange rate for measuring the willingness to settle foreign exchange (the ratio of foreign exchange income from foreign exchange to customers to the bank) was 71%. The main body maintains the rational trading model of "Extraorders Ending Exchange", and the willingness to settle foreign exchange to settle foreign exchange is increased; the exchange rate sales rate of foreign exchange sales (the ratio of foreign exchange from banks to customers from foreign exchange expenditures) is 67%. The willingness to purchase foreign exchange for market entities is generally stable.

It can be seen that the depreciation of the RMB in this round is mainly triggered by the US dollar index, and the operation of the three major RMB exchange rate index is still stable. The foreign exchange market reflects that the relevant indicators of exchange rate expectations are running smoothly.

Will the renminbi continue to adjust? In the short term, the RMB exchange rate trend will be affected by multiple factors such as foreign exchange supply and demand and the international financial market. A certain increase or decline in a certain period of time will occur. Maintain basically stability at a reasonable and balanced level.

At present, China's economic stability is restored, the main economic indicators are good, the industrial chain and supply chain remain stable, and support the RMB exchange rate. At the same time, China's foreign trade and foreign investment are strongly tough, and the funds at the real economic level such as trade and investment will still be the basic disk of flowing, which will help the basic balance of supply and demand for the foreign exchange market.

Picture source: Visual China

Look at the RMB exchange rate "Break 7" with ordinary heart

Comprehensive Economic Daily and China News Agency's state affairs through traffic, the RMB exchange rate broke the "7". It really did not think so seriously. It was just a price, and it would definitely rise. This is inevitable.

For a long time, "7" has been regarded as an important psychological barrier, and the RMB exchange rate has repeatedly broken the "7". For example, in August and May 2019, the RMB exchange rate broke the "7" due to trade friction and epidemic factors, respectively.

In fact, after the "Break 7" in August 2019, the RMB exchange rate has opened up and down elastic space. Now, regardless of the government and the market, the tolerance and adaptability of the two -way fluctuations of exchange rates and broad shocks are greatly enhanced. This can be confirmed from the recent market performance: the decline in the RMB exchange rate since August 15 has not accompanied market panic.

At present, my country's foreign exchange and sales market has been running smoothly. Since August, banks 'foreign exchange sales and foreign -related receipts have shown a dual surplus situation. In August, banks' foreign exchange and sales surplus surplus was $ 25 billion. $ 100 million is higher than the average monthly level since this year. Overseas investors overall buying China's securities, the main exchange market's main body participation is more rational, maintaining the transaction model of "settlement of high foreign exchange", and the exchange rate is expected to be stable.

It should be noted that the RMB exchange rate "breaks 7". This "7" is not an age. In the past, it will not come back, nor is it a dam. Once it is broken, it will be thousands of miles. The period is higher, and it will fall again when it is dry. It is normal to rise and fall. Everyone must realize that the RMB exchange rate does not have the basis of long -term depreciation, nor will there be unilateral markets that have been declining or rising.

Even if this time it is broken, in the future, with the stability of the domestic economy and the use of the US dollar index to recover the use of some tools, it is also inevitable to return to the "6" range.

Under the fundamental support, the financial management department has sufficient exchange rate fluctuation tools and large policy space. For example, in addition to the foreign exchange deposit reserve ratio that has been launched, at present, the central bank's tools in preventing the rapid depreciation of the exchange rate also have counter -cycle factor , Cross -border investment financing macro cautious coefficients, etc.

Taking recently as an example, on September 5th, the People's Bank of China announced that starting from September 15, two percentage points of the foreign exchange deposit reserve ratio of financial institutions will be reduced, that is, the foreign exchange deposit reserve ratio will be reduced from the current 8 % to 6 %. This is the second foreign exchange "reduction" this year. Experts believe that the central bank's move to release positive signals to the market will help stabilize the RMB exchange rate expectations and avoid irrational overruns.

It should be noted that the central bank announced on September 6 the news of foreign exchange "interest rate cuts" instead of being executed that day. In addition, in recent days, foreign exchange "interest rate cuts" are more of signal effects, and they are "shouting" to the market. If irrational depreciation occurs, the official will not sit down. The central bank of any country will not let the country's currency appreciate or depreciate rapidly.

Is the RMB depreciation even more worthless?

Will depreciation lead to rising prices?

In fact, the impact of exchange rate rise and falling is already an old topic, and the exchange rate depreciation has advantages and disadvantages. Moderate depreciation is conducive to improving the competitiveness and price advantages of export trade, and promoting the recovery of the real economy, but the import costs of imported enterprises will increase.

For example, China ’s export trade in China’ s shoes, boots, textiles and clothing, and leather bags occupy a large share, and the moderate devaluation of the RMB may benefit from companies in these industries. On the other hand, industries that need to import raw materials, goods, and services from overseas, and companies that carry more US dollar bonds may be negatively affected.

However, it is noted that the "valuable" of the depreciation of the renminbi is only reflected in the use of RMB to buy the US dollar. When import settlement needs to be used in the US dollar, the import cost will indeed increase.

If imported settlement is used in euro, yen, and pounds, the recent cost is decreasing, because the renminbi is actually appreciated compared to these currencies.

As for the problem of rising prices, most of the Chinese CPI composition can be used for it. It can be self -sufficient in China. The depreciation of the RMB on the US dollar exchange rate has a small impact on our own prices.

Of course, if you consume products in China, it is imported through the US dollar, or its parts are purchased with US dollars, the cost of RMB depreciation may be transferred to the price you want to buy, which will become expensive.

For the easiest example, if you pass the cross -border e -commerce Haitao in China, if you finally consume in the US dollar, it will have an impact on you.

However, there is a set of pricing mechanisms in the supply of many daily necessities. The final price after the pricing mechanism is not necessarily required to pay for the whole people.

Is the RMB assets "fragrant"?

It is undeniable that in this wave of depreciation of the renminbi, some funds will definitely go out, but these funds generally have short -term investment purposes or even with speculative mentality. Fund flow is also orderly.

Zheng Wei, deputy director of the Foreign Exchange Bureau last weekend, said that at present, China's cross -border capital flow is generally stable, and domestic foreign exchange supply and demand have remained basically balanced. The long -term good fundamentals of China's economy have not changed, and continue to attract direct investment and flow in the purpose of medium and long -term asset allocation.

In the first half of 2022, China's direct investment net inflow was 74.9 billion US dollars, of which a net inflow of direct investment in China showed a strong attraction of foreign investment in the Chinese market.

Recently, the data released by the China Foreign Exchange Trading Center also showed that in July, foreign institutional investors bought RMB 6.6 billion in nets. This shows that with the steady growth of China's economy, the confidence of overseas capital allocation of RMB bonds is rapidly recovering. Especially with the increasing risk of global economic recession and the sharp increase in the financial market, the risk aversion attributes of RMB bonds have been favored by overseas capital.

At present, the Chinese bond market has gradually become an important destination for global cross -border bond investment. RMB bonds have both decentralized investment value, as well as actual capital allocation needs, and more fundamental support. At present, the total scale of the Chinese bond market is US $ 21 trillion, and foreign capital accounts for about 3 %. There is still much room for improvement in the absorption of foreign capital in the Chinese bond market. In the long run, foreign capital will still steadily increase holding RMB bonds.

In addition, according to news from the State Administration of Foreign Exchange on the 15th, the net cross -border capital inflows under the trade of goods continued to increase high, and foreign capital inflows such as direct investment and other channels increased steadily.The cross -border income and expenditure surplus of goods in August was US $ 55.2 billion, an increase of 31%over July.At the same time, the net inflow under the direct investment of Lai China increased from July. The continued improvement of overseas investors' investment in domestic bonds and stock markets, highlighting the long -term investment value of my country's market and RMB assets.

Edit | Cheng Peng Du Hengfeng

School pair | Duan Lian

Cover picture source: Screenshot

Daily Economic News Integrity Journal of Economic Daily, China News Agency State Business Command and Market Information

Daily Economic News

- END -

Robotic electricity is here!Jining Power Grid for the first time carried out intelligent robots with electricity operations

On August 10th, with the last phase switching of the 10 kV Nanying Nanying II line...

The ambition of glory: the "high -end civilians" of the wisdom world

Text | Intelligence RelatrationAuthor | 凯 佘A year ago, Honor had just been indep...