How to look at the market outshore, how do you look at the market?

Author:First financial Time:2022.09.15

15.09.2022

Number of this text: 2343, the reading time is about 4 minutes older

Introduction: In the past two days, the peripheral conflict has continued, and the Fed's radical rate hike expecting has soared.

Author | First Finance Zhou Erin

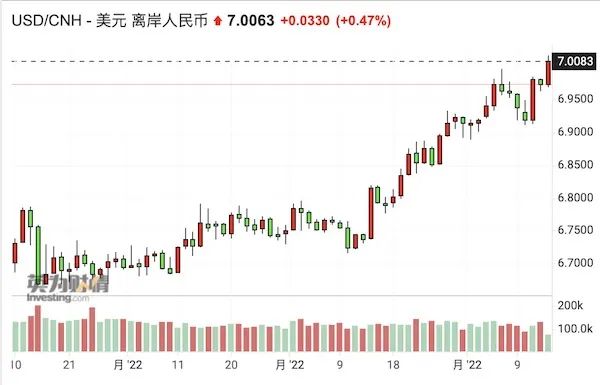

After a few weeks in the 6.9 interval, the offshore RMB fell below the 7th mark on the evening of September 15.

As of 18:45 Beijing time, USD/offshore RMB was reported at 7.0124, and USD/RMB was reported at 6.9924. In the past two days, the peripheral conflict has continued, and the expected expectations of the Fed's radical interest rate hikes have soared, all of which have caused the renminbi to pressure.

"Today the intermediate price deviation of the model is as high as 500 points. This deviation lasts for more than ten days. The intention of the central bank to maintain stability is still very obvious, but due to market emotions and strong dollars, the offshore market is still relatively heavy." Foreign exchange traders told reporters.

Another foreign exchange trader told reporters, "After 7 breaks, it is expected that there will still be some pressure in the future. It does not rule out that it is around 7.15-7.2. The decline of about 30%and 20%, in fact, this decline is normal. "

The Morgan Stanley Huaxin Fund mentioned to reporters that the United States "Inflation Act Act", which was approved by the local time on August 16, stipulated that the final assembly of the subsidy vehicle must be carried out in the United States or a free trade agreement with the United States. The geopolitical risks have aroused the concerns of the market's concerns about the export demand for industrial chain of photovoltaics and new energy vehicles, and have become the main driving force for the market to promote the decline of the market. The above -mentioned policies that will affect exports to Europe and the United States have previously released some information, but in the weak environment that has recently traded a low -time transaction, the market response has intensified.

However, Guan Tao, the chief economist of BOC Securities, believes that the recent market impact of this wave of exchange rate adjustment may be less than April and May, and you can usually look at the broad shock of the RMB exchange rate.

There are four reasons for the analysis of Guan Tao: First, the improvement of exchange rate volatility is often accompanied by the foreign exchange market's exchange transactions tend to be active, but this time the volume of foreign exchange transactions is not obvious. The second is that the RMB's rapid decline is accompanied by depreciation expectations, but the stability of the market expectations has increased compared to the last time. Third, the current RMB exchange rate callback is mainly driven by the offshore market. It is reflected in the direction of CNH's continued depreciation direction. The difference between the difference during the rapid decline has further expanded. Fourth, the twice of the RMB decline was accompanied by the stock market adjustment, but this time the land convergence item has been converted from a cumulative net sales to cumulative net purchase.

On the afternoon of the 15th, the State Administration of Foreign Exchange announced the foreign exchange market data in August. Guan Tao analyzed that in August, banks, that is, the long -term (optional rights) conclusion and sale from the deficit of the same period last year to a surplus of 15.1 billion US dollars, an increase of 1.30 times from the previous month; The exchange rate increased by 3.5 percentage points from the previous seven months. The exchange rate of exchange and purchase of the exchange rate decreased by 2.3 percentage points, showing that the market entity maintained rationality. The willingness to settle on foreign exchange was rising, the motivation for foreign exchange purchase was weakened.

"Today's foreign exchange revenue and expenditure data confirms the above judgment, that is, from a series of high -frequency data, the market impact of this wave of RMB exchange rate adjustment may be less than April and May." Guan Tao believes.

A state -owned bank's foreign exchange business expert mentioned to reporters that after a small twist, the US dollar index once again closer to the 110 mark again this week. It does not mean that the dollar will return to balance immediately, but it means that the deviation of the trend is very large, and the market participants need to keep a calm and objective position when the price is overheated. " The renminbi is actually in a relatively overestimated range. In the next 1-2 months, if the US dollar index hovers at a high level, the retracement pressure of the RMB exchange rate will still exist, but the retracement is not large.

In fact, starting in mid -August, most foreign banks have lowered the target price of the RMB year. Most institutions believe that "breaking 7" is a probability event, which is a natural reaction under the depreciation of the Asian currency. However, the institution also believes that the central bank still has many tools, and the balance of balance of income and expenditure in China is good, and the depreciation of the RMB will not be out of control.

"The strong balance of balance of expenditure means that the RMB exchange rate is still completely in the control of China." Zhang Meng, a macro and foreign exchange strategist of Barclays, said. She also told reporters on September 15 that the prediction of USD/RMB within the year was adjusted from 6.8 to 7.15. In her opinion, the renminbi is still strong on a basket of currencies. "Even if the dollar/RMB moves towards 7.25, the CFETS one -basket currency index is only back to the level of the first quarter of 2021."

Barclays recently stated that under a strong US dollar, China may try to control the speed of RMB depreciation, but the current RMB is at a relatively expensive level, and on this basis, it continues to suppress the RMB depreciation.

Coincidentally, Liu Jie, director of Standard Chartered Macro -strategy, recently told reporters that the RMB's basket currency against CFETS still remains close to 102, about 6%higher than the historical average, which is less than 1%from the beginning of the year. This shows that the renminbi is only a depreciation of the US dollar, and compared to China's major trade opponents, it remains in a few years or even decades. This shows that the recent depreciation pressure comes from the appreciation of the US dollar. She also believes that "Break 7" is not surprised, and the trend of strong dollar may continue. Since the beginning of this year, strong exports are a major factor in supporting the exchange rate, but due to the intensification of overseas recession risks, China's trade surplus may decline due to weakening foreign demand. "At present, overseas investors do have the position of short -selling RMB. The interest difference is a factor (the spread between China and the United States exceeds 70bp), but the more direct reason is that the Chinese monetary policy orientation becomes interest rate cuts in August."

Recently, the continued strengthening of the United States' swelling has also led to the rise of the US dollar, which has exacerbated the pressure of RMB. Data on Tuesday night showed that the US CPI in August increased by 8.3%year -on -year, higher than the market expectations of 8.1%; what was worried about policy makers is that after eliminating the price of food and energy with large fluctuations, the core CPI in August in August It rose 6.3%year -on -year, and the previous value was 5.9%.

Wall Street was caught off guard on the same day, and the stock bonds were killed, and the most serious selling since June 2020 appeared. S & P 500 closed down 4.3%on Tuesday, and the Nasda Index closed down 5.2%. The US dollar index is rushing.

The International Investment Bank Goldman Sachs raised interest rate hike forecast overnight, and raised the Fed's December meeting to 50bp (previously 25bp). Goldman Sachs is currently expected to raise interest rates by 75bp in September, and 50BP will be raised in November and December, which will bring federal fund interest rates to 4-4.25%before the end of the year. Even the market has an expectation of 100bp in September. The direction of the future exchange rate market also depends on whether the "inflation tiger" can be tamed to a certain extent.

In the future, the agency believes that it will not rule out that the People's Bank of China will take some measures to avoid excessive exchange rate depreciation. For example, Standard Chartered believes that the most likely measured measures in the near future are short -term tools, including increasing the scale of offshore central ticket issuance, tightening the liquidity of offshore RMB in a small amount, and increasing the cost of shorts. The next issue of central tickets expires on September 22; further reduced the reserve rate of foreign exchange deposits, such as further down from the current 6%to 5%or even 4%; Investment, including slowing the quota of QDII, etc.

- END -

Inventory in the first half of 2022: Listed companies exceeded a hundred, and the market ecology continued to optimize

On June 24, 2022, with the sound of the listed bell on the Beijing Stock Exchange, the total number of listed companies listed on the Beijing Stock Exchange reached 100, which officially entered the

Hainan Qionghai: Supply of agricultural protection when grabbing agriculture

On September 5, farmers in Tayang Town, Qionghai City watered vegetables at the pr...