Six major banks have lowered the deposit interest rate of three years fixed deposits 15bp 15bp

Author:Daily Economic News Time:2022.09.15

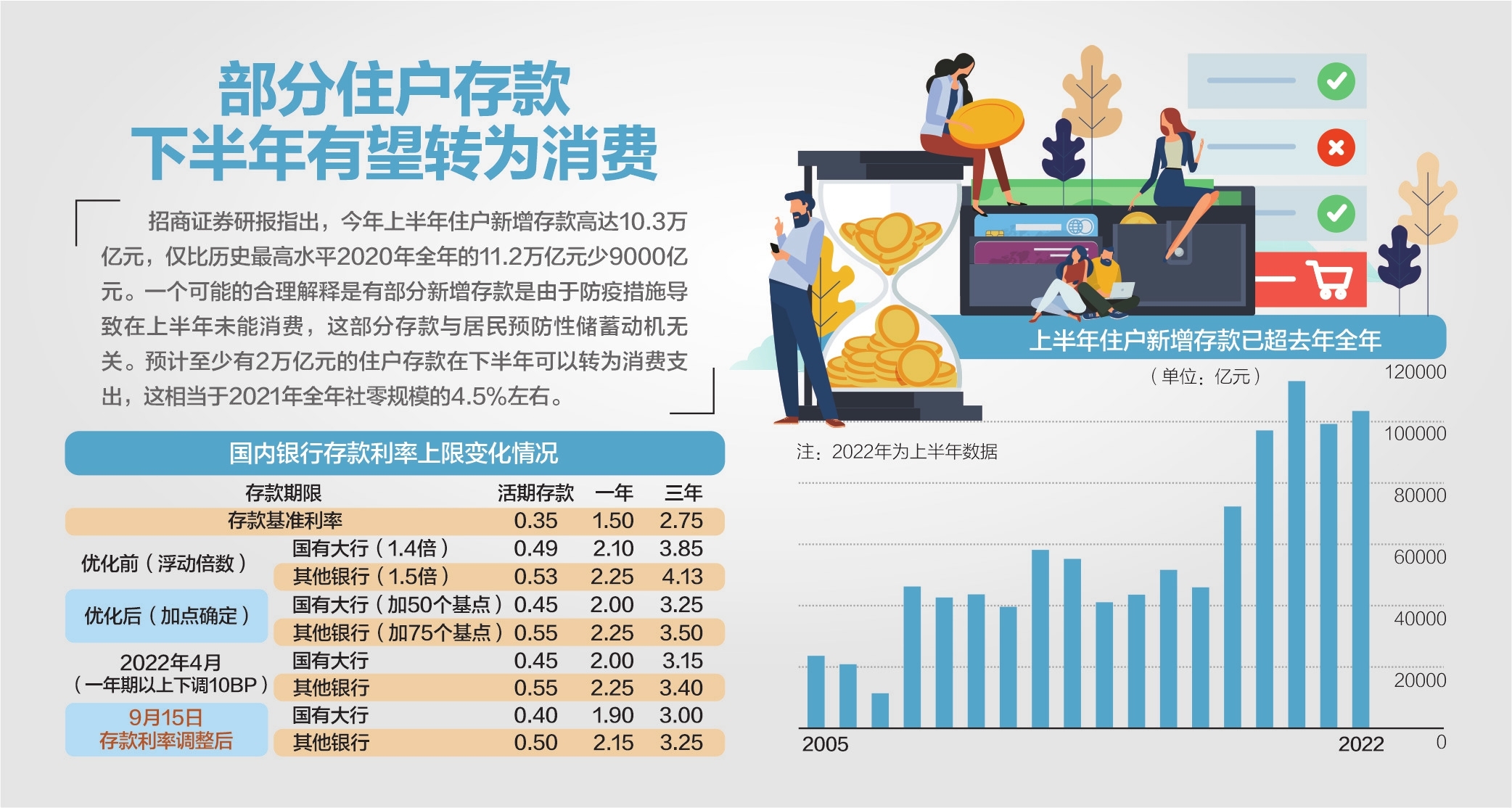

On September 15, reporters of "Daily Economic News" noticed that the official website of the six major banks of ICBC, Agricultural Bank, Bank of China, Bank of China, Bank of Communications, and Postal Savings Bank announced the adjustment interest rates of RMB deposits. Specifically, ICBC, Agricultural Bank of China, Bank of China, CCB, and Bank of Communications deposit interest rates are consistent: 5bp downgraded; three -year rectification and rectification of 15bp, that is, low to 2.6%(annualized, the same below); the remaining period is reduced by 10bp. The adjustment interest rate of the postal savings banking is slightly higher than the five -year period and one -year period is slightly higher than the previous five major banks, and the remaining period interest rates are the same as the aforementioned five major banks.

The reporter consulted many banks in Shanghai to learn about the latest deposit interest rate execution level. There is a large bank's customer manager that the actual deposit interest rate can rise more than the listing interest rate, but the specific range needs to be notified. Not only did the state -owned bank, the reporter learned in the consultation that some shares also lowered the time deposit interest rates in the near future, of which the three -year interest rate was reduced by 5bp.

It is worth mentioning that this is not the first time the bank deposit interest rate is reduced. In April of this year, the Daily Economic News reported that Dajiu lowered savings deposit interest rates, and the 2 -year and 3 -year interest rates were reduced by 10bp.

Source of data: central bank, Wind, China Merchants Securities Yang Jing map photo picture network diagram

Some shares are also adjusted

The reporter consulted the implementation level of the latest deposit interest rates in many banks in Shanghai. Some customer managers of Da Bank told reporters that the regular deposit interest rate "can be floated (compared to the listing interest rate), but the specifics need to be notified." The reporter learned that the bank's head office adjusted the listing interest rate and pricing limit of the RMB deposit on September 15, and the notice of adjusting the corresponding price approval authority was issued later.

The customer manager of a certain outlets of the Bank of China told reporters that the deposit interest rate just reduced the deposit rate on the same day, and the fixed deposit interest rate was 3%of the three -year fixed deposit rate, and the large deposit bill was 3.1%.

In addition to state -owned banks, the deposit interest rate of some shares has recently lowered. The customer manager of a certain outlets of Pudong Development Bank told the reporter of the Daily Economic News that the deposit interest rate after the central bank had reduced interest rates after the interest rate cut.

In addition, the reporter learned from the customer manager of China Merchants Bank that the bank also adjusted the interest rate of RMB savings deposits, and the adjustment of the post -deposit interest rate was consistent with the aforementioned five major bank listing interest rates. Among them, the three -year fixed deposit also lowered 15bp. However, the customer manager told reporters that the interest rate of large deposits and special deposits of the bank has not been adjusted for the time being.

Wen Bin, chief economist of Minsheng Bank, said that the interest rate of the deposit rate of the state -owned bank's bank shows that the reform of the deposit interest rate reform is now emerging. After the mid -August borrowing convenience (MLF) exceeded the expected interest rate cut 10bp, the 10 -year Treasury bond yield was rapidly decreased, and LPR of 1 year and 5 years decreased 5bp and 15bp, respectively. The above is generally consistent with it.

It is conducive to a virtuous cycle of economic

According to data from the CBRC, the net interest margin of commercial banks in the second quarter was 1.94%, which continued to narrow 3bp from the first quarter. Under the narrowing trend of net interest margin in the banking industry, the cost of controlling liabilities has become an important force for the stability difference between banks. At the performance conference of the listed bank interim results this year, the topic of stable interest differences has been repeatedly mentioned.

Guo Mang, deputy president of the Bank of Communications, said at the performance conference that in the low interest rate market environment, the interest margin of commercial banks may face a certain downward pressure. From the perspective of the Bank of Communications, thanks to policies such as the preliminary reduction and the adjustment of deposit interest rates, and the internal management of the Bank of Communications strengthened the cost of deposit costs, it is expected that the cost of deposit costs for the annual deposit will be basically stable. At the same time, the Bank of Communications will continue to drop high cost deposits. For example, the protocol deposit expires will no longer be renewed, the proportion of large amount deposit accounts will be set, and a regular structural deposit will be further dropped to less than 400 billion yuan at the end of the year. In addition, strengthen the construction of product channels, improve the ability of low -cost funds to absorb and reserve, and reverse the decline in the proportion of current deposits.

At the performance conference, CCB President Zhang Jinliang said that under the current policy of reducing the profit -making profit, CCB should put more energy on the control of the cost of the debt. It is necessary to take the traffic operation of the liability business as the top priority, and take large customers as the source to grasp the expansion of upstream and downstream small and medium -sized customers, especially to enhance the acceptance rate of large customers' allocation funds to form a closed loop of funds. At the same time, the management system with full -amount funds as the core is gradually constructing and improving. It is believed that with the promotion and implementation of the Great Wealth Management Strategy, more low -cost survival deposits will be precipitated.

Wen Bin said that the current market entity has a strong willingness to save, and reducing the cost of deposit will help stimulate the self -financing needs of the market entity. Since the beginning of this year, micro -subject savings are strong, risk preferences are weak, and regular deposits have continued to intensify. In August, residents' deposits increased by 1.83 trillion yuan, an increase of 1.17 trillion yuan from the previous month, an increase of 4.49 trillion yuan, and the new scale of residential deposits continued to reach a record high of the same period.

In addition, corporate deposits have also increased year -on -year. Wen Bin said that this means that the contraction of the asset -liability sheet of residents and enterprises such as market entities is still relatively obvious, and the willingness to take the initiative to produce or invest is not strong. Therefore, by reducing deposit interest rates and other methods, it helps stimulate the self -financing needs of market entities, conducive to transforming funds into the entity department, promoting the formation of wide credit, and driving the economy into a virtuous cycle track.

- END -

Dalian Pulandian District Layout Strategic Emerging Industry Project

On August 24th, a centralized signing ceremony of the investment promotion project was held in Pulandian District, Dalian City, Liaoning Province. A total of 3 projects signed a contract on the day, w

The commentator has something to say | Don't let the crops and fruits rot in the ground

On August 12, the pomegranate cloud client reported the news that a community cadre and volunteer organizations for multi -party forces would help a fruit farmer to sell grapes. Seeing this news, we m