Every hot review 丨 Try to reduce the funding rate as the fund investor to reduce the burden

Author:Daily Economic News Time:2022.09.15

Recently, many public funds have announced or participated in the purchase rate. Some opinions believe that investors should pay attention to the future performance potential of the selected funds, rather than refer to the intensity of preferential preferential purchase rates. The author believes that the reduction rate of public funds to reduce the burden on fund investors will help enhance its market competitiveness.

For example, the standard purchase rate of a fund purchase amount of less than 500,000 yuan is 1.2%, and the preferential rate rate in different purchase channels is 0.84%, 0.6%, and 0.3%. Some funds even enjoy 0 discounts at the purchase rate of some marketing agencies.

Some people dismiss the fund's rate and think that as long as the fund's performance is good, this small profit is nothing. However, the future performance of the fund is uncertain. Even if the original operating income is high, it does not mean that the future income is high. During the period when the current market is difficult to make money, the fund's reduction of fees is equivalent to saving investors.

If you take a closer look at the various rates of the fund, it is really scary. The first is the management fee, which is charged by the fund company. The active fund management rate is generally 1.5%and the index fund is 0.5%. The annual fee is deducted by the day. According to regulations, the fund manager can withdraw a certain fee from the management fee as the customer's maintenance fee for the fund sales, up to not more than 50%or 30%, which is the fund sales of the tail commission.

The second is the fund custody fee, which is charged by the custody bank. The active fund is generally 0.25%and the index fund is 0.1%.

The third is the subscription fee or purchase fee. The purchase period of the new fund is called subscription, and the subscription rate of stock funds and hybrid funds is generally 1%. After the new fund closed period is over, the purchase is called purchase, and the purchase rate of stock funds and hybrid funds is generally 1.5%. The subscription fee or purchase fee is generally owned by the sales channel.

The fourth is the redemption fee. The longer the general investor holds the holding time, the lower the redeeming fee. For example, some stock funds hold the rate of less than 7 days to hold a rate of 1.5%, and the rate of redemption from one year is 0.5%. The redeem fee of over two years is 0. The redemption fee charged is included in the fund assets, and the remaining fund holders are enjoyed; some cases are returned to the sales institution after deducting the assets of the fund.

At present, the share of the Class C fund does not take the front -end charging, but adopts the back -end charging model. It may not charge for (applying) purchase fees and redemption fees, but it must be charged for sales service fees. 0.60%of the annual fee rate.

All mentioned above are standard fees, generally there are discounts. If the fund charges various fees at a standard rate, the cost of the fund investor in one year may be as high as three or four percentage points. In the first August of this year, only the benefits of only one active equity fund were positive. From this point of view, the various rates of funds for various rates were discounted or reduced, which was not indifferent to fund investors, but it was too important.

Since 2019, fund product rates in major markets in the world have declined, and the rates of some ETF products and index funds in the United States have dropped to zero. The median annual operating rates of stock funds and bond funds in Mainland China are 1.75%and 0.46%, respectively, and are at a high level worldwide. At present, the sales of public funds for "price war" are undoubtedly a gospel for investors, and it is also the deserved meaning of normal market competition.

Of course, the more preferential the subscription rate or the purchase rate is, the more it is worth investing in the fund, which is also highly related to the investment level of the fund manager. However, reducing various rates of funds and reducing the burden on the foundation should be the right direction. In addition to further reducing the fund management fee and custody fee, the recognition (application) purchase rate is given to the greatest extent. It is compression and even completely cancel the fund redemption fee.

The "Regulations on the Management of Lobricity Risk Management of Open Securities Investment Fund" clearly states that the fund manager shall strengthen the management of short -term investment behavior of investors. Investors with a period of holding less than 7 will charge a redemption fee of not less than 1.5%, and the above redemption fee is included in the fund property. In my opinion, during the start of the fund, investors enter and exit the construction of investment portfolios, and it should be a bit high. Re -assigning it is difficult to say.

The author suggested that for related open funds, investors holding funds with a shareholding of less than 7 days, charging a redemption fee of not more than 0.25%, and holding the holding time for more than 7 days, all the redemption fees are exempted. For the back -end charging model such as Class C fund, the sales service rate should also be greatly reduced on the basis of the current basis.

In short, fund investors are not involved in the market to make soy sauce, and they hope to have a certain amount of investment income. The lower the cost of the fund's rate, the more guaranteed their income. Proper benefits to promote the healthy development of the fund market.

Daily Economic News

- END -

A -share noon comments: Index early trading low open and high walking intelligent wearable collar rising two cities

The three major indexes opened low in early trading. As of the afternoon, the Shanghai Index rose 0.57%, the Shenzhen Index rose 0.90%, and the GEM index rose 1.19%. The half -day turnover of the Shan

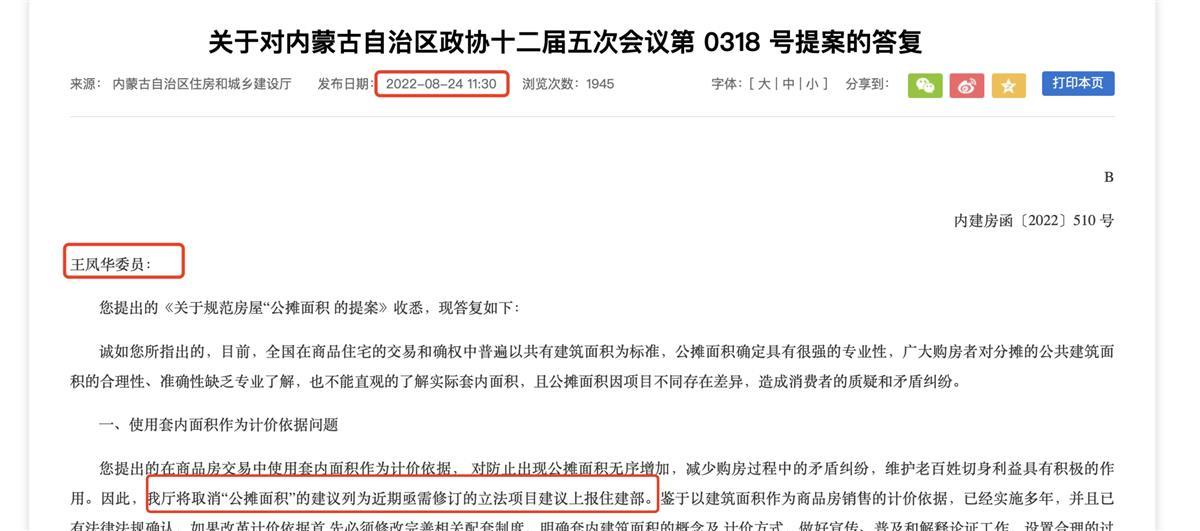

Inner Mongolia plans to cancel the "public storage area" as a proposal to report the legislative project. Experts: All localities should better investigate the situation of the publicity area

Jimu Journalist Zeng LingzhengIntern zodiac rainRecently, the official website of ...