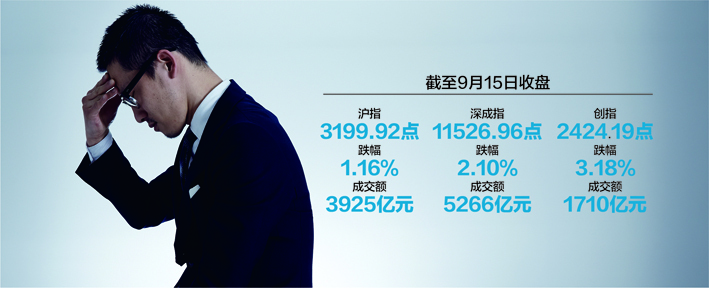

The Shanghai Index lost 3200 points yesterday!Institution: There is no large systemic risk in A shares

Author:Daily Economic News Time:2022.09.15

Since mid -July, the Shanghai Stock Exchange Index shook back and forth at 3100 points to 3300 points. On September 15, the A -share market reproduced significantly. The Shanghai Stock Exchange Index fell below 3200 points.

From the perspective of the industry, electrical equipment, semiconductors, chemicals, and colors have fallen more, all exceeding 3%. What performed well is some traditional industries, such as real estate, banks, winemaking, insurance, etc.

In the face of the continuous trembling market, although the market also has some structural opportunities, it is not easy to grasp. The Shanghai Stock Exchange Index has been oscillating around 3200 points for about 2 months. How will it be interpreted in the future? How should investors choose? "Daily Economic News" reporter interviewed a number of fund companies, and analyzed and interpreted this.

Data source: Reporter sorted out the visual Chinese map Yang Jing map

The bank real estate sector is relatively strong

Huaxia Fund said that the current logic of empty growth is more about the crowded of the track and the high valuation of some segments, but the investment of growth stocks is more closely related to the prosperity, performance exchanges, valuation income ratio, etc. There will still be a chance of exceeding expectations next year, and it is difficult to stand on the logic that is completely empty. It is currently in the "confusion period" brought by the reduction of risk preferences. It is recommended to prepare a balanced industry configuration in both hands to reduce the fluctuation retracement of the growth sector. On the one hand In terms of decline, further focusing on a more growing direction, light storage, military, smart vehicles, VRAR, etc. are still worthy of grasping.

Wang Jing, chief strategy analyst of Chuangjin Hexin Fund, has become a growth and value style after the growth of growth, value -widening in July to August, and the gradual increase in economic stability expectations. Considering that the incremental funds are not much this year, and more, more of the characteristics of the stock game, style convergence is likely to be reflected in the form of one after another. Judging from the current A -share valuation level and history similar to history, the potential returns and winning rates in the medium and long -term market are at a high level, and the short -term irrational declines have released some risks. Risk, it is recommended that investors look at short -term fluctuations and make funding arrangements according to their own risk tolerance.

Yongying Fund believes that the reason for fluctuations is that the market position distribution and valuation differentiation in the early stage are affected by catalysts such as the decline in deposit interest rates, overseas liquidity contraction, and other catalysts. "The effect, the bank real estate sector is relatively strong, and the growth sector has lowered significantly, and the market risk appetite has fallen, which leads to the pressure of the broader market, especially the GEM finger. For A shares, the pricing logic mainly depends on the internal fundamental expectations and the currency environment. The overall valuation of A shares is still at a low level, and there is still a large long -term investment value. It can still minimize the attention direction from the two dimensions of valuation and prosperity.

The Shanghai Investment Morgan Fund stated that without systemic risk, the A -share market will continue to be in a framework with liquidity as the main driving force. In terms of configuration, it is recommended that the balanced configuration respond to the fluctuations and dilute the game. At present, the main track transaction of the "New Half Military Vehicle" is crowded. It needs to wait for further data verification, and the overly pessimistic economic expectations have been corrected. It is recommended to respond to market fluctuations through balanced configurations and maintain strategic determination.

The institution recommends maintaining a balanced configuration

The Agricultural Bank of China Huili Fund believes that the current economy is in the stage of weak recovery, and it is difficult to see index level opportunities. In the early stage, the prosperity strategy continued to win under the liquidity loose thrust. The degree of valuation differentiation between growth and value style reached a historical high, and the short -term style had balanced pressure. It is recommended to focus on the two main lines in the future. One is low valuation. The current market value has a high possibility of overtaking rebound. The valuation of the value sector represented by bank real estate is low. At present In the past 13 years, the 0.5%division, the real estate PB was only 0.87 times, and it was in the past 13 years. It was optimistic about the valuation logic of the real estate chain industry including banks, real estate, and furniture appliances. The second is the growth of prosperity. From the perspective of the performance of the central report and the third quarterly report, the technology growth represented by the new energy sector is still the direction of strong performance and continuation of prosperity advantages. Configuration.

The Everbright Paudex Fund said that in terms of industry configuration, the proposal is mainly based on the main focus, focusing on three directions. First, the valuation of the economy -related sectors has been adjusted for a long time. There are opportunities for valuation repair in the rebound: stable medicine, liquor, cycle (petrochemical, coal, etc.) overall investment opportunities are worth looking forward to, pay attention to securities firms; pay attention to agriculture, society, society and society The consumption expectations of service representatives have positive marginal changes, and pay attention to holiday catalysts such as National Day. Second, the expectation of economic recovery is gradually adjusted. The growth style preferences are expected to form a consistent consensus, and the relative advantages have weakened. The internal rotation is faster: it is recommended to focus on domestic alternatives. Essence Third, the power restrictions and European energy crisis in some regions in China will also catalyze the production capacity value of traditional energy that need to be reserved.

The Western Lice Fund stated that at the industry level, the pan -new energy sector has more significant adjustments, and the sub -field market has differentiated. On the one hand, the accumulation of a large increase in the early stage and facing phased adjustment; on the other handIn terms of adjustment of the growth of optical storage demand, in terms of electric vehicle industry chain, demand in 2023 faces uncertainty, high lithium carbonate prices affect profitability, and the supply of lithium battery supply has increased competition, resulting in relatively significant adjustments in the sector recently.Looking forward to the market outlook, in the short term, the market structure has been adjusted between growth and value, and the phased bias is balanced; in the long run, considering the policy landing efficiency and domestic economic toughness, continue to pay attention to steady growth of main offline real estate and real estate chains, and continue to be high.The high -end manufacturing hard fields such as military industry, new energy, and semiconductor, as well as the consumption sector after the epidemic.Daily Economic News

- END -

Zaoyang: Innovative management and protection of farmland water conservancy projects to consolidate the foundation of food production

More receivables lies in fertilizer, no harvest is water. The reporter learned fro...

More than 20 million yuan!Qinhuangdao will focus on supplementing industrial enterprises from these aspects!

This morning, Qinhuangdao City Promoting Innovation and Development Policies and M...