RMB exchange rate breaks "7"!What is the reason?What is the impact?Will the depreciation expectations gather?Experts say this ...

Author:Daily Economic News Time:2022.09.15

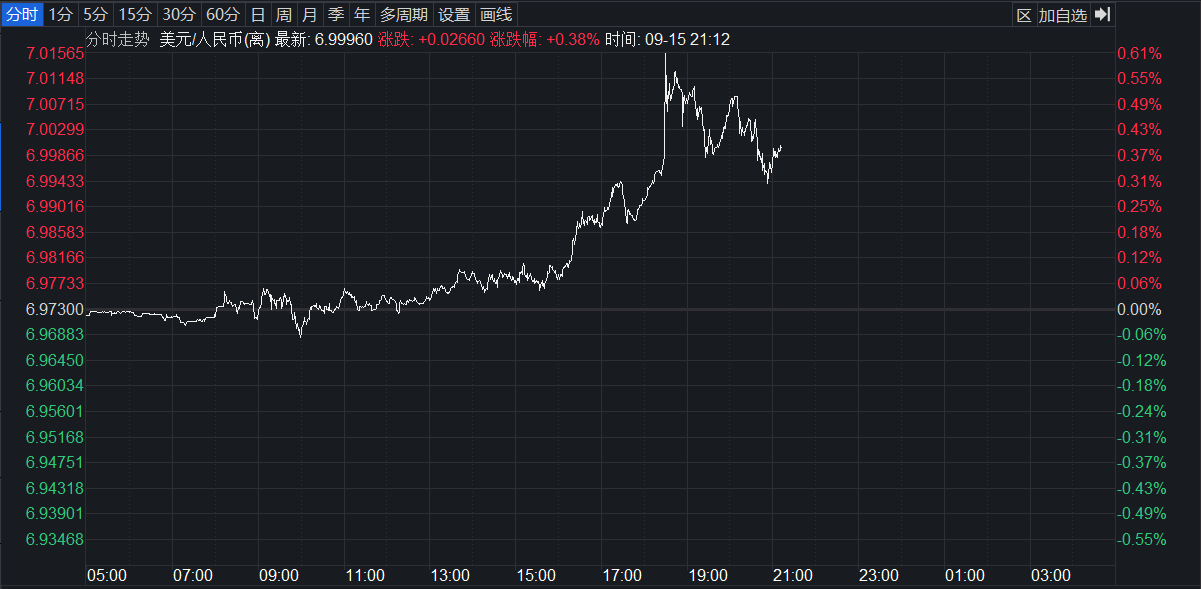

On September 15, the exchange rate of the offshore RMB against the US dollar fell below 7. As of the time before the release, it reached 7.0183, and the exchange rate of the US dollar to the US dollar reached 6.9998. This is also the first time that the offshore RMB has broken "7" since August 2020.

Wen Bin, chief economist of China Minsheng Bank, pointed out in an interview with a reporter that today's RMB offshore exchange rate breaks the "7" again after two years, mainly due to the Federal Reserve to suppress high inflation and accelerate the tightening of monetary policy to tighten the monetary policy The influence is that as the US dollar index continues to strengthen, most of the non -US dollar currency, including RMB, has depreciated to varying degrees. Compared with the major developed economies such as British pounds, euro, yen, the RMB depreciation is relatively small, and the RMB The exchange rate index is generally stable.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said in an interview with a reporter WeChat that the short -term strong dollar is still under certain pressure on the renminbi, but it is expected that the renminbi is expected to operate near the equilibrium level, and the two -way fluctuations are normalized.

There is no basis for the continuous depreciation of the renminbi

Since August 12 this year, the RMB has depreciated rapidly on the US dollar, and it has exceeded 7.0 points. This is also the first time since August 2020, the exchange rate of offshore RMB to the US dollar has exceeded 7.

Screenshot source: Wind

As an integer pass, whether it is the market or the central bank, the point of 7.0 is more important. Why will it break through the point? Whether it will cause depreciation expectations after the breakthrough, whether it will cause the rapid depreciation of the trend of the US dollar index, which is a problem that the market cares about.

For this exchange rate, Wen Bin told reporters that it was mainly affected by the Fed's expectations.

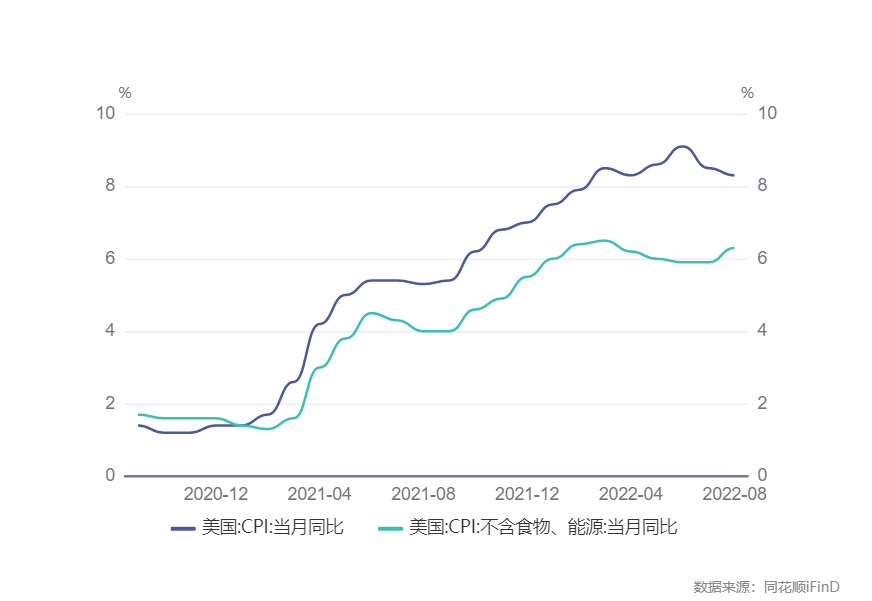

It is reported that the US Department of Labor released data on the evening of the 13th show that the August consumer price index (CPI) in the United States increased by 8.3%year -on -year, and the core CPIs of the core CPIs with large fluctuations increased by 6.3%year -on -year, which was higher than market expectations.

After the data was announced, the market quickly raised the Fed's expectations. Fed Watch data shows that the probability of 75bp in September is 64%, and the probability of 100bp rate hikes is 36%; the market's expectations of the Fed interest rate at the end of the year rose to 4%to 4.25%.

"Despite the Fed's radical interest rate hikes, from the actual interest rate, it is still in a negative area. Recently, the United States announced that the indicators have pointed to the economic slowdown as a whole. At the same time, the European Central Bank and others have also joined the ranks of radical interest rate hikes and do not support the strong US dollar trend. "Zhou Maohua said," In terms of renminbi, the domestic economy continues to recover, foreign trade has maintained toughness, cross -border capital flows in an orderly manner, and international revenue and expenditure remains basically balanced; In view of the attraction of RMB assets, the RMB trend is optimistic during the year. "

Wen Bin pointed out that from the perspective of my country's economic fundamentals, it is expected that the growth rate of GDP in the third quarter is significantly recovered from the second quarter. The level of inflation is mild and controllable, and the international revenue and expenditure conditions are good. Especially for regular projects and direct investment basic projects such as income and expenditure Maintaining a high surplus has laid the foundation for the stability of the RMB exchange rate and the stable operation of the foreign exchange market, and there is no basis for the renminbi.

Short -term "breaking 7" does not mean that the RMB exchange rate will fall sharply

From a basket of currencies, the RMB exchange rate index is still better. The CFETS RMB exchange rate index was 101.62, August 31, 102.10, September 9th.

Screenshot Source: China Currency Network

It is worth noting that the State Administration of Foreign Exchange today announced the data of banks' foreign exchange and banks in August 2022. Data show that according to the US dollar value, in August 2022, banks settled foreign exchange settlement 233.5 billion US dollars and sold US $ 208.4 billion. From January to August 2022, the bank had a cumulative settlement of US $ 178.27 billion, and a total of US $ 167.33 billion was sold.

"Judging from the recently announced foreign exchange settlement data, with the depreciation of the RMB, the market exchange rate has increased significantly compared with the previous, and the exchange rate of the exchange rate remains stable, which means that the overall expectations of market entities on the RMB exchange rate are stable. The transaction model of settlement and dips, so we see that in August, whether it is settlement and sale or transit receipt of cross -border passengers, there is a surplus and improvement. "Wen Bin said that this reflects that my country's foreign exchange market is running smoothly. The two basic projects in international revenue and expenditure have maintained a surplus of basic projects, providing support for the stability of the RMB exchange rate.

Zhou Maohua pointed out that the domestic scattered epidemic conditions are controllable, the support of stable prices, relief to help enterprises and stable growth policies support, and the domestic economy has steadily recovered. This is the world's largest certainty. At the same time, my country's supply chain industry chain has resumed smoothly, foreign trade structure is optimized, foreign trade enterprises have improved quality and efficiency, foreign trade toughness is sufficient, and the value of RMB assets has been prominent in long -term allocation. The international revenue and expenditure will remain basically balanced, and the elasticity of the RMB exchange rate has also significantly enhanced.

In addition, Wang Qing, chief macro analyst of Dongfang Jincheng, also pointed out that with the increase in domestic economic restoration and the situation of my country's international revenue and expenditure, it is expected to maintain a surplus situation. The RMB exchange rate will appear a large round of downward, especially the rapid downward down to the US dollar index trend.

Liu Guoqiang, deputy governor of the central bank, previously stated at the State Council's policy of briefing that the long -term trend of the RMB should be clear. The future world's recognition of the RMB will continue to increase, which is a long -term trend. However, two -way fluctuations in the short term are a normal state, with two -way fluctuations, and there will be no "unilateral cities". The policy tools for regulatory regulations are richer in policy tools

Several experts interviewed told reporters that the regulatory regulatory regulation of the foreign exchange market is relatively rich in policy tools in my country.

Wang Qing pointed out that if the RMB exchange rate will be separated from the U.S. dollar index in the next step, in addition to lowered the foreign exchange deposit reserve ratio, the central bank can also announce the restart of the inverse cycle factor in a timely manner, increase the foreign exchange risk reserve ratio, increase the offshore market center The scale of ticket issuance and strengthening the management of cross -border capital liquidity. In addition to the above specific policies and measures, the regulatory level can further strengthen market communication, guide market expectations, and prevent the "herd effect" in the foreign exchange market.

Wen Bin said that we have adopted macro -prudential management of the foreign exchange market. If the renminbi occurs in a staged super -adjustment, we may use counter -cyclical regulation tools, including counter -cycle factor, foreign exchange deposit reserve ratio, and long -term exchange risk reserves. Wait, stabilize market expectations, thereby promoting the overall stability of the RMB exchange rate level.

Regarding the future trend of the RMB against the US dollar, Wang Qing said: "We believe that the RMB will remain similar to the US dollar index trend during the year; in this process, there is no point that must be kept. The real important thing is Keep the RMB exchange rate index is basically stable. "

Extra -oriented enterprises should establish concepts of exchange rate risk neutrality

Wen Bin pointed out that with the increasing marketization of the RMB exchange rate formation mechanism, the elasticity of the RMB exchange rate is also increasing.

"In the past few years, the exchange rate of the RMB against the US dollar has always maintained a two -way fluctuation at a reasonable and balanced level. From the short term, the depreciation of the renminbi will bring goodness to export companies. It will bring cost increases. "Wen Bin said.

Wen Bin believes that for export -oriented enterprises, we must establish the concept of exchange rate risk neutrality, take the initiative to use derivative tools, do a good job of exchange rate risk management, and maintain normal production and operation.

For residents, the depreciation of the RMB against the US dollar means that the cost of buying foreign exchange is increased, and the cost of studying abroad and tourism will increase. "But to see that the exchange rate is fluctuated in two -way, and the flock effect of blind obedience should be avoided." Wen Bin suggested that the exchange of foreign exchange should be changed according to actual needs.

Daily Economic News

- END -

Promote the high -quality development of the Yangtze River Economic Belt (People's Daily)

Leading companies in the upper reaches of Yibin, Ningde Times, Tianhua Chaojing an...

Anhui Province will incorporate 343 Chinese medicine formula particles into the medical insurance fund payment

According to the Provincial Medical Insurance Bureau, in order to support the deve...