Small -scale taxpayers apply for VAT tax exemption policies.

Author:State Administration of Taxati Time:2022.06.21

In order to further support the development of small and micro enterprises, the Ministry of Finance and the State Administration of Taxation jointly issued the "Announcement of the General Administration of Taxation of the Ministry of Finance on the VAP for small -scale taxpayers" (No. 15, 2022), and clarified from April 2022 From the 1st to December 31, 2022, a small value -added taxpayer applied for taxable sales income of a small value -added taxpayer, exempting value -added tax for a value -added tax; Essence On the same day, the taxation department also issued the "Announcement of the State Administration of Taxation on Small -scale taxpayers exempts VAT and other collection management issues (2022 No. 6, hereinafter referred to as the" Announcement "). Including duty -free or abandonment of tax -free invoices, red terms invoice, and filling in the application form.

Related question and answer

ask

Small -scale taxpayers apply this tax exemption policy. How should they fill in the relevant duty -free column when applying for a value -added tax tax declaration?

answer

Article 3 of the "Announcement" clearly states that a small VAT taxpayer has a value -added taxable sales behavior, with a total monthly sales of not more than 150,000 yuan (in one quarter for 1 tax period, quarterly sales have not exceeded 450,000 For the same), the sales of VAT sales shall be filled in in the "VAT and the Application Form for VAT (Applicable for Small -scale Taxpayers)" or "Small and Micro -Enterprise Duty Free Sales" In the "point sales" related column, if there are no other tax exemption items, there is no need to fill in the "VAT tax reduction and exemption declaration"; if the total monthly sales of more than 150,000 yuan, all the sales of all sales of value -added tax shall be filled in in the project shall be filled in in the case. The "VAT and Supreme Tax and Fee Application Forms (Applicable for Small Like Taxpayers)" columns and the corresponding columns of the "Value -added Tax Revolution of Tax Revolution".

Whether the above monthly sales exceeded 150,000 yuan, determined in accordance with Article 1 and 2 of the State Administration of Taxation on Small -scale taxpayers exempting value -added tax collection and management issues (2021).

- END -

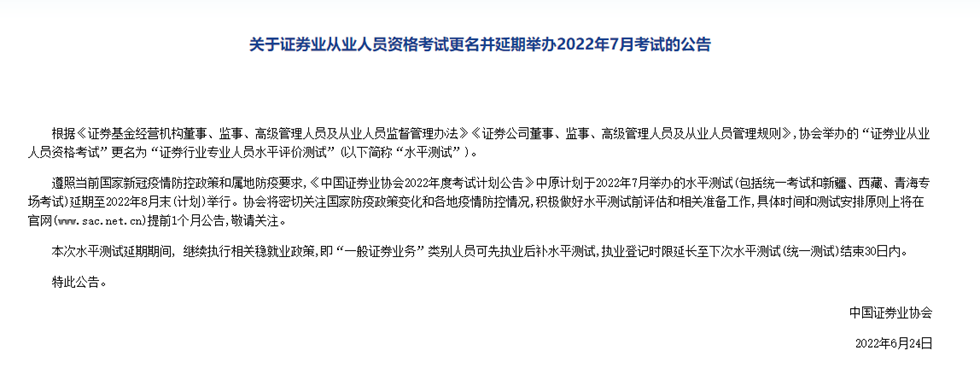

The new name of the "Securities Qualification Examination" is determined, and the test will start at the end of August!Practitioners should pay attention to this

Yesterday, the Securities Association announced on the official website of the Ann...

The golden laws in interpersonal communication, let you take less detours

Adeler once said: Human troubles are derived from interpersonal relationships.Comm...