The profit decline is high, can the expansion of production be saved?

Author:Radar finance Time:2022.09.15

Radar finance produce | Li Yihui edited | Deep Sea

Facing the new round of "expansion" of liquor, Shuijingfang bowed to it.

On the evening of September 7, Shuijingfang announced that it was planned to sign an agreement with the Municipal Government and implement it in detail. According to the investment plan, the total investment amount has reached 6.804 billion yuan.

In the research report, Shuijingfang pointed out that there are greater growth opportunities for the liquor industry in the middle and long term.

In the first half of this year, Shuijingfang's revenue was 2.074 billion yuan, an increase of 12.89%year -on -year; the net profit attributable to shareholders of listed companies was about 370 million yuan, a slight decline of 2%.

This revenue speed is not high, far less than doubled in the same period last year. Compared with the two high -end prices of the two high -end prices, Shuijingfang, the two high -end prices of the alcoholic wine, also slowed down.

Brand high -end is always a strategy for Shuijingfang. The above -mentioned expansion of production also undertakes the heavy responsibility of "improving the company's mid -to -high -end solid -brewing liquor output and supporting the company's high -end wine reserves of high -end wine products."

It's just that this road is high -end, and Shuijingfang is not going smoothly. An explanatory case is that on the e -commerce platform, the company's core product collections and well platforms have inverted prices. Nowadays, the company's gambling gambling is expanded, and the future output is time to observe.

High marketing expenses

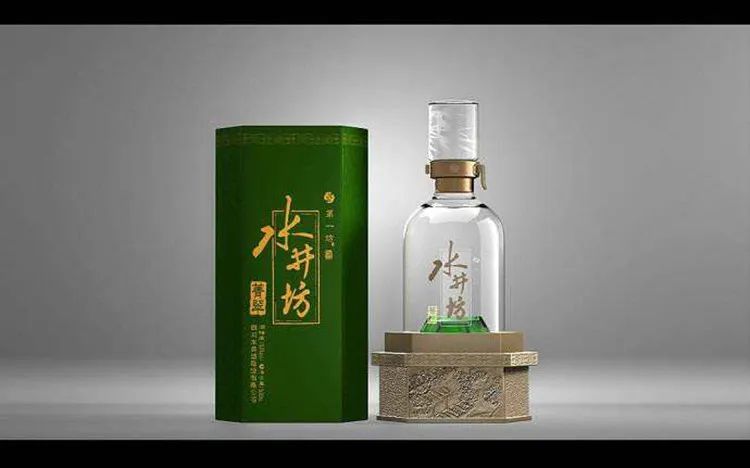

Sky Eye Check information shows that Shuijingfang is the production and sales company of the main wine product. At present, the company's white wine products mainly include the Century Collection of Shuijingfang, Shisan Shuijingfang, Fengya Song Shui Jingfang, Shuijingfang Jingcui, Shuijingfang Collection, Shuijingfang Jingtai, and Tianzhang Chen.

In the first half of 2022, Shuijingfang's performance growth was fatigue.

According to the financial report, Shuijingfang achieved operating income of 2.074 billion yuan from January to June this year, an increase of 12.89%year-on-year; net profit was 370 million yuan, a year-on-year decrease of 2%; net profit of deduction of non-returned mother was 363 million yuan, a year-on-year decrease of 6.88%.

According to the Flush iFind data, in the first half of 2021, Shuijingfang achieved revenue of 1.837 billion yuan, an increase of 128.44%year -on -year; net profit attributable to shareholders belonging to the parent company was 377 million yuan, an increase of 266.01%year -on -year.

Looking at the second quarter of this year, the company achieved revenue of 659 million yuan, an increase of 10.36%year -on -year, and the net profit of the mother was 711 million (42.13 million yuan in the same period last year), and the net profit of the deduction of non -returnees was 6.36 million (the loss of 16.31 million last year).

In the second quarter, it only achieved a net profit of more than 7 million yuan, but it still lost 42 million yuan in the same period in the past year. In terms of elongation, in the first half of 2020 that eliminated the epidemic, the net profit of Shuijingfang has maintained a growth trend since 2015.

A few years later, the company's interim reported decline in net profit again, which is not optimistic for it. In the financial report, Shuijingfang admits that under the impact of multiple factors such as epidemic disturbances and demand shrinkage, liquor consumption scenes have shrunk, and the growth momentum of the company's product sales has slowed down in the first half of the year.

Slowing revenue can be attributed to the impact of the epidemic. According to data, it can be found that the net profit of Shuijingfang is faded down by sales costs.

Data show that in 2021, the sales cost of Shuijingfang was 1.227 billion yuan, an increase of 45.89%year -on -year. In this regard, the company has repeatedly explained that since the second quarter of 2021, in order to promote a high -end strategy, the company has increased the cost of high -end projects and other projects, causing pressure on net profit.

Since the beginning of this year, Shuijingfang has continued the strategy of "holding high", and marketing costs have also remained high. In the first half of this year, the company's sales cost was 696 million yuan, an increase of 19.29%year -on -year, and the sales cost rate was as high as 33.56%, which was at the forefront of listed wine companies.

According to the semi -annual report, during the reporting period, the company and the in -depth cooperation of large IPs such as the China Ice and Snow Conference, the WTT World Table Tennis Federation, and the National Treasure of the National Treasures carried out marketing activities covering multiple high -end circle.

In terms of high -end marketing, the company penetrates the target consumer circle through various activities such as tasting, branding, museum experience, tennis club, and Shuijingfang Lion Kinghui.

Unfortunately, such a effortless marketing activity did not give a sufficient return to Shuijingfang. At the telephone meeting held after the semi -annual report was released, the management of Shuijingfang acknowledged that the "due to the impact of the epidemic" in the first quarter did not meet the expectations and affected the profit.

However, in the absence of the banquet scene due to the epidemic, Shuijingfang must find an appropriate alternative market. The company stated that the company is constantly promoting digital marketing; Shuijingfang Xinjingtai has actively launched the Jingtai group purchase project to expand new group purchase models; Shuijingfang Zhen Bai No. 8 also actively expands the new market on the original basis.

Double -digit increase in inventory scale increase

Welling Square, which vigorously do marketing, has continued to increase in inventory.

From the perspective of the semi -annual report, as of the end of the first half of the year, the amount of inventory of Shuijingfang was 2.321 billion yuan, accounting for 39%of the total assets of the same period.

As of the end of June 2021, the company's inventory was 1.921 billion yuan; as of the end of last year, the company's inventory amount increased to 2.197 billion yuan. Based on this, the inventory of Shuijingfang in the past year has increased by 20.82%, and the increase of 5.65%in the past six years has increased by 5.65%in the past six years. Essence

The inventory classification shows that at the end of the period, the book value of inventory goods is 253 million yuan, and the book value of the self -made semi -finished product is 1.934 billion yuan, accounting for 10.91%and 83.31%, respectively. It is reported that the inventory products are the finished wine. Most of the self -made semi -finished products are not much different from the inventory products. The two add more than 2 billion yuan. Compared with Shuijingfang's sales in the first half of the year Essence

High inventory continued to increase the inventory turnover days of Shuijingfang. In the first half of this year, it reached 1292.18 days, an increase of 260.16 days from the end of the previous year, highlighting the slowdown of Shuijingfang's inventory ability.

In terms of channels, the revenue of the wholesale agency in the first half of the year was 1.926 billion yuan, a year -on -year increase of 19.4%compared to 1.613 billion yuan in the same period of the previous year. This channel accounted for 94.2%of the total revenue, becoming the main channel for the company's revenue growth.

The new channels and group purchases of Shuijingfang achieved revenue of 120 million yuan in the first half of the year. Compared with 220 million yuan in the same period last year, it fell 46%year -on -year, and the proportion of revenue was reduced to about 5.8%.

At present, the new channels of Shuijingfang include e -commerce channels and group purchase channels. In terms of e -commerce channels, the company delivered products and operators, and operators are responsible for opening stores and daily operations in e -commerce platforms. In terms of group purchase channels, the company continues to develop group purchase customers and conduct refined management. Group buying customers intended to buy, and then dealers or stores were responsible for delivery.

According to the statistics of Shuijingfang, since the new collection of new collections in September last year, the number of group purchases in corporate groups has increased to more than 2,000, and the proportion of group purchase sales has increased to 50%. There are more than 1,100 group purchase customers.

However, according to the judgment of Huaxi Securities Research Report, the revenue of new channels in the first half of the year is mainly caused by the fluctuation of group purchase customers.

According to the research report of Everbright Securities, the channel construction of Shuijingfang has experienced many explorations, and has undergone a transformation from the traditional general generation model to the flat direct operation, and then to return to the general generation model. At present, the company's new purchase channels are relatively low, but they have higher growth.

Can expansion of production help high -end breakthroughs?

The Quanxing Daqu, which was born in Sichuan wine, was born in Sichuan wine, one of the "six golden flowers". It was once a high -end liquor brand under Sichuan Quanxing Group. It was controlled by the global spiritual wine giant Diajio. It is currently the only domestic liquor listed company in China Essence

As early as 2000, Quanxing Group launched a high -end positioning of Shuijingfang brand. At that time, the price of the product was set to 600 yuan, which was higher than the Moutai and Wuliangye at that time.

After Diageo entered the Lord, Mizuizhu cut off most of the original "full -bodied" low -end brand products, focusing on the high -end market. However, after we ushered in foreign executives, Shuijingfang's strategic focus turned to overseas markets, and failed to fully seize the window period for domestic liquor consumption.

In 2012, as the liquor industry was too required, the problem of a single product matrix in Shuijingfang was exposed, and some regional sellers withdrew from the inventory backlog, and the company's performance fell into losses the following year.

In 2016, the company completed the localization adjustment of management, clarified the secondary high -end positioning, the channel returned to the general generation model, and the performance of Shuijingfang entered a recovery state.

In July 2021, Zhu Zhenhao, who had the background of Emperor Yigou, officially served as the general manager of Shuijingfang. The company continued its past high -end strategy, and at the same time proposed the strategy of "brand high -end".

Obviously, Shuijingfang does not want to stay in the secondary high -end field. According to the annual report, the company's work in 2022 includes "strengthening the status of high -end liquor brand in Shuijingfang, improving the capabilities of high -end product business teams and consumer cultivation departments, and winning larger high -end and high -end market share."

According to the board of directors, the company believes that the company's high -end strategy must be reflected in the increase in price system. Consumers are willing to pay more about the brand's products in order to represent the brand's high -end and more success.

According to data from the Guoyuan Securities Institute, by July 2022, the average price of high -end liquor has been above 1,200 yuan. Correspondingly, the approach of Shuijingfang is to actively explore the proposed retail price of more than 1,500 yuan, and develop new products and ultra -high -end products such as Yuan and Ming 2.0.

However, the price increase strategy of Shuijingfang has not been truly recognized by consumers. According to media reports, Jingdong's self -employed platform and Tmall official flagship store, the well -to -hand price of the well platform and the collection is 615 yuan and 1069 yuan, which is about 200 yuan and 300 yuan lower than the company's suggestion retail price.

The total investment amount will reach 6.804 billion yuan in the first and second phase of the 产 All -Industrial Chain Base Promotion of Shuijingfang. Among them, the investment announcement of the second phase of the project states that it is expected that the production capacity of the curvature of 35,000 tons/year, the production capacity of the winemaking is 13,000 tons/year, the storage capacity of the tank area is 64,000 tons, and the storage capacity of the pottery altar is 52,700 tons. The production capacity of the packaging workshop is 33,000 tons/year.

At the same time, the product's product is positioned as a mid -to -high -end high -quality strong fragrant liquor. The construction and operation of the project can enable the company to increase the output of the mid -to -high -end solid -brewing liquor, increase the storage of the wine body, and support the high -quality original wine reserves of the company's high -end wine products Essence

On the one hand, although well -known wine companies such as Moutai, Wuliangye, Shinchi, Shanxi Fenjiu, and Li Lijiu in Guizhou have expanded their production, there is still a risk of short -term production capacity over -the -Lial production capacity.

In addition, Shuijingfang will take the route above high -end, and the reserves of high -quality base wines are the premise of scale expansion.However, under the slow progress of the company's high -end progress, it is the first to invest in production capacity, which is equally hidden.Ultra -high -end.

"The company's overall profit in recent years has continued to explore because it has overdrawn its own strength." Zhu Danpeng said that in the long run, if Shuijingfang's new production capacity is still high -end, its input and output will not be proportional.

- END -

The controlling shareholder of Luoyang Xiyuan Guotou changed!Bai Xitao Ren General Manager

[Dahecai Cube News] On June 21st, Luoyang Xiyuan State -owned Capital Investment Co., Ltd. announced that its original shareholder Luoyang City's Lixi District Finance Bureau made a decision on June 1...

Liushan Town, Lintong County: Qiu Taoxi gets a bumper harvest

Right now, Qiu Tao, Liushan Town, Lintong County, entered a mature harvest period. The peaches full of branches are big and sweet, full of happy taste. On August 27, the reporter walked into the Tao