Heavy!The six major banks announced: The interest rate of some deposits will be reduced from the 15th!

Author:Jiangxi Daily Time:2022.09.16

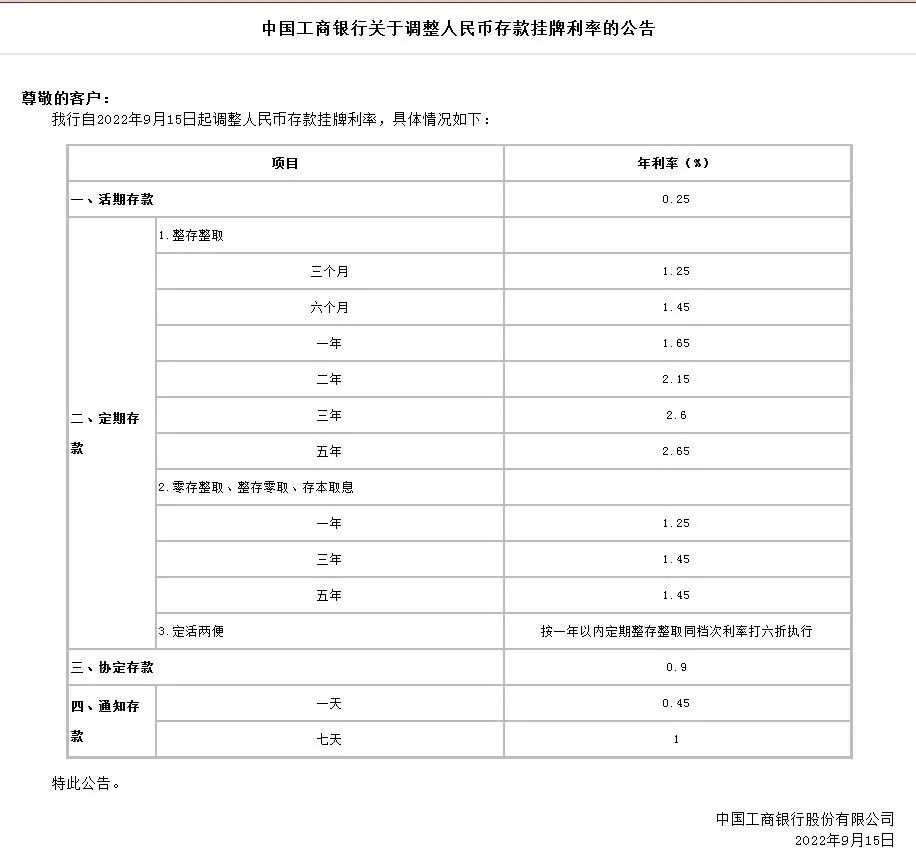

According to CCTV news reports, the reporter learned on September 15 from ICBC, Agricultural Bank, Bank of China, CCB, Bank of Communications, and Postal Savings Bank that these six major state -owned banks will adjust the personal deposit interest rate from today (September 15), including the current period of time, including the current period Multiple varieties, including deposits and regular deposits, have different levels of interest rates.

Among them, the three -year regular deposit and large -scale deposit interest rates were reduced by 15 basis points, and the one -year and five -year regular deposit interest rate was reduced by 10 basis points, and the interest rate of the deposit rate was reduced by 0.5 basis points.

At present, the annual interest rate of the sixth largest banks is 0.25%; the one -year terminal deposit interest rate is 1.65%; the annual interest rate of the three -year regular deposit is 2.6%; the annual interest rate of the five -year regular deposit is also 2.65%.

Earlier, the quotation of the loan market quotation (LPR) quotation released on August 22 showed that the 1 -year LPR reduced 5 basis points, and the 5 -year and above LPR downgraded 15 basis points. Many analysts believe that with the reduction of LPR, bank deposit interest rates may also be reduced.

The interest rate of different periods of deposits is lowered

On September 15, the Industrial and Commercial Bank of China, the Agricultural Bank of China, the Bank of China, and the Construction Bank of China all issued an announcement, which will adjust the listing interest rate of RMB deposits from now on.

The annual interest rate for regular deposits for three months is 1.25%, 1.45%in six months, 1.65%a year, 2.15%in two years, 2.6%in three years, and 2.65%in five years. Zero -deposit, zero -deposit, zero deposit, and deposit interest rate of one year of interest rates are 1.25%, and 1.45%in three and five years.

Picture from the official website of Industrial and Commercial Bank of China

Picture of the official website of Construction Bank

Picture from the official website of Agricultural Bank

Picture from Bank of China official website

It is substantially beneficial to the bank sector

According to the China Securities Journal, the semi -annual report of the listed bank shows that the industry's net interest margin is in a downward channel. Industry experts believe that with the continuous decline in the rate of return on the asset end of commercial banks, the rate of liabilities is also an inevitable trend. The reduction of deposit interest rates is conducive to relieving the narrowing pressure of interest differences.

Some experts also said that the deposit interest rate will be beneficial to the bank sector. Liao Zhiming, chief analyst of China Merchants Securities Banking Industry, said that the deposit interest rate is reduced to the substantial benefit of the banking sector, and the signal that the interest difference will not continue to be significantly reduced, which is conducive to stabilizing the profitability of banks.

In terms of stable interest margins, many bank executives point out that to start with the asset side and liabilities at the same time, the key to the liability side is to control and reduce costs.

Liu Jianjun, president of the postal savings banking, said that in terms of debt, the cost of liability should be continued, especially to increase the proportion of living periods, increase the traction of the assessment of wealth management, increase the proportion of the deposit of current deposits through wealth management, and continue to decline in the decline in the pressure Long -term deposit scale and interest rate.

Fu Wanjun, President of Everbright Bank, said that on the one hand, it is necessary to strictly control high cost liabilities, and on the other hand, it is necessary to absorb more current or low -cost liabilities by making large customer bases, strong transactions, and more settlement.

"In the next step, we must further give play to the role of the loan market quotation interest rate and the role of the market -oriented adjustment mechanism of deposit interest rates, guide financial institutions to transmit the decline in deposit interest rates to the loan end, and reduce the cost of corporate financing and personal credit." President Liu Guoqiang said.

- END -

The fuel surcharges welcome the first time this year. From August 5th, buying a ticket can save up to 60 yuan.

According to a number of domestic airlines, it will adjust the domestic route to collect fuel surcharges on August 5: Starting from August 5, 2022 (ticket date), domestic flight fuel surcharge standar

Tesla has been reduced in a lot, and Chinese car companies are in the top!"Women's Version Buffett" crazy buy Xiaopeng Automobile

China Times (chinatimes.net.cn) reporter Chen Feng reporter Qiu Li Beijing reportI...