Substitute!The six major state -owned banks issued an announcement

Author:Xinmin Evening News Time:2022.09.16

Yesterday, ICBC, Agricultural Bank, Bank of China, Construction Bank, Bank of Communications, and Postal Savings Bank's official website all announced the adjustment of RMB deposit interest rates.

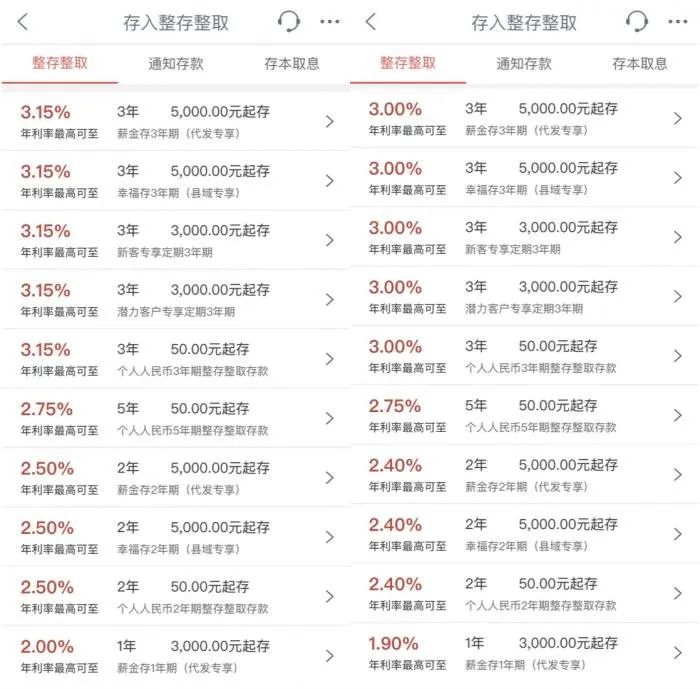

Specifically, ICBC, Agricultural Bank of China, Bank of China, CCB, and Bank of Communications deposit interest rates are consistent: 5bp downgraded; three -year rectification and rectification of 15bp, that is, low to 2.6%(annualized, the same below); the remaining period is reduced by 10bp. The adjustment interest rate of the postal savings banking is slightly higher than the five -year period and one -year period is slightly higher than the previous five major banks, and the remaining period interest rates are the same as the aforementioned five major banks.

In addition to several state -owned banks, many joint -stock banks such as China Merchants Bank have also followed up to reduce the deposit interest rate. The three -year downgrade of 15 basis points, and the other period is reduced by 10 basis points.

This is another decline in bank deposit interest rates since April this year. According to a number of media disclosure, in April this year, the annual interest rate of multiple banks' 2 -year and 3 -year period was reduced by 10 basis points.

This adjustment does not surprise the outside world. On August 22, in order to further reduce the cost of financing in the real economy, the 1 -year LPR lowered 5 basis points, and 15 basis points dropped by LPR above 5 years. At that time, many analysts believed that with the decrease of LPR, bank deposit interest rates may also be reduced.

Some analysts pointed out that the reduction of deposit interest rates in many banks will reduce the savings demand of residents, and then promote consumer demand and investment demand.

Dong Ximiao

Chief Researcher of Recruitment Finance

Dong Ximiao, chief researcher at Zhailian Financial, pointed out in an interview that for the majority of residents, if there are many deposits and cash management wealth management products in asset allocation, the yield may decline. Should balance the relationship between risks and income, based on their own risk tolerance and investment and financial needs, and do a good job of diversified asset allocation.

Yuejin

Research Director of the Think Tank Center of Yiju Research Institute

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, believes that the interest rate of this deposit rate will have a lot of impact on the savings and asset allocation of residents' families, especially from incidents such as buying houses and recent loans in advance. The impact of class events.

"From the perspective of the recent asset allocation, the deposit behavior has increased significantly, especially the three -year regular deposits. To some extent, the increase in deposits has changed. It will increase. However, from the perspective of social funds flow, the combination of funds and the real economy should be encouraged instead of entering the field of savings too much. From this perspective, interest rates will affect such savings behavior. Earlier repayment in advance is actually related to the return on yields. At present, the mentality of buyers is to deposit more money rather than more loans. However, from the perspective of the guidance of the home purchase market, multiple loans should be encouraged and actively buying a house. From this perspective, the decline in savings interest rates will make everyone rationally treat savings behavior, and it will also help guide to actively buy a house. Finally, the deposit interest rate will be reduced to further explain the market -oriented adjustment action. It also helps to set up better mortgages in the subsequent mortgage, especially low -interest mortgages, which also has a positive support for the real estate market. "

For the banking industry, the deposit interest rate is reduced to stabilize the profitability of banks. Some industry analysis pointed out that in the current environment, banks have lowered deposit interest rates under the market -oriented mechanism, reducing the cost of bank deposit liabilities to a certain extent, and further reasonable to make the real economy expansion space for banks.

Gold Coast Studio

Author | Yang Shuo

Graphic | Net

Editor | Lu Jiahui

- END -

Accelerating tax and fees preferential policies are implemented and effectively rescued the market entity

In order to implement the autonomous region's Several policies and measures for fu...

Leading Intellectual Manufacturing: As of the date of this announcement, the total number of pledged shares of Link Investment (Shenzhen) Co., Ltd. is about 571 million shares

Every time AI News, Yiyi Intelligent Manufacturing (SZ 002600, closing price: 5 yu...