Huaxi Biological is looking for the "second curve": 7 years of botulinum toxin planning, can collagen be successfully taken over?

Author:Corporate research room Time:2022.09.16

This article is based on public information, which is used only as information exchange and does not constitute any investment advice.

Produced | Company Research Office Large Consumer Group

Text | Cookies

After the A -share semi -annual report disclosed, the performance of the upstream company of medical beauty is still very bright. For example, the two hyaluronic acid giants, the net profit growth of Huaxi Biological and Beautiful guests exceeded 30%.

Among these two companies, Aimei is still dominated by the B -side market. Huaxi Bio has successfully shifted from the TOB market to the TOC market. In the first half of the year, the income was almost 3.4 times that of Ai Aike. However, high income relies on marketing drivers. In the first half of the year, Huaxi biological sales costs as high as 1.387 billion, and net profit was 20 % less than Aimei.

Will the Huaxi creatures that create a billion -level skin care brand such as Run Baiyan and Quadi will fall into the C -side marketing difficulties in the future? After hyaluronic acid, can collagen become the "second curve" of the company?

01. The income is 2 times more than the beauty guest, but the net profit is 20 % less

In the first half of 2022, the revenue and net profit of science and technology board companies increased by 33%and 22%year -on -year, respectively. Among the listed companies in the science and technology board, the performance of Huaxi Bio, a "hyaluronic acid leader", introduced it. In the first half of the year, Huaxi's biological revenue growth rate was 51.58%, and the net profit growth of the mother was 31.25%, which was higher than the large market.

Compared with another hyaluronic acid company in A shares, Huaxi's biological income is significantly higher than that of Beauty, but the gross profit margin and net profit are not as good as a beautiful guest.

In the first half of 2022, Huaxi biological revenue was 2.935 billion yuan, and beauty guests were only 885 million. In terms of income, Huaxi Biological is about 3.38 times that of beauty guests.

Both companies have gross profit margins that make other companies look eye -catching. In the first half of the year, the gross profit margin of Aimei was 94.39%, while Huaxi creatures were 77.43%, and the difference between the two was nearly 20 percentage points.

Although the income is 2 times more than the beauty guest, the disadvantage of the gross profit margin has made the net profit of Huaxi creatures 20 % less than the beauty guest. In the first half of the year, Huaxi Bio had a net profit of 473 million yuan in net profit, and beauty guests were 591 million.

Although it is also a company that produces and sells hyaluronic acid, the business direction of Huaxi Biological and Beauty has already been different.

At present, Aimei's products are still mainly facing the B -side market, and downstream customers are mainly hospitals, medical cosmetic institutions and dealers.

Huaxi Bio also mainly used the B -end market before 2018, mainly engaged in B2B raw materials business and B2B2C medical terminal business. These two business revenue accounted for over 70 %. Beginning in 2018, Huaxi Biological has entered the C -end market. The listing on the science and technology board in 2019 has greatly improved the company's popularity and attention, so that Huaxi Bio has accelerated the process of transformation to the TOC business.

According to the semi -annual report, the business of Huaxi Biological can be divided into four pieces, namely the raw material business and medical terminal business for B -end, the functional skin care products of the C -side, and the functional food business.

In the first half of 2022, the raw material business revenue of Huaxi Bio's raw material business was 461 million, an increase of 10.97%year -on -year, accounting for 16%; medical terminal business revenue was 300 billion yuan, a year -on -year decrease of 4.53%, accounting for 10%; , Year -on -year increased by 77.17%, accounting for 72%; new business functional food income was 44.3658 million, accounting for about 1.5%.

In the first half of the year, Huaxi Biological continued to maintain a high growth trend with the C -side skin care business.

02. BM muscle live shine, the sales cost reached a new high

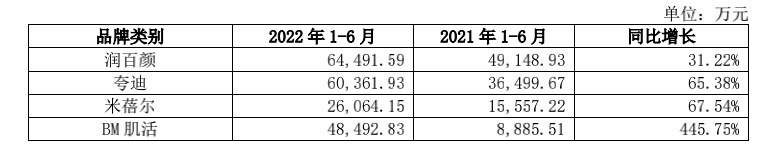

In terms of functional skin care products, at present, Huaxi creatures include "Runbaiyan", "Quadi", "Mibel", "BM Muscle Live" and other brands. In the first half of the year, among the four major brands, Runbaiyan, Quadi, and Mibel have slowed down, but the BM muscle live brand has quickly broken the revenue of the "brown rice fermentation liquid" with the toner of the toner. increase.

In the first half of 2022, Runbaiyan's revenue was 645 million, an increase of 31.22%year -on -year, and the growth rate of about 200%in the same period last year; Quadi revenue of 604 million, an increase of 65.38%year -on -year, the growth rate in the first half of 2021 was about 250%; Er revenue was 261 million, an increase of 67.54%year -on -year, and the growth rate of about 150%in the same period last year. If there is no accident, after Run Baiyan, Quyi will also become a brand with an annual income of over 1 billion.

In the first half of the year, Huaxi Biotechnology had a total of 6 items sales of more than 100 million yuan. Among them, there are 3 models in the Quadi brand, two Runbaiyan, and one BM muscle, and Mibeir has no.

Compared with the two brands launched in 2018 in 2018, according to the past financial reports, it can be calculated that in the first half of 2020, the income gap between Mibeir and Quadi was about 40 million. 340 million.

Quad's positioning is a hardcore anti -old master. It focuses on the old market of frozen age and anti -junior market. Mibeir is mainly for the "Z era" group, focusing on the market segment of sensitive muscle repair. Perhaps it is precisely because of the different target groups and target markets that the sales gap between the two brands is increasing.

As the growth rate of Runbaiyan and Quadi, Huaxi Biological has also excavated explosive items. In the first half of the year, the sales of "BIO-MESO muscle-based brown rice bottom essence water" of BM muscle survival exceeded 200 million, which increased BM muscle revenue from 89 million to 485 million, and the growth rate was as high as 445.75%.

However, the income growth of Run Baiyan, Quadi, and BM muscle work is inseparable from marketing assistance. In the first half of 2022, Huaxi biological sales costs were 1.387 billion, an increase of 54.68%year -on -year, and the revenue growth rate was slightly higher than 51.58%. The sales cost rate was 47.25%, an increase of 0.94 percentage points year -on -year.

Regarding the growth of sales expenses, Huaxi Biological said that the company's sales team expanded, which led to an increase of employees' salary year -on -year; secondly, the company vigorously developed online sales channels, increased information flow of e -commerce platforms such as Douyin, and strengthened. In cooperation between mainstream experts such as Douyin and other platforms, online promotion costs and advertising costs have increased significantly.

From a TOB -based company to TOC skin care products, Huaxi Bio inevitably put a large number of advertisements for marketing, which is also the main reason for its net profit to be less than lovers.

In order to gain a foothold in the skin care industry, maybe Huaxi creatures continue to increase marketing efforts. After all, consumer goods companies are most afraid of being forgotten by consumers.

03. The layout of botulinum toxin has been planted for 7 years and turned to betting in collagen

Although Huaxi creatures have laid out functional skin care products, functional food and other businesses in the field of hyaluronic acid, the company needs to find new growth points.

Previously, botulinum toxin may be regarded by Huaxi Bio as a "second curve". In 2015, Huaxi Biological and South Korea's Medytox established a joint venture company "Huaxi Beautiful" to develop, expand and sell specific injections A type A botulinum toxin and other medical cosmetic products produced by MEDYTOX.

But unfortunately, before the product landed, the cooperation announced the termination.

In 2020, MediTox, a botulinum product of Medytox, was exposed to safety problems. Since its first production in 2006, one -third of its products (nearly 16,000) were destroyed because of poor results. According to relevant Korean regulations, the product will be suspended at such a high unqualified rate. In order to maintain production, Medytox adopted the destruction number to improve the qualification rate and replace the presence of the prejudice of the experimental experiment, which violated the relevant laws and regulations such as the "Pharmacist Law" in South Korea.

This makes Medytox botulinum products unable to complete product registration and sales in China, and Medytox cannot provide botulinum products to Huaxi Bio.

In early August 2022, Huaxi Biological Announcement stated that it had issued a lawyer's letter to the Korean company Medytox, demanding that the termination/revocation/lifting the cooperation agreement reached between the two of the two.

The research report of Soochow Securities shows that it takes at least 8 years from the project to be approved. If it is directly introduced to overseas certification products, it will take at least 5 or 6 years from clinical trials to approval.

The competitors of Huaxi Bio, such as Meimei, announced in May that the company will be the only legal dealer of Botox products in South Korea's Huonsbp company in China. At present, South Korea's Huonsbp products have entered the third phase of clinical trials and are expected to be launched around 2024.

Although Huaxi Biological has been laying a botulinum track for 7 years, the choice of wrong partners or caused Huaxi Biological to lose the opportunity.

The botulinum toxin market has planted, and Huaxi creatures have turned their attention to the field of collagen.

On August 30, Huaxi Biological released a number of collagen raw materials products to implement the product of collagen business. Zhao Yan, chairman of Huaxi Bio, said that the company hopes to copy the logic of the entire industry chain of hyaluronic acid to the field of collagen and build it into the second strategic biological activity after hyaluronic acid.

Perhaps collagen can help Huaxi creature open a new growth space, but it is not something that can be completed from the field of hyaluronic acid to collagen.

- END -

The six keywords see "Her Hao Shandong Good Pin Shandong" how to become a beautiful business card for high -quality development in Shandong

Recently, the Her Hakka Shandong Shandong Xuanjiao Club was held in Beijing, and S...

New Era of Endering New Journal of Journey -National High -tech Zone Ten Years Achievement Tour 2

Xi'an High -tech Zone Speed up the creation of hard technology demonstration z...