A -share collective income: Education stocks fall, robotic concept stocks are active in the market

Author:Zhongxin Jingwei Time:2022.06.21

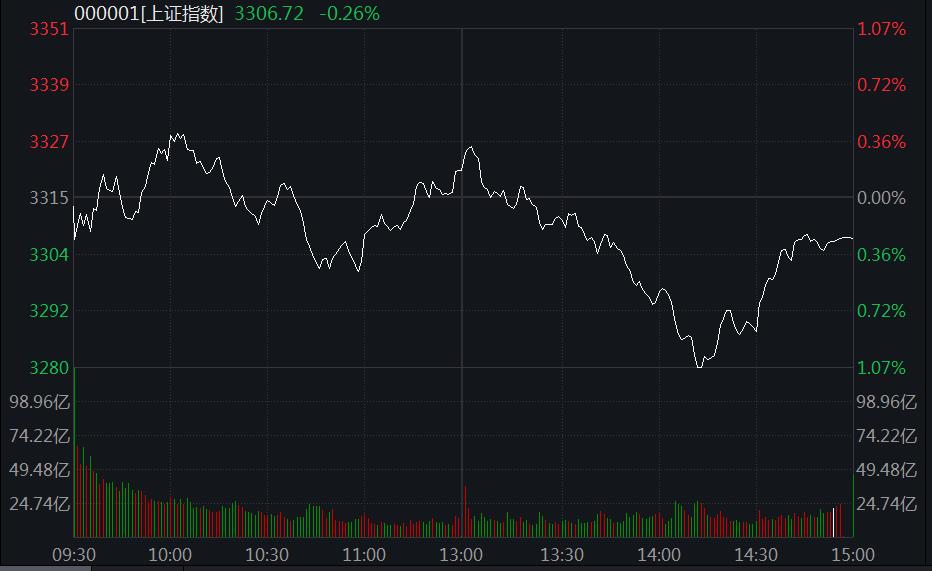

Zhongxin Jingwei, June 21st. On the 21st, the three major A -share indexes were weakly shocked. The Shanghai Index once fell more than 1%, and the GEM index fell more than 1.5%.

As of the close, the Shanghai Index fell 0.26%to 3306.72 points; the Shenzhen Index fell 0.51%to 12423.86 points; the GEM index fell 0.63%to 2692.98 points. The turnover of the two cities exceeded 1 trillion yuan again, breaking trillion yuan for the eighth consecutive trading day.

Source of the Shanghai Index throughout the day: Wind

On the disk, real estate, media, insurance, banking and other sectors have risen. The education sector led the decline, the Dou Shen education fell more than 15%, and the full -time education fell; the military industry, breeding industry, traditional Chinese medicine and other sectors and resource stocks fell.

Robotic concept stocks have a daily rising wave, Mai Heng shares and Shensi Electronics have a 20%daily limit;

As of the closing, the ratio of all trading stocks in Shanghai and Shenzhen was 1721: 2912, with a daily limit of 60 daily limit, and a limit of 10.

In terms of individual stocks, today's daily limit shares are as follows: Zhejiang Shibao (10.03%), Guoji Automobile (9.98%), Zhongke Jincai (9.97%), Jitai (10.01%), and Wangchang Electric (10.00%). The limit shares are as follows: Shao Neng (-9.97%), High-tech Development (-10.01%), the development of Minmetals (-10.03%), Zhongqi New Materials (-10.00%), Hengdian East Magnetic (-10.00%).

The first five stocks are: Mikong Biological, Tengya Seiko, Jingxue Energy Saving, Yubang New Materials, and Puchang Technology, with 60.586%, 51.535%, 50.925%, 49.850%, and 44.618%.

In terms of northbound funds, the net inflow of the northbound capital over the day exceeded 1.8 billion yuan, of which the Shanghai stocks were flowed for more than 2.2 billion yuan, and the depth of the deep stocks outflowed exceeded 400 million yuan.

According to the analysis of Central Plains Securities, the future of the stock index is expected to continue to fluctuate up, and at the same time, it still needs to pay close attention to changes in policy, capital, and external factors. It is recommended to pay attention to investment opportunities in industries such as new energy, automobiles, semiconductors, and software services, and the mid -line continues to pay attention to investment opportunities for low -valuation blue -chip stocks. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Guizhou has transformed into a variety of direct subsidies such as compulsory education nutritional meals into farmers' income

Colorful Guizhou News (Reporter Li Sijin Wu Wei) On June 15, the reporter learned ...

Luliang City's "Sanxia" agricultural production work Xiaoyi on -site observation promotion meeting

On June 20, Luliang City's Sanxia agricultural production work site observation pr...