The deposit interest rate has lowered the increase of the increase of life insurance for life insurance?

Author:21st Century Economic report Time:2022.09.16

The 21st Century Business Herald reporter Ye Mai Sui Guangzhou reported that the deposit interest rate was underway. Following September 15th, the Bank of Industry and Rural China Construction Council and Postal Savings Bank lowered the time deposit interest rates, and 6 joint -stock banks including CITIC Bank, Everbright Bank, Minsheng Bank, Ping An Bank, Pudong Development Bank, and Guangfa Bank issued an announcement on September 16th. Announce the time to reduce regular deposit interest rates.

According to the announcement, the deposit interest rate adjusted by the six joint -stock banks has basically been consistent. Among them, the annual interest rate of the deposit period is 0.25%, the one -year terminal deposit interest rate is 1.85%, the annual interest rate of the three -year regular deposit is 2.65%, and the five -year regular deposit annual interest rate is 2.7%. At the same time as the deposit interest rate is reduced, the life insurance products with fixed interest rates come to make fun, of which the increase of life insurance is the most concerned.

Increasing life insurance "supplement"

On the day before the shares reduce the deposit interest rate, many state -owned banks such as ICBC and Agricultural Bank stated that they have adjusted personal deposit interest rates from September 15th, including multiple varieties interest rates including current deposits and regular deposits. Fine tuning. Among them, the three -year regular deposit and large -scale deposit interest rates were reduced by 15 basis points, and the one -year and five -year regular deposit interest rate was reduced by 10 basis points, and the interest rate of the deposit rate was reduced by 0.5 basis points.

This is not the first time that the deposit interest rate is reduced during the year. In April this year, the central bank established a market -oriented adjustment mechanism of deposit interest rates on the self -discipline mechanism of the interest rate. Reasonably adjust the level of deposit interest rates. State -owned banks and most joint -stock banks such as Workers and Peasants' CCPPastes and other joint -stock banks have lowered their limited time deposits and large -deposit interest rates in late April.

The deposit fell and the insurance was full. As the deposit interest rate weakens, the increase of life insurance is brushed. "The deposit interest rate is reduced, not afraid or not! The incremental life insurance product of 3.5%compound interest can help you." "No matter how the deposit interest rate is reduced, the increase of the annualized return of 3.5%of the life insurance is written into the contract."

What is the increase of life insurance? You can first understand the next life insurance. The so -called lifelong life insurance refers to the life insurance period for life, that is, starting from the effectiveness of the policy, no matter when you died or fully disabled, the insurance company will pay the amount of the agreed.

Lifetime life insurance is divided into fixed lifetime life insurance and increased life insurance. Among them, the amount of the quota life insurance is fixed. As the name suggests, no matter when the insured person occurs in the insurance accident agreed in the contract, the amount of insurance for the amount you buy will be compensated. Forehead.

And the insurance amount of the increase of life insurance will grow up. From the beginning of the second insurance year, the effective insurance amount will increase according to the fixed interest rate. It will also grow.

CEO of Snail Insurance Broker Shang Mengmeng said in an interview with the 21st Century Business Herald that the reduction of deposit interest rates will directly benefit insurance with long -term savings functions, such as incremental lifelong life, and some pension gold products. Among them, the gold products of the pension will be more suitable for people with healthy and long life span, so that they can provide sufficient funds for subsequent pensions. Because it is received according to life, the longer the time, the higher the overall income compared to the deposit interest rate. It is expected that until the age of 90, long -term returns can reach 4%. The disadvantage is that the amount received each year is fixed, and the quota cannot be received according to the actual needs of the user. Especially when a large expenditure is required during the elderly stage, it will be more difficult to satisfy.

The increase in life -long life has the advantages of most pension age, which can help achieve long -term savings functions. In the short -term demand, it can also solve the need to receive on demand by reducing insurance. Because the policy stipulated in the contract is 3.5%, the annual order profit can be reached about 6%according to the calculation of 30 years. For the people, if there are relatively long and long needs such as children's educational expenditure, marriage funds, and entrepreneurial funds, if there is no particularly urgent need for funds around 5-10 years, it is equivalent to the overall return of life. Far long than the long -term savings of deposit interest rates. Especially in the pension stage, this money can solve large expenses, and at the same time, it can also ensure stable value -added, which can basically solve the pension needs of most people.

Consultation volume increased by 40 %

"After the amount of deposit interest rate was reduced, yesterday, our customers' consultations on the increase of life insurance increased by about 40%in the past. In the future, it will add a more stable and higher guarantee for income. "Shang Mengmeng said.

Master of Medicine of Jinan University, Sun Xiaosi, a senior life insurance manager in North America, said in an interview with the 21st Century Business Herald that the real economy is currently facing a certain pressure. In the future, the possibility of further decline in investment in investment products is greater. Increase life insurance will be a better wealth management product in the future. At present, the annualized yield of increased life insurance is mostly about 3.5%, and it can be calculated according to compound interest. "In fact, it was not the recent increase in life insurance, but the signs of fire since last year. The main reason for the fire is the current lack of investment products." Sun Xiaosi said.

However, he also believes that incremental life insurance has its own shortcomings, mainly because the initial liquidity is poor. If the funds need to be flowing within 5 years, it is not recommended to buy it. OtherwiseEssenceIn addition to liquidity issues, some people in the industry said that because the increased lifelong life insurance has two functions: insurance and wealth management, the product is more expensive than a single function insurance. In additionfew."There is no perfect wealth management product, and you still have to choose according to your own needs," said the person.

- END -

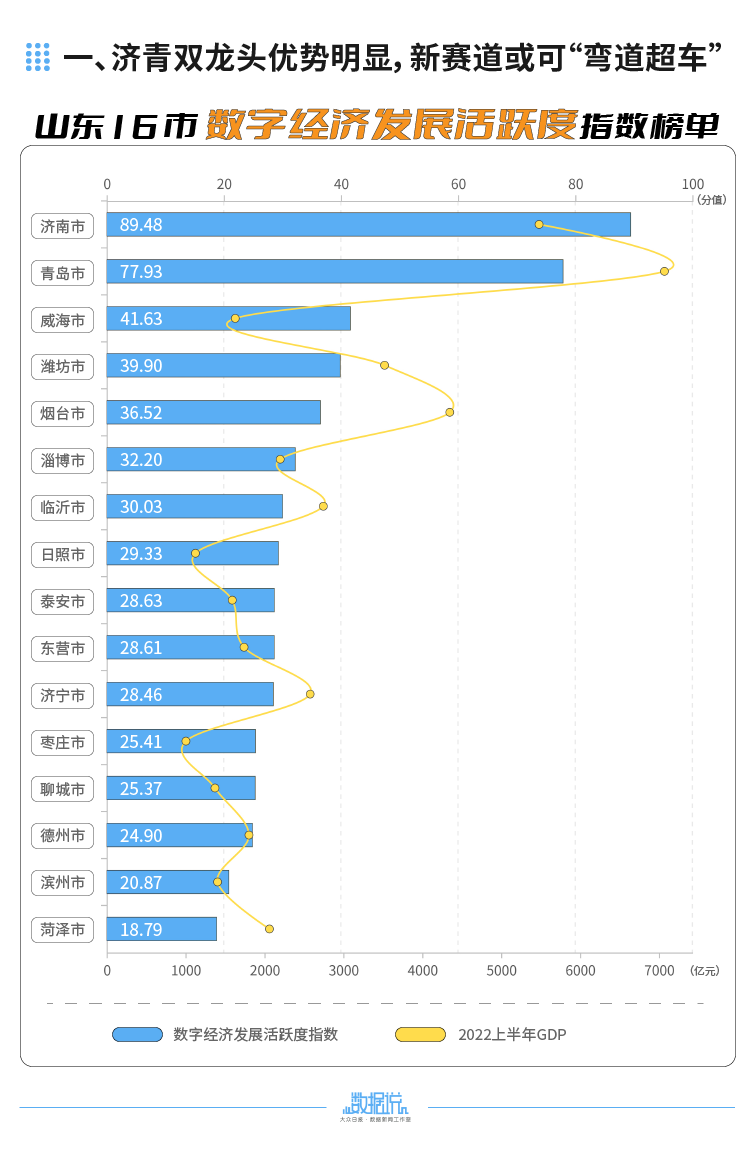

Data said | Digital economy, who is the most "dazzling" in Shandong 16?Ranking is here

The development of the digital economy is a strategic choice for a new round of sc...

The number of Shanghai hotpot store stores has exceeded 8,000!Where is the new hot pot brand "fire" than the predecessors?

Summer40 ℃ high -temperature red warning line is broken againShencheng Catering I...