Quick Comment | Specific pension savings support the "third pillar"

Author:Guangzhou Daily Time:2022.09.16

Not long ago, the China Banking Regulatory Commission and the People's Bank of China jointly issued the "Notice on Carrying out the Pilot Work of Specific Pension Savings", which clearly launched a pilot pilot on specific pension savings from November 20 this year. Analysis of insiders in the industry is conducive to accelerating the development of commercial pension financial business, further enriching the supply of pension financial products, and providing more choices for people to protect the elderly money. (Overseas Version of the People's Daily on September 13)

In April of this year, the General Office of the State Council officially issued the "Opinions on Promoting the Development of Personal Pensions", and proposed to promote the development of personal pensions that are suitable for the development of national conditions, government policy support, voluntary participation, and market -oriented operations, and basic pension insurance, enterprises (enterprises (enterprises (enterprises (enterprises (enterprises (enterprises (enterprises ( Occupation) annuity, realize the function of pension insurance, coordinate the development of other individual business pension finance business, and improve the multi -level and multi -pillar pension insurance system.

According to international practice, the endowment insurance system generally has "three pillars". At present, my country is the basic pension insurance system as the first pillar. The number of insureds in 2020 is 99.865 million; as the second -pillar enterprise (occupation) annuity system, the number of insureds in 2020 is 27.18 million. As the third pillar, the personal pension plan is initial. The pilot pilot of this specific pension is to enrich the supply of pension financial products and provide more channels for the preservation and appreciation of the people's pension money.

In the final analysis, the improvement of the pension system is to maximize the guarantee of "old raising", and the pilot pilot pilot pilot can to a certain extent can achieve wealth preservation. With the continuous enrichment of regular financial products facing the field of pension, setting up "idle money" in a more secure way in savings, it is also constantly eradicating the living space of "the elderly investment and financial scams", which is well -known for people.

The pilot pilot of specific pension savings should be opened, and supporting services must be kept up. Financial institutions such as banks should implement national policies. On the one hand, more social funds should be returned to financial operations; on the other hand, the interests of deposits should be guaranteed, such as more, more, and more, more, more, and more, more, and more, more, more, more, more, more, more, more, more, more, more, more, more, more, more, more, more, more, more, and more, more, and more, more, and more, more, more, and more, more, more, more, and more, more, more, more, and more, more, and more, more, more, more, and more, more, more, more, and more, more. Flexible access methods, better deposit interest rates, and more secure financial security strategies. With the improvement of personal business pension financial services, weaving a multi -level, multi -pillar pension insurance system network, helping "old -fashioned" covers a larger scale, and the prospects are worth looking forward to.

Text/Guangzhou Daily commentator Li Ji

Picture/Guangzhou Daily · Xinhua City reporter Su Junjie

Guangzhou Daily · Xinhua City editor Hu Jun

- END -

Qinghai Taxation: Do \"can\" do \"can\" in the \"something\" pos

In the past few days, the province's tax system has seriously conveyed the spirit...

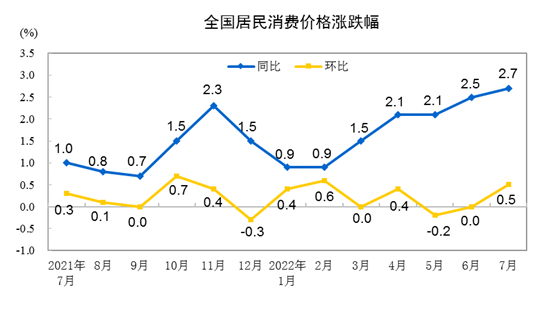

National Bureau of Statistics: In July

In July 2022, consumer prices across the country rose 2.7%year -on -year. Among th...