CITIC Trust and Yunnan Kangli Group's 2 billion debt dispute Followed by: 254 commercial houses under the ST Yuncheng company were seized!

Author:Daily Economic News Time:2022.09.16

A few days ago, ST Yuncheng (SH600239, stock price was 1.71 yuan, and market value of 2.7 billion yuan) issued an announcement. (2022) Sichuan 01 Executive 3974 "Executive Ruling" involves CITIC Trust and Company's controlling shareholder Yunnan Kangli Holding Group Co., Ltd. (hereinafter referred to as "Kanglou Group") Called "Yincheng Real Estate") borrowing contract disputes, 1.681 billion yuan in implementation.

The former Kangli Group was the Yunnan Urban Investment Group. Data show that as of the end of June this year, the Kangli Group has been overdue within the scope and the balance of debt has reached 2.812 billion yuan.

254 commercial houses were seized

The announcement revealed that the Chengdu Intermediate People's Court based on the (2022) Beijing Fangyuan Personal Certificate No. 91, which was issued by the Beijing Fangyuan Notary Office, accepts CITIC Trust, Kaijin Group and Yincheng Real Estate Loan Contract Disputes. Real Estate has the clue of property available for execution, and is the mortgage property in this case. The Chengdu Intermediate People's Court has taken compulsory measures on its property.

The announcement shows that the court seizes 254 commercial houses for the executed person Yincheng Real Estate. The seizure period is three years, from July 28, 2022 to July 27, 2025.

ST Yuncheng said that the company is actively communicating with the relevant parties and negotiating processing plans. In view of the implementation of the above matters, it is currently impossible to estimate the final impact of the above matters on the company. However, if the court's follow -up of the company's subordinate Yincheng Real Estate takes measures such as the handling of relevant assets in the Yintai IN99 Shopping Center property, it will have a greater impact on the company.

On the afternoon of September 14th, Chengdu Yincheng Real Estate Co., Ltd., a company affiliated to Yintai IN99 Shopping Center, issued an announcement saying: "This seizure is a normal legal procedure, which is not the final right and obligation. Operations have caused adverse effects. "The announcement also mentioned that IN99 has stable operation and good financial conditions. Since its opening, sales and passenger flow are at the forefront of each shopping center. In the future, it will also adhere to the original intention. market.

It is reported that the dispute stems from the 2 billion yuan "Credit Agreement Agreement" and the "Credit and Debt Confirmation Agreement" signed by Kangli Group and CITIC Trust. The company's subordinate Yincheng Real Estate provides the first settlement mortgage guarantee for the transfers of the CITIC Group's creditor's claims with the Yintai In99 Shopping Center property it holds; guarantee.

On September 16th, for the debt disputes with Yunnan Kangli Group, each reporter contacted the relevant person in charge of CITIC Trust, but it said that the incident was still in the process of disposal.

According to public information, as early as October 2020, the relevant person in charge of CITIC Trust led the team to visit the Kaijima Group to promote comprehensive business cooperation with the person in charge of the Kangli Group and the subordinate urban investment, urban renewal, and hot spring valley. Discussion.

At that time, the relevant person in charge of CITIC Trust pointed out at the meeting that CITIC Trust and Kangli Group's predecessor Yunnan City Investment Group had a deep foundation for cooperation. Combining the transformation needs of the Kangli Group and the latest development direction of the trust industry, the person in charge proposed the customized comprehensive comprehensive comprehensive of the company's four main business around its four main business around its four main business around its "cultural tourism, health services, urban comprehensive development, and ecological and environmental protection" Financial service plan.

In June 2021, CITIC Trust and Kangli Group signed the "Strategic Cooperation Agreement". The relevant person in charge stated that CITIC Trust has maintained a long -term good cooperation relationship with major state -owned enterprises such as Yunnan Kanglin Group and other provinces and cities. The signing of China will open the comprehensive deepening of the cooperation channels with the state -owned enterprises of Yunnan and the state -owned enterprise of Yunnan, further expand and deepen the comprehensive business cooperation with the Kaili -Journal Group, and form a deeper friendship.

Kangli Group's short -term debt repayment pressure is high

Kangli Group was formerly known as Yunnan Urban Investment Group and was positioned as a leading enterprise in two trillion -level industries in Yunnan Province's "cultural tourism, health services". In terms of equity structure, Qixinbao showed that Yunnan SASAC and Yunnan Investment Holding Group Co., Ltd. held 46.73%and 44.92%of the shares of the Kaili Tour Group, respectively.

In recent years, the debt problem of the Kaijima Group cannot be ignored. According to the report disclosed by CITIC Securities a few days ago, as of the end of June this year, the Kangli Group has been overdue within the scope and the balance of the unsuitable debt was 2.812 billion yuan, including the overdue amount of the Kaijima Group's headquarters of 105 million yuan, and the subsidiary within the scope of the merger statement was 27.07. 100 million yuan. Among them, bank loans are 521 million yuan, and non -bank financial institutions loans are 2.291 billion yuan.

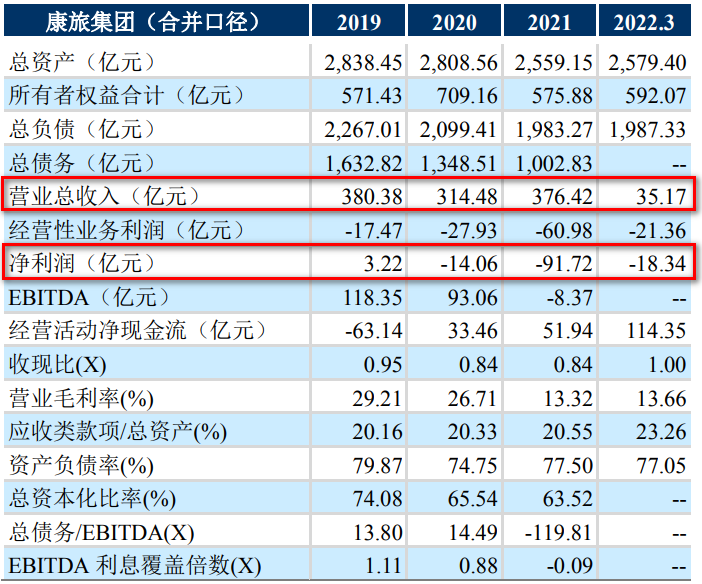

From 2019 to 2021, the Kangli Group achieved operating income of 38.038 billion yuan, 31.448 billion yuan, and 37.642 billion yuan, respectively; net profit was 322 million yuan, -1406 billion yuan, and -9.172 billion yuan, respectively. In the first half of 2022, the company obtained 9.191 billion yuan in operating income, a year-on-year decrease of 50.24%; net profit was -51.10 billion yuan.

Photo source: Yunnan Kanglife Group 2022 tracking rating report

In February of this year, China Chengxin International adjusted the main credit level of Yunnan Kangli Group from AAA to AA+, maintaining the rating outlook as negative.

In the follow -up rating report issued in June this year, China Integrity International stated that the rating outlook for the Kangli Group to maintain negatively based on: the company's profitability in 2021 has decreased significantly, the financial leverage has maintained a high level, and the short -term debt repayment pressure is very high. The key subsidiaries have not been issued in 2021 and have not been issued a audit report for no reservation. The company's asset quality has been weakened further and the follow -up business of the newly established three major groups needs to be followed. China Integrity International mentioned in the report that in 2021, the company raised debt payment funds by dealing with assets, claims collection, and re -financing, and the scale of liabilities and equity achieved a double drop. And the debt period structure has not been improved, and the company still faces a lot of short -term debt repayment pressure.

In addition to the Kaili -Journey Group, in May last year, Huangting International (SZ000056, a stock price of 4.81 yuan, and a market value of 5.6 billion yuan) issued an announcement. Due to the dispute between the borrowing contract, CITIC Trust filed a lawsuit against the company and related parties and applied for seizure to seize Shenzhen's melting hair. Investment Co., Ltd. is located in the real estate shopping center in the Lingdao State Business Shopping Center in the center of Futian District, Shenzhen, and the seizure period is 36 months.

Daily Economic News

- END -

23 funds under the Jinyuan Shunan Fund disclosed the latest semi -annual report of 2022

On August 31, 2022, Jinyuan Shunan Fund Management Co., Ltd. disclosed the latest semi-annual report of 23 fund products (separated share) (January 1, 2022-June 30, 2022).According to data, Jinyuan Sh

The city of live broadcast adds "Fast Brand" to build a new market well.

Cover reporter Cai ShiqiOn June 26, the Linyi Municipal Government signed a contra...