[Cai Zhi Headline] Intersection of stocks, Alibaba, JD.com and other stocks, asset management giants Fidelity International Layout the Chinese market

Author:China Well -off Time:2022.09.17

Picture source: network

The international giants have attracted much attention because of their mature investment concepts and stock selection ideas, and they have always been considered an important vane of the market.

Despite a certain decline in the A -share market, global asset management giants such as Fidelity International and Anben Investment still increased their positions in Chinese assets.

During August, the China Stock Fund of Fidge International's China Stock Fund fully increased its positions in related stocks such as the Internet. Anben Investment's China Stock Fund mainly increased its positions in Ningbo, and at the same time reduced the holdings of many China.

Fidelity International Increases China's Internet leader

As a global asset management giant Fidge International, it was established in 1969 and was originally an international investment department of Fidelity Investments, which was established in Boston in 1946. In 1980, it was independent of Fidge Investment in the United States. At present, it is an independent company that co -shares of the founder family, management and senior employees. The company has offices in 25 countries and regions around the world. It has more than 7,000 employees. Internationally served as a fund manager and vice chairman of the company.

Fidelity International's investment experience in China has exceeded 20 years, and it is also one of the earliest foreign -funded institutions to enter the Chinese market.

In 2004, Fidelity International established the first office in Shanghai; in November 2010, he received the first $ 150 million QFII quota; Established in Shanghai; In January 2017, Fidelity International was approved to become the first foreign private equity manager through its Fida Litai Investment Management (Shanghai) Co., Ltd., and obtained the first 460 million yuan RQFII quota; 4 months later Fidelity International became the first foreign -funded institution to launch private equity products in the Mainland.

As of December 31, 2021, Fidelity International was US $ 812.8 billion (equivalent to RMB 5.17 trillion) from more than 2.7 million customers in the world.

According to the latest data from the international authoritative rating agency Morningstar, Fidge International's China Stock Fund has released its position as of the end of August, and invests in stocks from China Internet companies such as Tencent, Alibaba, Meituan, JD.com, and will also Alibaba US stocks move to Hong Kong stocks.

Fidge International's China Stock Fund has updated the position as of the end of August, and the China Consumer Power Fund, a subsidiary of Fidelity International, added positions to most of its heavy positions.

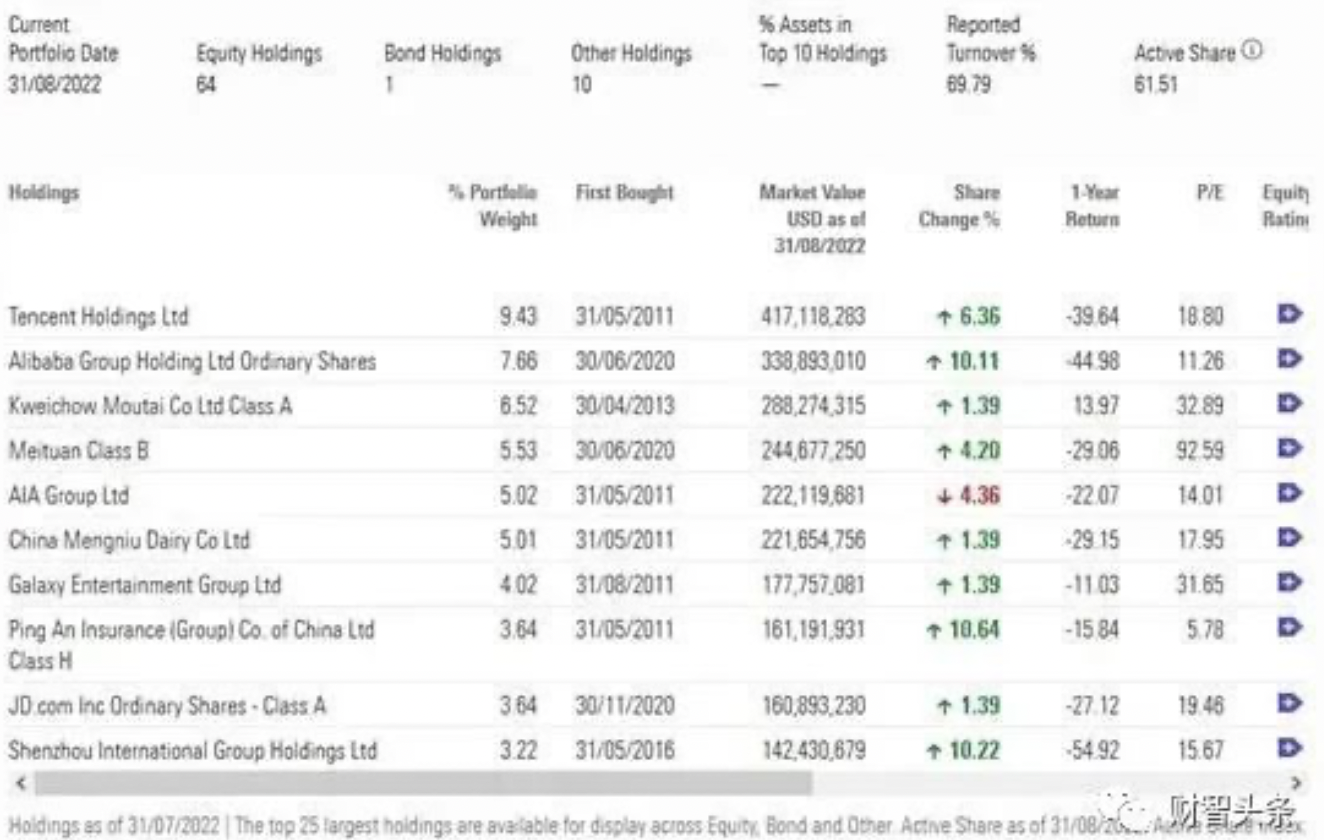

As of the end of August, the top ten heavy stocks of the China Consumer Power Fund under Fidelity International were Tencent Holdings, Alibaba, Guizhou Maotai, Meituan, AIA, Mengniu, Galaxy Entertainment, Ping An of China, Jingdong, Shenzhou International Essence

During August, the fund fully increased its holdings of Internet stocks such as Tencent Holdings, Alibaba, Meituan, JD.com. Among them, Tencent Holdings and Alibaba increased their holdings relatively large. During August At the end of the period, the market value of the shareholding was US $ 417 million, an increase of Alibaba 10.11%of the shares, and the market value at the end of the period was US $ 339 million.

At the same time, the fund reduced the 4.36%shares of AIA, and Ping An H shares in China, which are also the insurance industry, received a 10.64%stake in the insurance industry.

Picture source: Securities Times

Tencent is the big shareholder frequently reduced holdings

Fidge International Portrait

It is worth noting that another China Stock Fund under Fidelity International has a larger position on Internet stocks, and Tencent Holdings has exceeded 60%.

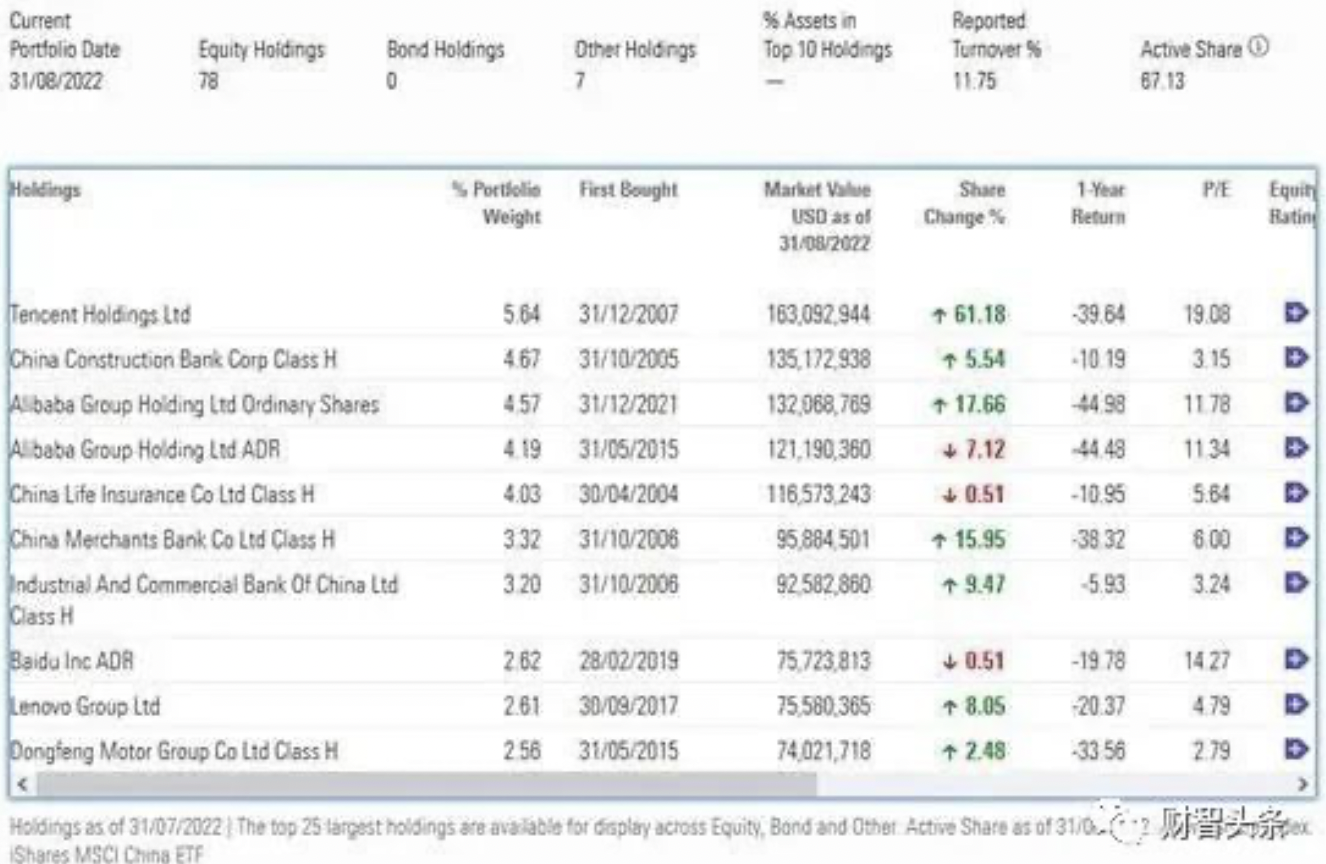

According to Morning Star data, as of the end of August, the top ten heavy stocks of Federal International Fund Fund under the International Fund of Fidelity were Tencent Holdings, Construction Bank H shares, Alibaba, Alibaba ADR, China Life Insurance, China Merchants Bank H shares, ICBC H shares, Baidu ADR, Lenovo Group, Dongfeng Automobile H shares.

During August, the fund increasing holdings of its number one heavy position shares Tencent Holdings increased at 61.18%of their positions. At the end of the period, the market value of the position reached US $ 163 million. Essence Construction Bank, China Merchants Bank, ICBC and other financial stocks have also received a lot of shares of fund holdings.

Picture source: Securities Times

On the occasion of Tencent, Fidelity International Investment, Tencent was frequently reduced by major shareholders. Tencent's largest shareholder Naspers (South Africa Newspaper Group), a subsidiary of PROSUS, announced on September 8 this year that in order to cooperate with the continuous implementation of the company's repurchase plan, it sold 1.15 million shares of Tencent ordinary shares, and the shareholding ratio dropped to 27.99%.

It is reported that this is the second time PROSUS reduced its holdings within 3 months. Tencent announced in June this year that major shareholders will sell shares. It is expected that Tencent shares that are sold every day will not exceed the average daily transaction volume of the company's shares of about 3-5%.

At the same time, Alibaba also encountered major shareholders' holdings.

SoftBank Group released its financial report on August 8, and recorded the company's largest 31627 trillion yen (about 23.4 billion US dollars) in a single quarter in a single quarter. Subsequently, as Alibaba's largest shareholder, SoftBank Group announced that early settlement with Alibaba related prepaid forward contracts (a derivative) involved 242 million shares, with a total of 34.5 billion U.S. dollars. After the transaction was completed It is 14.6%.

Although the two giants of Alibaba and Tencent have encountered major shareholders, it is worth noting that in recent years, Qiaoshui Fund has greatly increased Chinese assets, and its Bridge water China has also become the first foreign capital to manage the scale of more than 10 billion yuan in management scale exceeding 10 billion yuan. Private equity. Dalio, the founder of Bridge Water Fund, has repeatedly emphasized the optimism of the Chinese market. Dalio said he was a long -term investor in China. "I believe that China has provided excellent opportunities, and not investing in China will take the risk of missing high returns. I will be optimistic about China for a long time. Based on what I see and thought, I have made a decision to invest in China. "

The British hedge fund giant and the British Man Group are also optimistic about the Asian stock market. Since March, Man's Group has added an openness to the Chinese market in its Asian investment portfolio. Tencent Holdings is the company's second largest heavy stock stock in the Asian investment portfolio.

Anben Investment Concentration Jiacang Ningbo Bank

For bank stocks, the market is not friendly in the near future. Affected by multiple factors, bank stocks performed weakly during August, but foreign -funded giants Anben Investment was increasing against the trend.

As the largest and second -ranked active asset management giant in the UK, the investment business of Anben Standard Investment Management is operating with Anshi brand. To.

Localization is the only way for foreign private equity to take root in the Chinese market. Anben Standard Investment Management has been rooted in China since 2002, and has invested in China since the mid -1980s. The company is one of the first batch of global investors to enter the domestic market through QFII and RMB qualified foreign institutional investors (RQFII). Anben Standard Investment Management completed the qualification registration of the private equity investment fund manager in November 2017. Anben Standard Investment Management (Shanghai) Co., Ltd. launched the first A -share private equity fund in May 2018.

During August, the latest data from Anben Investment's China Standard Anben Standard China A shares fund showed that the top ten heavy warehouse stocks were adjusted. It has also increased its holdings of 7.02%, while the second largest heavy stocks were reduced by 13.19%of the shares, which was the largest stock of the top ten heavy stocks.

Picture source: Securities Times

The Ansmark Standard has also increased its holdings of 7.02%of the Bank of Ningbo Bank, while the JD.com and Ningde Times were slightly reduced, and other heavy positions changed their overall changes.

(WeChat public account "Caizhi Headline" comprehensive self: Finance News Agency, Securities Times, Interface News, etc.)

Edit: Bai Jing

School pair: Yuan Kai

Review: Gong Zimo

- END -

Authoritative Express 丨 Beijing Stock Exchange will launch the first index

September 2, 2022Beijing Stock Exchange released the first index preparation planT...

28 measures, 16 lists!Yunnan releases policy to promote consumer development

Consumption traction drives economic cycleTo further boost consumer confidenceRele...