what's the situation?Foreign capital suddenly entered the A -share military industry crazy!The 30 billion giants have been on fire: the increase in the position of more than 60%

Author:Broker China Time:2022.09.17

Source: E Company ID: lianhuacaijing

Affected by the violent fluctuations of the peripheral market, the risk aversion emotions again heated up again, and the funds sold to 6.088 billion yuan this week. Among them, the Shanghai Stock Connect was sold 2.777 billion yuan, and the Shenzhen Stock Connect was sold 3.311 billion yuan.

The continuity of the European Energy Crisis has caused the mining industry to be sought after. Coal mining, petroleum mining, and mining services have obtained net buying nets. Food, beverage and other industries have also received net purchase of funds over 100 million yuan this week. Public utilities, banks, electrical equipment and other industries have been sold over 100 million yuan.

Greatly improve the position of military stocks

This week, the funds in the north increased sharply on a number of stocks in the national defense military industry.

Zhongbing Red Arrow is a company affiliated to China Weapon Industry Group. The product involves large -caliber artillery shells, rockets, missiles, aircraft parts and other fields. As of the closing of this Friday, the stock value of the stock exceeded 36 billion yuan. This week, the funds in the north spent 331 million yuan, and 12.01 million shares of the Bingzhong Red Arrows were added. The holding of the shares increased from 19.76 million shares last weekend to 31.77 million shares, a two -month high, an increase of more than 60%.

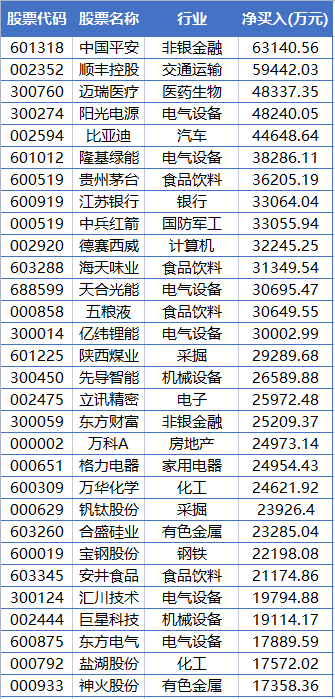

This week, I bought more stocks in the north to buy more stocks

In addition, the north funds also increased the positions of Chenxi Airlines, Tianhe Defense, Thunderbolt, and Gangyan Gao Na this week.

As the market is adjusted in depth, the north funds are so favored by the national defense military stocks, or it is related to the current regional economic, political, and military situation in the world. After the global military expenditure exceeded 2 trillion US dollars in 2021, the global defense budget continued to increase in 2022. Tianfeng Securities judges that the global arms stagnation period may end, and my country is also expected to usher in a new round of defense equipment development and installation period.

The high prosperity of the A -share military -based listed company has fully benefited the industry. Wind data statistics show that under the high base and this year's epidemic, after eliminating the target of the civilian ship manufacturing business with cyclical attributes, the military sector realized in the first half of 2022 to achieve the realization of 2022 realization. The total operating income was 249.4 billion yuan, a year -on -year increase of 13.5%, and net profit was 22.3 billion yuan, a year -on -year increase of 27%.

Galaxy Securities pointed out that the "14th Five -Year Plan" and even the "Fifteenth Five -Year Plan" period of the defense industry is expected to tilt towards the fields of actual needs, and the aviation industry chain, missile development chain, and new materials will benefit in depth. Military equipment procurement has a strong planned planning, the demand side growth is determined, and the bottleneck of the supply side capacity continues to be eliminated. In 2022, the performance of the sector is expected to achieve a growth rate of more than 30%. In addition, industrial capital increase will also effectively drive the increase in investment confidence in the sector.

Food and beverage stocks become a shelter

With the approaching of the National Day holiday and the continuous improvement of the epidemic, the government has continuously introduced the consumer policy, and the market is full of longing for the consumer market during the National Day.

Although the food and beverage industry was affected by the adversely affected by the epidemic in the first half of the year, and the overall growth rate slowed down, 78 of the 84 listed companies still achieved a year -on -year increase in net profit.

The beautiful food and beverage industry has therefore become a hedge in a weak city and has attracted the focus of the main funds. According to incomplete statistics, in the past two months, a total of 39 food and beverage companies have obtained intensive investigations from public funds, brokers, insurance capital, sunshine private equity, QFII and other institutions. Nine of them have been investigated by more than 100 institutions.

Bei Shang Fund this week, the stocks of the food and beverages industry in the next week, buying 362 million yuan in Moutai in Guizhou, 313 million yuan in net purchase, and 306 million yuan in Wuliangye, Anai Food, Yili, Chongqing Beer, Chongqing Beer, Chongqing Beer Wait for a net purchase of over 100 million yuan.

Everbright Securities believes that at present, the fundamental prospects of the segmentation of the liquor sector are still stable, and the valuation switching at the end of the year is expected to become the follow -up driving force of the sector; the monthly sales feedback of all casual food sections with the stock market for the peak season is more positive, the industry is more positive, and the industry The fundamentals are stable as a whole, providing configuration opportunities for the short -term adjustment of the sector.

Responsible editor: Yang Yucheng

School pair: Zhao Yan

- END -

Douyin takeaway is really here?Can you even take a takeaway even Douyin? Are you hungry?

In the Chinese takeaway market, the takeaway rivers and lakes have been silent for...

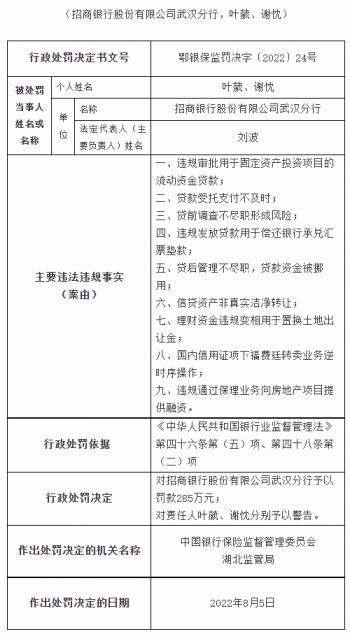

Due to the incomparable management of the loan, the loan funds were misappropriated, and the Merchants Bank Wuhan Branch was fined 2.85 million yuan

【Source: China Economic Network】On August 8th, the public information on the adm...