More than half a month of 6 new shares broke on the first day!When a stock is listed, it fell 16%, and the medium sign may lose more than 3,000 yuan!Twelve shares next week, do you still play new?

Author:Daily Economic News Time:2022.09.18

According to the issuance arrangement, there are 12 new shares issued next week (September 19th-September 23rd), including 4 science and technology boards, 4 GEM, 3 Shenzhen motherboards, and 1 Shanghai City motherboard.

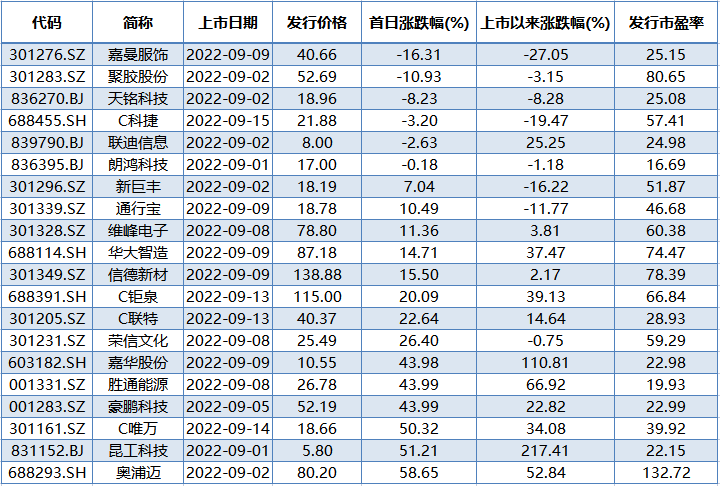

It is worth noting that the A -shares entered in -depth adjustment in September, and the Shanghai Stock Exchange Index fell 4.16%on the first Thursday after the Mid -Autumn Festival. New shares on the first day of September also increased from the previous month. A total of 5 new shares broke on the first day, and 6 new shares were broken on the first day since September.

After the listing of new shares in September

Data source: wind

Break and reproduce on the first day

According to the Securities Times, from May to June this year, A shares continued to rebound, and the Shanghai -Shenzhen -Shenzhen new shares that were listed during the period broke. But entering July A -share trend began to adjust. Among the 34 new shares listed in July, 8 were broken on the first day. The biggest decline on the first day was Zhongke Lanxun, which was listed on July 15.

On July 15th, Zhongke Lanxun launched the first show. The company opened for 1 minute. The company fell nearly 30%to a minimum of 63.4 yuan. As of the close, the stock price was 64.3 yuan, a drop of 29.85%. The issuance price of Zhongke Lanxun was 91.66 yuan. According to the calculation of the first -hand sign (500 shares), the maximum floating loss of the Chinese -signed shareholders exceeded 14,100 yuan. Zhongke Lanxun's main business is the development, design and sales of wireless audio SOC chips. The main products include TWS Bluetooth headset chips, non -TWS Bluetooth headset chips, Bluetooth speaker chips, etc.

In August, a total of 5 new shares listed in the month were broken on the first day. The biggest decline on the first day was Hengshuo shares.

Hengshuo was officially listed on the science and technology board on August 29 with a issuance price of 65.11 yuan, and the issuance price -earnings ratio was 40.7 times. Heng Shuo's shares fell below the issue price, the lowest in the market was to 47.98 yuan. Based on the lowest point, the investor in each of them lost 8,565 yuan. Hengshuo is an integrated circuit design company that is mainly engaged in storage chips and MCU chips research and development, design and sales. The prospectus disclosed that Hengshuo completed the first Norflash product stream film in November 2015, using the 65nm process. In May 2020, the company's first Norflash product based on the 50nm process was mass -produced and sold. 50nm is also the most advanced process of Hengshuo's Norflash products.

It is worth noting that the A -shares entered in -depth adjustment in September, and the Shanghai Stock Exchange Index fell 4.16%on the first Thursday after the Mid -Autumn Festival. From the first day of September, new shares also increased month -on -month. A total of 5 new shares broke on the first day, and 6 new shares were broken on the first day since September.

On the first day of September, the biggest new stocks were Garman's clothing. On September 9th, Garman's clothing landed on the GEM. The opening price was 34.01 yuan, which was 16.36%lower than the issuance price of 40.66 yuan, and the lowest in the market was to 33.9 yuan. As of the closing of the first day, 16.31%.

Based on the minimum price in the market, the maximum loss of 500 shares in China One was 3380 yuan.

Garman Clothing is a mid-to-high-end children's clothing operation enterprise. The business covers the core business links such as R & D design, brand operation and promotion, direct operation and franchise sales of children's clothing. Essence The company adopts multi -brand operating strategies, including its own brand, authorized business brand, and international retail agency brands, which correspond to the mid -end, middle and high -end children's clothing markets.

Twelve shares next week

According to the issuance arrangement, there are 12 new shares issued next week (September 19th-September 23rd), including 4 science and technology boards, 4 GEM, 3 Shenzhen motherboards, and 1 Shanghai City motherboard.

In terms of new time distribution, new shares are purchased every day next week, including 3 on Monday (Wanrun New Neng, Hongrida, Yahao New Material), 4 on Tuesday , Bofei Electric), 2 on Wednesday (good, Oujing Technology), 1 on Thursday (Fuchuang Precision), 2 on Friday (Biden Pharmaceutical, Holy Integrated).

The top three market value required for Dingge's purchase is Holy Integrated (200,000 yuan), Boffei Electric (200,000 yuan), and Hongrida (145,000 yuan). In terms of issuance price, the issuance price has been announced, including Wan Run Xinneng, Hongrida, Yihao New Materials, Bofefei, Oujing Technology, and Shenghui, respectively, 299.88 yuan, 14.60 yuan, 23.88 yuan, 19.77 yuan, 15.65, 15.65 Yuan, 27.25 yuan.

In terms of popular companies, Fushen Precision is a domestic leader in the field of precision components in semiconductor equipment. It is the only supplier certified by the mainstream customers in international mainstream customers, and is the one in the world. One of the parts manufacturers. In 2021, the company ranked first in the global market share of precision parts in semiconductor equipment. It is the only domestic enterprise certified by the international mainstream customers. The company has the supply chain system of mainstream domestic semiconductor equipment manufacturers such as Customer A, Tokyo Electronics, and ASMI, and mainstream domestic semiconductor equipment manufacturers such as Huachuang, Sino -Micro Corporation, Tuojing Technology, Huahai Qingke, Xinwei, and Kai Shitong.

Daily Economic News Comprehensive Securities Times, Announcement of Listed Companies

(Disclaimer: The content and data of this article are for reference only, do not constitute investment suggestions, verified before use. According to this, the risk is self -affordable.)

Daily Economic News

- END -

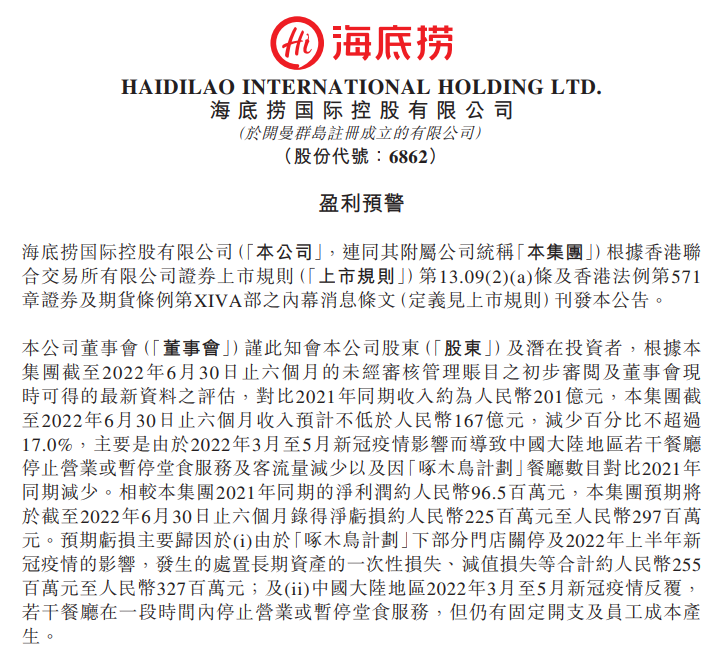

Haidilao is expected to have a net loss of about 225 million yuan to 297 million yuan in the first half of the year

[Dahecai Cube News] On August 14th, Haidilao announced that the revenue in the fir...

Yu Jinhua, joint general manager of the Macro Strategy Department of Southern Fund: The key to the development of personal pensions is to help investors get ideal long -term returns

21st Century Business Herald reporter Pang Huawei Guangzhou reportWhether it can help investors get the ideal long -term return will become the most important driving force for continuous transformat