The top ten news that affects the market on weekends (new shares+reviews)

Author:Broker China Time:2022.09.18

The above audio technology comes from: Xunfei Voices

1

The economic indicators in August are restored, and the economic expected to restore the trend throughout the year

On September 16, the National Bureau of Statistics released August Economic Data. In August, the added value of industries above designated size increased by 4.2%year -on -year, an acceleration of 0.4 percentage points over the previous month; the national service industry production index increased by 1.8%year -on -year, which was 1.2 percentage points accelerated from last month. Last month, 2.7 percentage points were accelerated. From January to August, the investment in fixed assets nationwide increased by 5.8%year-on-year, 0.1 percentage points accelerated from January-July. Driven by economic recovery, the national urban survey unemployment rate was 5.3%in August, a decrease of 0.1 percentage points from the previous month.

Comments: Generally, the main indicators of the economic indicators in August exceeded expectations, and the economy is still recovering to normal track. On the one hand, we must see the economy better. For example, the manufacturing and non -manufacturing PMIs are better than July. Infrastructure investment continues to make efforts, manufacturing investment has increased rapidly under the influence of the preliminary policy, the unemployment rate is downward, the total credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit and the total amount of credit. Structure is improved. On the other hand, it is still necessary to face up to difficulties. Policies also need to continue to consolidate the current pattern of weak recovery. In August this year, the year -on -year data was greatly affected by the low base of last year. It is negative growth, and real estate investment and sales have not fundamentally improved.

2

LPR offer in September will be announced! More than 15 banks have lowered deposit interest rates

On September 20 (Tuesday), the quotation interest rate (LPR) of the loan market for one -year and 5 -year loan will be announced. On September 15th, the central bank launched an MLF operation of 400 billion yuan. After hedging, the 600 billion yuan expired on the day will achieve a cage of 200 billion yuan; the operating interest rate is flat at 2.75%. This is MLF's second consecutive month shrinkage.

At the same time, the deposit interest rate ushered in adjustment. According to incomplete statistics from Chinese reporters from securities firms, the six major countries have taken the lead in downgrading the regular deposit interest rate. Among them, 15 basis points were reduced by three -year regular deposits, and other regular deposits generally lowered 10 basis points. Later, China Merchants Bank, CITIC Bank, Everbright Bank, Minsheng Bank, Ping An Bank, Pudong Development Bank, Guangfa Bank, Huaxia Bank, Hengfeng Bank, etc. at least 9 shares announced the deposit interest rate. The decline of regular deposit products ranges from 10-50 basis points.

Comments: Wen Bin, chief economist of Minsheng Bank, pointed out that the downside of deposit interest rates is expected to open up the space for LPR. Wang Qing, chief macro analyst of Dongfang Jincheng, believes that the MLF interest rate remained unchanged in September, which means that the basis of the LPR quotation of the month has not changed. In addition Small. However, the recent decline in bank deposit interest rates does not rule out the possibility of 5 -year LPR quotes.

See details: "Settle again during the year! Following the reduction in the interest rate of the six major countries, at least 8 shares followed up. What is the reason? "

3

The Securities and Futures Commission approves the first batch of 8 science and innovation boards to be qualified for city merchants! COSCO 500ETF options appear, a large wave of liquidity is approaching?

On September 16, the CSRC approved the science and technology board of science and technology boards such as Shen Wanhongyuan Securities, Huatai Securities, Galaxy Securities, CITIC Construction Investment Securities, Oriental Securities, Caitong Securities, Guoxin Securities, and Guojin Securities. The launch of the market business mechanism is an important measure to continuously improve the capital market's basic system and further play the role of the "test field" of science and technology board reform. The current introduction of a market business mechanism will help further enhance the liquidity of the science and technology board stocks, enhance market toughness, and better promote the construction of the sector.

In addition, after nearly three years, the pilot of the ETF option label has expanded to 6. The CSI 500ETF options will appear on Monday, September 19th. This is also the first option product based on the CSI 500 index. It is the management of small and medium -sized market value stocks. Effective tools for risks. According to the announcement of the two exchanges, the CSI 500ETF options will be listed on September 19, respectively. In addition, the Shenzhen Stock Exchange will also launch the GEM ETF options, the target is the ETF ETF. It is worth mentioning that the GEM ETF options are the first standardized derivatives in the GEM and the first risk management tool for innovative growth stocks.

Comments: The launch of the CSI 500ETF options has formed a complementary stock option product system with existing varieties, which is conducive to the accurate management of various types of investors in the market to accurately manage emerging growth and medium -sized stocks. The products will be further enriched, which will further meet the investment needs of various investors.

4

"Ning Wang" has a big move! Chery Automobile: 100 billion yuan in 5 years, entered the new energy and smart car track

On the evening of September 17, the Ningde Times announced that the company's first MTB (Module to Bracket, Module Integration Chassis) technology will be the first to be applied to the National Electric Power Core Core Dynamic Card Electricity Project. It is reported that this technology can also be applied to the bottom -hanging power conversion card and construction machinery. Ningde Times is committed to promoting the comprehensive electrification of the commercial vehicle market by providing sustainable solutions for electricity replacement cards and construction machinery. In addition, Ningde Times New Energy Co., Ltd. recently answered investors' questions on the interactive platform that it is committed to promoting the industrialization of sodium ion batteries in 2023. Recently, Chery Automobile announced that it would enter the new energy and smart car track. Yin Tongyue, chairman of Chery Automobile, said that in the next five years, Chery plans to invest 100 billion yuan for technological innovation and cultivate more than 20,000 R & D personnel, of which the software talent ratio will exceed 50%. Chery's goal is to build 19 Yaoguang Lab this year, and 300 will be built in 2025.

Public information shows that in 2021, Chery Automobile Group achieved operating income of 105.6 billion yuan throughout the year, an increase of 1.2%year -on -year. This is the company's fourth consecutive year revenue exceeded 100 billion yuan. If the next five years, Chery Automobile's average annual investment in R & D is about 20 billion yuan, which means that Chery Automobile's R & D investment accounts for 20%.

5

Is Evergrande's life -saving straw? Hengchi 5: Mass production! Hengchi 6 and 7 plan to mass production next year, and the annual report will also be disclosed as soon as possible ...

On September 16, Evergrande official announced that Hengchi 5 was officially mass -produced in the Tianjin plant. It is understood that Hengchi 5 realized the first vehicle offline on December 30 last year. Global pre -sale was opened on July 6. The order in less than 15 days was over 37,000. Essence At the same time, Hengchi Automobile also said that in addition to Hengchi 5, it will also accelerate the production and development of other models. Among them, Hengchi 6 will be offline at the end of this year and mass production in the first half of next year; Hengchi 7 will be offline in the first half of next year next year. , Mass production in the second half of next year, at the same time speed up the R & D and Hengchi 3 R & D progress.

It is worth mentioning that Evergrande Motors also issued an announcement saying that the relevant audit and review work is still ongoing. After the relevant procedures are completed, they will release the annual results of the 2021 audits and the mid -term performance in 2022 under the feasible circumstances and feasible circumstances. Essence

See "Evergrande's life -saving straw?" Hengchi 5 official announcement: official mass production! Hengchi 6 and 7 plan to mass production next year, and the annual report will be disclosed as soon as possible ... "

6

The Fed will hold a conversation meeting, or a significant interest rate hike

This week, the Fed will hold a interest -bearing meeting to announce the interest rate resolution. The previously stronger inflation data shattered the hope of investors to slow down interest rates. According to data from the US Department of Labor, the US August CPI rose by 8.3%year -on -year, higher than the market expectations of 8.1%. The core CPI of food and energy increased by 6.3%year -on -year, and 0.6%month -on -month was higher than market expectations.

As of the latest closing of the US stocks, the Dow Jones Index fell 0.45%; the Nasdaq index fell 0.90%; the S & P 500 index fell 0.72%. The Blue Chip of the United States continued to decline weakly, of which Apple fell 1.10%, Tesla fell 0.13%, Amazon fell 2.18%, Google-A fell 0.11%, Microsoft fell 0.26%. The Chinese stocks fell sharply on Friday. The Nasdaq's China Golden Dragon Index closed down 4.28%. Weilai, Xiaopeng Automobile, Ideal Automobile, Bilibili fell more than 6%.

Comments: Although most economists think that 75 basis points of interest rate hikes are the most likely result of the interest rate meeting, after the announcement of the core inflation rate at the expected core in August, it is not all impossible to raise interest rates by 1 percentage point. The pricing of interest rate futures shows that investors believe that the probability of 100 bases for interest rate hikes is about 24%, while some Fed observer believes that it is more likely.

7

Multiple heavy meetings will be held

The three -day "2022 China Beidou Application Conference and China Satellite Navigation and Location Services" will be launched in Zhengzhou, Henan on September 20. The conference focuses on innovative applications in the fields of satellite navigation and location services.

From September 19th to 21st, Huawei will host the Huawei Full -time Conference 2022 in Bangkok, and simultaneously provide global live broadcast and interaction. The Huawei Full Linking Conference is an industry conference hosted by the global ICT field, which aims to create a platform for openness, cooperation and sharing.

The 7th China-Asia-Europe Expo will be held in Urumqi from September 19th to 23rd. The theme of this expo is "common, discussion and sharing cooperation to the future".

The 2022 World Manufacturing Conference is scheduled to be held in Hefei, Anhui from September 20th to 23rd. Compared with previous years, this year's World Manufacturing Conference will set up a conference release at the opening ceremony for the first time. For the first time, the National Affairs Group, China Power Section, and China Construction Materials will be invited to host the manufacturing exhibition of major powers, and for the first time, the construction and development achievement exhibition of strong manufacturing provinces will be held.

The 2022 Zhongguancun Forum will be held in Beijing from September 22 to 27. The forum organizes more than 130 activities such as six major sections including artificial intelligence and medical health and other hot topics such as artificial intelligence and medical health.

8

The CSRC approved the IPO approval of 1 company, and agreed to the 7 companies IPO registration

The CSRC approves an IPO approval of a company. The CSRC approved the first public offering of no more than 46.9 million new shares in Shaanxi Mei Energy Cleaning Energy Group Co., Ltd. The CSRC agreed to register the 3 company's science and technology board IPO. The CSRC agreed to register the IPO of the research of semiconductor silicon material shares, Sanwei Xinan Technology Co., Ltd., and Hunan Kirin Xinan Technology Co., Ltd.

The Securities and Futures Commission agreed to register 4 companies GEM IPO. The China Securities Regulatory Commission agreed that the Huaxia Ophthalmology Hospital Group Co., Ltd., Southeast Electronics Co., Ltd., Zhejiang Tianzhen Technology Co., Ltd., and Ruijie Network Co., Ltd. for the first time publicly issued shares and were listed on the GEM.

9

Tip: There are 15 new shares to purchase this week

A total of 15 new shares were issued this week (September 19th to September 23rd). Among them, 4 on Monday: Silicane Technology, Wan Run Xinneng, Hongrida, and Yahao New Materials; 5 on Tuesday: near -shore protein, New Zhenti Biology, Weite Puppet, Van Tuoduyin, Boffeng Electric; Wednesday 2 2 Only: good, Oujing Technology; 1 on Thursday: Fuchuang Precision; 3 on Friday: Bi De Medicine, Holy Integrated, Hualing Co., Ltd..

10

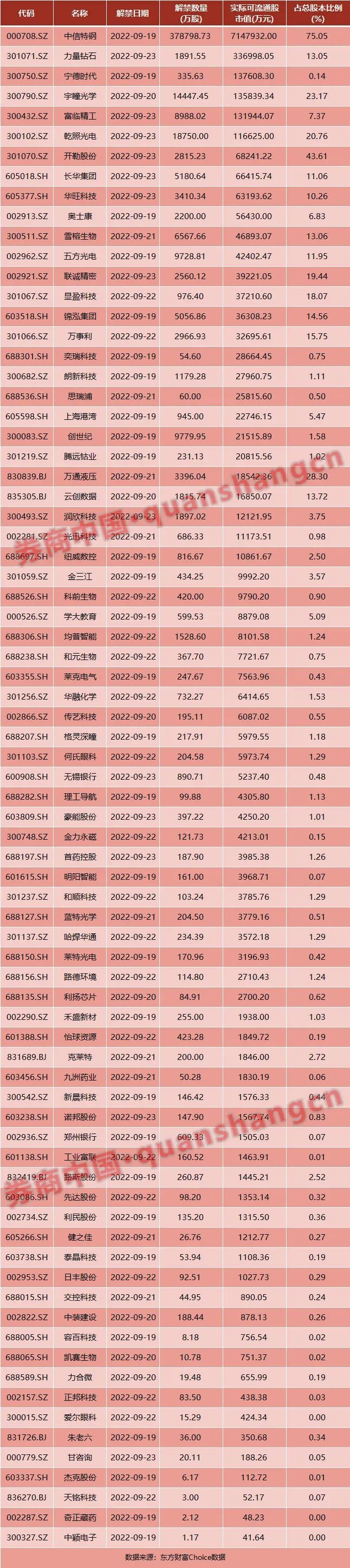

This week's 88.6 billion market value restricted stocks lifted the ban.

Data show that a total of 76 companies have been lifted one after another this week (September 19th to September 23rd), and a total of 4.964 billion shares were lifted. Based on the closing price on September 16, the market value of the ban was 88.619 billion yuan.

From the perspective of the market value of lifting the ban, the top three of the ban on the ban are: CITIC Special Steel (71.479 billion yuan), strength diamonds (3.37 billion yuan), Ningde Times (1.376 billion yuan).

From the perspective of the proportion of lifting the ban, the top three of the lifting of the ban are: CITIC Special Steel (75.05%), Kaili (43.61%), and Wantong hydraulic pressure (28.3%).

Responsible editor: tactics

School pair: Gaoyuan

- END -

The power transformation and upgrading of the power for the day will help enterprises to benefit the people

Recently, the Yili Fairing Branch of Fujian Rongneng Electric Group Co., Ltd. completed the renovation project of the power supply system of Fangqin Garden Hotel, upgraded the power facilities to effe

Jining builds Shandong's inland and international open bridgehead

Relying on the advantages of the Golden Waterway of the Beijing -Hangzhou Grand Ca...