Reading ESG 丨 Listed Listed Companies of the Wine Industry to do a good job of ESG can help reduce costs and reducing the risk of bankruptcy

Author:Daily Economic News Time:2022.09.18

On September 19, the 7th China Wine Capital Forum hosted by the Daily Economic News will be held in the cloud. Based on the rating data of the "ESG Action" platform of the "ESG Action" platform of the China Caisai Green Gold Institute, every four levels of ABCD, from the perspective of financial performance, the 39 A-share liquor listed companies of different ESG ratings are based on ABCD. Comparison analysis.

Specifically, among the 39 A -share wine industry listed companies, the number of ESG rated A is 19, accounting for nearly half, and it is also at the leading level in the industry. There are 12 ESG rated companies with 6 companies with C, 2 companies with C, and 2 companies with rating D.

Studies have found that the ESG rating of listed companies in the A -share wine industry is positively related to the company's scale, and it is also positively related to profitability. This may be related to ESG sustainable capabilities to reduce sales cost and increase sales gross profit margin. In addition, research also found that actively following the ESG concept can also reduce the risk of bankruptcy of the enterprise.

ESG rating is positively related to the company's scale, and the performance of the rating is particularly obvious

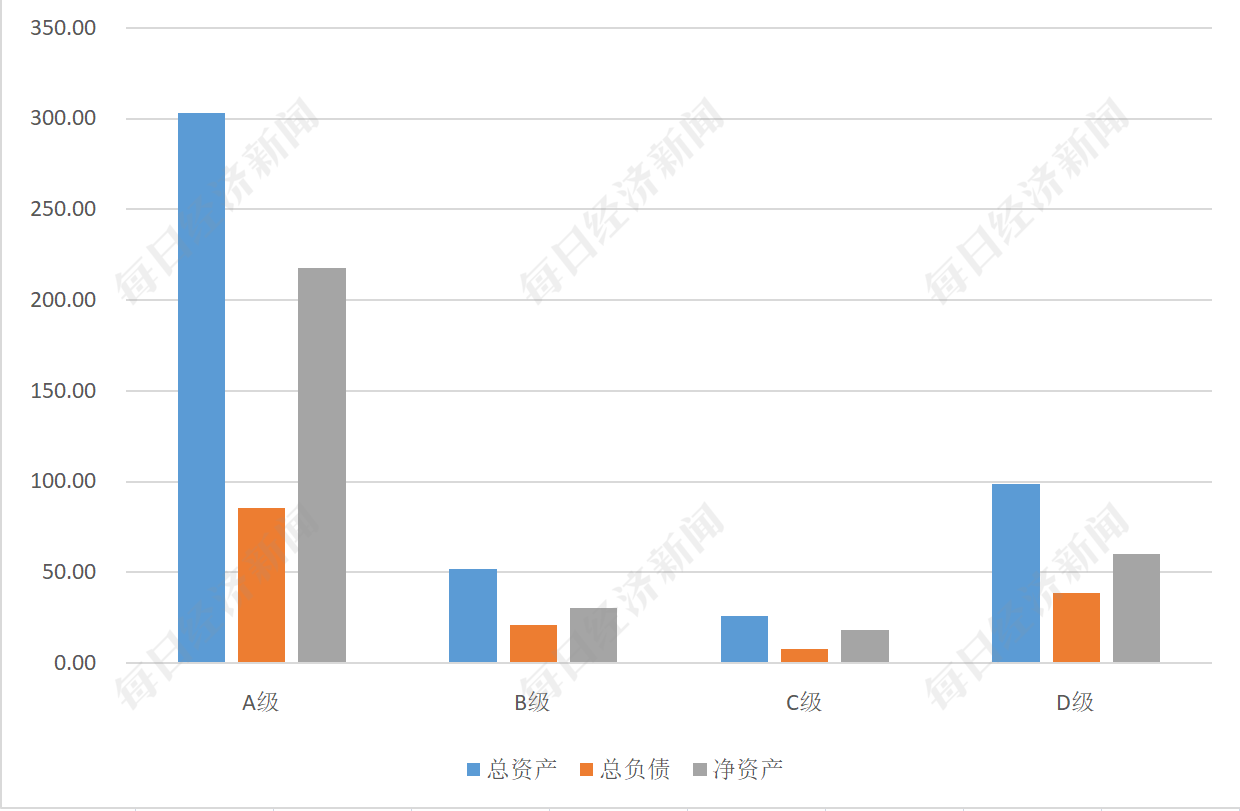

Every time the brand value research institute statistics from the balance sheet data of listed companies in the A -share wine industry, it is found that the ESG rating is positively related to the company's scale. In addition to listed companies with ESG rating D, the higher the ESG rating, the higher the total assets, total liabilities and net assets. Among them, the ESG rating of A wine industry listed company, its total assets, total liabilities, and net assets of the three indicators of net assets is much higher than the remaining listed companies with the remaining levels, reaching 30.330 billion yuan, 8.540 billion yuan, and 21.789 billion respectively. Yuan.

Different ESG rating A -share wine industry listed companies with total assets, total liabilities, and net assets (units: 100 million yuan, data source: ESG action school, the same flowers in the same flower)

In addition, after the profit statement of the listed company of the A -share wine industry after the brand value research institute, it is found that the ESG rating is also positively related to the total operating income and net profit. Among them, the ESG rating of A wine industry listed company, its total operating income and net profit an average of more arithmetic than the remaining ESG rating, reaching 15.030 billion yuan and 4.928 billion yuan, respectively. The difference is small. It is worth noting that listed companies with ESG rated C are not as good as listed companies with ESG rating D as D in business profit and net profit. Essence

Different ESG rating A -share wine industry listed companies' total operating income and net profit of net profit (unit: 100 million yuan, data source: ESG action school, the same flowers in the same flower)

ESG rating and profitability are "inverted U -shaped"

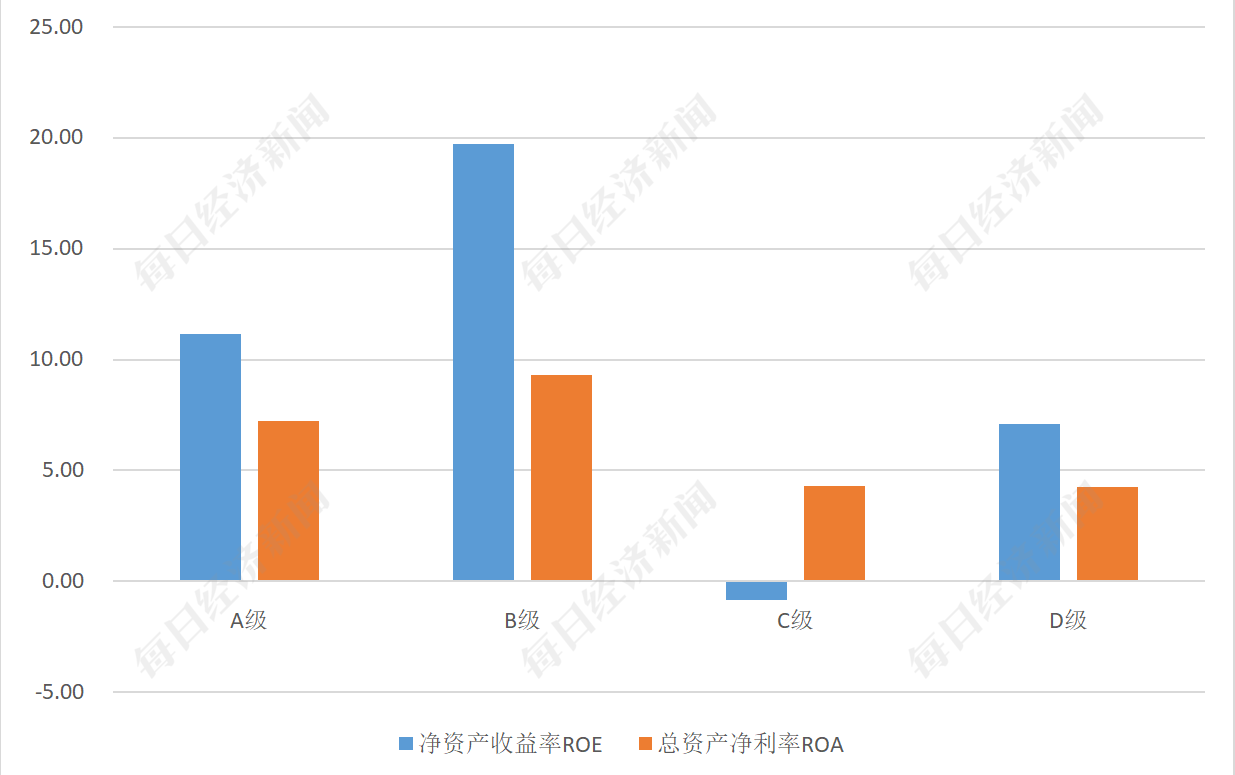

Each brand value research institute analyzes the profitability of different ESG rating of the wine industry listed companies by calculating the two important financial indicators of the net asset yield (ROE) and the total asset return rate (ROA).

Data show that there is a certain "inverted U -shaped" relationship between the ROE and the ESG rating. The average ROE and ROA with ESG rated B. The average ROE and ROA were the highest, reaching 19.74%and 9.30%, respectively. Two values of listed companies with ESG rated A were sub -natal. This may be because its scale is much larger than the former.

It is worth noting that both listed companies with rating B are higher than listed companies with rating C and D. Among them, the ROE average value of listed companies with ESG rated C is even negative, at -0.83%. This shows that in a similar scale, the higher the ESG rating, the stronger the profitability, that is, the improvement of the ESG governance to a certain extent enhances the profitability of the enterprise.

The average value of ROE and ROA of different ESG rating A -share wine industries (unit:%, data source: ESG mobile school, the same flowers)

Doing good ESG can help reduce costs and benefits, and reduce the risk of bankruptcy

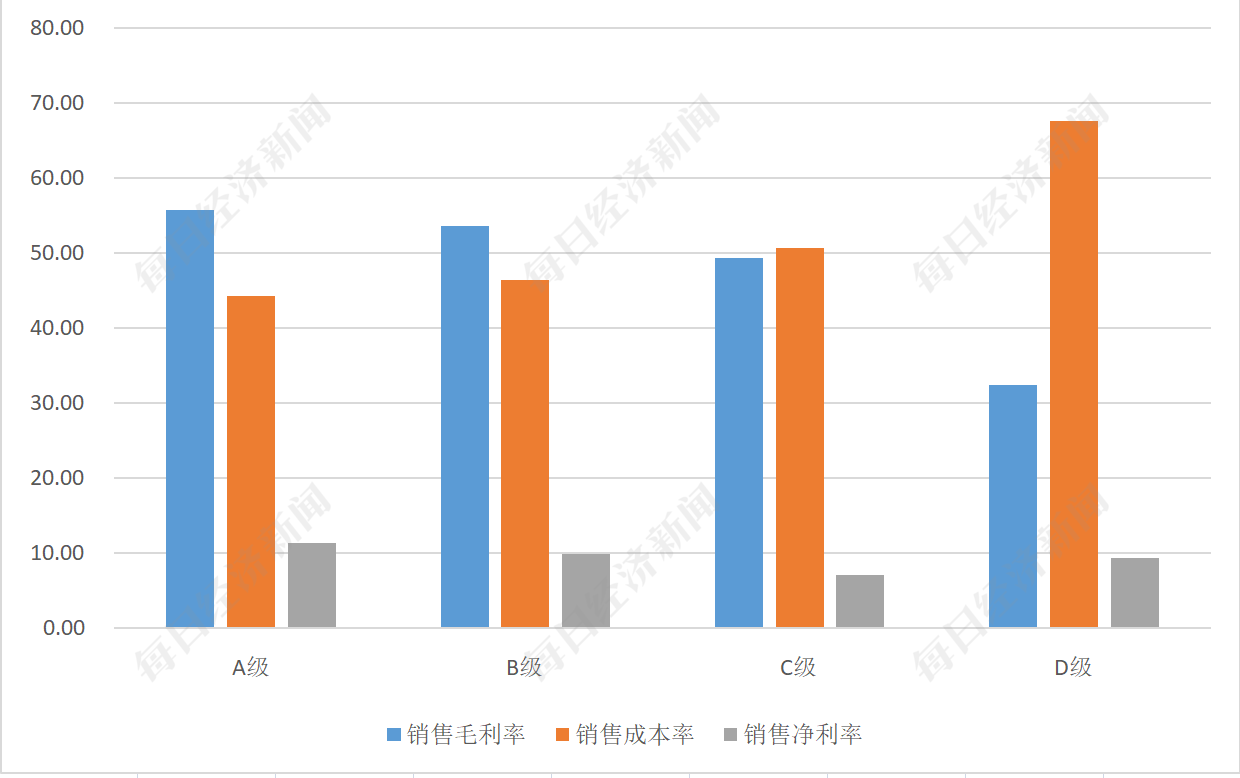

So, how does ESG improve the profitability of listed companies in the wine industry? Each Brand Value Research Institute counts the gross profit margin, sales cost rate and net profit margin of different ESG -level listed companies.

Data show that the ESG rating is positively related to the sales gross profit margin and is also related to the sales cost rate. Among them, the average sales gross profit margin of listed companies with ESG rated A is the highest, reaching 55.75%, and the average sales cost rate is 44.25%. In contrast %, The average sales cost is the highest, reaching 67.61%.

In terms of net interest rates, ESG rated A listed company with the highest listed company, and ESG rated C is the lowest. This shows that actively implementing ESG can achieve the effect of reducing sales costs and increasing sales gross margin to a certain extent, and ultimately improve the net interest rate and profitability of sales.

Different ESG rating A -share wine industry listed companies sell gross profit margin, sales cost ratio and net profit margin (unit:%, data source: ESG action school, fellow flowers)

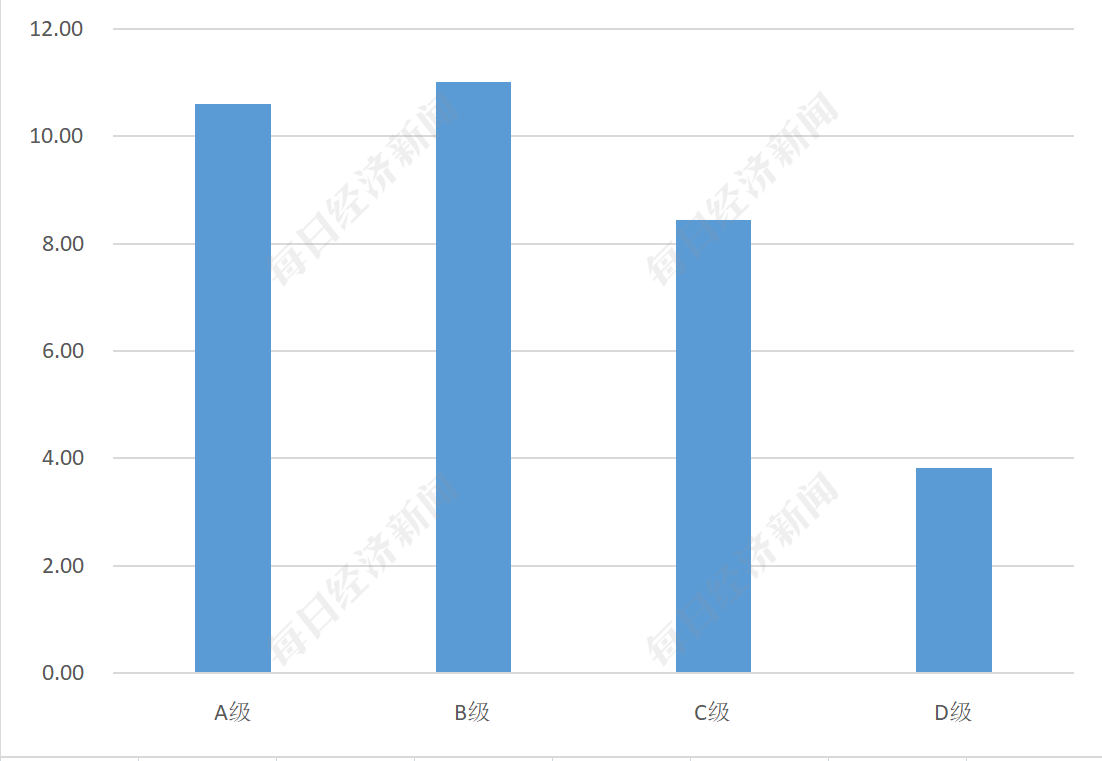

The Z value can intuitively measure the risk of bankruptcy of the enterprise, so it is widely used, which is related to the risk of bankruptcy. Each brand value Research Institute counts the average Z value of different ESG -level listed companies.

The results show that the ESG rating is strongly correlated with the Z value.Among them, the average Z value of listed companies with ESG rated B is the highest, reaching 11.01, which is slightly higher than that of the ESG rating of A. The Z value of the two exceeds 10.The average Z value of listed companies with ESG rated D is the lowest, only 3.83, which is far lower than those with higher ESG rating.This shows that in addition to improving profitability, ESG can also reduce the risk of bankruptcy and ensure the smooth operation of enterprises.Different ESG rating A -share wine industry listed companies' average value (data source: ESG action school, fellow flowers)

Daily Economic News

- END -

This year is expected to harvest 7,000 to 8,000 tons of dried peppers in Pakistan this year

In the Pakistan Pacpan area in July, the temperature was sunny and hot, and the te...

Ningde Times officially announced the production of Kirin batteries next year?How can Kirin batteries change the car market?

Recently, due to the continued high operation of oil prices, the new energy vehicl...