Interview 丨 Whitemakai CEO Bryan Donaghey: The prices of whiskey in the Chinese market will increase with the demand to increase the importance of the supply chain under the global epidemic

Author:Daily Economic News Time:2022.09.18

With the performance of Scottish whiskey in the Chinese market, many whiskey -born whiskey -born whiskey -born in Scotland is also seeking more emerging markets to expand global business growth space.

In July of this year, the fifth largest Scottish whiskey producer, WHYTE & Mackay, was listed twice on the Singapore Exchange. Emperador Inc. whiskey business director and WHYTE & Mackay CEO Bryan Donaghey said at the time that as the largest spirits company in the Philippines, the company is expected to introduce more international investors with the help of Singapore's financial advantages to achieve 50%sales from overseas targets in 2025. Essence

At present, Whitenian whiskey owned by Whitemakai has been exported to more than 100 countries and regions around the world. In September, Bryan Donaghey was interviewed by a reporter from the Daily Economic News (hereinafter referred to as NBD) through emails. He said that foreign whiskey brands will face the challenges of commercial positioning, distribution network and supply chain in the Chinese market, and the Chinese market will be challenged. Great demand will continue to push the potential growth of whiskey.

Emperador Inc. whiskey business supervisor and WHYTE & Mackay CEO Bryan Donaghey

Photo source: respondent picture confession

Limited output, demand growth push up the price of whiskey

NBD: From the perspective of the global market layout of Huangsheng Group and Whitemakai Group, what position does the Chinese market occupy? What kind of opportunities and challenges do foreign brands face when entering the Chinese market?

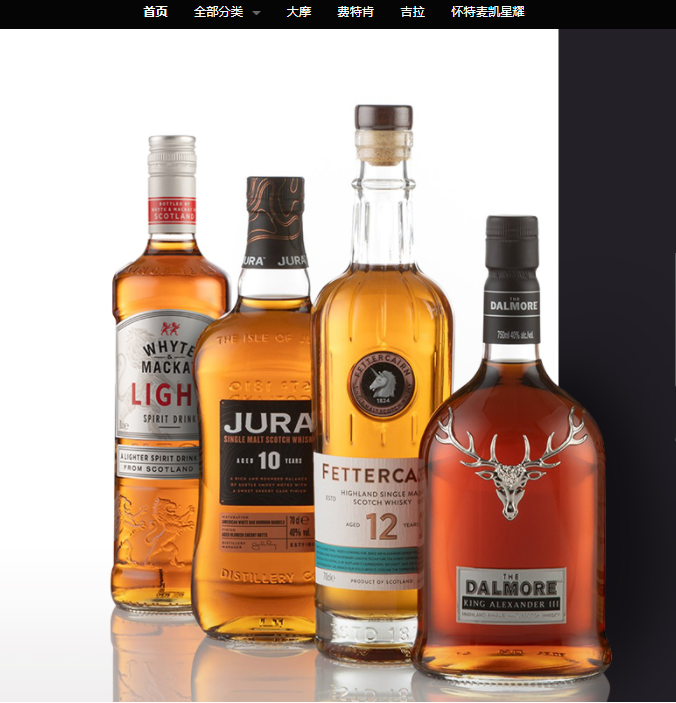

Bryan: Huangsheng and Whitemakai's Chinese market is the top priority. Emperor Sheng's capital injection allowed Whitemakai's Greater China business to accelerate, including the Dalmore, Jura and many other global best -selling single malt whiskey wineries.

We decided to focus on the Chinese market because of its future growth potential. We will continue to develop local customer relationships, especially in Shenzhen, Guangzhou, Shanghai, and Beijing. It has occupied a place in the field of high -end catering and luxury retail. In addition, we also decided to develop the e -commerce business of JD.com and Tmall.

For European manufacturers, entering the Chinese market will encounter a lot of challenges. We believe that one of the elements of success is unique positioning and powerful brands. However, only marketing can not win, and the lack of brand, commercial advertising and supply chain is indispensable.

Looking forward to the future, the environment faced by wine merchants will be more complex and changeable. Manufacturers will encounter a lot of difficulties when entering a new market. Especially in international trade and distributors, if they can find suitable partners and correct brand positioning, In order to discover the huge potential of the Chinese market.

NBD: What categories are more popular among Scottish whiskey exporting to China? Why did the factory prices from major wine merchants began to rise since the end of last year?

Bryan: In our opinion, the price increase in 2021 does not mean that this is a special year, but a part of a long -term trend development process.

Since 1980, the global Scottish whiskey market has begun to accelerate. Many long -established distillers have launched very rare high -year whiskey, but not all wineries have the ability to produce whiskey for 40, 50 years, and even 60 years. The manufacture of old whiskey needs to take care of the wine and the producers for generations. Used for mature wooden barrels.

For artificial reasons, the output of whiskey is limited, and when the output cannot meet the demand, it means that the wine merchants need to screen the product sales place, and the price of the limited edition of Scotland whiskey will naturally be seen.

In addition, since 2000, the needs of these old whiskeys welcomed by collectors have also ushered in unprecedented growth. At the same time, the old auction houses such as Christie's and Sosby have entered the market one after another to auction the rare "priceless" whiskey collections. The commercial performance of this type of top whiskey has also promoted the accelerated growth of the overall Scottish whiskey market.

In China, Scottish whiskey, as a popular imported wine, has a high price in mainstream retail channels. We expect that whiskey will accelerate the infiltration of the local alcohol retail market, and prices will increase with demand. During the continuous growth of the Scottish whiskey market, a single malt whiskey was overwhelmed, and the harmony of the whiskey in one fell swoop became the leader in the industry.

As a whiskey wine merchant, Whitemakai is committed to developing four single malt whiskey wines led by Damo, and Damo, as our fist product, has always been in short supply in the market. The reason for continuous price adjustment is that we understand that because of its small and private winery, Damo's output will continue to be low. As demand continues to increase, we will naturally review its price.

The development and sales scenario of the borrowing e -commerce business is widened

NBD: In China, what are the places for Scotch whiskey? How do you evaluate the penetration of whiskey?

Bryan: As far as we know, the best occasion for drinking whiskey is when you are gathered with friends and relatives in special season. The Chinese market is at the forefront of the industry in many aspects, such as Light Bars, new catering concepts and e -commerce.

The strong performance of Scotch whiskey is mainly due to the vigorous development of e -commerce and chain retail networks. E -commerce will play an increasingly important role in the next stage of this high -end spirits, but this will not change the basic characteristics of a single malt whiskey. Because people want to taste a single malt whiskey produced by the best company in the best place, the emergence of contemporary high -end catering and hotels will continue to become an important factor affecting this type of spirits. In the past few years, the demand of whiskey in China has continued to grow, and various types of whiskey activities have appeared. Experience stores provide us with a place for exquisite ways to display products. For example, we have recently launched with many boutique shops in Hainan and Beijing. Cooperation.

And the key event that changes our overall evaluation of the Chinese market is the Dalmore Decades that we launched in 2021. It tells the history of the sixty years of brewing of Damo. We are not only in boutique stores Selling this product, it also established a single malt whiskey category on the Tmall e -commerce platform.

In October last year, the No. 6 of the Damo Golden Times 6 was auctioned in the price of HK $ 8.75 million ($ 1124,000) in Hong Kong, China, and set a record of whiskey auction of the highest price in Asia.

This makes us realize that Chinese consumers highly respect bold innovation and interesting brands. To this day, Whitemakai's single malt Scottish whiskey business set up 89%of the annual compound growth rate in Greater China from 2015 to 2020 (far higher than the industry average of 8.6%). As high as 114%. The above performance proves that under the complex international trade and the global sustainable new crown epidemic situation in recent years, the trust chain partner is fundamental. In addition, local infrastructure, resources and market insights are equally important.

Whitemakai e -commerce flagship store picture: screenshot of third -party platform

The establishment of a factory in China is beneficial to the local economy

NBD: The current sales environment is complex and changeable, and the supply chain problem is particularly prominent. Will this affect the sales of whiskey?

Bryan: The global spirits industry is indeed affected by the supply chain problem. Strong demand for logistics plus global shortages such as bottle and bottle caps has brought a lot of difficulties to whiskey manufacturers. However, for Whitemakai, although the production cycle has increased, the above problems have been solved quickly.

We look forward to the global recovery after the epidemic, and the business environment has changed rapidly. What is unchanged is that the demand for high -end spirits, especially single malt whiskey, has continued to rise, even more vigorous than before. From the accelerated development of e -commerce and limited collection business of high -end consumer goods, it can be seen that the consumption trend that has begun to be initially emerged has become more obvious before the epidemic.

NBD: In the Chinese market, liquor is still the mainstream of consumption. Some people say that the consumer group of whiskey is still niche. What are the opportunities for the growth of whiskey categories? How do you think of some international manufacturers to invest in construction in China?

Bryan: A single malt whiskey, as a prestigious spirit, has also attracted a group of consumer consumers. Most of them like high -end catering or vibrant hotels and bars. At present, whiskey has deeply attracted some young consumers. They understand high -quality single malt whiskey and appreciate this high -end consumer product.

The demand for liquor in China is very strong, and the rise of individual leading brands in the ultra -high -end price belt also proves that they are sought after by local consumers because they have "excellent bloodlines". However, we still believe that whiskey will continue to be welcomed by more consumers who are pursuing the best quality consumer goods.

International wine merchants have successively invested in construction factories in China is a phenomenon worthy of attention, which is also very beneficial to the local economy. China has a very outstanding distilled winery and a harmonious whiskey manufacturer. We will continue to pay attention to the development of the local market, but our investment focus is still in Scotland.

The reason why we focus on investing in factories in Scotland is because we think that we can make unique wines there, especially Damo, we cannot copy the high -quality single malt whiskey we produce in other places. Our products can be lucky to ranks at the forefront of similar spirits. The key is to have a winemaking technology with Scotland as the stronghold.

For Whitemakai, we are willing to see wine merchants increase investment and produce whiskey in the construction of factories in China. The demand for Scottish whiskey has risen globally, especially in the Chinese market. If you can put into bottle in the local area, consumers will undoubtedly have more choices, and prices may decline. Even so, the reason why Scottish whiskey is high because it is produced in Scotland. The important reason for consumers to admire and love a single malt whiskey is that it can only be brewed in a specific area.

Daily Economic News

- END -

Yiwu e -commerce anchor: The problem of continuous delivery of live broadcasts under the epidemic is helped by someone

Zhejiang News Client reporter He Xianjun Kim Sicheng Sharing Alliance Yiwu Station...

The Securities and Futures Commission has released ETF incorporation into the rule of interconnection.

Wen | Wu XiaoluOn June 24th, in order to further deepen the interconnection and in...