Turn right!National tax revenue in August increased by 0.6%

Author:Daily Economic News Time:2022.09.18

A few days ago, the website of the Ministry of Finance issued a document introduced in August 2022's fiscal revenue and expenditure. Data show that the total public budget revenue nationwide in the first August was 13804.3 billion yuan. After deducting the retained tax refund factors, it increased by 3.7%, and the calculation of natural caliber was reduced by 8%. Among them, the national tax revenue was 11324.9 billion yuan. After deducting the retained tax refund factors, it increased by 1.1%, and the calculation of natural caliber decreased by 12.6%; non -tax revenue was 2479.4 billion yuan, an increase of 21.2%over the same period last year.

According to CCTV News, in August, the national tax revenue increased by 0.6%, achieving negative to positive, and after deducting the retained tax refund factor, it increased by 5.5%year -on -year.

Public budget revenue declines narrowing

According to data from the Ministry of Finance, the total public budget revenue across the country in the first August was 13804.3 billion yuan. After deducting the retained tax refund factors, it increased by 3.7%, and the calculation was 8%calculated by the natural caliber. The reporter noticed that this is the reduction in the cumulative data of general public budget revenue for three consecutive months.

From the perspective of the main tax type, the domestic consumption tax increased by 8.7%compared with the same period last year, the corporate income tax increased by 2.5%over the same period last year, and the personal income tax increased by 8.9%compared with the same period of the previous year. The domestic value -added tax was 2828.2 billion yuan, and it increased by 1.4%after deducting the retained tax refund factors. Export tax refund refund 207.8 billion yuan over the same period last year, an increase of 18.2%, which has effectively promoted the steady development of foreign trade exports.

BOC Securities pointed out that with the large -scale implementation of the tax refund policy, the supporting role of VAT on public fiscal revenue is gradually returning.

The effectiveness of stable economic policy continues to appear

According to CCTV News, in August, the increase in tax revenue in the country has been reached from negative to positive. Data show that in August, the national tax revenue increased by 0.6%, achieving negative to positive, and after deducting the retained tax refund factor, it increased by 5.5%year -on -year.

In addition, in August, after deducting the deduction of tax refund factor in general public budget revenue across the country, it increased by 9.5%over the same period last year and 5.6%by natural caliber.

The relevant person in charge of the Ministry of Finance said that this is mainly to stabilize the effectiveness of the economy's policies to continue to appear, and the economy continues to resume the development trend; after the large -scale retaining tax refund redefrontation tasks are basically completed, the income factors are obviously weakened. The income increased by 5.6%according to the natural caliber, and has achieved positive growth for the first time since April.

Li Chao, chief economist of Zhejiang Business Securities, pointed out through WeChat's reporter of "Daily Economic News" that the stronger fiscal revenue performance reflects economic restoration that drives the steady growth of fiscal revenue.

Li Chao said that after the impact of concentrated large -scale tax reduction and impact of the impact of the epidemic, it can be used through a series of normalized epidemic prevention and control measures to coordinate economic growth and the prevention and control of the epidemic. Stability, the fiscal revenue of deducting taxes, revenue reduction and reduction in June and July has improved significantly compared with April and May, and this view is verified on the side.

In August, although the domestic epidemic and real estate disruption of economic restoration process, a series of normalized epidemic prevention and control measures effectively coordinated economic development and epidemic prevention and control, and the operation of the industrial production and service industry improved significantly compared with the beginning of the year. On the basis of the base at the end of August last year, after the deduction of tax refund factor in general public budget revenue in August in August, it increased by 9.5%over the same period last year.

In terms of general public budget expenditures, Li Chao pointed out that from the latest data, the fiscal expenditure structure in 2022 is similar to 2020. On the one hand, it actively responds to the impact of epidemic impact. The progress of social security -related expenditures has significantly ahead of other fields, and expenditure for transportation under the demands of stable growth has also performed active.

Daily Economic News

- END -

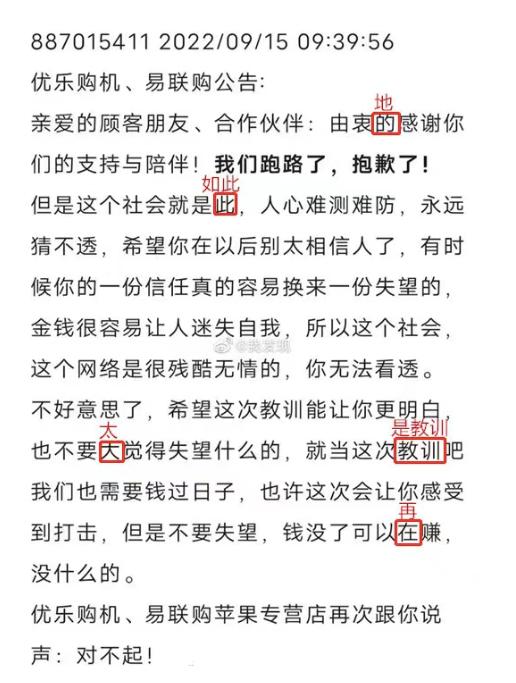

Yilian purchased the money and did not ship the goods, and left arrogant announcements?Instead of the platform, which is unbearable, it has released the announcement of the announcement of the announcement

Shandong Business Daily · Sudao News reporter Zhang Lei, a trainee reporter Wang ...

National Medical Insurance Bureau: Three years of inspection of fixed -point pharmaceutical institutions to recover 58.3 billion yuan in medical insurance funds

Cover news reporter Shao MengOn July 22, the National Health and Health Commission...