The performance increased by 26%, and the "price increase strategy" of Fuling mustard is not good?

Author:Kanjie Finance Time:2022.09.19

The Fuling mustard, which had just rebounded because of its performance, has recently fell sharply.

On September 5th, Fuling mustard opened a straight -line diving. The stock price fell at the market once reached 8%, and the final closing fell 6.62%. As of the closing of September 16, the stock price of Fuling musts closed at 27.68 yuan/share. The decline has reached 26.09%.

Behind the felling of Fuling mustard stocks, as a "squeeze" of A shares, is actually a gradual failure of its price increase.

According to media reports, the price of Fuling mustard has exceeded 10 times in the past 10 years. Now the price of Fuling mustard for 80g bags has been around 3 yuan and 5 yuan. Small meals, now the price is comparable to pork.

Affected by the continuous price increase, although the performance of Fuling mustard in the first half of this year has rebounded, from the perspective of sales, the sales of mustard have fallen by nearly 10%. No small crisis.

It is impossible for any product to raise prices unlimitedly, and the Fuling mustard is naturally the same. When the price is not moving, the Fuling mustard, known as the "mustard", will eventually go?

Can't afford from "valuable" to consumption

As the absolute leader in the field of mustard, Fuling mustard can be said to have a historic source.

The history of Fuling mustard can be traced back to 1898. At that time, Qiu Shouan, a Fuling person, invented a new pickled vegetables with the local green vegetable head as the raw material, named Fuling mustard. Along with the continuous development of Fuling mustard, by 1970, Fuling mustard is even called "the world's three major pickled vegetables" with German sweet acidic cabbage and European acid cucumbers.

In 1988, with the continuous expansion of the mustard market, multiple production workshops of Fuling must began to integrate, and then merged into Chongqing Fuling mustard group. From then on, Fuling mustard has officially has its own brand -Wujiang mustard.

Unlike other foods, the production process of mustard is relatively simple -Fuling mustard only needs to clean the vegetable heads acquired from the farmers, and then ferment and marinate for 3 to 4 months. Because of the simple process, the price of Fuling mustard at the beginning is also relatively low. At the lowest, the price of Fuling mustard for 80g bag is only about 5 cents. It is a cheaper meal food.

However, with the continuous rise in prices, today's Fuling mustard has changed from "worthless" to today's consumption. According to media reports, since 2008, Fuling mustard has been raising at least 10 times; the most recent one was in November last year. At that time, Fuling mustard released a price increase announcement to announce the adjustment of the factory prices of some products, and the categories have been raised up. The range ranges from 3%-19%.

Under the influence of continuous price promotion, the price of Fuling mustard in 80g bags has now risen to about 3 yuan, and the price of 1 catties of mustard is more than 22 yuan; and 70g of hardcover Fuling mustard retail price is 3.5 yuan, which is converted to conversion The price of 1 catties of mustard has reached 25 yuan. Looking at the price of pork today is also up to 20 pieces, the price of Fuling mustard is now comparable to pork.

The sales volume fell, and the price of Fuling mustard was rising and anti -baying

For enterprises, product price increases are often a double -edged sword.

On the one hand, the price increase of products is the most direct and most likely to drive up the rising performance of enterprises.

According to the latest financial report released by Fuling mustard, in the first half of this year, Fuling mustard achieved a revenue of 1.422 billion, an increase of 5.58%year -on -year; net profit was 516 million, a year -on -year increase of 37.24%, and both revenue and net profit increased significantly.

From the perspective of the net interest rate of sales, the net interest rate of Fuling mustard in the first half of this year was 36.31%, which was significantly increased by 8.38%compared with 27.93%in the same period last year. obvious.

However, although it can bring improvement of performance, on the other hand, Fuling mustard is likely to lose the market.

From the perspective of financial reports, although the performance of the first half of the year has maintained a growth, its sales have decreased by nearly 10%on the core item mustard.

In fact, the overall scale of the mustard market is not large, and the growth rate has begun to slow. According to data compiled by the media "Ou Rui", the market size of the packaging of the mustard industry in 2021 is about 8.3 billion yuan, which is expected to increase in the next 5 years. The speed will be reduced to 8.5%, and the compound growth rate of the industry in 2015-2021 is as high as 11.6%, and the growth rate is very obvious.

In the case of a small market size and a decline in growth, Fuling mustard chose to increase the price increase in order to maintain the growth rate of performance. This approach is the same as "killing chickens and eggs". The price of Fuling mustard is resistant.

From the perspective of the stock price, although the performance of the interim reports has increased greatly, the stock price of Fuling mustard has not followed a sharp rebound. It only risen after the performance disclosure, and it fell again. As of the closing of September 16, Fuling mustard's stock price closed at 27.68 yuan/share. In less than a year, the stock price decline in Fuling mustard has reached 26.09%during the year.

The product is diversified, Fuling mustard urgently search for "new antidote"

Faced with the gradual failure of price increase, Fuling mustard did not find new strategies.

From the perspective of capital actions in recent years, the diversification of products may be the "new antidote" of Fuling mustard beyond the price increase. Earlier, Fuling mustard once mentioned that it is necessary to turn the strategy of "clear mustard value and make the hot Wujiang brand" to "upgrade the mustard to make transparency, the radish is diverse, extend the development of snacks, and try to enter the sauce" strategy. Literally, it is also literally. It can be seen that Fuling must start to promote new products and transform large single product strategies into product diversified strategies.

In order to promote the diversification of products, Fuling mustard acquired Huitong food industry in 2015. It was involved in the kimchi field. The kimchi revenue was 21.136 million yuan in that year. In the following years, the kimchi business ushered in a major development, and the revenue in 2018 reached 147 million yuan. However Beginning in 2019, Huitong Food's business began to stop, with revenue of 159 million yuan in 2021, an increase of only 8%compared to 2018.

In order to expand new products, in the past two years, Fuling mustard has also added multiple product projects, such as "Pingshan Company 10,000 tons/year Douban Sauce Reform Project" and "Liaoning annual output 50,000 tons of kimchi production base construction project" Wait, it is not difficult to see the determination of Fuling mustard to expand new products.

However, from the perspective of financial reports, the diversification of Fuling mustard products is not too obvious.

According to data from the semi -annual report, in the first half of this year, Fuling mustard's mustard revenue was 1.236 billion, accounting for 86.96%of the revenue ratio; the revenue of kimchi was 105 million, accounting for 7.39%of the income ratio, and the revenue of radish was 55.541 million. The proportion of income is 3.91%, and the revenue of other products is only 22.512 million, accounting for 1.58%of the income ratio.

Obviously, the core of Fuling mustard is still in the category of mustard, and the proportion of other products is not too high.

From the current point of view, the Fuling mustard is facing the fading price, and on the other hand, the diversification of the product is slow. Under multiple pressures, the downturn of Fuling mustard may continue for a period of time.

- END -

Semi -annual report signal!The steady growth and long -term potential energy of Liangpinpu

In the past, people regarded innovation as risks, and now it is the biggest risk t...

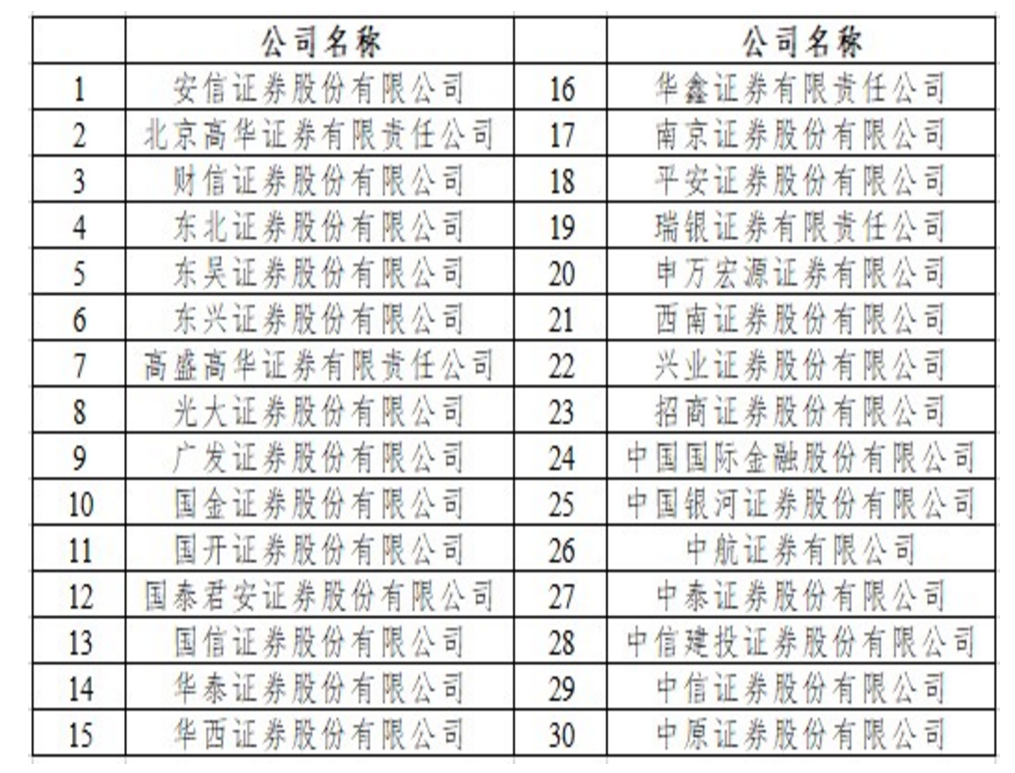

The Securities and Futures Commission announced the "whitelist" of the brokerage firms in June.

On June 22, the Securities Regulatory Commission released a new issue of the white...