Quality rises!Longjiang Enterprise uses the capital market to directly raise more than 10 billion yuan

Author:Heilongjiang Daily Time:2022.09.19

The reporter learned from the Heilongjiang Securities Regulatory Bureau that since this year, the direct financing of Heilongjiang enterprises has reached 11.455 billion yuan, an increase of 73.67%year -on -year. Among them, listed companies realize 1.283 billion yuan in equity financing; through the issuance of general corporate bonds, exchanging corporate bonds, securities company bonds, etc. to achieve debt financing of 6.272 billion yuan; issuance of green asset support special plans (carbon neutralization) financing of 3.9 billion yuan Essence The scale of direct financing in Heilongjiang Province has increased significantly. Enterprises have steadily improved by using the capital market financing level. The number of reserve enterprises, tutoring enterprises, and the number of enterprises in the audit of the company have reached a new high for many years.

While promoting the listing of enterprises, Heilongjiang Province has also realized the multi -level capital market through multiple channels, and enterprises use the capital market financing level to steadily improve. From the perspective of financing scale, in addition to achieving direct financing of 11.455 billion yuan this year, eight companies including Guanglian Airlines are promoting nearly 10 billion yuan of financing projects. Corporate bond applications have been approved by the China Securities Regulatory Commission recently.

From the perspective of financing channels, multi -level capital markets provide financing support for enterprises of different types of, different scale, and different development stages. Since the beginning of this year, the listed company Baotai Long has set up a financing of 1.237 billion yuan; the new third board listed company Iri Technology and Ke Neng's melting -oriented increasing financing of RMB 46 million. Listed companies, real estate industry in listed companies, Xiangcai Co., Ltd. issued 5.832 billion yuan in debt financing by issuing general corporate bonds, exchanging corporate bonds, etc., and 440 million yuan in debt financing for securities company issuance of securities company. At the same time, AVIC financing as a primitive owner to raise a special plan (carbon neutralization) of green assets support of 3.9 billion yuan.

At present, the development of the capital market in Heilongjiang Province has shown a vigorous trend, and the promotion of the listing of corporate listing has achieved remarkable results. Longjiang enterprises have continuously enhanced the capital market capacity, the capital market has stimulated the vitality of the market entity, providing financing support, and helping the stable economic operation of the economy further. It shows that serving the high -quality development of Longjiang's real economy has achieved positive results, and the highlights of the "Longjiang section" of the capital market have continued and imposing.

Source: Lottery News

- END -

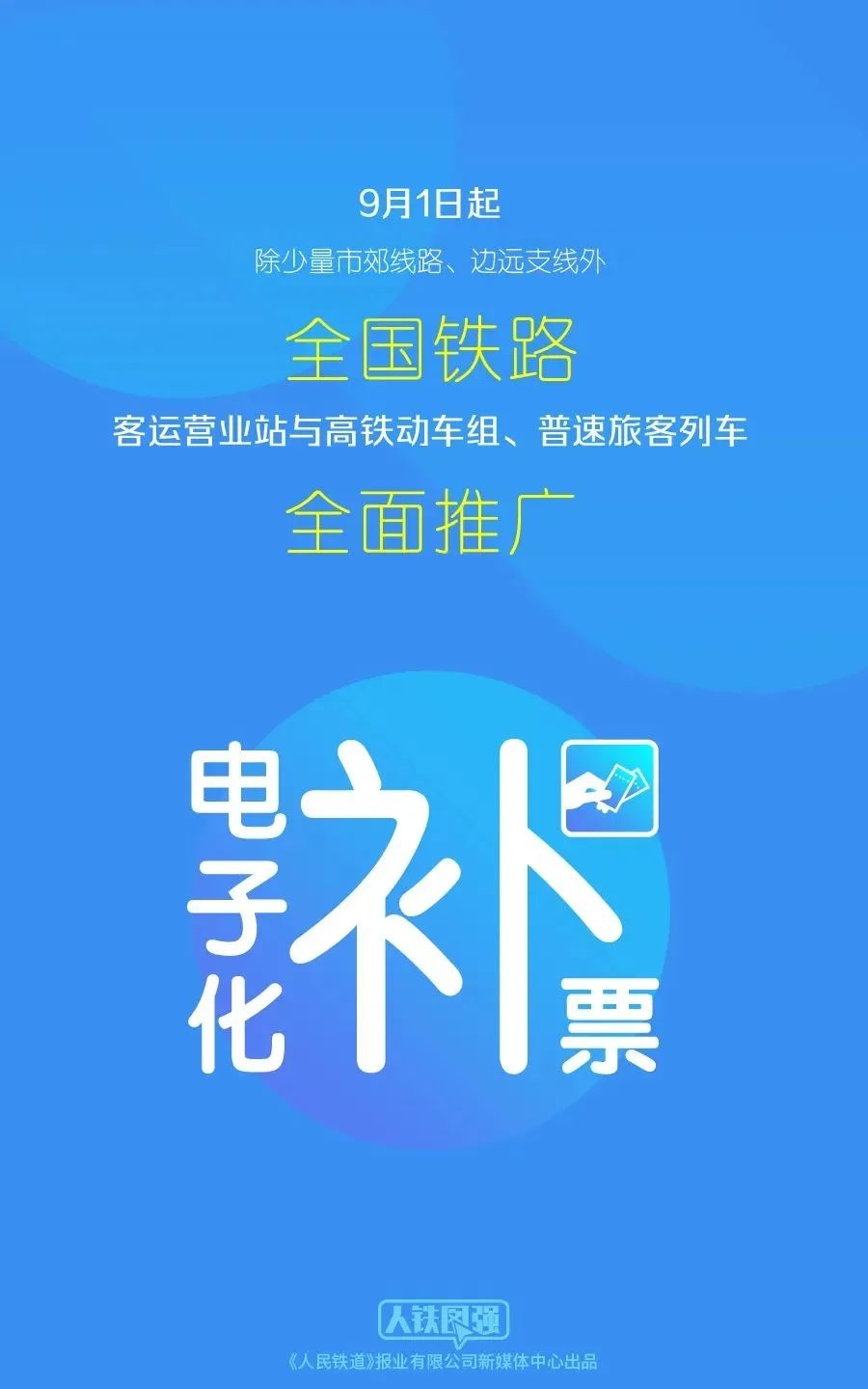

Notice!There have been new changes in railway votes from today

From September 1st, in addition to a small number of urban suburban lines and remo...

Tianqi Lithium Industry: It is intended to pay 12.863 billion yuan to subscribe for three companies with 1 yuan/share

On July 19, 2022, Tianqi Lithium Industry (002466.SZ) issued an announcement on the capital increase of wholly -owned subsidiaries.Tianqi Lithium Industry Co., Ltd. (hereinafter referred to as Compan