The yen exchange rate has reached a new low in the past 24 years!The Japanese Prime Minister and the Governor of the Central Bank urgently consult ... Foreigners swept the goods in Japan: Apple mobile phones are 1300 yuan cheaper!

Author:Daily Economic News Time:2022.06.21

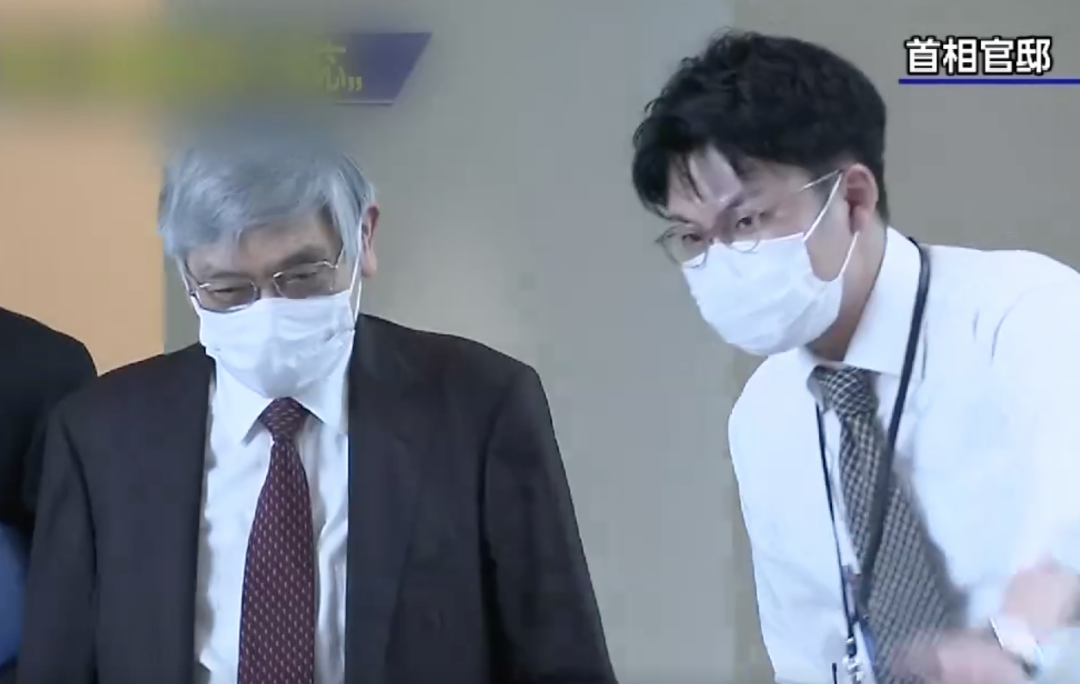

According to CCTV news reports, on the afternoon of the 20th local time, according to media reports such as Kyodo News Agency, Japanese Prime Minister Kishida Kishida and the President of the Bank of Japan Kuroda Hitahiko held talks at the official residence of the Prime Minister and exchanged opinions on the recent foreign exchange market trends. After the meeting, Kishida said that they mentioned the sharp depreciation of the yen in the talks.

Photo source: CCTV News Screenshot

Kuroda Dongyan also said that the sharp depreciation of the yen brought various uncertainty to the operating plan of Japanese companies, and did not want this situation to continue. He stated that he would pay attention to the trend of the foreign exchange market and cooperate with the government to respond.

It is understood that recently, the exchange rate of the yen to the US dollar has continued to decline. At the beginning of last week, the yen's exchange rate against the US dollar fell to 135.58 yen against 1 US dollars, a new low in the past 24 years. As of press time, the exchange rate of the yen to the US dollar was 135.91 yen against 1 US dollars.

Regarding the depreciation of the yen, the Japanese media said that for many foreigners, Japan is now a "low -cost country", and the foreign people's congress will "sweep the goods" in Japan.

Image source: Yingwei Caiqing

As well as

Japanese economist:

The US -Japan monetary policy contrary to trigger the depreciation of the yen

According to CCTV News, on June 15, local time, the Federal Reserve Commission announced that it had raised interest rate hikes 75 basis points to curb inflation again. This is the largest interest rate hike since the Federal Reserve since 1994.

It is understood that in March of this year, the Federal Reserve raised the federal fund interest rate target range from a nearly zero level by 25 basis points, opening a tightening cycle to curb inflation. In early May, the Fed announced another 50 basis points.

Japanese experts said that this year the United States has raised interest rates at an unprecedented speed this year, and funds flowing into the international market will return to the United States in large numbers; while Japan continues to maintain a super loose monetary policy, leading to a large number of US dollars in the foreign exchange market and selling yen. One of the main reasons for depreciation.

Photo source: CCTV News Screenshot

Kono Yingsheng, chief economist of Japan's First Institute of Life Economics: In March of this year, the United States suddenly raised interest rates and was raised by unprecedented speeds. The funds flowing into the international market returned a large amount of funds. As a result, global inflation has led to global inflation.

(Declars of the Japanese yen) There are also reasons for Japan. The United States and Europe have begun to tighten the policy. Only Japan continues to maintain a super loose monetary policy, which leads to a large number of US dollars in the foreign exchange market and selling the yen to cause the yen depreciation.

The rapid depreciation of the yen has made small and medium -sized enterprises be more pressured

Kumano Biosheng believes that the rapid depreciation of the yen may make Japanese companies unable to respond in time. Among them, small and medium -sized enterprises face greater influence.

Kumano Shengsheng: For small and medium -sized enterprises in Japan, companies focusing on domestic businesses are concerned, import prices have risen, profit decreases, and even deficits. It can be said that most SMEs are more affected by the depreciation of the yen compared with large enterprises.

Photo source: CCTV News Screenshot

Kumano Biosheng believes that the devaluation of the yen still has the structural reasons for the high economic dependence on imports. As the price of international commodities continues to rise, Japan's imports have continued to rise.

According to data released on the 16th of the Ministry of Finance of Japan, Japan's imports increased by 48.9%year -on -year in May, a record high for three consecutive months.

In May, the Japanese trade deficit reached the second highest since the comparative data in 1979, and the trade deficit occurred in the 10th consecutive month.

Foreigners sweep the goods in Japan

Apple mobile phone, cosmetics, etc.

According to CCTV.com, we have read Weibo news, and since this year, the yen exchange rate has entered a downward channel. After entering mid -June, it was a historic low value. Japanese media said that for many foreigners, Japan is now a "low -cost country." A Mexican who currently lives in Japan claims to buy about 50 hands a day, and then send it back to the country to sell a lot of money. A family from Iceland took out a large box of Lego from the shopping bag, while talking about spending 22,800 yen to buy it, it was too cheap to buy it in Japan.

International students in the United States took out the newly bought Apple headset and said: It's really cheap, and don't worry about rent. She also added a special sentence: Everything is cheap.

Japanese media believe that the yen may devalue further. Under the depreciation of the yen, the price of consumer electronics represented by iPhone is lower. The data released by local research institutions show that the 128G version of the iPhone 13 is priced at 98,800 yen in Japan, which is equivalent to about 4,900 yuan. Compared with the price, it is about 1300 yuan cheaper.

Apple China official website shows that the official price of 128G iPhone 13 is 5999 yuan.

A Swedish working in Japan said he recently purchased Apple products such as iPad Pro and Apple Watch in the Apple Store in Japan, because Japan's price is obviously cheap. According to exchange rate conversion, the Swedish brother buying Apple in Japan is equivalent to enjoying a discount of 50 % for him.

On the other hand, some Japanese companies began to transfer production bases from overseas.

According to Japan Economic News, because manufacturing exports occupy an important position in the Japanese economy, the devaluation of the yen can increase the price competitiveness of export products. Therefore, the devaluation of the yen has been considered a favorable factor in the Japanese economy for a long time. However, analysts pointed out that the situation this year is not optimistic. The main reason is that compared with the positive effect of the devaluation of the yen to promote exports, the negative impact of the soaring energy import price of oil and gas has become more obvious. The yen depreciation has exceeded the expected government management and control is very important

It is understood that Kumano Yingsheng has been engaged in professional economic analysis for 20 years. Regarding the rapid depreciation of the rare yen in this time, he predicts that due to the different financial and monetary policy directions of Japan and the United States, the interest rate difference may expand further, and the yen may continue to depreciate.

Photo source: CCTV News Screenshot

Kono Yingsheng, chief economist of Japan's First Institute of Life Economics: Obviously, the rate of yen depreciation exceeds the impact of US interest rate raising. If the market loses confidence in the Japanese yen, the yen will further depreciate, and the depreciation exceeding the expected depreciation will occur. I think the current depreciation of the yen may have exceeded the scope of reason, and the management of the Japanese government and the central bank is very important.

The Bank of Japan bought a historical record of 10.9 trillion national bonds last week

According to the statistics of Bloomberg, the Bank of Japan purchased a total of 10.9 trillion yen (US $ 80.8 billion) in Japan last Sunday, which was the highest level in history.

The Bank of Japan has always adhered to the implementation of bond yield curve control policies. Under this policy, Japan's 10 -year Treasury yield rate is 0.25%. In order to achieve its control of yields, the bank has continuously purchased the newly issued 10 -year Treasury bonds without restrictions at a fixed yield of 0.25%since April, and has recently increased the trend of purchasing.

However, the Japanese government bond futures market fell into a "collapse" last week. On June 15th, Beijing time, Japan's 10 -year Treasury Treasury market set the largest single -day decline in nine years, and triggered the melting mechanism of the Osaka Exchange twice. On June 17, Japan's 10 -year Treasury yield hit 0.265%, a new high since January 2016.

Market analysis believes that this situation is due to the context of global inflation and the Federal Reserve ’s interest rate hike expectations. The“ offensive and defensive warfare ”intensification between overseas investors and the Bank of Japan. Increasing, bond traders have bet that the Bank of Japan will be forced to abandon the rate of interest at 0.25%.

At the moment when many central banks such as the United States and the United Kingdom began to raise interest rate hikes, the Bank of Japan's unwillingness to change monetary policy made the pressure on the Japanese financial market grow. On June 17, the bank still announced that it continued to adhere to the current super loose monetary policy and maintained interest rates unchanged.

Mari IWashita, chief market economist in Yamato Securities, said that the fluctuations in the Japanese bond market are closely related to the global response to the US inflation data and the Fed's tightening policy. Essence

It is worth noting that the Ministry of Finance of Japan announced on the 17th that Saito Takashi, known as the "Mr. Bond", served as a key position in the agency. Regulatory experience. According to some strategists, he will lead a department including the bond market.

IWASHITA believes that if the Bank of Japan wants to successfully withdraw from the purchase of large -scale bonds, it is important to cooperate with the Ministry of Finance, so it is very important to appoint an experienced person in charge. From this point of view, Saito Takamota's appointment "is a good news for the market."

As of press time, Japan's 10 -year Treasury yield was 0.24%, an increase of 1.91%.

Image source: Yingwei Caiqing

Edit | Cheng Peng Gai Yuanyuan

School pair | Duan Lian

Cover picture Source: CCTV News Screenshot

Daily Economic News Integrated from CCTV, CCTV quickly watch Weibo, every APP (reporter Zhang Lingxiao)

Daily Economic News

- END -

The advantages of China's supply chain are irreplaceable

Regarding the information about the withdrawal and transfer of multinational companies from China, the media continued to see the media, and all sectors of society began to pay attention to the discus

Changsha Evening News commentator | Come on the source of living water

Yuan YuncaiStrong provincial capital must be strong in industries, and strong indu...