Bank of insurance for insurance sales must be contending

Author:Hubei Daily Time:2022.09.19

The silent banking channel was returned to the insurance company's attention, but there were still many problems to be solved by Bankbone cooperation.

"If you tend to keep the capital, there is currently a product with a fixed income of 3.5%." After simply understanding the reporter's financial preferences, the customer manager of China Merchants Bank Wuhan Sub -branch's outlets recommend a bank security product.

Banking products are insurance products sold by banks from the hot to downturn, and now they have a strong recovery. According to the semi -annual report of the 5 major insurance companies in A -share, the number of individual agents has decreased sharply, and the performance of individual insurance sales is "weakened", and the premium revenue of bank insurance channels has risen sharply. Correspondingly, multiple bank agency insurance income achieve double -digit growth.

Fulbilia reporters found on the major banks in Wuhan that the insurance companies cooperated with banks in different periods were also different, and the agent products were very different.

Bank outlets are pushing insurance

Recently, the reporter visited business outlets such as China Merchants Bank, Industrial and Commercial Bank of China, Agricultural Bank, and Postal Savings Bank. He claimed to have about 500,000 yuan of idle funds at hand, tending to keep the capital low -risk investment, and seek reasonable allocation plan.

As the global economy is facing the possibility of decline and the uncertainty of the epidemic, people have risen their "hedging" emotions, and consumers with the same needs as reporters are not a small number of consumers. In this regard, the "science popularization" of customer managers of various banks is also consistent. At present, there are only three types of financial products that can be redeemed for rigid payments: less than 500,000 yuan, government bonds, and insurance.

As the interest rate continues to reduce, the value -added space for fixed deposits and large deposit orders is very limited. "The 1 -year fixed deposit interest rate is about 2%, and the 3 -year period is 2.9%." China Merchants Bank customer manager said. On September 15, a number of state -owned banks reducing personal deposit interest rates again, with a three -year fixed deposit rate of only 2.6%.

At the same time, the 3 -year national debt yield is only about 3%, and it is difficult to grab it. The day of sale is basically robbed.

So where do you go to high -yield wealth management products? This is to mention the new asset management regulations that have been landed early this year. Bank financial management breaks the rigid redemption and also breaks the fantasy of many people's "buying bank financial management will not lose money." Among the wealth management products of major banks, 4%of the expected annualized yields are rare and do not guarantee income.

The era of "closed eyes and buying wealth management" is over, and the advantages of bank security products are gradually emerging. Some banks even write the income of insurance products on the small blackboard in the name of "Governor's recommendation" and attract customers in a prominent position. The reporter noticed that the postal savings bank's approach was more "radical" and directly posted relevant information on the walls and desks of the customer manager's office.

It is worth mentioning that the main products pushed by several banks belong to the same type: life is increased by 3.5%for life, and it is not affected by the downward interest rate.

A customer manager of China Merchants Bank said that such products have been sold since 2019. The insurance companies that have cooperated before include China Merchants Xinnuo, everyone's insurance, etc., but each company has a limited product quota, and it will be removed from the shelves after selling. "The working class deposits 50,000 to 100,000 yuan a year, and it can be locked at 3.5%of the yield for 5 years. After that, the longer the time, the higher the income."

The reporter checked the two products currently sold at the China Merchants Bank APP, called "British Life Life and Enjoyment Family Lifetime Life Insurance" and "CITIC Prudential Stone Hengli Lifetime Life Insurance". "Ceiling" incremental life insurance.

The reporter also noticed that it is also life insurance. The products sold on each bank are different, mainly from small and medium -sized insurance companies. ICBC's first publicity is the "Xin Ruyi", the ICBC of the ICBC, and the Great Wall Life "Aiyong Sui Life Insurance"; in addition to the postal life insurance product in the postal savings bank "Jiujiu to enjoy lifelong life insurance."

In the interview, a ICBC customer manager said, "In the past, bank insurance was paid by 4%-5%of the sale of income (all premiums were paid at one time). Funding life insurance is also a wealth management attribute, the income is determined, and the white paper and black words are written into the contract. It is currently the hottest bank security product.

Head insurance companies are also adding bank insurance

In fact, the banking channel has experienced a round of popularity and downturn.

As the ICBC financial management manager said, before 2017, the insurance products such as universal insurance and dividend insurance were very popular in banks with the advantages of "short term, fast return, and high returns". Especially for many small and medium -sized insurance companies, because the individual agent team is difficult to compete with head companies, Bank Insurance has become a weapon for expanding business scale.

Later, the CBRC issued a "Circular 134", which made the products "yellow flowers tomorrow". One of the important contents is that since October 1, 2017, annuity insurance shall not be returned within 5 years, and the amount of return per year after 5 years cannot exceed 20%of the premiums that have been paid; universal insurance cannot exist in additional insurance forms. The deep meaning of this provision is that insurance must be "insurance". In the following two years, the bank insurance business with strong financial management attributes fell.

In the past two years, under the influence of multiple factors such as the continuous adjustment of the product structure, the loss of personal agents, the decline of interest rates, and the epidemic, the insurance company's premium scale of bank agency channels has resumed the growth trend.

The "2021 Bank Agency Channel Business Development Report" released by the China Insurance Industry Association shows that in 2021, the bank insurance company's bank insurance business realized premium income of nearly 1.2 trillion yuan, an increase of 18.6%year -on -year from 2020, exceeding the total premium income of personal insurance companies' premiums 1/3 of the amount. The once silent bank insurance channel, re -returning to the insurance company's attention, even head insurance companies have increased the relevant business layout. In the first half of this year, in contrast to the continued decline in the human and premium income of individual insurance channels, the five major insurance companies' silver insurance channels rose sharply.

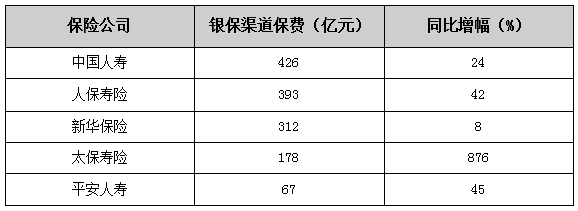

It is worth mentioning that in the first half of the year, the premium revenue of Chinese Life Bank Insurance Channel was the highest, reaching 42.6 billion yuan, an increase of 23.7%year -on -year; the income of Tai Baoshou insurance bank insurance was 17.8 billion yuan, the largest year -on -year, reaching 876%.

In the first half of the year, the five major listed insurance companies silver insurance channel premium income

On the other hand, it can also be seen from the handling fees and commissions income from major banks. In the first half of the year, China Merchants Bank's wealth management fee and commission revenue was 18.9 billion yuan, a year -on -year decrease of 8%, of which the agency insurance income was 9 billion yuan, a year -on -year increase of 62%. Construction Bank realized the proxy business fee of 13 billion yuan, an increase of 9%over the same period last year, mainly due to the growth of agency insurance income; Agricultural Bank realized an agency insurance premium of 80.9 billion yuan, and the annual payment premium increased by nearly 20%year -on -year.

China Merchants Bank said that the configuration of customers' equity products has decreased, and the sales insurance sales have increased year -on -year.

Symbol fees, professionalism and other pain points to be solved

Of course, there are also many challenges in the bank security channels. Such as the superficialization of banking cooperation, rising fees, and lack of service professionalism.

A person who has been responsible for fund, trust, insurance and other agency business in the bank told the fulcrum financial reporter that a bank can sell products from three insurance companies in contemporary insurance companies. The competition between the banking insurance channels is quite fierce, and the bank's right to speak is better than the insurance company.

Banks often focus on two aspects. On the one hand, the interests of the shareholders' background are bundled, such as the products of Everbright Bank selling Guangda Yongming products, because the shareholders are Everbright Group; in the same way, CITIC Bank sells CITIC Baocheng's products, China Merchants Bank sells investment promotion Xinnuo products, and so on.

On the other hand, the selling point and handling fee of the product itself. For insurance companies, it is often possible to larger the business scale and look good on their faces, but "only make money and drink without making money", because most of the profit is given to the bank. The bank agency business fees and commissions mentioned above are From then on.

According to reports, the current payment of product fees ranges from 10%-20%of premiums. China Merchants Bank has a large number of customers, has a good customer foundation, and has a high proportion of private banks and wealth customers. It is relatively good for insurance in banks, but because the handling fee is too high, some insurance companies are unwilling to cooperate with China Merchants Bank.

According to the industry's analyst, based on the experience of selling wealth management products, bank customers managers are better at paying insurance products. After the income of the product has gradually weakened, the bank began to transform the product to the current product. However, the reporter found that customer managers still tend to explain insurance products from the perspective of "income".

For example, a certain outlets of the postal savings recommend to customers when they recommend the insurance "for a long time to enjoy life insurance". They say that 50,000 yuan each year, 5 years in a row, and 6,500 yuan each year; the annual deposit is 100,000 yuan, and the income doubles.

In fact, the interest demonstration of the increase of life insurance is not so simple. As an example, the above products are saved by 100,000 yuan each year. The cash value in the first annual account of the year was 36,700 yuan. Until the fifth year of the payment period expired, a total of 500,000 yuan was invested. At this time, the value of cash was only 489,800 Yuan. That is to say, not only has no benefits during the payment period, but the principal has not returned yet, and there have been benefits since the 6th year.

Under the questioning of the reporter, the customer manager of the outlet said that the annual income of 6,500 yuan is "converted", which is more convenient for customers to "understand".

Insiders in the industry told a fulcrum financial reporter that although the customer manager of the bank, although the quality is high, in the face of performance assessment, it is necessary to take into account the sales of various products such as deposits, funds, insurance, and no more energy to explain complex insurance clauses. Consumers buy wealth management insurance at banks, and they must also consider not to be misleading. It is recommended that goods are more than three.

Reporter Wu Ling

Edit 丨 Liu Dingwen Hu Xinyue

The Hubei Daily client, paying attention to the major events of Hubei and the world, not only pushing the authoritative policies for users, fresh hot information, and practical convenience information, but also launched a series of features such as reading newspapers, newspapers, learning, online interactives.

- END -

815.76 kilograms per mu, "Hemai 29" Chuanghe Mai Mai Mascin's highest record in Heze City

The reporter learned from the Municipal Academy of Agricultural Sciences that a group of expert groups consisting of 7 experts including the Provincial Agricultural Technology Promotion Center, the Pr

People's Daily | Smart Chinese Pharmaceutical Room, convenient and intimate!Provide one -stop services such as adjustment, cooking, packaging, delivery, etc.

Content source: People's Daily September 9, 2022 Edition 19 Reporter: Yang Yanfan ...