With beauty, Haierbi, Gree seems to lose?

Author:Bobo Finance Time:2022.09.20

Source | Bohufn

Author | Mengde

In 2019, Dong Mingzhu spoke: "Gree will achieve 600 billion revenue in 2023!"

At that time, Midea Group, Gree Electric, and Haier Group were already the three giants of Chinese home appliances. The revenue of 2019 was 278 billion yuan, 198 billion yuan, and 20100 million yuan. Gree's 71.2%, Haier's 98.5%.

Four years have passed, and the financial report in the first half of the 2022 shows that the revenue of Midea, Gree, and Haier is 183 billion yuan, 95 billion yuan, and 122 billion yuan. Midea's revenue is almost twice of Gree, and the gap between Haier's revenue is from from Harr's revenue from from Haier's revenue from from the income gap from Haier's revenue. 1.5%to 22%.

In recent years, compared to Midea and Haier's stuffy, Gree is extremely active, cross -bank, build "the next Dong Mingzhu", enter the live broadcast and bring the goods.

Midea and Gree's market value is twice as poor

The same air -conditioning giant, the same as the Guangdong enterprise, Midea and Gree can be regarded as old enemies. Dong Mingzhu publicly satirized the beauty in an interview with the media: "Beauty is not an opponent at all. If I use him as an opponent, I feel that I am sad." A few years later, I almost stood on the same running line. It's really not an opponent. As of September 13, 2022, the market value of Midea and Gree was 395.3 billion and 197.9 billion, respectively. Midea's market value and revenue were almost twice that of Gree.

(Picture source: Network)

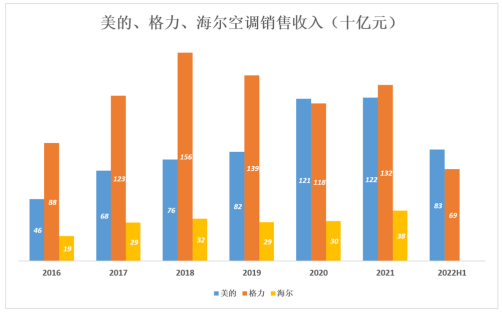

The financial report in the first half of 2022 showed that Gree Electric's operating income was 95.22 billion yuan, an increase of 4.58%year -on -year; net profit at home was 11.466 billion yuan, a year -on -year increase of 21.25%. Among them, Gree Electric's air -conditioning revenue was 68.75 billion yuan, accounting for 72.2%. It is not difficult to see that air conditioners are still the main source of income from Gree. From 2014-2022, the sales scale and proportion of Gree air-conditioning business can be found that although the overall trend is declined, it still accounts for the big head. The air conditioner, as Gree's ace business, was surpassed by the Midea air conditioner again in the first half of 2022.

(Picture source: Network)

There are two main reasons:

1. Affected by the epidemic, the offline stores of the home appliance industry have been affected to a certain extent, and the advantages of the beauty of online channels have long been obvious.

2. Gree launched marketing reform, tight relations with some dealers, and channel changes have a certain impact on sales.

In addition to the air -conditioning business, Midea's diversified development has also achieved certain results. According to the financial report in the first half of 2022, Midea's operating income in the first half of the year was 183.663 billion yuan, an increase of 5.04%year -on -year; net profit attributable to mother was 15.995 billion yuan, a year -on -year increase of 6.57%. Among them, smart home revenue was 125.9 billion yuan, accounting for 69%of the total revenue; Midea air conditioners reached 83.236 billion yuan, accounting for about 45%of the total revenue. The categories of refrigerators, washing machines, kitchen appliances, and small appliances of the early layout of Midea have been expected to become the second growth curve.

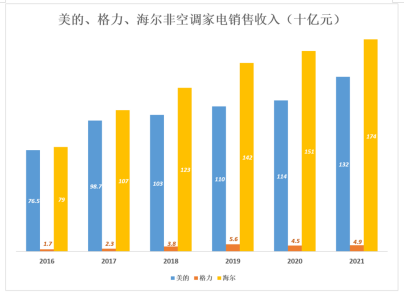

According to the data of Ovi Cloud Network, in the first half of 2022, among the domestic air -conditioning, microwave ovens, desktop ovens, electric fans, electric heaters, induction cookers, electric kettle and other categories, Midea products are all online and offline market share Rules first. Even if it is not first, it is the second and third position in the market. In 2021, Midea's total revenue was 3412 billion yuan, and non -air -conditioning home appliances revenue was 132.2 billion yuan, accounting for 39%of the total revenue.

In addition, Midea's overseas layout is also the reason why Gree "has a market value of 197.4 billion". In the past ten years, Midea has successively invested and invested in Miraco, Toshiba Power in Japan, CLIVET, KUA, Servotronix and other companies. In the first half of this year, Midea's overseas revenue was 73.96 billion yuan, accounting for 42.55%of revenue. Gree's overseas revenue was only 13.735 billion yuan, accounting for 14%of revenue.

(Picture source: Network)

In the final analysis, although Gree and Midea are often compared, they follow two roads. Gree is still a company that mainly focuses on the domestic sales market. The revenue of air -conditioning accounts for more than 80 %, and the domestic market revenue accounts for more than 80 %. The beauty is multi -category and multi -line development, which is expected to carry out the second growth curve. For the current beauty, Haier is a stronger opponent than Gree.

Haier's strong development

Although in terms of air -conditioning business, Haier is relatively beautiful and Gree is the second gradient, but Haier's development focuses on high -end and overseas, ushered in rapid growth. According to the financial report in the first half of 2022, Haier's operating income in the first half of the year was 121.858 billion yuan, an increase of 9.07%year -on -year, and the net profit attributable to the mother was 7.949 billion yuan, an increase of 15.89%year -on -year. Among them, overseas business achieved revenue of 61.481 billion yuan, accounting for 50.4%of the total revenue, which has exceeded the domestic market.

There are two main reasons for Haier's rapid growth:

On the one hand, it is power for overseas markets.

Haier is the earliest company in China's home appliance industry to launch an international strategy, and its play in overseas markets is remarkable. Through its own brands to go to sea and cooperate with mergers and acquisitions brand, quickly promote the localization of global layout. For example, in the US market, in addition to its own brands, the three high -end brands of Monograph, CAFE, and GE Profile of the United States have acquired the three high -end brands of the United States. In 2021, the three major high -end brands in the US market increased by more than 40%year -on -year.

In addition, while deploying the overseas high -end brand market, it has also enhanced the supply chain capacity of various regional markets around the world, and avoids adverse factors such as rising raw material prices and tariff sanctions. Overseas business growth of 13%. (Picture source: Network)

On the other hand, Haier has been working on high -end home appliances and smart home business since 2016. Compared with the beauty, Haier's home appliances choose the "less and fine" route, but the category is less revenue but the beauty.

Especially Haier's Casa Di has almost become synonymous with domestic high -end appliances. In the domestic price segment market above 10,000 yuan, the offline market share of the Casa Di brand washing machine reached 73.9%, the refrigerator reached 36.2%, and the market share of the price section of more than 15,000 or above reached 30.3%. The average price of refrigerators, air conditioners, and washing machines has doubled to three times the industry. In addition, Haier also achieved full coverage of high -end, terminals, and sinking markets through the three brands of Casa Di, Haier, and Leader.

It can be seen from 2016-2021 Midea, Gree, and Haier's non-air-conditioning home appliance sales revenue. Haier's non -air -conditioning appliance income has been growing, and the growth rate is faster. In 2016, Haier's non -air -conditioning home appliance revenue was 97%of Haier, and in 2021, it had fallen to 76%. Gree non -air -conditioning appliances and beauty, Haier is incomparable.

(Picture source: Network)

Among the three major home appliance giants in China, Midea relies on the ace air conditioners and other appliances to bless, with total revenue and net profit ranks first; Haier relies on the "overseas market+star product" to settle in the first home appliance camp; what about Gree? Can the air conditioners on "Mastering Core Technology" go on for a long time?

Gree's road is not easy to walk

Obviously, no.

"Talking about Gree said air conditioning" has now become a spell of Gree. In the early years, the home highlight industry achieved high growth, professional air -conditioning, mastering the core scientific and technological concepts to help Gree stabilize the forefront of the domestic home appliance market. However, with the disappearance of the demographic dividend and the decline in consumption in the entire environment, domestic appliance sales have declined.

According to data from the National Home Appliance Information Center: In the first half of 2022, the domestic appliance sales scale was 360.9 billion (including 199.5 billion online, 166.4 billion offline), a year -on -year decrease of 11.2%. Among them, the retail sales of air conditioners were 78.2 billion, a year -on -year decrease of 16.2%. To rely on air -conditioning to occupy the market leader in the future, it is obvious that competitiveness is not strong enough.

In fact, Gree has been trying to break through the dilemma of a single business, but it has not set off water. In the home appliance business except the air conditioner, Midea and Haier have firmly occupied the market at home and abroad. Gree and the two are too different. The smart home industry also has Internet manufacturers successively entered the bureau, such as Xiaomi and Ali. Competition has entered the stage of heat.

(Picture source: Network)

Regarding the layout of other fields, Gree has also hit the wall many times. Since 2013, Gree has announced that it has entered the field of mobile phones, new energy vehicles, intelligent wearables, ice washing and kitchen appliances, and even starting to deploy chips and medical equipment industries, enter the live broadcast industry, enter prefabricated dishes, and so on. However, this "cross -border" attempt is not easy. Gree's previous mobile phones, cars and other incidents are already a lesson.

As of now, Gree has not yet really had large -scale revenue. In the attempts that repeatedly failed, Gree seemed behind Midea and Haier. In addition, under the catalysis of the epidemic, Gree is focusing on channel reform, but it is not easy.

In the early days, Gree's deep bundling of the interests of dealers gave Gree's great advantages in sales channels, so as to live in the leading boss of the air -conditioning industry all year round. And Gree is now paying for it. Since the reform of the channel, 20 years, Gree Shandong dealers have anti -water and have been to the competitors. In June of the same year, the second day of the 618 Gree Electric live sales exceeded 10 billion yuan, the Beijing -sea interconnection reduced its holdings of 2.5 billion yuan Gree's stock; June this year, Jinghai Internet once again cash more than 3.5 billion yuan. In August, Xu Zifa, "General Generation" in Hebei, went to Feili. Obviously, the contradiction with dealers is already "connected to the blade", and the impact on Gree's revenue will continue.

(Picture source: Network)

The gap with the beauty and Haier has gradually increased, and the exploration in other fields has not achieved results. Now the contradiction with dealers has also intensified. It is also a question to control whether the ability to control Gree channels is still strong.

As Dong Mingzhu said, "(Gree) sales have relaxed their vigilance over the years, and they are a bit of great respect for the excellence." Now, Gree must accelerate.

Reference source:

1. Tiger Sniff APP: Follow the beauty, Haierbi, Gree is really behind

2. Tiger Sniff APP: Gree "crossing the robbery"

3. Yuanchuan Research Institute: Midea Bigri is 240 billion yuan, Dong Mingzhu lost?

4. Specific articles: high performance, the stock price has dropped sharply. Has Haier fell out of cost -effective?

*The first picture and picture of the cover of the article, the copyright belongs to the copyright owner. If the copyright owner thinks that his work should not be browsed or should not be used for free, please contact us in time. This platform will immediately correct it.

- END -

Liu Zhongbo: Be a good spokesperson to broaden the "getting rich"

up to date!National new crown pneumonia epidemic risk level partition list

up to dateHierarchical listClassification and prevention and control measures of r...