"A" A "expansion!17 only split listed stocks have been available in A shares, these sections are the most concentrated

Author:Dahe Cai Cube Time:2022.09.20

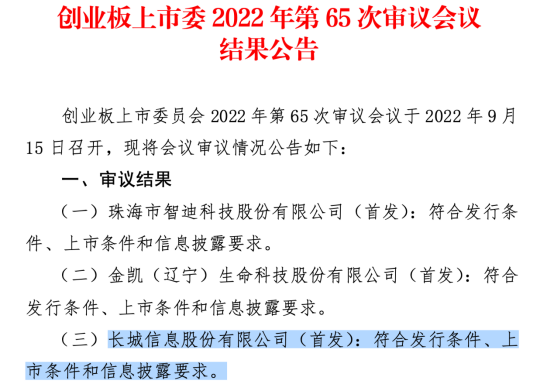

The popularity of the listing and listing gradually increased. Recently, there are two other A -share companies subsidiaries who are about to split and listed -Starnet Ruijie Holdings Ruijie Network GEM IPO has been registered with the China Securities Regulatory Commission, and the Great Wall Information GEM IPO of the Great Wall of China has also been recently received The GEM Listed Committee was approved.

Source: official website of the Securities Regulatory Commission and Shenzhen Stock Exchange

According to incomplete statistics, since the birth of A shares in February last year, the first spin -up listed stocks have been split for more than a year, and 17 have been split listed stocks to log in to the A -share market. Popular sections such as semiconductor, new energy, power batteries, automobiles, biomedicine and other popular sectors have become multi -hair areas for spin -up and listing.

Experts believe that spin -up and listing is conducive to the reasonable valuation of mothers and subsidiaries, further expanding financing channels, and helps to straighten out the company's business structure, promote the development strategy more focus, and expand development space. It is expected that more listed companies will work in the future to implement the spin -up listing plan.

17 subsidiaries successfully landed on A shares

Since February last year, Shengyi Electronics Login Science and Technology Board and became the first spin -up listed company after the implementation of the "new listing of listing". For more than a year, 17 subsidiaries have successfully landed on A shares.

The China Securities Journal reporter combed and found that the spin -off and listed motivation explained by listed companies mainly includes promoting parent and subsidiaries to focus on the main business, enhance independence, broaden financing channels, enhance the company's overall valuation, enhance subsidiaries' profitability, optimize management capabilities, and so on.

A list of A -share spin -off listing

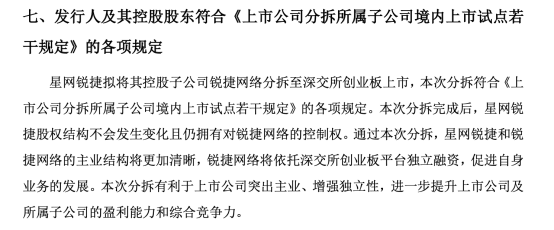

For example, the prospectus of Ruijie Network said that through this spin -off, the main structure of Starnet Ruijie and Ruijie Network will be clearer. Ruijie Network will rely on the independent financing of the GEM platform of the Shenzhen Stock Exchange to promote the development of its own business. This spin -off is conducive to listed companies to highlight the main business, enhance independence, and further enhance the profitability and comprehensive competitiveness of listed companies and subsidiaries.

Source: Announcement of listed companies

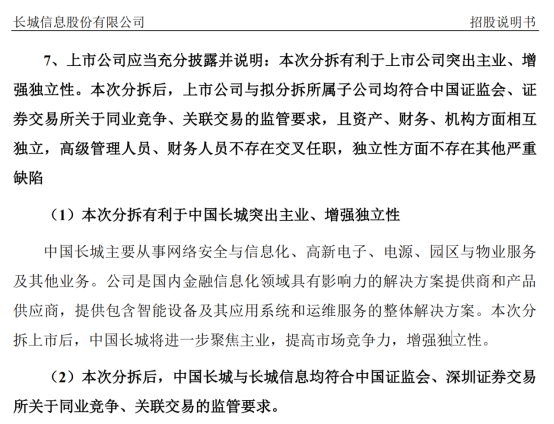

The Great Wall Information Prospectus states that the Great Wall of China is mainly engaged in network security and informatization, high -teal electronics, power, parks and property services and other businesses. Great Wall Information is an influential solution provider and product supplier in the field of financial informatization. It provides an overall solution including smart devices and its application systems and operation and maintenance services. After this spin -up listing, the Great Wall of China will further focus on the main business, improve market competitiveness, and enhance independence.

Source: Announcement of listed companies

"Spreading and listing is conducive to further realizing the main business of listed companies; the independent listing pricing of the subsidiaries has a positive impact on the valuation of listed companies, which is conducive to the market's reasonable pricing of the marketing company's innovative business subsidiaries; subsidiaries from the subsidiaries The spin -off listing has opened a new financing channel for the innovation business of listed companies. "Anxin Securities Research Report believes that the opening of the listing channels in the country is conducive to the value discovery of listed companies.

In addition, from the perspective of the "destination" of the A -share company splitting the listing, most of them are concentrated on listed sections such as GEM and science and technology boards. In this regard, Tian Lihui, the dean of the Institute of Finance Development of Nankai University, said that there are many listed companies for spin -off to GEM and science and technology boards. Most of the subsidiaries listed on the market are concentrated in emerging industries such as new materials and information technology, which is in line with the industrial positioning of the two major sectors. It is also a reflection of the vigorous development of my country's strategic emerging industries and helps to motivate innovative development.

About 90 listed companies plan "A" A "A"

China Securities Journal reporters combined with Wind data and incomplete statistics from listed companies. Since the release of the "Pilot Pilot of Listing in the Subsidies of the subsidiaries of listed companies in the subsidiary of listed companies" in December 2019, as of September 20, 2022, about 90 A The stock listed company planned to be listed on the domestic exchanges. Expert analysis believes that in the future, many listed companies will start to implement spin -up and listing plans, and the scale of listing will continue to expand.

China Securities News reporters sorted out spin -up listed companies that their industries were mainly concentrated in popular sections such as semiconductors, new energy, power batteries, automobiles, biomedicine and other popular sectors.

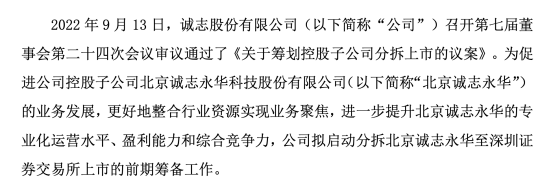

Chengzhi announced on the evening of September 13 that it was planned to start the preparatory work of the listing of Beijing Chengzhi Yonghua to the Shenzhen Stock Exchange. According to the company's announcement, Beijing Chengzhi Yonghua has deeply cultivated the research and development, production, sales and services of LCD materials and fine chemicals, and created the precedent of localization of LCD materials. The listing of Beijing Chengzhi Yonghua is conducive to the further development of the company and optimizing the company's layout of the company in the semiconductor display material industry.

Source: Announcement of listed companies

Chen Li, chief economist of Chuancai Securities and director of the Institute of Research, said: "Many listed companies intend to dismantle A ', mainly because the original listed companies have independent financing needs of the emerging and popular track business. The pursuit also makes it easier for the spin -up listing. In the context of the steady progress of the reform of the entire market registration system, the listing process of the enterprise is more reasonable and convenient, and it paves the way to the operational level for spin -off and listing. "

In addition, Tian Lihui said that, in view of the financing needs of listed companies in my country and the development of strategic emerging industries, it is expected to usher in more cases of "A". "A reasonable and reasonable real -time spin -up and listing will effectively improve the quality of letters, improve the level of corporate governance, promote scientific and technological incubation, and promote high -quality development of listed companies." He said.

The phenomenon of launching the subsidiary of the split subsidiary increases

While splitting the listing, reasonable supervision is also being strengthened simultaneously. Recently, the termination of the listing of split subsidiaries has increased, and issues such as related parties and affiliated transactions, interbank competition, and independence of asset finance and personnel have become the focus of the regulatory authorities. Zhejiang Digital Culture issued an announcement on September 16 stating that considering the company's operating conditions and future business strategic positioning, coordinating the arrangement of business development and capital operation planning, after fully communicating and prudent demonstration with relevant parties, the company intends to terminate the Zhejiang newspaper integration media Science and technology spin -up listing.

Source: Announcement of listed companies

Due to the dissatisfaction of the relevant conditions, many companies have recently split the listing plan. For example, the Greenmei announcement shows that the time of the holding subsidiary Green Cycle to complete the time of the electronic waste spin -off and the business reorganization time to the listing, and the independent operation time after the Green circulation spin -off and reorganization. The conditions for continuing to promote the launch of Green's cycle splitting are immature during the stage.

For another example, Shiji Information Announcement disclosed that due to the negative value of the company's expected net profit in 2021, the company will not meet the conditions for spin -off and listing in the next three accounting years. The company decided to terminate the listing of Si Xun Software Software Software for Disassembly Holdings.

Source: Announcement of listed companies

Tian Lihui analyzed that some enterprises could not meet the review requirements of the independence of the enterprise and the rationality of spin -off, and the phenomenon of "demolition for demolition" has aroused the attention of the regulatory authorities. Strengthen the supervision of spin -off listing, effectively curb listed companies to use spin -up and listing for bad phenomena such as shell speculation and benefit delivery, which helps maintain the market environment.

It is understood that in response to the "capital operation" and "shelling of the shell" caused by spin -off, the "Several Provisions of the Listing Pilot of Listed Subsidies in Listed Companies Disciplinary" implemented at the end of 2019 has made targeted arrangements. The Securities and Futures Commission clearly stated that it has increased its crackdown on false information disclosure, insider transactions, and manipulation markets found in pilot listing pilots, especially using spin -up listing for concept speculation, "flickering" spin -off and other illegal activities.

Experts remind that it should not be blindly followed, not all listed companies are suitable for the implementation of spin -off and listing. "Listed companies should be conducive to whether listed companies to highlight the main business and enhance independence from spin -up and listing; whether the listed company and the subsidiaries of the plan to be split are fully considered. The company's risk of competition in the company. "Xu Feng, a lawyer of Shanghai Jiucheng Law Firm, said.

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

Port and Xiong Kai Wanli Stream | "Hong Kong's Four Seas Land and Eight Party" will enjoy the charm of Shandong Port in one minute

Editor's note: On August 16-19, under the guidance of the Central Internet Informa...

Shidianmu Laotong: Gravate "ruby" to help farmers increase income

The Mid -Autumn Festival is the best season for the listing of Tunisian soft seed ...