The cost of 100 yuan mask is only 10 yuan.

Author:New entropy Time:2022.09.20

New Entropy Original

Author: Kai Kai Editor: Monthly

Since the concept of "Medical Beauty Mask" is born, it is linked to the high -priced "medical beauty project" in the consumer impression. It has to be rolled several times here.

However, if behind the "high price" medical beauty mask is unexpectedly low cost, is consumers willing to pay for it? Recently, the "Internet Red Mask" Yajia made a hot search because of the cost of the mask of#148 yuan.

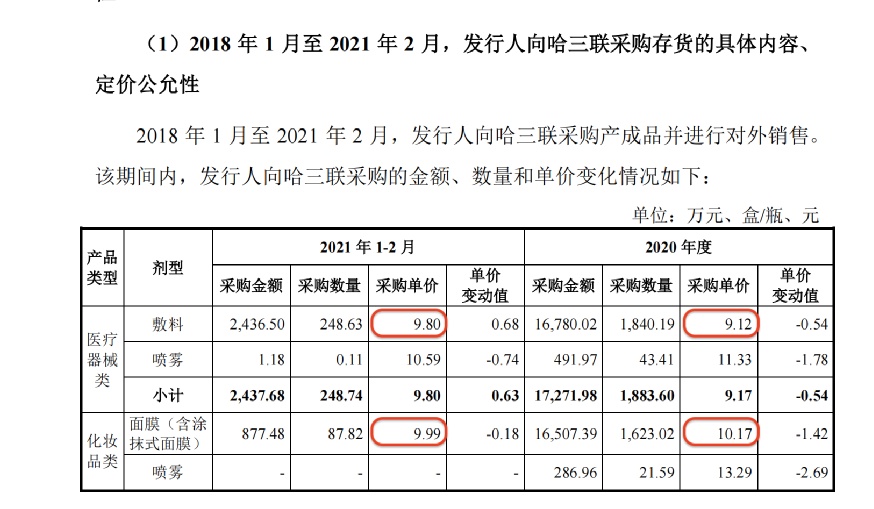

On the official flagship store of Tmall, its star products "black film" and "white film "'s single box retail prices were 199 yuan and 148 yuan, respectively. According to the inquiry letter disclosed by Kejia, from January to February 2021, the unit prices of its medical dressing and mask procurement were 9.12 yuan/box and 10.17 yuan/box, as well as 9.8 yuan/box and 9.99 yuan/box.

The "net red mask" with a price of more than 100 yuan, but the cost behind it is only 10 yuan. Such a "low cost, high price" also made Yajia make a lot of money. From 2019-2021, it has its The net profit of home was 661 million yuan, 648 million yuan, and 806 million yuan, respectively.

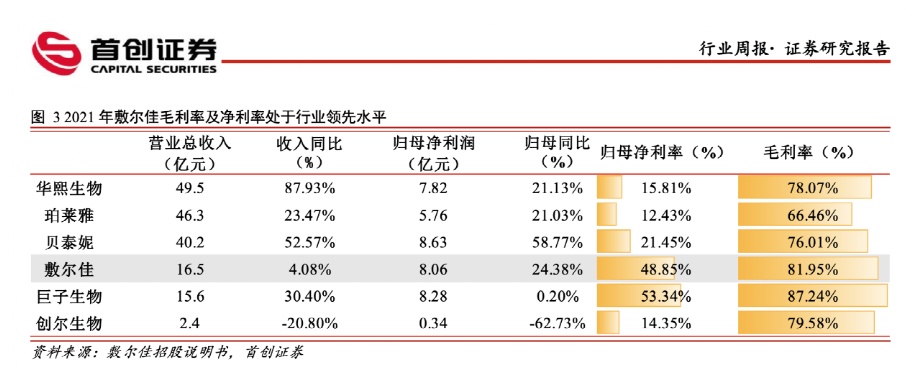

Small masks have made 100 million yuan in revenue. Before Yaerjia, Chuanger Bio (main product is "Chuanger Mei") and giant creatures (the main products are "Fu Mei") have shocked the listing. The company, their gross profit margins are not as good as the average, up to about 80%.

It can be seen that "high gross profit" can be regarded as a common phenomenon of medical dressing mask companies. Because of this, the so -called "medical beauty mask" has always been suspected of harvesting IQ tax.

In fact, before the concept of the "Medical Mask", medical dressings are not a fresh gadget. It is mainly used for anti -inflammatory, soothing skin, and promoting the repair of skin barriers.

However, in recent years, with the upgrading of consumption, various types of medical aesthetics have also gradually released the threshold to consumers. Therefore, the medical dressing mask with the effect of repairing the skin has a high unit price of medical beauty projects.

In addition, under the guidance of some producers in the early days, the medical dressing mask has also been named the title of "Medical Beauty Mask". This can easily make some consumers illustrate. Similar to "doing medical beauty"?

Based on this background, the consumer market of the medical auxiliary materials mask has developed rapidly in the past two or three years, from 6.7 billion yuan in 2017 to 25.9 billion yuan in 2021, with a compound annual growth rate of 40.0%. The establishment of less than 5 years has also won 2.3 billion yuan in revenue in 4 years.

However, such a "dislocation" packaging positioning was quickly rejected. On social platforms such as Xiaohongshu and B Station, many big Vs have science popularization "medical beauty mask" do not have the functionality of medical beauty projects; consumers who over -use the "medical beauty mask" even cause the skin harm.

Therefore, at the beginning of last year, the Drug Administration stopped the claim of the "Mask Mask", and stated that the medical dressing should be managed according to the medical device. It should not be named "mask", let alone "beauty" and other claims.

After the propaganda of the side ball was stopped, taking Yaerjia as an example, the growth rate of its performance seemed to have slowed from 2020. From 2018 to 2021, its revenue was 373 million yuan, 1.342 billion yuan, 1.585 billion yuan, and 1.65 billion yuan, respectively.

Among them, its revenue growth rate in 2019 was as high as 259%, 18.1%in 2020, and by 2021, it fell to the growth rate of individual digits, only 4.1%. Similar situations also appeared on Chuanger creatures. The revenue of Chuanger Bio in 2021 was 240 million yuan, a year -on -year decrease of 20.8%.

Bi Shijia's early sprinting IOP creatures passed the review of the Science and Technology Board Listed Committee in 2020. After a year of hard work, they were terminated on the last day of 2021 and folded the IPO.

From this point of view, even if it has been over the meeting, it is still unknown whether it can successfully go public and impact the "first share of medical dressing". Reference to the question of Chuanger Bio, such as the company's R & D costs, sales costs, etc. These are also the tests that Yajia will face.

Taking R & D expenses as an example, from 2019 to 2021, the R & D investment in Yajia was 603,900 yuan, 1.4787 million yuan, and 5.2429 million yuan, only 0.04%, 0.09%, and 0.32%of revenue. Moreover, as of December 31, 2021, there were only 6 R & D personnel in Shierjia. Such R & D reserves and investment are really difficult to support the future long -term development of the enterprise, let alone the problems such as product iteration and variety expansion.

However, compared with the average proportion of Biological sales expenses in Biological sales, the sales expenses of Yajiajia have not been huge. In the past three years, the proportion of sales expenses accounted for 8.60%of the operating income of each period, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, respectively, and 8.60%, respectively, respectively, and 8.60%, respectively. 16.75%and 16.01%.

However, this may be related to the "natural person distribution model" of Shierjia, which is also the reason why Yajiajia is controversial. In this model, when a natural person becomes a dealer, it can get 3%-30%of sales rebates based on sales performance. Although there is no multi-level distribution, it is very similar to the micro-business model of La Ren. Search on the search website to search for keywords such as "Yajia, Agent", and you can find the information of many agents. According to media reports, there are dealers who claim to obtain officially authorized Terja's officials that they only need to pay 198 yuan for 198 yuan -598 yuan, you can join the team of Yajia agents and enjoy the rights and interests of receiving goods at the agency price.

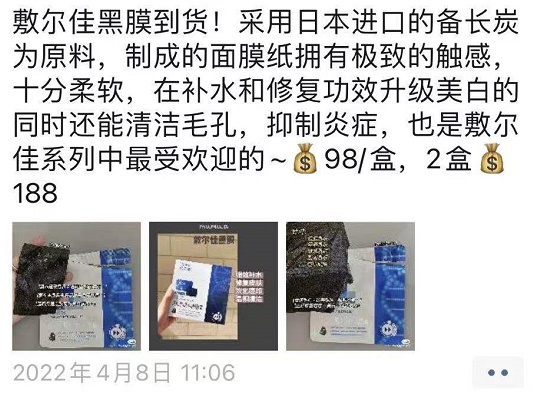

In the circle of friends, Weishang purchasing also said that it only costs 98 yuan/box to win the Kajia black film that price of 168/box in the official flagship store. The price structure of the product is so chaotic, whether it is a brand product, or a micro -business product, or a MLM product. This is really hard to say.

However, the price difference between different levels of product is so huge. Regardless of the actual efficacy of Yajia products, for consumers purchased through official channels, this disgusting "cut leeks" may not escape.

In addition to the "alliance dealers" mainly based on natural person dealers, its offline channels also include hierarchical dealers. However, according to its prospectus data, the number of dealers in Yajia is also declining year by year. 1156, reduced to 847 in 2021.

For Yaerjia, the current offline channels are still the head of their income. Last year, the offline channel revenue of Yajia accounted for 65.83%of the total revenue. However, the creation of its offline channels is more based on the "people" distribution network, not the "store" -based distribution channels. This model also increases the variables of the offline channels.

In general, in addition to the "high gross profit", Yaerjia lacks R & D and innovation in products; there is also lack of core competitiveness in channels. Whether to maintain the current reputation.

However, in the prospectus mentioned that the funds raised by the listing will be used for R & D investment. To increase R & D, this also makes people doubt that the purpose of its listing is to "make money" or make "products"?

Investigation, whether it is an Internet celebrity product or ordinary consumer goods, word of mouth and product quality is the core of the brand to win consumers. If the Canon of Canon break through the IPO, I hope it will not forget the original intention and make the product well. Essence

- END -

Tax and benefit enterprise innovation and development are motivated

Scientific and technological innovation is an inexhaustible motivation for enterpr...

Goldman Sachs Industrial Bank Financial has been allowed to open aiming for quantitative investment and cross -border financial management

Economic Observation Network reporter Liu Peng, June 24, 2022, Goldman Sachs annou...