Force 400 million yuan!Two months after returning, Dong Qing's husband had an accident again

Author:Daily Economic News Time:2022.09.20

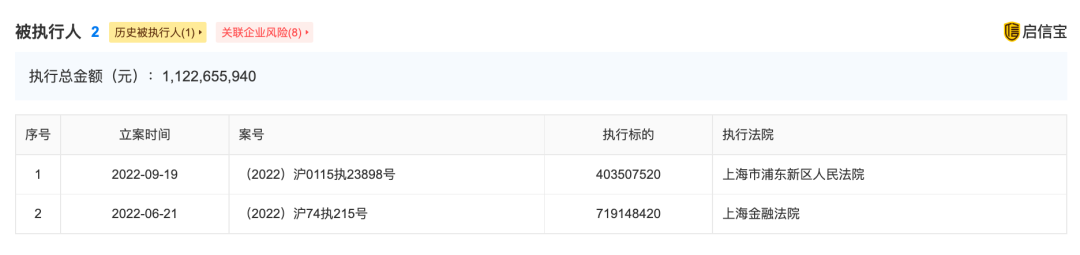

Today, the news of "Lanhai Holdings was forced to execute 400 million" has aroused market attention. Up to now, a total of 1.1 billion has been implemented in a total of 1.1 billion.

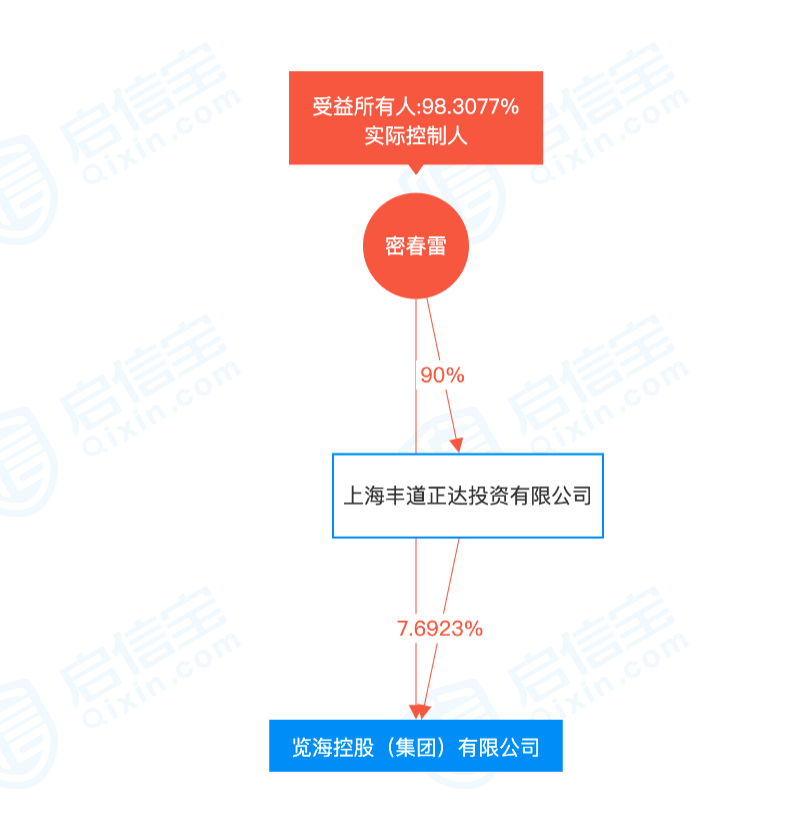

It is reported that Luanhai Holdings was established in 2003. The legal representative and the largest shareholders are Miyanglei. This person has multiple labels.

Image source: Ji Mu News Video Screenshot

He was forced to execute 400 million yuan

Cumulative execution of over 1.1 billion yuan

China Executive Information Disclosure Network shows that recently, a newly executed person's information was added to Luanhai Holdings (Group) Co., Ltd., which executed about 404 million yuan. 100 million yuan.

Shanghai Lanhai Investment Co., Ltd. held 100%of the shares of Lanhai Holdings (Group) Co., Ltd., and finally controlled the human Michuna. Lahai Holdings (Group) Co., Ltd. was established in 2003 with a registered capital of 6.5 billion yuan. Michuna is the company's legal representative and executive director. The shareholding accounts for 91.38%.

On June 21 this year, Michri, Shanghai Lanhai Investment Co., Ltd., and Lanhai Holdings (Group) Co., Ltd. added the case to execute the case, and the implementation of the target was about 719 million yuan. 2022) Shanghai 74 is No. 215.

It is reported that the husband of Dong Qing, the well -known host of Michun, and the actual controller of the listed company Luanhai Medical, and the legal representative and chairman of Shanghai Life. The Securities Times reported earlier. According to reports, Michuna was born in Chongming, Shanghai. In 2003, it was founded by Lahai Holdings (Group) Co., Ltd., which is quite low -key and mysterious. On the Hurun Rich List in 2019, Michri ranked 684 yuan for RMB 6 billion. Miya Lei was on the list again in 2020, with a net worth of more than 10 billion yuan. The Hurun Rich List in 2021 showed that Michuna's wealth exceeded 10 billion yuan.

Image source: Ji Mu News Video Screenshot

It was applied for freezing 88 million shares

His father is out of executive director

In addition, Michun Lei was also applied for frozen 88 million shares by Huayi.

According to Qixinbao APP, in July of this year, Huayi Brothers (Tianjin) Real Entertainment Co., Ltd. applied for frozen freezing Shanghai Lan Sheng Enterprise Management Co., Ltd., Hainan Guanhonghu Huayi Feng Xiaogang Cultural Tourism Industry Co., Ltd. Group) Co., Ltd., Inner Mongolia Zhongying Tianshan Energy Development Co., Ltd. holds 18 million RMB equity, a total of 88 million RMB equity is frozen.

The above matters are all applied for Huayi Brothers (Tianjin) Real Entertainment Co., Ltd. Huayi Brothers Media Co., Ltd. holds 39%of Huayi Real Estate Entertainment and is the actual controller.

In addition, according to the interface news previously reported, more than 40 days after Michri returned, the website of the national corporate credit information publicity system showed that on August 20, Mi Chunlei's father Mi Boyuan withdrew from the legal representative and executive director of Shanghai Luanhai Real Estate Co., Ltd. Xu Limin took over. At the same time, the company's shareholders were changed to Shanghai Life Insurance Co., Ltd., and Luanhai Holdings (Group) Co., Ltd. and Shanghai Lan You Enterprise Management Partnership (Limited Partnership) withdrew from the ranks of shareholders. Earlier, Mob Yuan replaced Duan Xiao Dong as the legal representative of Shanghai Lanhai Automobile Development Co., Ltd.

It is worth mentioning that since the beginning of 2022, Michimi has been unknown for nearly half a year. Until the evening of July 6 this year, Lanhai Medical Industry Investment Co., Ltd. issued an announcement saying that the company's director and chairman Mi Chunlei authorized the company's director Ni Xiaowei to fulfill the duties of chairman, and the authorization period was expired on July 6. Since July 7, Mi Chunlei has fulfilled the duties of the company's directors and chairman.

During the period of "lost contact" in Midunlei, on March 10 and 11, Luanhai Holdings and Shanghai Lan You Enterprise Management Partnership (Limited Partnership) will hold Shanghai Luanhai Real Estate Co., Ltd. and Shanghai Lanhai Automobile Development Co., Ltd. The equity pledged to Shanghai Life; on April 19, Luanhai Investment will produce part of the equity of Luanhai Medical to Shanghai Life.

"Lanhai Series" is involved in multiple fields

According to China Securities Network, the predecessor of the delisting sea medicine is the old listed company Zhonghaihai Sheng. In 2015, Michun, a well -known capital leader in Shanghai, spent about 3 billion yuan to enter the main. Later, the company changed its name to Luanhai Medical, and the main business gradually shifted from sea transport to the medical industry.

Image source: Daily Economic News (Data Map)

The delisting sea doctor has also become the core listing platform for Michun Lei in the A -share market.

The company is mainly engaged in medical services, including providing customers with general clinics, health examination services, medical beauty clinics services, etc. The company's operating medical projects include the presence of the sea clinic, the Jihe Luanhai Clinic and the Lanhai Rehabilitation Hospital.

However, in the past six months of Michuna's "loss", the delisting sea doctor has undergone major changes. The company has become a delisting stock, which has been terminated to the market. It is currently in the period of delisting. On June 21 this year, the delisting sea doctor disclosed that the company received the stock to terminate the listing decision, and the Shanghai Stock Exchange decided to terminate the company's stock listing. On April 30 this year, the delisting sea doctor disclosed the 2021 annual report. The company's 2021 financial accounting report was issued a audit report for reserved opinions by the Credit Accounting Firm (special common partnership). The above situation touched the termination. In terms of business, from 2019 to 2021, the net profit attributable to the deduction after the deduction of the deduction was -191 million yuan, -166 million yuan, and -319 million yuan, respectively. , 6128 million yuan, -281 billion yuan.

In terms of stock prices, as of July 13, the stock price of the delisting sea medicine was reported at 1.02 yuan/share, which has fallen by nearly 95%higher than the highest point, and the current total market value is 1.15 billion yuan.

In addition to the delisting sea doctors, the footprint of the "Sea Department" of Miyanglei also involves multiple sectors such as real estate, cultural tourism, and insurance.

According to the official website of the delisting sea medical, Michri is currently the chairman of the Lanhai Holdings (Group) Co., Ltd., the chairman of Shanghai Lanhai Investment Co., Ltd., the legal representative and executive director of Shanghai Life Shou Medical Industry Co., Ltd., Shanghai Life Insurance Co., Ltd. Chairman of the company and chairman of the delisting sea doctor.

Among them, Shanghai Life was established in 2015, with a registered capital of 6 billion yuan. At the beginning of the opening, the company implemented the "Bank Insurance Pioneer" strategy and quickly opened the market. In 2016, as regulatory departments successively introduced standardized documents, Shanghai Life launched market strategy adjustment to develop guarantee business.

Data show that in 2021, Shanghai Life's real estate revenue was 20.45 billion yuan, an increase of about 21%year -on -year. The fourth quarter of 2021's solvency report shows that as of the end of the fourth quarter of last year, the company's comprehensive solvency adequacy ratio was 124.89%; the core solvency adequacy ratio was 119.99%.

Edit | Cheng Peng Gai Yuanyuan Du Hengfeng

School pair | Duan Lian

Cover picture Source: Ji Mei News Video Screenshot

Daily Economic News Integrity from China Fund News, Qixinbao, Public Information, China Securities Network

Daily Economic News

- END -

Twenty -four solar terms commemorative coins!And super cute little tiger!

The People's Bank of China will issue a twenty -four solar terms (stories of time)...

Prospective of the financial incident next week: July CPI and other data will be announced by 11 new shares issuance

Next week, data such as CPI, PPI, new loans, M2, and total social financing will b...