13 brokerage companies stopped business during the year!Under the epidemic, Hong Kong Voucher Commercial Accelerated Horchings

Author:Huaxia Times Time:2022.06.21

Huaxia Times (chinatimes.net.cn) reporter Wang Jingge Aifeng Shenzhen report

For Hong Kong local securities firms, the days in the first half of this year are not good.

According to relevant statistics, as of the end of May 2022, 31 Hong Kong securities firms have closed or suspended retail business, of which 13 Hong Kong brokerage companies have stopped operating on the exchange.

"Huaxia Times" reporters asked digital industry insiders and experts to verify that under the influence of the epidemic, in addition to the sluggish number of the Hong Kong stock market, this year's Hong Kong stock market is poor, operating costs, and survival space by Internet brokers are all caused the Hong Kong voucher industry, especially in the Hong Kong securities industry, especially Important reasons for the difficulties of small and medium securities firms.

In the opinion of Zheng Lei, chief economist of Samoyed Cloud Technology Group, the suspension of some local Hong Kong securities firms is the principle of rationality. The city may start to ease at the end of 2023, and the business environment of the brokerage company will have a fundamental change.

Yu Yang, a researcher at the Institute of Finance and State -owned Enterprise State -owned Enterprise Research Institute of China (Shenzhen) Comprehensive Development Research Institute, analyzed the reporter of the Huaxia Times that with the gradual stable of the Hong Kong epidemic in China, the normal customs clearance of Hong Kong and the Mainland still It is expected to restart, the Hong Kong securities industry may usher in a new round of growth.

13 Hong Kong securities firms announced the suspension of business

In March of this year, the 18 -year -old Hong Kong -based and holding brokers who held the Hong Kong Securities Regulatory Commission 1 to 7 categories of licenses announced their graduation. On June 8th, Yaocai Securities, who was also a well -known old -fashioned broker in Hong Kong, was revealed to owe tenants for more than 27 years. Subsequently, Yaocai Securities posted photos of the banner that had been removed on the social platform account, emphasizing that everything was normal.

In recent days, there are many market news about Hong Kong's Chinese -funded securities firms. According to relevant news, there are at least two Chinese investment behaviors to reduce operating costs. It is planned to gradually reduce some employees of investment banks and stock capital markets (ECM) and other departments this year.

According to the announcement of the statistics of the Hong Kong Stock Exchange, from 2019 to 2021, the number of participants (licensed brokers) who have stopped the business (licensed brokers) of the Hong Kong Stock Exchange were 22, 37 and 17, respectively. From 2016 to 2018, this number was 4. Home, 4 and 6. As of May 2022, 13 Hong Kong securities firms have stopped operating on the exchange.

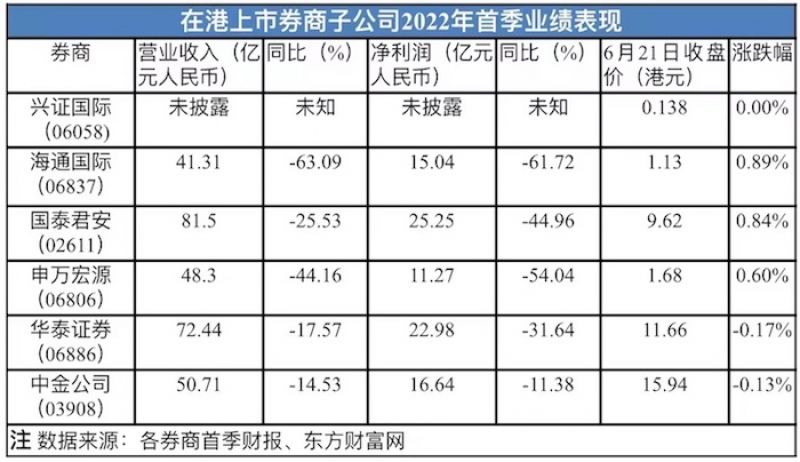

"Huaxia Times" reporter conducted statistics based on the performance of overseas subsidiaries of Chinese -funded securities firms listed in Hong Kong in Hong Kong, and found that except for the international evidence of not disclosed financial data, the income and net profit of each listed broker subsidiary were all year -on -year. 15%-60%of a large degree.

According to Wind data, as of May 31 this year, in addition to several companies listed, there were 16 companies that completed listed in Hong Kong stocks, a year -on -year decrease of nearly 60 %. At 188.272 billion Hong Kong dollars, a sharp decrease of 91%.

In the meantime, due to the significant decline in operating performance, many companies took the initiative to choose to postpone the listing plan. Yu Yang pointed out to the "Huaxia Times" reporter that in addition to the company's active choosing to delay the listing of IPOs, Hong Kong stocks continued to slump this year. The Hang Seng Index decreased by about 30%compared with the same period last year. In addition, the turnover of Hong Kong stocks in the first May of this year decreased by about 32%compared with the same period last year, the overall transaction activity decreased significantly, and the breaking capacity of brokers decreased significantly.

Financial technology transformation is difficult

As an international financial center in Hong Kong, its brokerage market competition has always been fierce. The securities industry is mainly profitable by earning transaction commissions. However, in recent years, Internet brokers, including FUTU, have actively seized the market. In addition to buying and selling more convenient, Hong Kong has also promoted the current era of zero commissions.

Liang Haiming, dean of the Silk Road Zhigu Research Institute, pointed out in an interview with the reporter of the Huaxia Times that it is difficult for traditional brokers to compete with Internet brokers. Moreover, traditional brokers did not provide customers with more diversified investment services and did not pay attention to strengthening their competitive strength. Therefore, many customers lost to other high -quality brokers including Internet brokers, and their living space was also seized.

The results of the Hong Kong Securities Industry Association's capital market questionnaire in 2022 show that information technology investment and labor costs are the two largest expenditures in the securities industry. 40%of member agencies believe that the biggest increase in cost is the investment of information technology; 44%of member agencies believe that salary is the company's largest operating expenditure.

Despite the impact of the epidemic, many local traditional brokers have begun to seek Internet transformation. However, the traditional transformation of traditional securities firms is more difficult. Zheng Lei told this reporter: "Traditional securities operations and Internet securities have different market channels and operation methods, and they require a lot of capital investment information systems. ","

In terms of policy, last year, the Hong Kong government increased its stamp duty to 0.13%, which increased the cost of transaction costs, and the profit margin of securities firms was further compressed. In addition, regulatory regulation is also strict, and the requirements for trading systems are getting higher and higher.

In this regard, Liang Haiming told the reporter of Huaxia Times that the new measures launched by the regulatory authorities in Hong Kong have become higher and higher, which leads to the cost of resource costs in the transaction system and compliance. This is also an important reason for the difficulty of operating brokers.

In addition to the significant decline in the Hong Kong IPO market year -on -year, Zheng Lei analyzed to this reporter that the main income of Hong Kong brokers came from brokerage business and bond underwriting business, especially US dollar bond business. This year's Hong Kong stock market is poor, and the real estate dollar debt is overdue, and the market conditions are downturn. As a result, the above three main businesses have encountered a great impact. Hong Kong's local securities firms usually rely more on brokerage business to survive, so the number of local securities firms, which has been impacted most, has increased sharply. Where is the way out?

Although the market transaction volume of Hong Kong stocks has increased significantly compared to March since June. However, the Hong Kong stock market transactions are relatively sluggish. According to the data released by the Hong Kong Stock Exchange, the average daily turnover of Hong Kong stocks in the first quarter of this year was only 146.5 billion Hong Kong dollars, a year -on -year decrease of 35%, and the fund -raising amount was HK $ 14.9 billion, a year -on -year decrease of 89%.

In Zheng Lei's view, the Hong Kong stock market has a small chance of reversing this year. He believes that the cold winter of the industry has just arrived, and it is usually rarely acquired between securities firms. In addition, the global financial market may be greatly impacted in the next year, and some Hong Kong local securities firms to suspend business are the principle of rationality. The market may start to ease at the end of 2023, and the business environment of the brokerage company will have a fundamental change.

Yu Yang analyzed the "Huaxia Times" reporter that because Hong Kong's labor costs and office rents were higher than the Mainland, the operating profit margin of Hong Kong brokerage firms was significantly lower than that of domestic brokers, making Hong Kong securities firms weaker in the face of industry fluctuations. With the gradual stability of the Hong Kong epidemic, the normal customs clearance of Hong Kong and the Mainland is still expected to restart, which will have a favorable support for the Hong Kong stock market.

Yu Yang suggested that companies can reduce operating costs and reduce financial leverage on the one hand when the industry's prosperity declines; on the other hand, strengthen cooperation with mainland financial institutions and increase expansion of mainland customers within the scope of supervision permits.

Liang Haiming also believes that in the future, the roads of securities firms can transform into the business model of wealth management and asset management, especially in mainland cities that enter the Guangdong -Hong Kong -Macao Greater Bay Area to provide family offices or fund for the wealthy class of these cities to collect management fees and On the one hand, the performance fee can not only expand the business of securities firms, and on the other hand, it can also promote the development of Hong Kong into the center of the World Asset Management and Family Office, thereby consolidating and developing Hong Kong's position as an international financial center.

"In the future, the concentration of the Hong Kong voucher industry will be further improved, and the overall status of Chinese securities firms and international investment banks will become increasingly consolidated. With the increasing influence of the Mainland on the Hong Kong capital market, the capital strength of mainland financial institutions will continue to increase, and the Chinese securities firms The overall strength is expected to be further strengthened. In addition, international investment banks are still an important intermediary for international capital to invest in China and domestic companies through the Hong Kong market to obtain international financing, and their status is difficult to shake. "Yu Yang further pointed out.

Editor -in -chief: Xu Yunqian Editor: Gong Peijia

- END -

From January to May, Huangshi High -tech Industry has a strong development momentum

According to the latest data released by Huangshi City Statistics Bureau on the 21st, from January to May, the development momentum of the high -tech industry of Huangshi City continued to be strong,

Astraikon Global Executive Vice President: We have long been brewing "big moves"

The new coronary pneumonia's epidemic has impacted the global economy, but this does not affect the confidence of multinational companies in China. At the Qingdao Summit, Astraikon, a global leader...