70,000 "old man music", created 13 billionaires

Author:Jinan Times Time:2022.09.21

Zero -running cars went ashore to become the fourth listing of the listing after Wei Xiaoli.

Just through the Hong Kong Stock Exchange, the number of IPO global offering shares was 130.8 million shares, and it was planned to raise 1 billion yuan.

Based on the planned up to HK $ 62 (about 55 yuan) per share, the market value of zero -running cars is about 62.85 billion.

There are still some gaps with the dream of the founder's "100 billion market value".

However, there are a number of wealth freedoms of wealth for new buildings.

"Old Music" entrusts the fourth new forces of listing

Zero -run Hong Kong stocks are listed, and the offer price per share is from 48 ~ 62 Hong Kong dollars.

In contrast, at the beginning of the listing of Hong Kong stocks, Wei Xiaoli sells for HK $ 160, HK $ 165, and HK $ 118, respectively.

Corresponding to the market value of Hong Kong stocks, it is more than more than 60 billion yuan.

This is related to the positioning and business status of Zero Run itself.

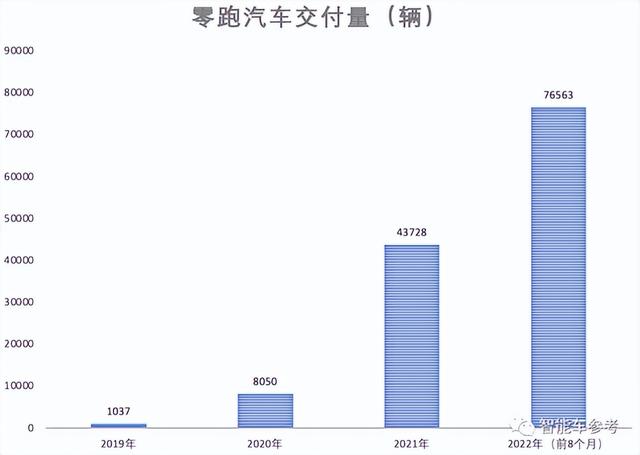

According to the latest disclosure of the IPO, zero -run in recent years has grown rapidly:

However, among all the vehicles delivered by zero running, the miniature car T03, which is priced at 70,000 to 90,000, occupies the vast majority. T03 is also a "old man music" model that users ridiculed.

The newly launched C11 models with the mainstream market interval are in the climbing stage. At present, 5-6 thousand units are delivered a month, accounting for about 50%.

From a historical and global perspective, C11 sales are still very low.

Therefore, the T03 is still the largest model when the zero -running deadline is listed, and it is also the biggest contributor to the 68 billion market value of zero running.

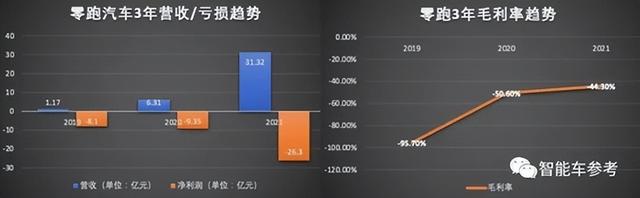

However, this also causes the current status of cycling in the zero -run performance statement:

The profit of not high and the fierce competition in the small car market has made the development of this category insufficient.

The total revenue is not enough, and the financing is not as smooth as Wei Xiaoli.

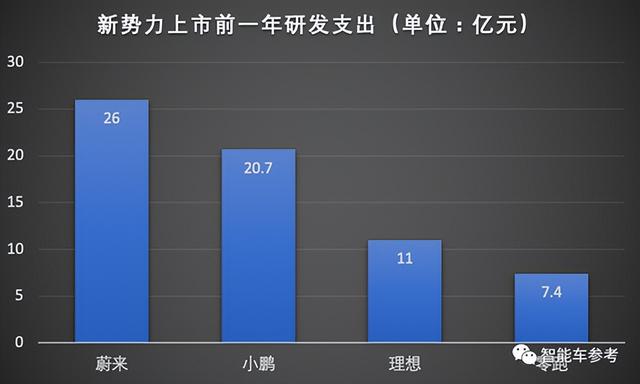

From 2019 to 2021, the cumulative R & D expenditure was 1.387 billion yuan, of which 740 million yuan was spent in 2021, accounting for 23.62%of the revenue scale during the fixed-term period.

Selling cars, low profits, and low research and development investment. This is why zero running to the Hong Kong stock under the momentum of sales has increased. The market value and stock price are much lower than other new forces.

However, it can be seen in the prospectus that the breakthroughs of the zero -run brand have achieved remarkable results.

In the latest disclosed data in the first quarter of 2022, the zero-running margin rate rose to -26.6%due to the expansion of C11.

From the perspective of the proportion of C11 delivery in July and August, the medium-sized SUV, which sells for 1.83 million range, will soon replace T03 to become the main delivery force.

C11 Cheng Zero Running Business Pillar and rapid growth, and the opening of the car C01 at the same level, this trend has made Zero running great potential this year.

During the year, except for the total delivery of zero running, there was almost no suspense to pass the 100,000 mark. The most important thing is that zero running is likely to reverse the gross profit margin to positive and get rid of the situation of "selling one loss and one car".

At the moment of the 68 billion market value, are you willing to get on this train zero?

Run zero to go public, who is wealth free?

At the beginning of the prospectus of zero running, we have introduced in detail to excavate the equity structure of Zero Running.

The top ten shareholders are:

Among them, Fu Liquan and Zhu Jiangming, the key souls of the key soul of the zero -run cars, and their family members, which directly or indirectly held 31.01%, are the largest shareholders group, with the actual control and weight of zero running cars with the largest weight. The right to vote.

Zhu Jiangming, the founder and CEO of Zero Running Cars and CEO, are the largest individual shareholders, holding 11.89%of the shareholding (including the indirect shareholding of affiliated companies), which is counted as its family's shares, with a total of 16.33%of the shares.

Under the same algorithm, Lianchuang Fu Liquan and his family held 14.68%.

In addition, the other two public positions and executives of the zero -run car, including Wu Baojun, who are responsible for marketing, and Cao Li, who are responsible for technology research and development, holds 0.17%and 1.12%of the zero -run cars.

With this information, you can probably calculate the listing of zero running, how many "richness" has been created.

Calculated according to the market value of the highest issue price per share, and the method of merging family shareholdings and indirect shares:

The founder Zhu Jiangming, due to zero running market, has increased sharply by 11.145 billion. Zhu Jiangming had a value of 5 billion due to the shares of the security giant Dahua before.

The co -founder Fu Liquan increased by 10.02 billion. Because Fu Liquan was the founder of Dahua, his previous value had reached 27.1 billion.

Cao Li, an executive, unlocked 819 million.

Another executive Wu Baojun won 116 million.

There are 9 other independent natural person shareholders listed in the prospectus, with a maximum shareholding ratio of 0.9%and a minimum of 0.21%. Correspondingly, the theoretical income of the Hong Kong stock market was maximum of 616 million, and the lowest was 144 million.

In other words, the actual beneficiaries behind the institutions and shareholders of the company, the Hong Kong stocks were listed in zero, and hundreds of millions of rich people directly created 13, and the least theoretically profitable was about 100 million.

Of course, strictly speaking, Zhu Jiangming and Fu Liquan, two core figures, are actually not the "rich" created this time.

The security giant Dahua, founded by the two together, has long allowed them to achieve freedom of wealth.

This origin also carried out the past and present of the zero -run car.

"The last ticket of investor", what kind of new forces are the family?

Zero Running Cars was established in 2015 and was born in the world's AI security enterprise Dahua Technology, which is second only to Hikvision. The two key core characters are the founding veterans of Dahua.

Fu Liquan, the founder of Dahua, graduated from Zhejiang Electronic Industry School, and started Dahua in scratch to become the second in the global AI security industry. He claims to have a dream of 100 billion yuan, but the global security market is only 100 billion yuan, so he turns his eyes to cars.

Zhu Jiangming is the co -founder of Dahua. In his early years, he held a group of 5,000 yuan to start a business with Fu Liquan. He was an intimate comrade in the distress.

Zhu Jiangming was born in technology. He graduated from Hangzhou University Electronic Engineering (now merged with Zhejiang University). Before zero running, it was Dahua CTO. The key products of Dahua's growth, breakthroughs, and high -speed development period were all Zhu Jiangming's research and development, of which Including car security products.

After the establishment of a zero -run car, Zhu Jiangming gradually resigned from Dahua's position, and was fully responsible for the management and operation of Zero Run. He is also the chairman of the zero -run car and is the title of the founder.

Fu Liquan retreated behind the scenes and ranked among executive directors.

Zhu and Fu, together with their family, are the largest shareholders group, and they have reached an agreement to take consistent action. If there is controversy, Zhu Jiangming decides.

Therefore, the current actual controller and the highest decision maker of the zero -run car are Zhu Jiangming.

In the management of zero running, the important names are Wu Baojun and Cao Li. They are all executive directors.

Wu Baojun, born in 1970, graduated from the School of Automobile and Track of Jilin University of Technology.

Wu Baojun is currently the president of Zero Running Auto. He is mainly concentrated in car sales, market services, and auto insurance. He has been in GAC for a long time and has served as the leader of many brand markets under GAC.

Cao Li, graduated from Zhejiang University of Technology. The vice president of zero -run car, the general manager of the R & D department of the vehicle, is the current technology and product leader of Zero Run. Born in Dahua Group, he has been engaged in design work for a long time.

Beginning in 2021, the sales volume of zero running began to counterattack, squeezing off Weimar Motors, and rushing into the first echelon. The annual delivery of 4,3121 new cars, followed by Wei Xiaoli, ranked fifth.

But there have always been tight days for insufficient funds.

Since its establishment, a total of eight rounds of financing have been raised, totaling 11.86 billion, which is not much for car building.

Except for Zhu Fu and Dahua's blood transfusion, zero running is almost relied on the "circle of friends" of the wealthy businessmen in Zhejiang.

For example, Chen Jinxia, a natural person shareholder, is the head of the "Yongjin System" who has once gone, and many other institutions of Yongjin Department are involved in the investment zero -run.

Among all rounds of investment, the most common is Hangzhou Hanzhi, Hangzhou pan -chain, Huzhou and Ninghai, Zhoushan Haihai, Hangzhou Chunsheng, etc., all of which are all local investment institutions and private enterprises in Zhejiang.

However, for the zero running, the buying and selling of the car is also called "keeping the clouds and seeing the moon".

For 6 years, the sales volume took off, and the reputation gradually started, and the investors began to pay attention.

Beginning last year, zero running through the stages and entering rapid growth.

The strategy, technical route, advantages and challenges of zero running are gradually clear.

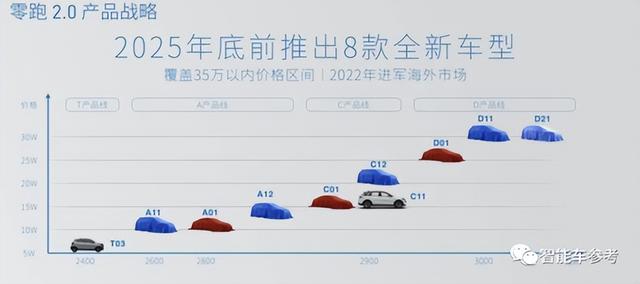

In terms of product layout, the next three years will be the stage of "lower dumplings".

At the end of 2025, zero -running cars will launch 8 new models, including three cars (coupe/miniature cars), four SUV models, and one MPV model.

If the layout of the zero -run car 2.0 product layout, the above three new cars, in addition to the known zero -run C01, Zero Running Motor will also launch two models between 100,000 yuan to 150,000 yuan and 250,000 yuan, respectively. The internal codes between the yuan and 300,000 yuan are A01 and D01, respectively.

It can be seen that the layout of zero -running models is large -scale and high -end, and covers all range of 10W to 30W.

In the prospectus, Zero Run thinks that its own advantage is self -research and cost.

According to zero -run themselves, they are a smart car company with a full stack. This full stack self -research is the same hard core strength as Tesla and Xiaopeng.

Hardware includes vehicle research and development, design, line control chassis, battery packs (except battery cells), driving motor, high -voltage charging technology ...

Software includes autonomous driving algorithms, smart cockpit OS and other car software.

There are even chips. Zero running last year with Dahua set up a chip subsidiary, developing a car AI chip, the latest flagship model C11, and the calculation platform for autonomous driving dependencies, which is the zero -run self -developed chip Ling core 01, and the computing power is 8.4TOPS.

Although the current annual R & D investment is only equivalent to the level of one quarter of other new forces, the team size is not large, but this does not prevent Zero running with Tesla's technical standards.

Zero Run believes that the advantages of the full stack of self -research have extended, forming the best vertical integration capabilities in the industry.

It means that zero -run self -developed technology, with the supply chain company investing or controlled by Dahua Ecology, can minimize the cost of zero -run car manufacturing, and mention the highest efficiency.

An example is the security system on the zero -run car.

Where is the challenge of the zero -run car?

Obviously, the investment in technology research and development is not enough. "Three years exceeding Tesla", the difficulty is not ordinary.

When the sound of zero -run listing just happened last year, Zhu Jiangming said this:

"Zero running is likely to be the last ticket for them (investors)."

At present, the technology, products, strategies, prospects, etc. of zero running are already the cards.

"The last ticket", will you get in the car?

Source: Smart Car Reference Editor: Zheng Chuqiao

- END -

Nanyang prefabricated dishes!It is planned to set up 10 billion -scale industrial parent funds, and there are prefabricated dishes professional sub -funds

[Dahe Daily · Dahecai Cube] (Reporter Wu Haishu Chen Wei intern Yang Sa Wen Ma Te...

Gaoshan Vegetable Harvest Mianzhu opposite mouth help drives Liangshan Ganluo villagers to increase their income

Qianxian Cover Journalist Wang Xianglong Xueju reporter Leng YuEntering August, at...