More than 120 billion yuan of loans!Dongguan Agricultural Bank of China Special Action Special Action contains "gold" with a full amount

Author:Yangcheng Evening News Yangche Time:2022.06.22

On June 21, under the guidance of the United Front Work Department of the Dongguan Municipal Party Committee and the People's Bank of China Dongguan City Sub -branch, the Dongguan Industry and Commerce Federation (General Chamber of Commerce) and the Dongguan Branch of the Agricultural Bank of China jointly organized the "Bank Enterprise to help the future to help economic growth". The launching ceremony of the action, comprehensively improved the cooperation of helping companies and benefiting enterprises.

Special action launching ceremony site

Gathering can link, condense consensus

Chen Guoliang, deputy minister of the United Front Work Department of the Dongguan Municipal Party Committee and secretary of the Party Group of the Municipal Federation of Industry and Commerce, said that in recent years, the Municipal Federation of Industry and Commerce and the People's Bank of China Dongguan Municipal Sub -branch and various financial institutions have worked hard to open up the channels for banks and enterprises, improve the normalization communication mechanism of banking enterprises, and serve as the private economy. Development has created a better financial ecology. In the future, through the overall linkage of the Town Federation of Industry and Commerce, we will carry out a series of activities with the Dongguan Branch of the Agricultural Bank of China to connect with the financial needs of private enterprises, and to attract financial "living water" to increase confidence and vitality to private enterprises. It is hoped that private enterprises will grasp the favorable factors of a package of policies, stabilize, and step by step to achieve better development of enterprises and help the overall economic growth.

Wang Zhiwei, Secretary of the Party Committee and President of the Agricultural Bank of China, said that the Dongguan Branch of the Agricultural Bank of China adhered to the original intention of serving the people and served various market entities with affection. This special operation will effectively build three major platforms: First, a platform for docking policy solutions. With the "helping economic stable growth of 83516 strategy", it provides enterprises with a more professional and high -quality package financial service solution. The second is to build a platform for deepening exchanges and cooperation. Focus on the four major grasps of policies, products, services, and activities to achieve mutual integration of policies, common information, and resource sharing. The third is to build a platform that condenses cooperation consensus. Through the coordination of silver administration and enterprises, we jointly build a strong joint force to support the development of the entity, and contribute more to Dongguan's economy steady.

At the launching ceremony, Chen Guoliang and Wang Zhiwei signed a comprehensive strategic cooperation agreement on behalf of the Municipal Federation of Industry and Commerce and the Dongguan Branch of the Agricultural Bank of China. Subsequently, Wang Zhiwei and Dongguan Women's Entrepreneurs Chamber of Commerce, Dongguan City Rural Revitalization Promotion Association and other business (association) associations, as well as Dongguan Construction Industry Group, Guangdong Zhongtu Semiconductor Technology Co., Ltd., Marco Polo Holdings Co., Ltd. Representatives such as Sunshine Industry Development Co., Ltd. signed a comprehensive strategic cooperation agreement on the spot to further consolidate a powerful force to help the development of the private economy. At the event, the promotional video of the Agricultural Bank of China Dongguan Branch was broadcast to show the bank's struggle footprint for rooting and helping development.

Focus on entities, full of dry goods

At the launching ceremony, the Agricultural Bank of China Dongguan Branch launched the "helping economic growth of 83516" at the scene, making the "eight major commitments" such as "the annual loan investment in the next three years", and proposed a "three measures" for helping the real economy. , Help the rural revitalization of the "five measures", solve worries and rescue, help small and micro "16 measures", and fully play the role of financial engines.

At the event site, the bank reads the "Special Action Plan for helping private enterprises to develop the" Bank Enterprise Together to the Future ", and introduced in detail" policy integration into thousands of enterprises "," product Sunac's power "," service integration and excellent experience "," activity integration promotion promotion promotion " The four major actions of win -win "showed the innovative financial products, discount financial policies, and professional financial services of Agricultural Bank of China, which made the participants shine.

In addition, the event specially invited Wang Yi, an international lecturer of the Science and Technology Innovation Bureau of Shenzhen Nanshan District, to give a speech, focusing on the challenges and opportunities of digital transformation in the new era, and using rich practical cases to propose one thinking, two major opportunities, three ideas, four motivation , Five key and six capabilities, lead the people present to improve digital thinking and provide intellectual support for enterprises to improve their operating level.

Gathering development, highlighting the responsibility

In the context of building a business card in Guangdong's high -quality development, it is more significant to implement the requirements of economic stable growth. As the national team and the main force of the development of local development, the Agricultural Bank of China has always worked with the Enterprises of Dongguan to continue to deepen multi -party cooperation, provide preferential interest rates, increase credit investment, and improve the effectiveness of the development of financial resources. As of the end of May, the balance of various loans of the local and foreign currencies of the Agricultural Bank of China Dongguan Branch exceeded 150 billion yuan, an increase of nearly 18 billion yuan from the beginning of the year, and ranked first in four major banks.

In supporting "intelligent manufacturing", the Agricultural Bank of China Dongguan Branch has a positioning of "the advanced manufacturing center of Guangdong, Hong Kong, Macao Greater Bay Area" around Dongguan, makes full use of credit policies to actively support industrial transformation and upgrading. At the end of May, the bank's manufacturing loan increased by nearly 16 billion yuan from the beginning of the year, an increase of 85.02%, and the increase accounted for 89%of the increase in various loans. Essence

On the help of "small and micro", the Agricultural Bank of China Dongguan Branch actively promoted online inclusive loan products such as mortgage E loans. In response to insufficient guarantee of small and micro enterprises, a policy guarantee company was introduced. The credit support of small and micro enterprises, the balance of inclusive loans at the end of May increased by 24.41%over the beginning of the year. In addition, the bank provides financial support in comprehensive use of non -repayment loans and exhibition periods, and continues to increase fee reductions to make benefits. At the end of May, the overall interest rate of inclusive loans decreased by 10bp compared with last year. Enterprises provide non -repayment loan funds over 190 million yuan.

In supporting foreign trade, the Agricultural Bank of China Dongguan Branch follows the speed of capital elements in the Bay Area, continuously optimizes the authority of foreign trade financing approval, product policies and business processes, and first accesss the FT account account accounting business system in the free trade zone.The linkage services of financing, settlement, and sale and sales meet the financial services needs of various enterprises.From January to May of this year, the bank has invested more than 20 billion yuan for foreign trade enterprises, an increase of 145.87%year -on -year.According to reports, the next phase of the Agricultural Bank of China Dongguan Branch will continue to contact each other in close silver, political, and enterprises, give full play to the advantages of collaborative cooperation, take the optimization of financial services as the starting point, take the real economy as its own responsibility, and do a good job of credit support for key areas. It is stable for stability.The economic market contributes more power.(Zhou Xiaoling)

Source | Yangcheng Evening News • Yangcheng School

Responsible editor | Zhang Degang

- END -

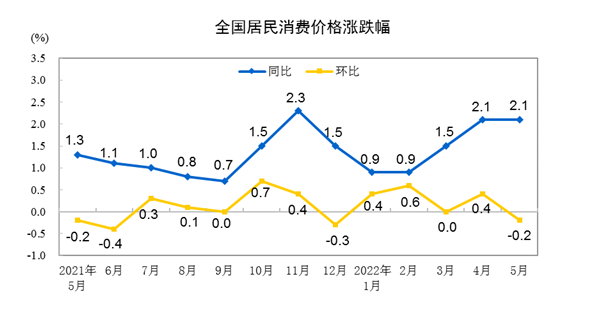

In May, the consumer prices nationwide rose by 2.1% year -on -year decreased by 0.2% month -on -mont

According to the National Bureau of Statistics, in May 2022, consumer prices acro...

The first docking activity of the "Ten Chain and Hundred Thousands of Thousands of Thousands" series in the province was held in our district

On the morning of the 14th, the first special session of the Ten Chain and Hundred Thousand Thousands of Thousands of Thousands of Thousands of Thousands of Thousands of Thousands of Thousands of Tho