Dongpeng Beverage Second shareholders have reduced the planned stock price than last year from last year

Author:Zhongxin Jingwei Time:2022.09.21

Zhongxin Jingwei, September 21 (Yan Shixin intern Chen Shiqing) After the unsuccessful reduction of holdings, the second shareholder of Dongpeng Beverage began the second round of reduction plans.

On the evening of the 20th, Dongpeng beverage announced that Tianjin Junzheng Investment Management Partnership (Limited Partnership) (hereinafter referred to as Junzheng Investment), due to its own capital needs, planned to reduce holdings by concentrated bidding transactions and large transactions. 12 million shares, which does not exceed 3%of the company's total share capital.

On the 21st, Dongpeng beverage opened low and walked down. As of the afternoon closing, it was reported at 134.19 yuan/share, down 2.75%.

Two shareholders intend to sell one -third of the shares

In this round of reduction plan, Junzheng Investment plans to reduce the shares holding one -third of the Dongpeng drink. The announcement shows that Junzheng Investment holds 36 million shares of Dongpeng Beverage, accounting for about 9%of the company's total share capital, all of which are the shares obtained before the company's IPO.

According to the prospectus of Dongpeng Beverage, on April 28, 2017, its predecessor Dongpeng Co., Ltd. and Junzheng Investment signed the "Shenzhen Dongpeng Beverage Industry Co., Ltd. Capital Increase Agreement". Equity. Immediately afterwards, Dongpeng Co., Ltd. Lin Muqin and Junzheng Investment signed the "Regarding the Equity Transfer Agreement on Shenzhen Dongpeng Beverage Industry Co., Ltd.", which agreed that Lin Muqin would increase the capital increase in 2017 (that is, the registered capital 1.51 1.51 1.51 The contribution of 100 million yuan) was 2.2623 million yuan, transferred to Junzheng investment for 52.5 million yuan, accounting for 1.5%of Dongpeng Co., Ltd.

Through the capital increase and transfer of actual controller old shares, Junzheng Investment received a total of 10%of Dongpeng beverages, and spent about 351 million yuan.

On May 27, 2021, Dongpeng Beverage was listed on the main board of the Shanghai Stock Exchange. For the first time, 10%of the shares were publicly issued. Junzheng Investment's holdings were diluted to about 9%, but it was still the second largest shareholder of Dongpeng beverage.

Based on the closing price of 137.98 yuan/share on September 20, the market value of the shares held by Junzheng Investment at the moment of Junzheng Investment is about 4.967 billion yuan, which is about 14 times the return. Essence

The Tianyancha APP shows that Junzheng Investment is a major shareholder of Anhui Jiahua Anyuan Investment Fund (Limited Partnership). The company was established in 2016 and is a member of Canada Capital. According to public reports, Jiahua Capital focuses on investment in China's large consumption and modern service industry, and has invested in dozens of consumer service industries such as food, plus soy sauce, Laidi, fellow chicken, and Barbie Food.

The stock price has fallen by more than 25% since this year

It is worth mentioning that this is not the first disclosure of Junzheng's investment to disclose a reduction plan for Dongpeng drinks.

On May 27 this year, the Dongpeng Beverage shares held by Junzheng Investment ushered in a lifting of the ban. As early as two days ago (May 25), Junzheng Investment had issued the "Reference to the Holding Plan" to the Dongpeng drink, At that time, it was also planned to reduce the holding of one -third of the shares, that is, no more than 12 million shares. On the day of lifting the ban, Dongpeng beverage announced this.

However, until the expiration of the planning period (June 20th to September 18th), Junzheng Investment did not reduce the holding of Dongpeng drink any shares. In this regard, Dongpeng Beverage explained in the announcement that this is the result of comprehensive investment in Junzheng Investment and the reduction of holdings of holdings.

However, on September 20, Dongpeng Drink disclosed the second round of holdings of Junzheng Investment. As soon as the ban is lifted, the holdings must be reduced. After the reduction of the holdings is unsuccessful, they will start the second round of reduction plan. In addition to their own capital needs, is there any other consideration of Junzheng Investment?

Public information shows that the main business of Dongpeng beverage is the development, production and sales of beverages, and its leading product Dongpeng special drink. Familiar with consumers. Among them, Dongpeng Special Drink ranked second in the domestic energy beverage market, second only to Red Bull.

According to Wind data, in the first half of 2021, Dongpeng beverage revenue and net profit attributable to mother had greatly increased by 49.11%and 53.14%, respectively. However, in the first half of this year, the related growth rate slowed down significantly. Data show that in the first half of 2022, Dongpeng beverage achieved operating income of 4.291 billion yuan, an increase of 16.54%year -on -year; the net profit attributable to mothers was 755 million yuan, an increase of 11.66%year -on -year; the net cash flow generated by operating activities fell 39.52 year -on -year by 39.52 %.

Among them, in the first quarter of 2022, the net profit of Dongpeng beverages increased by only 0.81%, and the deduction of non -net profit fell 1.60%compared with the same period of the previous year.

On the other hand, since the stock price of Dongpeng beverage in early July 2021 set a peak of 285.70 yuan/share, there has been no breakthrough. On May 10 this year, its stock price once explored 111.35 yuan/share. As of the afternoon of September 21, Dongpeng beverage reported at 134.19 yuan/share. Since this year, a total of 25.38%has been reduced, compared with the peak value of early 2021, a decline of 53.03%.

However, according to recent research reports of Galaxy Securities, with the improvement of the fee control in the second quarter of 2022 and the accelerated sinking channels, the profitability of Dongpeng beverage has improved slightly, and its performance growth and growth are still in the industry. More scarce.

Southwest Securities also mentioned that raw materials increased the short -term performance of Dongpeng beverage. The company is still in the national expansion stage and still has the potential in the north and North China regions.(For more report clues, please contact the author of this article: [email protected]) (Zhongxin Jingwei APP) (The viewpoint in the article is for reference only, does not constitute investment suggestions, investment is risky, and you need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Editor in charge: Luo Yan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

The country shot!You can eat it next month

Source: CCTV Finance, CCTV News ClientThe copyright belongs to the original author, if there is any infringement, please contact it in timeGovernment pork reserves are here!According to the National D

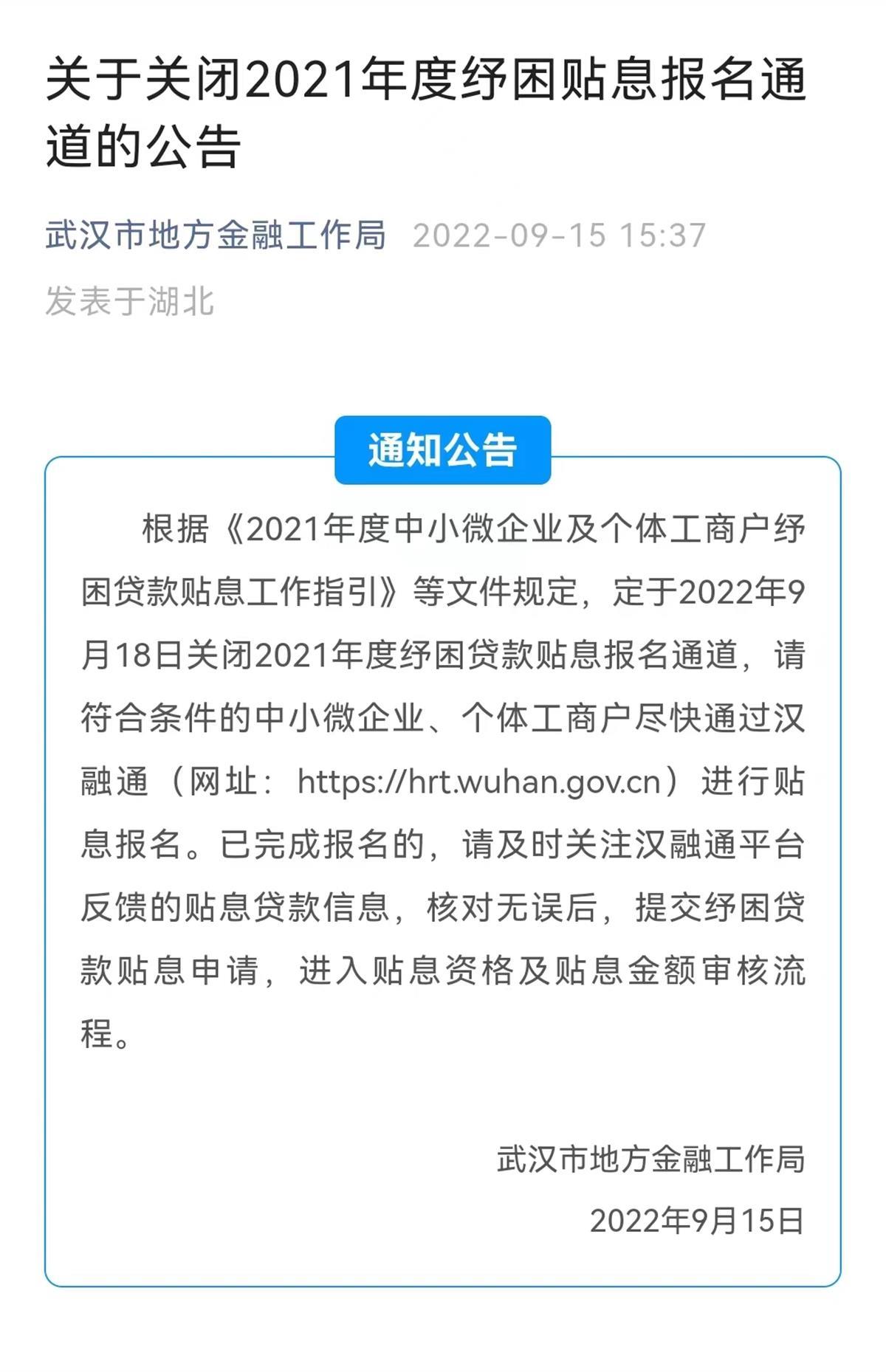

remind!Han Rongtong's 2021 relief and discounted registration channel is about to be closed

Jimu Journalist Chen HongJimu Journalists learned from the Wuhan Local Financial W...