The price of new houses in the country has rebounded 11.4%, Beijing and Shanghai are rising, Zhengzhou and Harbin are still falling.

Author:China Economic Weekly Time:2022.09.21

"China Economic Weekly" reporter Sun Tingyang

In August, new residential sales nationwide were still weak.

The National Bureau of Statistics recently announced the changes in residential indexes in 70 large and medium -sized cities in August.

The average sales price in August was almost the same as that in July. Data show that the average sales price of new housing in August in the country was 10,774 yuan/square meter, which increased by 8 yuan per square meter from July, which was basically the same. Beginning in April, the average sales price of newly built nationwide began to rebound, and the price in August was 11.4%higher than April. But compared with the high level in early 2021, it is still 4%lower.

Source of the average price trend of new housing in the country: National Bureau of Statistics

Sales and sales area in August decreased by more than 20%year -on -year

The new residential sales data released by the State Bureau of Statistics directly adopts the online signing data of the local real estate management department, covering all the transactions of the newly -built commercial housing, including detailed information such as address, floor, price and amount. It has complete data, complete information, complete information , Get the advantage of convenience.

The willingness to buy a house is still not strong. The cumulative personal mortgage loan in the first eight months of this year was 1.62 trillion yuan, a new low since 2019. This value is 7%, 14%, and 24%lower than in the same period of 2019, the same period of 2020 and the same period of 2021.

The sales area and sales area of new residential residentials in August increased slightly compared to July, but compared with the previous years, it still declined sharply.

In August, the national sales of new residential buildings were 896 billion yuan, an increase of 3.6%over July, but it was still a new low in the same period in the past five years. Compared with August 2020 and August 2021, it decreased by 36%and 21%, respectively.

In August, the new residential sales area was 83.16 million square meters, an increase of 3.56%over July.

The micro -sales data of the real estate company shows a consistent trend with the macro data statistics from the State Statistics Bureau.

Among the top 5 real estate companies in 2021, except for China Evergrande (3333.HK), the sales data of the other four companies were declining. Sunac China (1918.HK), Country Garden (2007.HK), Poly Development (600048.SH) and Vanke (000002.SZ). The sales of 4 companies in August decreased by 76%, 36%, 18%and 18%and 18%and 18%. 16%.

The largest decline in Sunac China, the cumulative sales in the first eight months of this year decreased by 68%compared with the same period last year. The sales in the first eight months of this year are 20%less than the sales of the first 4 months of last year.

China Evergrande, who did not disclose sales data, would try to protect the building. Evergrande Group's official WeChat disclosed on September 12 that Evergrande Group held a re -production and re -production and insurance delivery week conference. Xu Jiayin said at the meeting that 668 projects have reached normal construction level, and 62 and 62 In the process of restoring normal construction, it is required that companies in relevant areas must all reach the normal construction level before September 30.

Weak sales, real estate companies are not active.

In the first eight months of this year, the land transaction price decreased by 42.5%year -on -year to 381.9 billion yuan, close to the cut. This is a new low of land transactions in the same period (after 2010) in the past 12 years (after 2010). In the first eight months of 2018, the land transaction price reached 817.7 billion yuan, which was more than double the same period this year.

Photography: "China Economic Weekly" Chief Photography Reporter Xiao Yan

Most third -tier cities have fallen in the past year in the past year

What is the change in price changes in new buildings and second -hand houses in various cities?

In August, the price of new commercial housing was close to July, but of 70 large and medium cities, there were 50 cities with declined new commercial housing prices, and 56 cities with declined sales prices in second -hand housing.

First look at the newly built house. Among the 70 large and medium cities, the number of newly -built commercial housing has declined, the number of cities with flatness and rising rises is 50, 1, and 19, respectively. The top 3 cities are Shanghai, Hangzhou and Beijing, with more than 0.4%. Wuhan, Chongqing, and Hohhot are the top three of the provincial capital cities, down 1.3%, 1.1%, and 1%respectively.

Look at the second -hand room. Among the 70 large and medium cities, the sales prices of second -hand residential houses have declined, flat and rising, respectively 56, 1, and 13, respectively. The top 3 cities are Nanjing, Chengdu and Shanghai, and the rise is more than 0.5%. Harbin, Shenyang, and Nanning are the leading provincial capitals, and their declines have exceeded 0.8%.

It can also be seen from the above data that the prices of newly built and second -hand houses in Shanghai are rising.

Relevant personnel of the National Bureau of Statistics interpreted the data on September 16 that in August, the sales prices of new commercial housing and second -hand residential housing in third -tier cities decreased by 3.7%and 4.2%year -on -year, respectively, and the decline expanded from last month.

The decline in new and second -hand housing in third -tier cities also exceeds first -tier cities and second -tier cities.

The National Bureau of Statistics explained that the first -tier cities of 70 large and medium -sized cities refer to 4 cities in Beijing, Shanghai, Guangzhou and Shenzhen; second -tier cities refer to 31 cities including Tianjin, Shenyang, Dalian, Jinan, Qingdao and Urumqi; third -tier cities refer to Tangshan and Qinhuangdao , Baotou, Dandong and Dali 35 cities.

In August this year, in August last year, only new residential prices in Sanya, Ganzhou and Wuxi in the third -tier cities rose, rising by 1.4%and 1%and 0.5%, respectively. All other 32 cities have fallen. Beihai, Zhanjiang, and Yueyang were the top three of the decline, decreased by 10.1%, 8.9%, and 7.1%, respectively. Cities with more than 5%include 6 cities in Dali, Luzhou, Qinhuangdao, Changde, Nanchong and Xiangyang. Let's look at the second -hand housing price index of third -tier cities.

Compared with August last year, only in the third -tier cities, only the price indexes of second -hand housing in Ganzhou and Wuxi rose by 0.7%and 0.5%, respectively. All other 33 cities have fallen. Mudanjiang, Jilin, and Beihai were the top three of the decline, decreased by 10.7%, 6.8%, and 6.5%, respectively. Cities with more than 5%include Luoyang, Anqing, Yichang, Quanzhou, Jinhua, Changde, Zhanjiang, Dali and Xiangyang.

Since the beginning of this year, some cities have loosened real estate regulation policies. Zhengzhou was the first provincial capital to relax the price limit. At the end of February, Zhengzhou issued the "Notice on Promoting the Patient Circle and Healthy Development of the Real Estate Industry", which relaxed the purchase restrictions in disguise, and measures such as price limit and loan restrictions also relaxed.

The prices of Zhengzhou new houses and second -hand houses are still declining.

Zhengzhou's new residential prices and second -hand housing prices decreased by 0.4%and 0.8%respectively from July. Compared with February this year, Zhengzhou's newly -built commercial residential price index fell by 1.39%in August. The price of second -hand housing in Zhengzhou decreased a greater decrease, a decrease of 2.83%at the same time.

After Zhengzhou, Harbin loosen the purchase restriction policy in March.

Harbin's new residential prices and second -hand housing prices decreased by 0.5%and 0.9%respectively from July. From February to August this year, in the provincial capital cities, Harbin's second -hand house has decreased the largest and decreased by 4.99%. The new residential price index in Harbin decreased by 3.03%at the same time. Among the provincial capital cities, only Wuhan (-3.69%) and Lanzhou (-3.34%) fell more than Harbin.

Responsible editor | Guo Yiyao

- END -

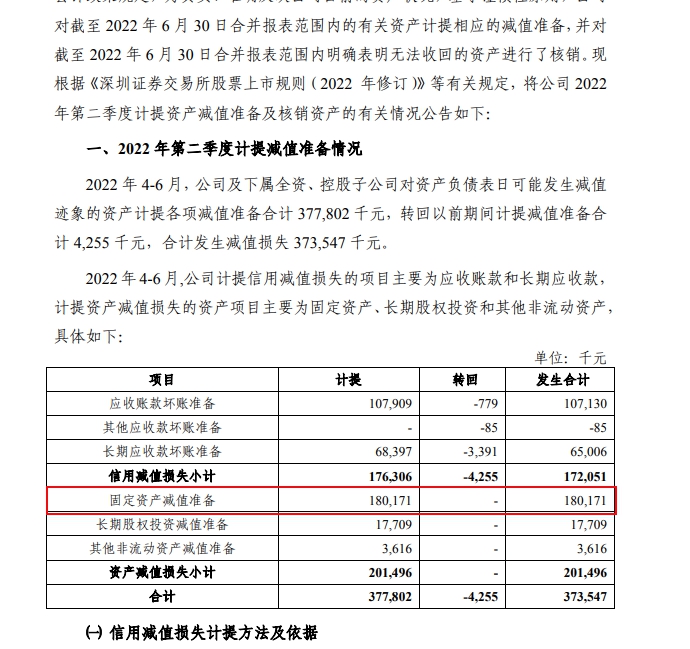

V Observation Financial Report | Bohai Leasing for the second quarter measurement of impairment of 374 million

Zhongxin Jingwei, September 2nd. Bohai Leasing Co., Ltd. (hereinafter referred to ...

Shijiazhuang City adjusts the minimum payment base of urban employees' medical insurance to implement at 71463 yuan from July 1

On June 30, the three departments of the Shijiazhuang Medical Security Bureau, the Finance Bureau, and the Taxation Bureau jointly issued the Notice on Adjusting the Minimum Payment Base of the Basic