Every time it goes, it will be known (evening version) 丨 north to the capital outflows exceeds 3 billion, and Maotai has also sold over 800 million; Tianqi Lithium Industry plans to repurchase shares; follow the Federal Reserve's September Intersection Conference

Author:Daily Economic News Time:2022.09.21

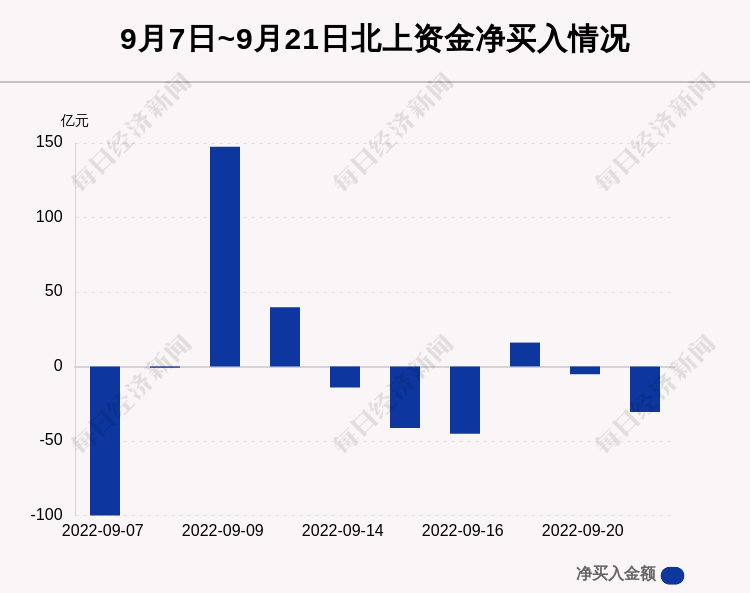

On September 21, the Shanghai Index fell 0.17%. Northern Fund sold 30.60 billion yuan today. Among them, the Shanghai Stock Connect was sold 2.473 billion yuan, and the Shenzhen Stock Connect was sold for 587 million yuan.

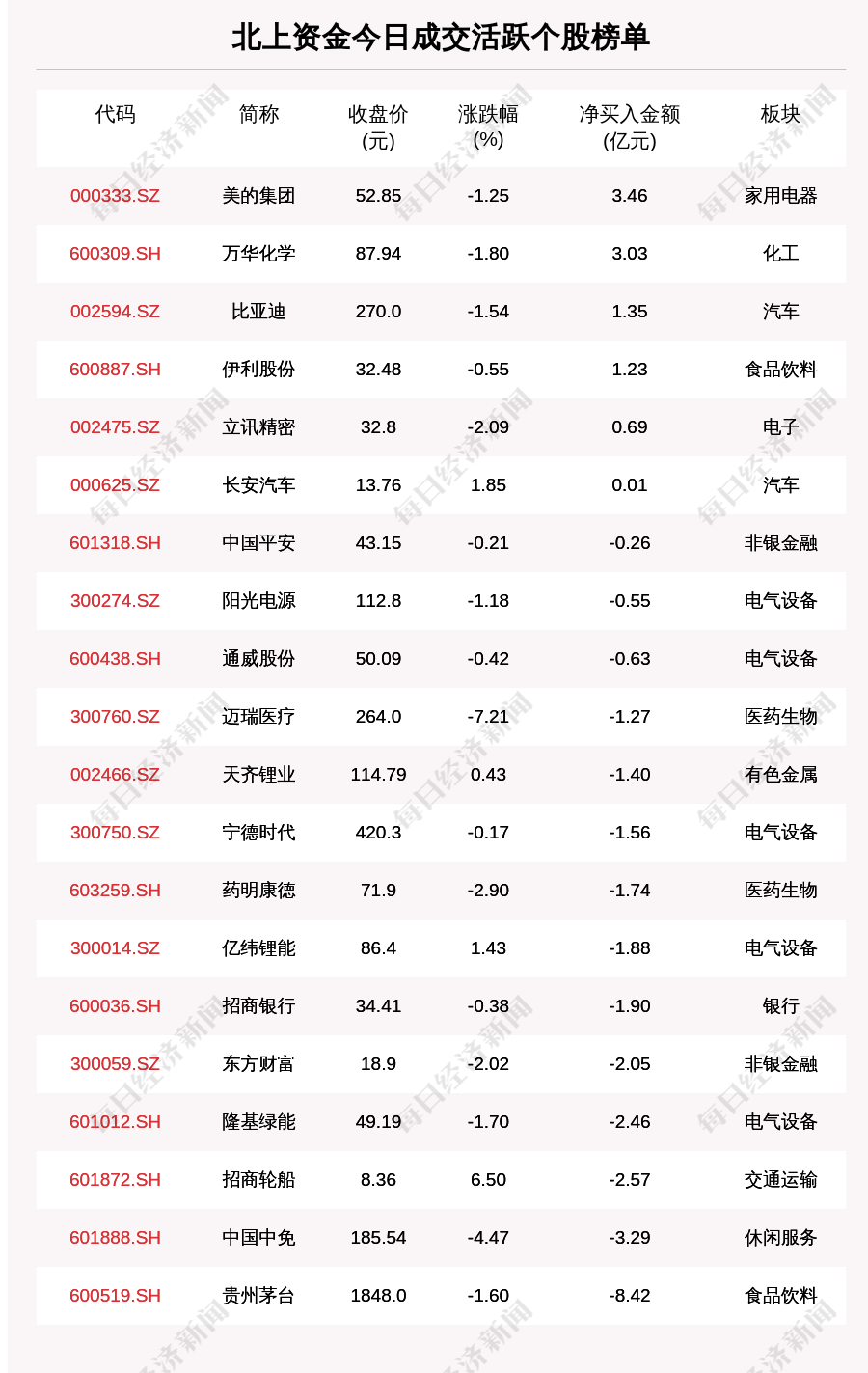

On September 21, in the list of active stocks of the capital transaction, there were 6 net stocks in a total of 6 stocks, and the most amounts were Midea Group (000333.SZ, closing price: 52.85 yuan), net purchase 345.9 billion yuan; net sell There are 14 individual stocks, and the largest amount is Guizhou Maotai (600519.SH, closing price: 1848.0 yuan), and sold 842.3 billion yuan.

On September 21, a total of 36 stocks were on the list of the Dragon and Tiger List. The sea oil development dragon and tiger list had the largest number of net buyers, reaching 100 million yuan.

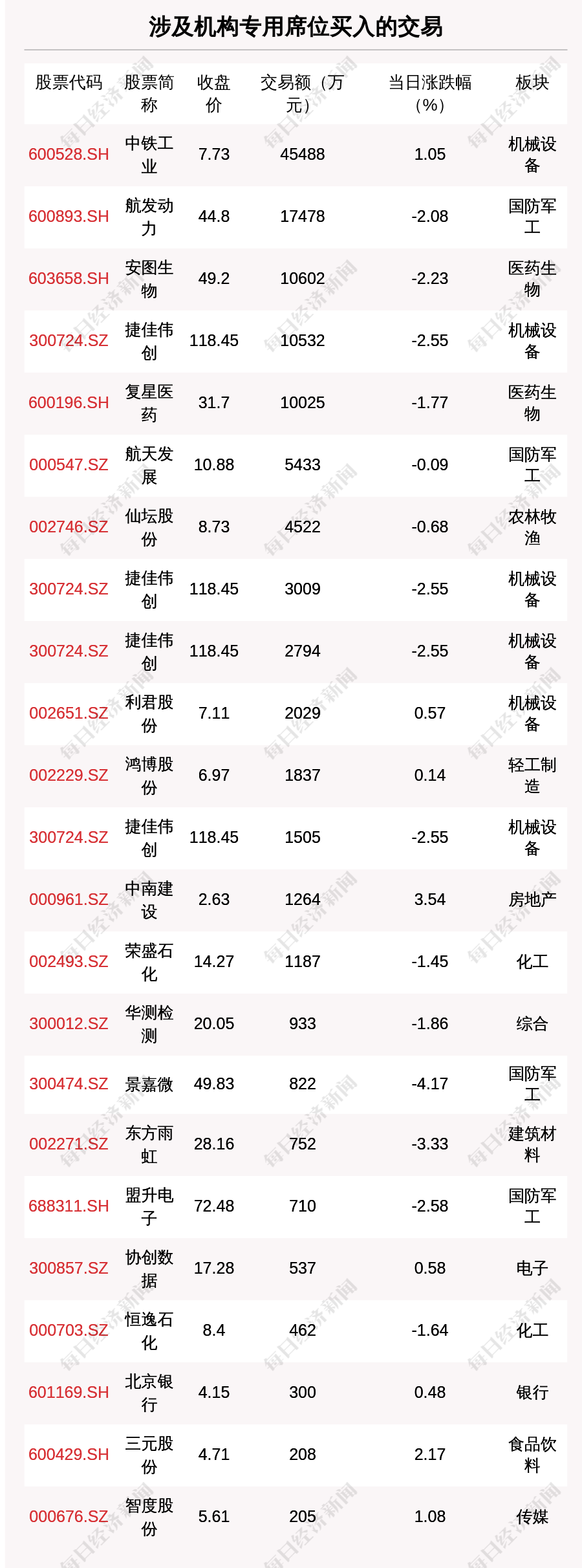

In the Dragon and Tiger List, there are 27 stocks involving a special seat in the institution. The top three of the net purchase are tin -loaded shares, Qixia Construction, and East China heavy machines, which are 92.733 million yuan, 34.892 million yuan, and 22.4246 million yuan, respectively.

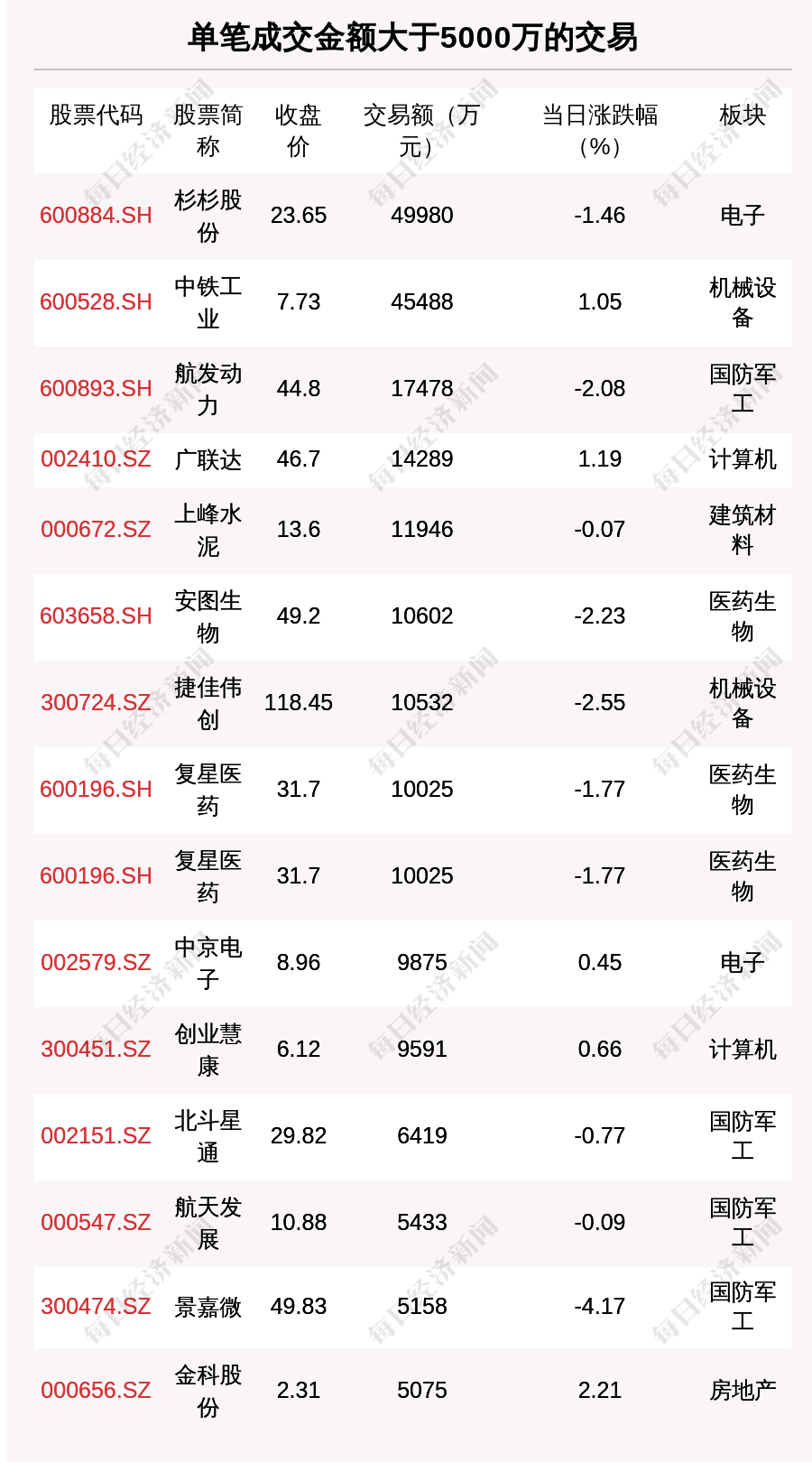

On September 21, 2022, a total of 111 large transactions occurred in Shanghai and Shenzhen, with a total of 3.319 billion yuan, involving 84 listed companies.

Kaig Jing (301338.SZ) said on the investor interactive platform on September 21 that the company focuses on the research and development and manufacturing of precision automation equipment. The product application industry and field are wider (including the new energy industry), but the company does Related technologies in the field of new energy power replacement.

New Shida (002527.SZ) said on the investor interactive platform on September 21 that as of September 21, the company and company subsidiaries Shanghai Xinshida Robotic Company, Shenzhen Zhongwei Xing Technology Co., Ltd., Hangzhou Shanzhi Control Technology Co., Ltd. and Shanghai Singglinga New Shida Electric Co., Ltd. belong to the "specialized new" enterprise.

Jingyuntong (601908.SH) said on the investor interactive platform on September 21 that the existing production capacity of the first phase of our Wuti Sea was about 8.5GW, and the single crystal furnace of Wuhai can currently be used to produce 182mm or above silicon wafers. Our company can currently produce a silicon rod of 8 inches and below.

Four vitamin Xin (002405.SZ) said on the investor interactive platform on September 21 that Jiefa Technology has more than 130 registered patents at home and abroad. , Smart robots, unmanned planes, etc. The company will continue to actively invest in new automotive electronic chip products.

Chifeng Gold (600988.SH) stated on the investor interactive platform on September 21 that Vientiane Mining is currently undergoing further exploration and development preparations for rare earth resources in the mining area, and strategic cooperation with Xiamen tungsten industry is promoting as planned. The company will disclose resource exploration and strategic cooperation in a timely manner according to the information disclosure rules.

Jiahua (603182.SH) said on the investor interactive platform on September 21 that soy protein is a very important plant meat processing raw material. Soy protein provides products and technical services in the field of plant meat processing.

Asia Pacific Technology (002540.SZ) said on the investor interactive platform on September 21 that the company's main products are high -performance precision aluminum pipes, special profits and high precision sticks based material.

Wanshun New Materials (300057.SZ) said on the investor interactive platform on September 21 that the battery aluminum foil production and sales situation is requested to pay attention to the regular report of the company. The 10,000 -ton project is stepping up construction. It is planned to be put into production next year.

Anxian Detection (300572.SZ) On September 21st on the investor interactive platform, the company's "intelligent connected car safety testing solution" was applied to emerging fields such as smart transportation and smart cities to promote testing technology in the field of intelligent transportation. Application practice.

Disai Battery (000049.SZ) said on the investor interactive platform on September 21 that the company is mainly engaged in the power management and packaging business of lithium batteries. Products are widely used in smartphones, laptops, smart wearable devices, electric tools, energy storage energy storage On terminal products such as new energy vehicles, the proportion of new energy vehicle power batteries related to the company's revenue is very low.

Tianqi Lithium (SZ 002466, closing price: 114.79 yuan) issued an announcement on the evening of September 21st that it is intended to repurchase the company's issued public shares (A shares) to repurchase the company's issued by the Shenzhen Stock Exchange trading system through the Shenzhen Stock Exchange trading system Essence The repurchase shares will be used for employee shareholding plans. The total amount of this repurchase funds is not less than RMB 136 million (inclusive) and no more than RMB 200 million (inclusive). The price of this repurchase shares does not exceed RMB 150/share (inclusive). The upper limit of the repurchase price does not exceed the company's board of directors to review and pass the company's average stock transaction price of the company's stock transaction on the previous 30 trading date. The implementation period of this repurchase shares is within 12 months from the company's board of directors to review and approve the repurchase plan.

Zhongke Shuguang (SH 603019, closing price: 24.36 yuan) issued an announcement on the evening of September 21st that the company's shareholders Beijing Zhongke Beatsyuan Asset Management Co., Ltd. was implemented, and the company's shares were reduced by about 29.28 million shares during the period, and the reduction of 29.28 million shares of the company's shares was reduced. Holding the shareholding of the company's total shares is 2%. From January to June 2022, the operating income of China Science and Technology dawn was: 44.74%of the government, 39.38%of small and medium -sized enterprises, and 15.86%of public undertakings. New Zealand (SZ 300037, closing price: 41.29 yuan) issued an announcement on the evening of September 21st that New Zealand issued convertible corporate bonds to unspecified objects. The total amount of funds raised by the intended to issue convertible bonds was 1.97 billion yuan, and the number of issuances was 19.7 million. Within five trading days after the expiration of the conversion company's bond period, the company will redeem the unpopular convertible corporate bonds at a price of 110%of the face value of the bond. The first trading day of the convertible bonds issued from the end of the convertible bond issued this time from the end of the end of the end of the convertible bond to the expiration date of the convertible bond. The initial conversion price of convertible corporate bonds issued this time is 42.77 yuan/share.

Kaipu Bio (SZ 300639, closing price: 18.15 yuan) issued an announcement on the evening of September 21st, saying that on September 21, 2022, the company held the second meeting of the 5th board of directors and the second session of the fifth session The item reviewed and approved the "Proposal on Buying Company Shares in a concentrated bidding transaction", and independent directors expressed independent opinions on the consent of the shares' repurchase. The total amount of funds repurchased this time is not less than RMB 50 million (inclusive), and does not exceed RMB 100 million (inclusive). The total amount of repurchase funds is subject to the total amount of funds used in the actual repurchase of shares when the repurchase period expires. The repurchase price does not exceed RMB 25/share (inclusive). The repurchase period is not more than 12 months from the date of reviewing and approved the shareholders' meeting.

Chuanyi (SH 603100, closing price: 25.34 yuan) issued an announcement on the evening of September 21st, saying that on September 19, 2022, Chongqing Chuanyi Automation Co., Ltd. held the seventeenth meeting of the 5th board of directors for review and approval " A proposal about Chuanyi Co., Ltd. repurchase the company's shareholding plan with a concentrated bidding transaction. " The shares repurchased this time are used for equity incentive plans. The total amount of repurchase funds is not less than 62 million yuan (inclusive), and no more than 124 million yuan (inclusive) The price of the company's repurchase shares is not more than 31.3 yuan/share, and it has not exceeded the board of directors to pass the repurchase of 30 transactions before the resolution of the repurchase shares. The average stock price of the company's stock is 150%. The repurchase period does not exceed 12 months from the date of reviewing the company's board of directors to adopt the repurchase share plan

Jinbo (SH 688598, closing price: 289.54 yuan) issued an announcement on the evening of September 21st, saying that on September 15, 2022, the company held the eleventh meeting of the third board of directors to review and approve the "Regarding concentrated bidding transactions with centralized bidding transactions Method to repurchase the company's share plan ". The shares repurchased are intended to implement employee holdings or equity incentive plans. The total amount of repurchase funds is not less than RMB 100 million (including), and does not exceed RMB 200 million (inclusive); the repurchase price does not exceed RMB 400/share (inclusive). The average company's stock transactions on the previous 30 trading days were 150%of the company's stock transactions; the repurchase period was within 6 months from the date of reviewing and approved the repurchase plan;

Double Star New Materials (SZ 002585, closing price: 17.44 yuan) issued an announcement on the evening of September 21st that about 50.47 million shares of Jiangsu Double Star Color New Materials Co., Ltd. (accounting for 4.37%of the company's total share capital) Wu Di The total shares of the company held by the concentrated bidding method and the transaction method of the community did not exceed 12.61 million shares held, not more than 1.09%of the company's total shares. During the disclosure of this announcement, within six months of the disclosure of this announcement, the holding of the holdings within six months after the trading day was concentrated, or the disclosure of the disclosure of this announcement should be reduced by six months after three trading days. hold.

Fenida Technology (SZ 002681, closing price: 3.78 yuan) issued an announcement on the evening of September 21st that Shenzhen Gada Technology Co., Ltd. recently received the company's controlling shareholder Xiao Fen. Xiao Wu's notice learned that he had a total of more than 1%in total from February 18, 2022 to September 20, 2022. The company's shareholders Xiao Wenying, Xiao Yong, and Xiao Wu reduced the company's shares of about 25.243 million shares from February 18, 2022 to September 20, 2022, with a reduction of 1.38%.

ST Oma (SZ 002668, closing price: 5.51 yuan) issued an announcement on the evening of September 21 that the shares of Guangdong Oma Electric Co., Ltd. will start the market for one day on September 22, 2022 (Thursday), and on 2022, 2022 On September 23 (Friday), the market will be resumed. The company's shares have revoked other risk warnings from the market on September 23, 2022. The stock abbreviation will be changed from "ST Oma" to "Oma Electric", and the stock code will still be "002668".

Cutting -edge creatures (SH 688221, closing price: 13.43 yuan) issued an announcement on the evening of September 21 that after the issuance was completed, the number of new shares of the company was about 14.82 million shares, the issuance price was 13.51 yuan/share, and the total amount of funds raised was about 200 million yuan Yuan. There are 7 targets in this issuance, all of which have participated in the subscription with cash. All issued shares subscribed for all issuances shall not be transferred within six months from the end of the issuance. Digital Zhengtong (SZ 300075, closing price: 14.42 yuan) issued an announcement on the evening of September 21st that Beijing Digital Zhengtong Technology Co., Ltd. intends to use its own funds to repurchase some company shares in a centralized bidding transaction for employees to implement employees Holding plan and/or equity incentive. The total amount of funds for this repurchase is not less than RMB 50 million (including) and no more than RMB 100 million (inclusive), and the repurchase price does not exceed RMB 23/share (inclusive). According to the upper limit of the total amount, the total number of shares can be repurchased is about 4.3478 million shares, accounting for about 0.86%of the current total share capital of the company; according to the total lower limit of the total amount, the total number of shares can be repurchased will be about 2.1739 million shares, accounting for about the company's current total share capital 0.43%. The implementation period of this repurchase shares will not exceed 12 months from the date of reviewing and adopting the repurchase share plan.

Haizheng Pharmaceutical (SH 600267, closing price: 10.26 yuan) issued an announcement on the evening of September 21 that the company repurchased shares were planned to be used for subsequent implementation employee holding plans. The total amount of funds repurchased this time was not less than RMB 1 1 1 The price of this repurchase shares of the company's repurchase of 100 million yuan and no more than RMB 195 million is not more than RMB 13/share (inclusive). 150%. The repurchase period is within 12 months from the date of reviewing the repurchase plan and adopting the repurchase plan.

Kangtai Biological (SZ 300601, closing price: 30.33 yuan) issued an announcement on the evening of September 21st, saying that on September 21, 2022, the company first repurchased the company's shares to repurchase the company's shares by concentrated bidding transactions through the share repurchase of special securities accounts. The proportion of the company's total share capital is 0.06%, the highest transaction price is 30.68 yuan/share, the minimum transaction price is 29.85 yuan/share, and the total transaction amount is about 18.69 million yuan.

Longjin Pharmaceutical (SZ 002750, closing price: 9.83 yuan) issued an announcement on the evening of September 21st that the company's shareholders Lixing Industrial Co., Ltd. reduced its holdings of about 40.354 million shares on September 20, 2022, with a reduction of holdings to a reduction of the holdings to the holding of the holdings to a reducing holding ratio to a reducing holding ratio to a reducing holding ratio to a reducing holding ratio to a reducing holding ratio to a reducing holding ratio to to 1%. From January to June 2022, the operating income of Longjin Pharmaceuticals was: 90.94%of drug sales, 8.66%of the planting industry, and 0.4%of other industries.

Yonghui Supermarket (SH 601933, closing price: 3.38 yuan) issued an announcement on the evening of September 21st that Yonghui Supermarket Co., Ltd. held the third meeting of the fifth board of directors on August 8, 2022 to review and approve the "About About About "A proposal to repurchase the shareholding plan in concentrated bidding transactions", the company decided to use its own funds to not be less than RMB 400 million (inclusive), not more than RMB 700 million (inclusive), and at a price of no more than 5 yuan/share. Put the share repurchase, from August 8, 2022 to August 7, 2023. On September 21, 2022, the company repurchased the company's shares for the first time through a concentrated bidding transaction through a share repurchase securities account, accounting for 0.02%of the company's total share capital. The highest transaction price was 3.39 yuan/share, and the minimum transaction price For 3.35 yuan/share, the total amount paid is about 6.52 million yuan.

Jin Hong Gas (SH 688106, closing price: 21.8 yuan) issued an announcement on the evening of September 21st that the type of this securities was converted into convertible corporate bonds for the company's A -share shares. The A -share shares that can be convertible and future conversion will be listed on the Shanghai Stock Exchange Science and Technology Board; the total amount of convertible corporate bonds will not exceed RMB 1.016 billion (including 1.016 billion yuan); this issuance The period of convertible corporate bonds is six years from the date of issuance; the specific issuance method of this convertible corporate bond shall be determined by the company's shareholders 'meeting with the company's shareholders' meeting and the sponsor (main underwriter). The issuance target of the convertible corporate bonds is the natural person, legal person, securities investment fund, and other investors who hold the securities account of Shanghai Branch of China Securities Registration and Clearance Co., Ltd..

① As of 20:01 Beijing time, the three major indexes in the US stocks rose and declined. The Dow of futures rose 0.21%, the S & P 500 Index futures rose 0.15%, and the NASA futures fell 0.04%. Shangbo Digital (HKD, a stock price of US $ 72.5, a market value of US $ 13.416 billion) U.S. stock market rose in front of the US stock market, an increase of over 12%.

② As of press time, WTI crude oil rose 2.24%to $ 85.86/barrel, and Brent crude oil rose 2.21%to $ 92.55/barrel.

③ According to CCTV News, on September 21, local time, Russian President Putin delivered a video speech and announced some mobilization. Russian Defense Minister Shoygu said on the 21st that part of the current mobilization does not involve college students, and the compulsory soldiers will not be sent to the front line. The mobilization is expected to recruit 300,000 reserve personnel.

④ Schneider Electric (SU, the stock price is 115.9 euros, and the market value of 66.281 billion euros) issued a statement stating that the company agreed to acquire a minority equity of the British Industrial Software Company Aveva Group PLC at a price of 31 pounds per share. The transaction has a valuation of Jianwei Software 9.5 billion pounds. At present, Schneider has held 59.14%of Jianwei Software; according to transaction terms, Schneider will pay about 3.87 billion pounds to acquire the remaining equity. ⑤ According to Bloomberg, Germany will acquire all shares of Finnish energy company Fortum at the natural gas giant Uniper (UN01, 2.69 euros, and a market value of 1.533 billion euros) for a 1.7 euro/share price.

⑥ Amazon (AMZN, a stock price of US $ 12.2.19, a market value of 1.24 trillion US dollars) announced that it has implemented 71 new renewable energy projects worldwide, including the first project in Brazil, India and Poland.

According to the Korean media Edaily, Samsung Electronics Vice President Li Zaiyu said that about the acquisition of the British chip design company ARM, SoftBank Group (9984, 5453 yen, a market value of 9.395 trillion yen) may be Visit Shouk next month.

⑧ Morgan Chase (JPM, a stock price of $ 115.83, a market value of US $ 339.68 billion): It is estimated that by 2025, Apple (AAPL, a stock price of $ 156.9, a market value of US $ 2.52 trillion) may transfer one -quarter iPhone production to India.

, Citi Group (C, a stock price of $ 47.25, a market value of 91.51 billion US dollars): It is expected that the Fed will raise interest rate hikes 75 basis points to increase the interest rate of federal funds to 3.00%~ 3.25%. It is necessary to focus on the dot -matrix map and economic forecast of the Federal Reserve. The federal fund interest rate in the economic prediction abstract is still significantly higher than the expected hawk risk in June. It is expected that the dotted line map will show that the federal fund interest rate is medium to the end of 2022. It will rise to 4.0%~ 4.25%, and will rise to about 4.5%in 2023.

美 At 2:00 Beijing time, the Fed issued a statement of the FOMC interest rate resolution and quarterly economic expectations for the September FOMC interest rate; Beijing time at 2:30 Federal Reserve President Powell held a routine press conference.

Daily Economic News

- END -

Xiaomi's second president was officially approved.

Huaxia Times (chinatimes.net.cn) reporter Fu Le Ran East Beijing reportChongqing X...

Data said | Expenses digital economy, how can these two cities in Shandong overtake?

In the 2022 Shandong 16th city digital economy development activity index list joi...