Global breathing!The Federal Reserve issued a resolution in the early morning. The probability of rating 75 bases at a rate hike was as high as 80 %. The Dow rose 113 points.

Author:Daily Economic News Time:2022.09.21

The Fed will issue a resolution at 2 am on September 22, Beijing time, and the market is expected to reach more than 75 basis points.

Picture source: Federal Reserve website

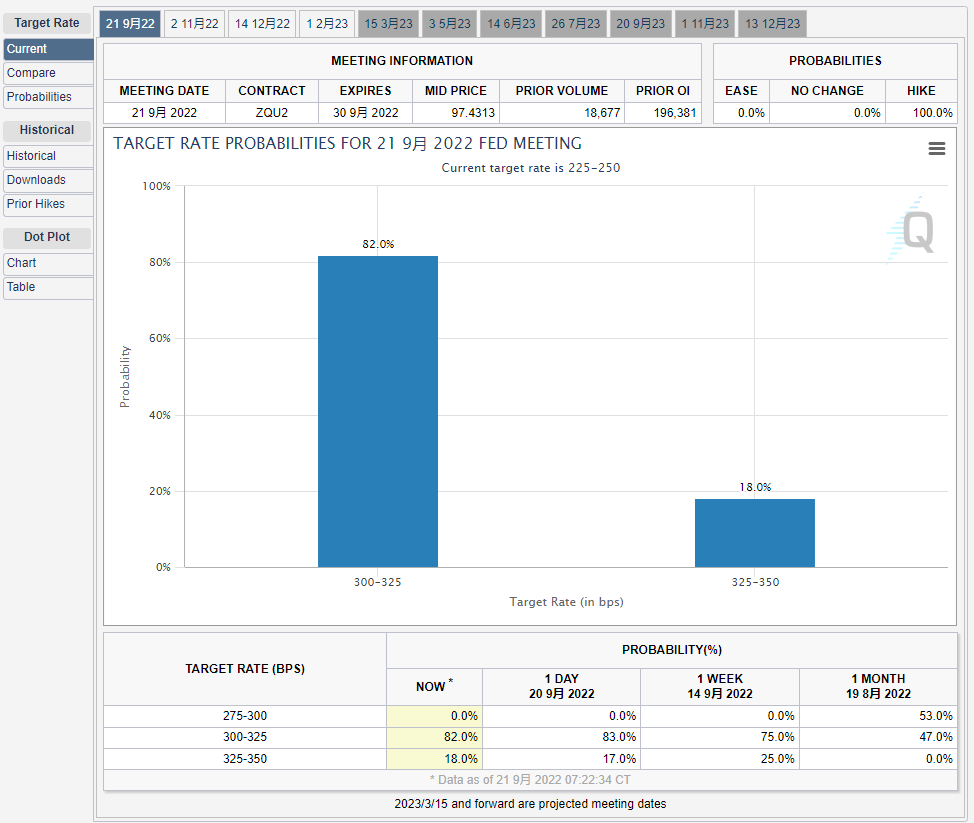

As of press time, data from the CME Fedwatch tool show that the possibility of 75 basis points in September is 82 %, and the possibility of 100 basis points in interest rate hikes is 18 %.

Image source: CME Fedwatch Tool

Affected by this, the US stocks opened slightly, and the Dow rose 113.16 points, an increase of 0.37%to 30819.39 points; the S & P 500 index rose 15.47 points, an increase of 0.40%to 3871.4 points; point.

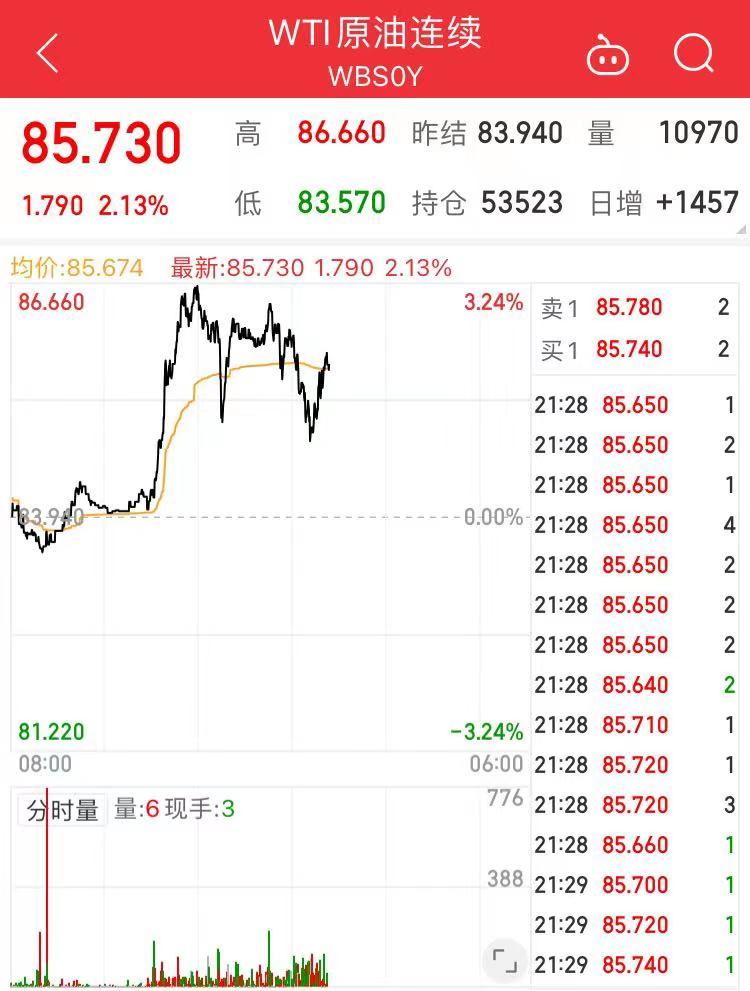

In addition, as of press time, the US dollar index rose 0.50%to 110.77, and it continued to brush a new high since June 2002. The short -term gold rose more than $ 12 to $ 1683.2/ounce. WTI crude oil futures rose 2.13%to $ 85.73/barrel. Brent crude oil futures rose 2.01%to $ 92.44/barrel.

Where is the end of the interest rate hike? Where does the September line map go?

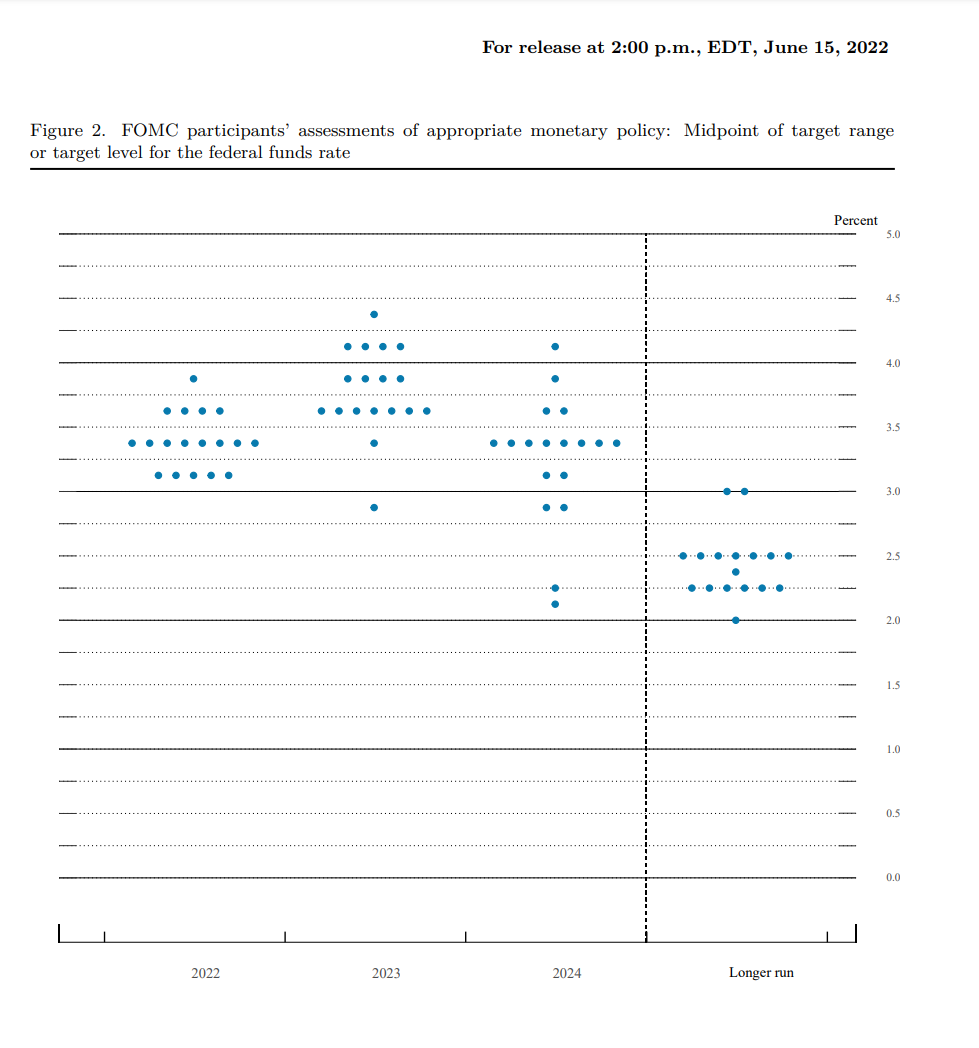

According to the surging news report, the dot-matrix chart in June shows that FOMC's median expectations for federal funds in the end of 2022 and 2023 are expected to be 3.25%-3.5%and 3.5%-3.75%, respectively. If the interest rate hike is 75 basis points in September, the federal fund interest rate will rise to a range of 3%-3.25%.

Picture source: Federal Reserve website

Wang Jinbin, executive deputy secretary and deputy dean and professor of the Party Committee of the School of Economics of Renmin University of China, said that the future or next year's interest rate hike path will be clearly seen by the end of this year. The market generally expects that the end of this year's interest rate hike will be at least 4%.

Huatai Securities stated that the September FOMC Federal Officer (voting) dot -matrix map was expected to be further increased from June in the end of 2022 and at the end of 2023. After this interest rate meeting, the federal fund interest rate may reach 3%-3.25%, while the pace of interest rate hike may not stop in November, December, and in the first half of next year. Looking forward, the Fed may still raise interest rates by 50-75 basis points in November.

China Gold Macro stated that the Fed may fulfill its promise of anti -inflation through strengthening expectations of interest rate hikes, weakening interest rate cuts, and upward inflation forecasting. The Fed needs to maintain the same words and deeds. The actions of too much pigeon will be interpreted as "chaotic communication". It is expected that the medium value of the federal fund interest rate at the end of this year will rise to more than 4%, close to 4.5%next year, and remain in this one. For a period of time, this will also support US debt yields and US dollar exchange rates.

CICC Macro also said that some Fed officials advocated the practice of Front loading. Fed officials will express their ideas by raising interest rates in the line map. Although the dot -line diagram does not necessarily represent the exact path of future interest rate hikes, in this current high inflation environment, the dot -matrix chart can still play an expected role.

CPI data super market expectations, Powell: Controlling inflation is still the key goal of the Federal Reserve

According to CCTV news reports, on September 13, local time, the US Department of Labor announced data showing that the US Consumer Price Index (CPI) increased by 0.1%from the previous month, which was 0.1%higher than the market expectations. It was expected to rise by 8.1%in the market.

In the month, after eliminating the large fluctuations and energy prices, the core CPI rose 0.6%month -on -month and 6.3%year -on -year, all higher than market expectations.

Although the growth rate of CPI has declined for two consecutive months, it still maintains a historical high, and it is higher than 8%for 6 consecutive months, indicating that the level of inflation is high. Among them, rising housing, food and medical care prices are the main pushes.

Specifically, the cost of housing accounted for one -third of the CPI weight increased by 0.7%month -on -month and 6.2%year -on -year; food prices rose 0.8%month -on -month and increased by 11.4%year -on -year; medical care costs rose 0.8%month -on -month, up 5.6%year -on -year.

Affected by this, on September 13, local time, the three major US stock indexes plummeted across the board. US President Biden said the stock market that fell sharply due to inflation that day did not necessarily reflect the overall situation of the economy. He said he was not worried about the inflation data released that day.

According to the analysis, the continuous upward rise in US housing and food will have an impact on consumers' psychology, which not only indicates that inflation is stubborn, but also makes the Fed lack room for slow interest rate hikes. In the future, it will be forced to continue to aggressive interest rate hikes to cope with inflation.

Felipe Silva, assistant professor of the University of Missouri, said in an interview with the CCTV reporter of the General Taiwan: "The inflation data just announced today is higher than expected. One percentage point. However, what I want to say is that the situation in the next two months is basically like a dependent function, depending on how the concerns of inflation and economic recession actually evolve, you will see that the Fed will actually become more aggressive or not. So radical. "

Felipe Silva pointed out: "As of now, the market has basically updated the expectations of the next interest rate hike. I think this is clear. The market expects to raise 75 basis points in the next time. The most likely situation. "Previously, according to CCTV News, on August 26, local time, Fed Chairman Powell delivered a speech at the Annual Meeting of the Global Central Bank of Jackson, saying that the United States will continue to take measures to" strongly "fight inflation, but At the same time, warning that strong interest rate hike measures will bring "pain" to American families and companies. Powell's speech shows that the Fed may still raise interest rates in the next few months, which may disappoint investors. They originally hoped that the Fed Energy would ease interest rate hikes later this year.

Image source: Visual China-VCG111400112344

Powell emphasized at the meeting that reducing the inflation rate of the United States to 2%is still the key target of the Federal Reserve, but the rate hike measures carried out on this goal will affect the US economy. Powell said that rising interest rates, slowing economic growth, and weak employment markets will lower inflation. "This will bring some pain to families and enterprises, but these are the unfortunate cost of reducing inflation. More pain ".

Daily Economic News Comprehensive CCTV News, CME Fedwatch, Surging News, Federal Reserve's official website

Daily Economic News

- END -

A total investment of 780 billion yuan!Hubei focuses on the construction of eight major areas to strengthen key projects

Jimu Journalist Zhao BeiIntern Guo Sicheng Zhou YijiaOn August 1, the Hubei Provin...

Ctrip releases the Mid -Autumn Festival forecast: local and surroundings still occupy the mainstream

The summer heat retired, the Mid -Autumn Festival holiday was nearly in front of h...