All in ESG?Bellaide's myth and reality | Smart money · ESG

Author:36 氪 Time:2022.09.21

Value investment has been deeply rooted, and the ESG evaluation system is still yet to be established.

Text | Wang Lin

Edit | Huang Yida

Source | 36 氪 Finance (ID: krfinance)

Cover Source | Vision China

The energy crisis disrupted the European carbon neutralization plan. As the dispute over the old and new energy sources further became fierce, the king of global finance Belaid was also pushed to the forefront.

At the end of August, Glenn HEGAR, the Auditorist of Dezhou, announced that 10 Wall Street giants, including BlackRock, used ESG to resist the fossil fuel industry, and listed these 10 financial companies as prohibiting signing with the Duzhou government and local enterprises. Most contracts of the "blacklist", Berlaide is also the only American company that is included in the "blacklist" by the state.

Unlike the European ESG policy, the government is mostly led by the government. The United States is mainly promoted by financial institutions. Among them, Berlaide, as the leader, naturally becomes the object of ESG opponent and supporters.

As early as 2018, Berlaide's legendary CEO Larry Finck made only two strategic goals in the next ten years: ESG and the Chinese market. In 2020, he promised to put environmental management at the core of nearly $ 9 trillion in asset management business in the company, which is quite ALL in.

After decades of further evolution, the ESG (E -Enterprise's impact on the environment, the social responsibility of S Enterprise, and G company governance) have become another evaluation system outside the mainstream financial indicators. As the epidemic evokes the world's attention to the field of sustainable development, ESG investment has ushered in a new round of development opportunities.

However, the increasing energy crisis, torture of its ESG investment strategy, income, and charging standards are back reality.

ESG ideal of the king of finance

As a pioneer, Berlaide launched ESG ETF series funds such as Ishares ESG Aware MSCI USA ETF (ESGU) and US Carbon Transition Readiness Fund.

Specific to the investment strategy, similar to most fund institutions, Bellee ESG ETF series funds can be roughly divided into three categories:

1. Screening class, that is, companies that do not invest in specific business areas such as weapons, tobacco, oil sand, and power coal. At present, the active investment portfolio of all independent decisions of Bellede has completely withdrawn from the listed enterprise with more than 25%of its revenue, as well as controversial weapon manufacturers;

2. Theme category, that is, focusing on investing in the ESG theme track, such as clean energy, low -carbon, UN sustainable development goals, Paris Agreement goals, etc.;

3. Broadly, its core strategy is more stocks investing in higher MSCI ESG scores, and less invested in stocks with lower ESG scores. Leader) and four small series including ESG+.

Among them, the extensive class of tracking index (passive investment) is the main force of Berlaide. This is the mainstream of ESG financial products in the United States, and it also conforms to the style of Bellaide.

According to Bloomberg, the scale of funds in the ESG field has increased in recent years, while Berlaide has won half of them.

Among them, ISHARES ESG Aware MSCI USA ETF (ESGU), which was established at the end of 2016, is the Berlaid ESG flagship fund and the world's largest ESG index fund. As of March 31, 2022, the fund's management scale was US $ 24.88 billion, and the tracking target was MSCI USA Extended ESG Focus Index.

As early as the day when he was separated from Blackstone in 1995, Palegide deeply put on the brand of passive investment. Black Stone CEO Su Shimin once led early investment against Perlace, and the differences between Finke and Su Shimin's development direction for future asset management companies are the key factor in the two people.

The asset management industry decompose the contribution of investment returns into Alpha and Beta. Among them, ALPHA depends and attributes to the fund manager's investment capabilities, and Beta is a market average return (this is a return that can be obtained by passive investment in the index).

As the chief star fund manager of Blackstone, Su Shimin was drunk at active investment and pursued Alpha's income beyond the average level. Fental believes that the pursuit of Alpha is extremely difficult, because there are too many uncontrollable factors, and human resources are always limited. As an individual, star fund managers are limited. Therefore, Berlaide refused to rely on the star fund manager to invest.

Before and after the economic crisis in 2008, with its excellent risk control system and lower commission, Berlaide, which was established for less than 30 years, jumped to many hundred -year -old stores and became the largest financial institution in the global asset management. The era. According to the official website of Bellaide, as of the first quarter of 2022, the proportion of passive products (indexes and ETFs) in total assets management was still as high as 66%.

If you think of passive ESG as a competition, the referee is the famous index compile company. The MSCI EXTENDED ESG Focus INDEXES tracked by Bellaide aims to build an index by looking for ESG positive factors, that is, in the negative screening stock pool, the company with a higher ESG score is selected to establish an index. The ESG score of the index is based on the existing system of MSCI. Negative screening is based on the following three standards:

1. Companies based on social value and climate change, companies that eliminate production or sales of disputed weapons, tobacco and civilian guns, and companies that gain from power coal and oil sand;

2. Due to the exclusion of ESG dispute scores, companies using MSCI ESG dispute scores to identify companies that have serious disputes in operations, products and services to ESG, and companies with ESG dispute scores 0 are excluded;

3. Other exclusion criteria: exclude companies that lack ESG dispute or ESG rating.

Although passive investment is still the mainstream, Bellaide did not give up the exploration of ESG's active investment. According to the official website of Bellaide, the company is continuously expanding the active investment strategy to measure the results of the investment results. It also establishes data partnerships with SustainAslytics, Refinitiv and Rhodium, and has continuously introduced new sustainable development investment indicators So as to better actively analyze.

Blow whistle: just a "placebo"

The ideal of morality is very plump, and Bellaide is also willing to market the ESG investment strategy of foreign marketing. On its official website, Bellaide listed the persistent investment related index during the panic period of multiple markets, such as the emerging market retracement/petroleum crisis (2015.7.21-2016.2.1), the new crown crisis (2020.1.1-2020.3.31) You can win the global market.

However, opening the position of ESGU, then Bellaidela returned to reality.

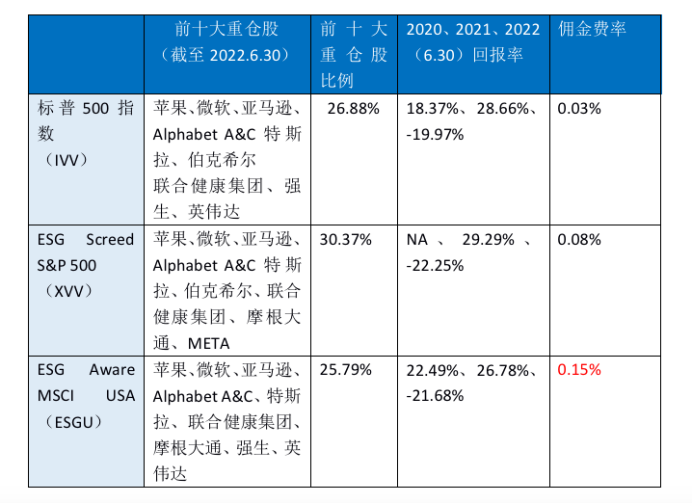

In the second quarter of 2022, the top ten weights in ESGU's positions were Apple, Microsoft, Amazon, Alphabet AC, Tesla, Nvidia, JP Morgan Chase, United Health Group, Johnson & Johnson. Except for Morgan Chase, the remaining nine are the top ten heavy stocks of the S & P 500 at the same time. From the perspective of the industry, ESGU's largest industry opening is information technology, medical care, consumer goods and finance. It is difficult to clear whether the excess returns are because of ESG, or because of these familiar giants, especially technology companies.

The top ten heavy stocks of ESGU (as of 2022.6.30)

Source: Bellaide's official website

At the end of 2021, the public back thorns of Tariq Fancy, the chief investment officer of Perlerte, pushed the questioning of the push to the apex. He pointed out that in addition to not really contributing to ESG, these ESG funds can also produce a "placebo" effect. "ESG investment is to sell wheat grass to cancer patients. People just believe in the advice of doctors, but there is no scientific basis that it is effective."

Entering 2022, the Federal Reserve's interest rate hike and the European energy crisis made ESGU lose the "shame" of relative benefits. As technology stocks fell into a bear market, ESGU has run for S & P 500 for two consecutive seasons.

It is difficult to prove that it has a long -term return ability. The rate of Black ESG Fund products is significantly more dazzling than that of ordinary funds. "In addition to the benefit of Wall Street, these funds have not achieved other achievements," Fan Xi said.

Taking the following three ETF funds below Bellaide as an example:

Core S & P 500 Index Core SP500 (IVV), the S & P 500 Index (XVV), ESG Aware MSCI USA (ESGU) with ESG screening, ESG screening, ESG Aware MSCI USA (ESGU). Microsoft, Amazon, Alphabet AC and Tesla; the largest industry opens are technology, medical care, financial services and consumer goods.

S & P 500, S & P 500 ESG Index and ESGU indicators comparison

However, these three funds that are similar have different service fees. The cost of the S & P 500 Index (XVV) of ESG is almost three times the non -ESG fund; the ESG Aware MSCI USA (ESGU) is five times that of the ESG fund. Even low -cost index funds, the charge for ESG funds is higher than the non -ESG fund charges.

Of course, these are not problems facing the Bellee family, but also the current industry common.

The original intention of the ESG rating is to promote the sustainable development of enterprises, and pay more attention to long -term value such as social responsibility. By measuring the degree of non -financial risks in a company and promoting its stock price and capital costs accordingly, it is forced to rectify or closure.

However, due to the lack of reliability, comparability, and transparency of the measurement object, excessive noise generated during the ESG score process, and accurate signals cannot be provided. French école des hautes etudes Commerciales du Nord (Edhec) institution pointed out that in a general climate fund, the climate data point only represents 12%of the decisive factors of investment portfolios. According to the research of Alessandrini and Jondeau, European companies, information technology companies, and large market value companies often have higher ESG scores. Global asset allocation combinations with positive screening strategies may be over with these sections, bringing areas, industries, and style passive passive concentrated.

Financial institutions often invest in theme tracks such as clean energy, low -carbon technology, and green buildings. In actual operation, the current institutional investment strategy is highly homogeneous. Therefore, most of the positions are concentrated in some popular industries. The concentration of the end itself is also too high, and the funds are superimposed, so these fund products can achieve excellent performance in the short period of time; but as the valuation pressure rises, the asset side will foam until the funds embrace the disintegration of the group. As a result, great fluctuations in fund performance.

With reference to A shares since 2020, liquor, medicine, and new energy have become the object of institutional groups. At the end of the investment, the investment has become a simple and rude cycle for small parts and individual stocks to buy and increase. However, the feathers after the industry's valuation overdrawn are also criticized by investors.

Faced with doubts, at the first quarter of Belide's financial report, Finck reiterated the company's commitment to sustainable investment. He acknowledged during the Q & A session of the conference call that the rise in energy prices and inflation caused a "serious impact" on many ESG investment, but he emphasized that this will not change the "long -term characteristics of ESG".

Fan Xi once said the fundamental defect of breaking the ESG strategy.

The concerns of the CEO of the previous Blarye may become a reality. In the third quarter of this year, ESGU's positions on the oil giant Exxon Mobil have risen from 17th to 10th in the second quarter.

The anti -winds of ESG Investment are still blowing strongly. At the end of August, in order to implement "the only starting point can only be based on the benefit of the return of investment", Florida passed a resolution. factor.

It is certain that it can be that the coexistence and questioning will be accompanied by ESG investment for a long time. After all, compared with the traditional financial investment system, Graham Buffett has inherited the golden signboard for hundreds of years. If you want to have social value and performance in social value and performance Everyone is here, and the young ESG evaluation system distance has become a long way to go.

*Disclaimer:

The content of this article only represents the author's opinion.

Market risk, the investment need to be cautious. In any case, the information in this article or the opinions expressed in this article does not constitute investment suggestions for anyone. Before deciding to invest, if necessary, investors must consult with professionals and make careful decisions. We have no intention of providing underwriting services or any services that need to be held in the transaction parties.

36 The official public account of its subsidiary

I sincerely recommend you to follow

Let's "share

The ESG evaluation system is still yet to be established

- END -

The people's Pharmacy has been re -pushed by Morgan Stanley to push the institution's attention to continued to rise again

15AUGOur reporter He Wenying Get Damo's recommendation, what are the highlights of...

Dunhuang: "Three Hearts" service allows taxpayers to enjoy policy dividends

Since the launch of the annual calculation of the comprehensive income of personal...