Whenever the hot review | Whether the IPO of all things can break through the valuation logic of the property company

Author:Daily Economic News Time:2022.09.21

The most watched leading property company in the industry officially started the IPO roadshow officially on September 19, which is expected to be listed within this month. Everyone's distribution is expected to be 800 million to 900 million US dollars (approximately 6.27 billion to HK $ 7.064 billion), and the market value will be between approximately HK $ 54.972 billion and HK $ 61.508 billion.

This is also the largest IPO in the Hong Kong stock market since 2022. The IPO this time has attracted the ultra -luxury cornerstone investor lineup, including Temasek, UBS asset management, Chinatong Holdings, and state -owned enterprises mixed ownership reform funds, Runhui Runhui Investment, HHLR Fund and YHG Investment, Athos Capital, etc.

Frankly speaking, it is not a good time for the listing of property companies. Since last year, property stocks that have been regarded as Xiangxiang have appeared in a large market value and PE, including listed leading property companies. Zhu Baoquan, CEO of Benn Yunyun, also wrote in social media: "Poor markets make true friends."

In the author's opinion, in the moment when the overall valuation of the property industry returns to rationality, the valuation of all things from 28.46 ~ 31.85 times is within a reasonable range. Compared with the Hong Kong stock listed property company with the same echelon. In July last year, the price -earnings ratio of China Resources Vientiane Life was as high as 113.8 times, which has fallen to about 30 times recently. It has been adjusted to less than 10 times.

Thanks to the blessing of commercial management properties, China Resources Vientiane Life is currently occupying the throne of the Hong Kong stock market's earnings and market value. Country Garden services follow the market value of about 50 billion Hong Kong dollars. Competition pattern.

From the perspective of valuation, everything in all things is higher than that of Country Garden services, Poly Property, and China Shipping Property, but it is lower than China Resources Vientiane life. The revenue of everything and the area of the pipeline is at the forefront of the industry, but this is no longer the core logic of the current valuation of the property company in the capital market. It can be seen from the Country Garden service valuation of the Country Garden service in the pipeline area and revenue.

The market had previously given high valuations to the property company. It is based on the profit imagination space brought about by the property management after large -scale management. New imagination space. This is why major property companies have seized non -residential tracks, value -added services, and developed technology and intelligence.

Compared with their peers, everything has established mature business models and samples in non -residential tracks such as commercial management and urban services, but has not yet established an absolute leading advantage in their peers. In the track outside the scale, how the capital market will redefine property stocks, and everything will become the most suitable test field at the moment, and may also be a sample -like existence in the future.

The market concern is science and technology. The valuation of everything also includes the market's recognition and expectations of technology investment. In recent years, everything has continuously emphasized its own scientific attributes and tried to jump out of the single concept category of property. Since 2015, it has been added to technology, and has invested a lot of real gold and silver, recruiting a large number of technology and Internet of Things talents, and digital restructuring.

The scope of the valuation is not high to the scope of "technology" enterprises, because the technology sector of all the clouds has not yet been driven and linked to the performance. From another perspective, the current valuation also gives everything to the upper space of all things in the future. The performance driver may come more down -to -earth than the valuation driver.

Daily Economic News

- END -

"Iron Fist" to escort the opening season of Dayi County, Sichuan Province, announced typical cases of minors protection

The school is about to start in autumn, is the safety of food safety around the ca...

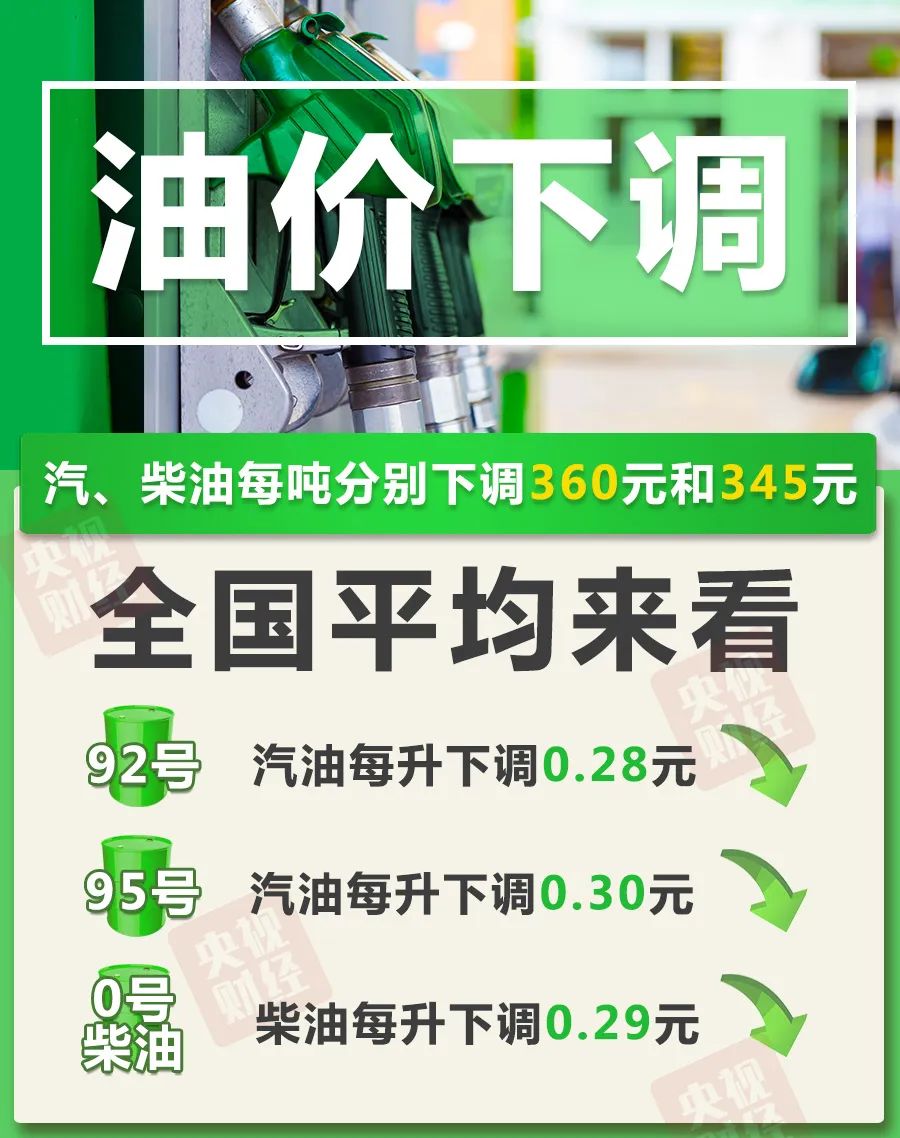

@All car owner's oil price is about to fall!Just tonight ...

notSource: CCTV Finance (ID: cctvyscj)The copyright belongs to the original author...