Tianqi Lithium revealed the repurchase report, and will also contribute not over 695 million yuan to participate in the IPO of China Innovation Harbor Stocks

Author:Daily Economic News Time:2022.09.21

While disclosing the repurchase report, the 100 billion lithium ore faucet and power battery head enterprise once again strengthened cooperation.

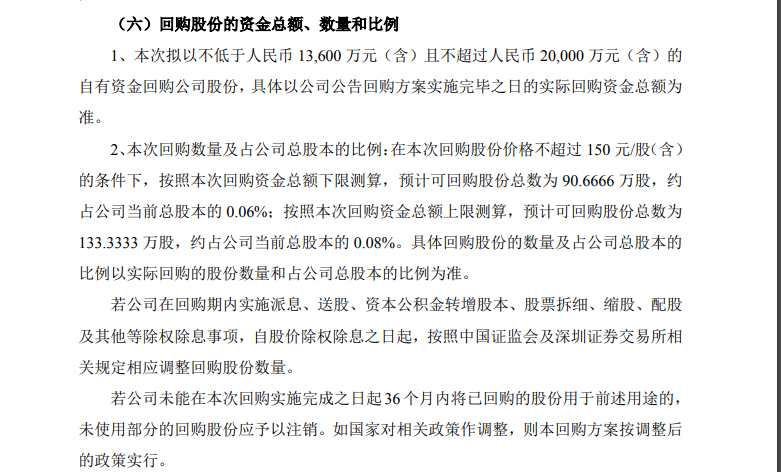

On the evening of September 21, Tianqi Lithium (SZ002466, the stock price was 11.479 yuan, and the market value was 188.4 billion yuan) disclosed the repurchase report that the company intends to use not less than 136 million yuan and no more than 200 million yuan to repurchase stocks for repurchase shares for repurchase of stocks for use for it for use for repurchase shares for it for use for it for for use for repurchase shares for it for used for it. Employee holding plans, repurchase special accounts have been opened.

On the same day, Tianqi Lithium also announced that it was intended to be the cornerstone investor to contribute no more than 100 million US dollars to participate in China Innovation Airlines Technology Co., Ltd. (hereinafter referred to as "China Innovation Airlines") Hong Kong IPO. Earlier, when Tianqi Lithium Hong Kong Stock IPO, China Innovation Airlines also participated in the subscription as the cornerstone investors.

Discover the repurchase report, for employee holding plan

The announcement shows that Tianqi Lithium intends to use its own funds to repurchase some RMB ordinary shares (A shares) shares issued by the company in a concentrated bidding transaction. The total amount is not less than 136 million yuan (inclusive) and no more than 200 million yuan (inclusive). According to this calculation, the number of shares is expected to be repurchased from 906,700 shares to 1.333 million shares, accounting for 0.06%to 0.08%of the current total share capital.

The above information is the same as the repurchase solution disclosed by Tianqi Lithium on August 30. The latest progress is that the company has issued a special securities account of the Shenzhen Branch at the Shenzhen Branch of China Securities Registration and Settlement Co., Ltd.. Since then, the company will make decisions and implement it according to the market conditions during the repurchase period. The date of review and approval of the repurchase plan is within 12 months, that is, before August 30 next year.

Image source: Announcement Screenshot

For the use of the repurchase shares, Tianqi Lithium said that it will be used to implement employee holding plans. On the evening of August 30, Tianqi Lithium also disclosed the planning plan of the employee's shareholding plan, but after the disclosure of this plan, a lot of controversy was caused. A response to this.

The Shenzhen Stock Exchange's focus on the employee holding plan of Tianqi Lithium focuses on three points, which is more controversial is the first two points.

The first point is that the company's level of performance assessment indicators only include the main consideration of production capacity indicators. No other such as income and net profit performance assessment indicators are not set. Whether it meets the company's current business development and performance improvement requirements. In this regard, Tianqi Lithium said in a reply that the company's income or profit indicators have been greatly affected by market fluctuations to a certain extent, and there are still many uncontrollable factors.

The second point is that the transfer price of the employee's shareholding plan is 0 yuan per share, and whether it has harmed the interests of listed companies and small and medium shareholders. In this regard, Tianqi Lithium industry claims that this price considers the company's internal operations, talent policies, incentive purposes, external competition, willingness to participate in objects, and funding capabilities. There are many precedents for "0 yuan purchase".

The proposed capital contribution does not exceed 100 million US dollars, participating in the IPO of China Innovation Airlines

In addition to the shares of shares for not exceeding 200 million yuan for employee holding plans, on September 21, Tianqi Lithium also disclosed another investment announcement, that is, it is intended to be the cornerstone investor to contribute no more than 100 million US dollars to participate in innovation. Navigation Hong Kong IPO was converted at the mid -range price of the RMB exchange rate on September 20, equivalent to about 695 million yuan.

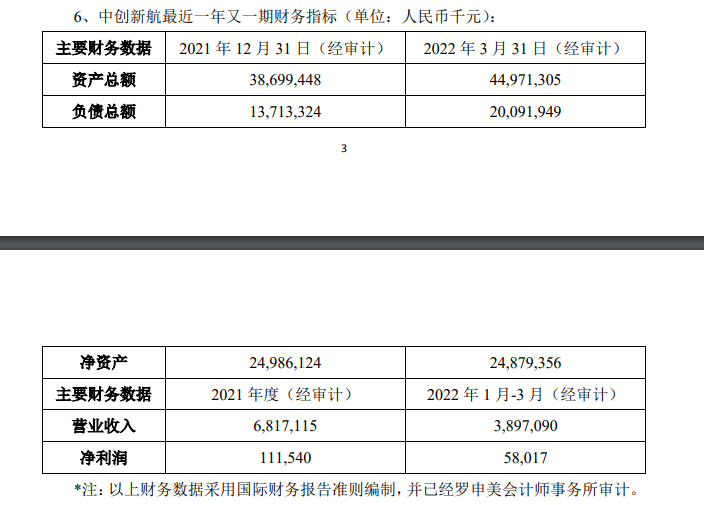

It is reported that China Innovation Airlines is mainly engaged in the design, research and development, production and sales of power battery and energy storage system products. Regarding its industry status, Tianqi Lithium said in the announcement that China Innovation Airlines entered the head enterprise in terms of industry ranking, market share, product power, customer loyalty, and brand influence. A coexistence of 3.3GWH, ranking second in China's third -party power battery, and fifth in the world's third -party power batteries.

Image source: Announcement Screenshot

On March 11 this year, the Hong Kong Stock Exchange disclosed the prospectus of China Innovation Airlines. Its raised funds will be used for new and expanded industrial bases, technological research and development, and daily operations, but have not disclosed specific financing amounts.

In fact, as a partner of the upstream and downstream industry chain, China Innovation Airlines and Tianqi Lithium Industry frequently cooperate.

For example, in May this year, Tianqi Lithium and China Innovation Airlines signed the "Strategic Partnership Agreement" and "Lithium Carbonate Supply Framework Agreement", which planned to launch related cooperation in all aspects of the lithium battery industry chain. At the same time, China Innovation Airlines also contributed about 50 million US dollars as the cornerstone investors to participate in the Hong Kong stock IPO of Tianqi Lithium.

Tianqi Lithium said in the announcement that the investment is the continuation of the strategic relationship between the two parties, which is conducive to maintaining and consolidating the strategic cooperation between the company and the other party, deepening the mutual benefit of the two parties, and exerting the two parties in the integration of resource integration, technical support, and business collaboration between the two parties. The competitive advantage of the other side further promotes the cooperation between the two parties in the field of battery materials.

Cover picture source: Every reporter Zhu Wanping (information map)

Daily Economic News

- END -

Interview with Beihang Tao Yong: Robot production has gradually realized "domestic alternative", core technology needs to strengthen breakthroughs

A few days ago, at the 2022 World Robot Conference held in Beijing, Tao Yong, a re...

29 measures!Important release of Jilin Province

At the morning of the 30th, the reporter learned at the Provincial Government Pres...